Learn about marketing beauty during the pandemic crisis imposed by COVID-19. I have prepared a comprehensive report using an exhaustive consumer survey of 40 respondents and interviews with 10 beauty founders, to help beauty brands navigate through these tough times successfully.

The below report covers, amongst other topics,

1. Segmentation of consumers based on their current thought process.

2. Classification of product categories as defined by the consumer survey respondents for skincare, makeup, body care, hair care, and durables.

3. Tactical marketing and innovation recommendations for beauty brands by consumer segment and product category type.

4. Big opportunity to create routines and rituals for marketing beauty brands during the pandemic crisis.

5. Cost-effective ways for content marketing and advertising during this crisis.

Covid-19 has ushered us into an incredibly uncertain time without any existing model to bank upon. The pandemic has caused fear, isolation, government lockdown, uncertainty in the minds of consumers, unemployment, and an extreme change in consumer behaviour plus a more than a surge in demand for a few essential categories like hygiene, home, and personal care, and groceries.

I combined the findings from my consumer survey and beauty founder interviews with Harvard Business Review article by John Quelch and Katherine E. Jocz, published in April 2009, on “how to market in a downturn” along with the observable and successful tactics of various beauty brands.

The resultant report needs to be applied within the context of your business.

Please comment with your inputs so we could create an exhaustive strategic, supported by tactics, document to help out the beauty industry during this crisis.

According to the HBR article “In recessions, marketers have to stay flexible, adjusting their strategies and tactics on the assumption of a prolonged, severe slump and yet be able to respond quickly to the upturn when it comes. This means, for example, having a pipeline of innovations ready to roll out on short notice. Most consumers will be ready to try a variety of new products once the economy improves. Companies that wait until the economy is in full recovery to ramp up will be at the mercy of better-prepared competitors.”

Consumer Behaviour and Impact on Marketing Beauty Brands during the Pandemic Crisis:

I have customised HBR’s chart for a recession with current pandemic induced consumer behaviour.

There is a dual impact of the current crisis, of course, led by the pandemic. First, closure of businesses, especially services, leading to unemployment and lack of disposable income coupled with the pandemic induced behaviour leading to quarantining at home, social distancing etc.

All purchase for outside consumption of anything is practically zero.

The pandemic is making consumers spend on a few essentials, focused on hygiene and health, diverting money from spending on other essentials and non-essentials.

Govt. stimulus and money for businesses, unemployed and self-employed individuals, will hopefully let consumers spend on essentials even though they might as well decide to save the money rather than spend back into the economy.

Four Types of Consumers for Marketing Beauty during the Pandemic Crisis

In line with the HBR report cited above, there are 4 types of consumers during a recession, which is confirmed by our research as well.

Very Careful right now and worried about the long-term

feels most anxious and hardest hit monetarily. “This group reduces all types of spending by eliminating, postponing, decreasing, or substituting purchases.”

25% of our respondents belong to this category.

In today’s times, this segment is likely to be both low and high-income segment, as evident in our survey findings, primarily because of massive layoffs, leaving them with little disposable income and worsened by the uncertainty surrounding the economic future and health.

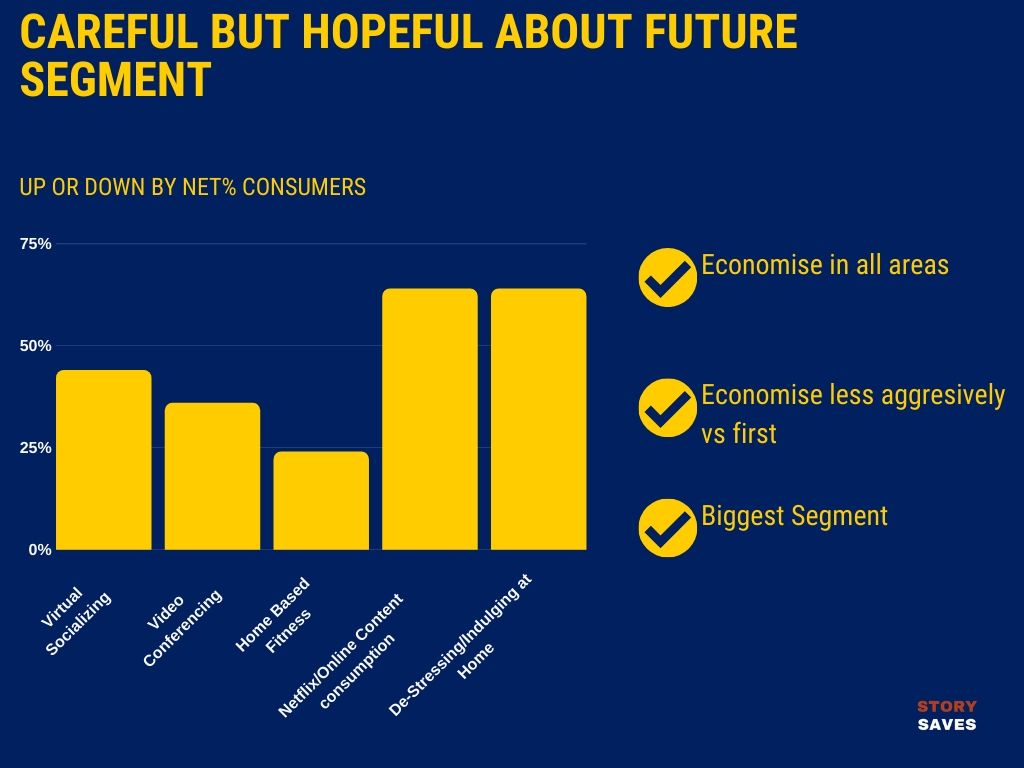

Careful right now but hopeful for the future

“tends to be positive about the long term but less confident about the prospects for recovery in the short- term or their ability to maintain their standard of living.”

Like “very careful right now and worried about the future” consumers, they economize in all areas, though less aggressively. They constitute the largest segment, 60% of respondents in our survey, which corroborates the HBR claim that this is the biggest segment.

26% of the above segment respondents are unemployed versus 38% for slam-on-the breaks( very careful and worried about the long-term).

This segment represents a wide range of income levels. As situation worsens, this segment is highly likely to move into the “very careful and worried about the long-term” segment.

Financially well-off segment

feels confident about their ability to face current and future issues in the economy. “They consume at near-prerecession levels, though now they tend to be a little more selective (and less conspicuous) about their purchases. The segment consists primarily of people in the top 5% income bracket.”

My survey reported 6/40=16.7%(approx.) respondents as within the top 5% of consumers, but these overlapped, when it comes to the thought process, with worried and hopeful about the long-term segments.

It also includes those below top 5% income bracket but feel confident about their finances. This demographic also is going to be slightly older overall and would naturally be very health conscious.

The live-for-today segment

spends almost as always and isn’t too worried about savings. The consumers in this group respond to the crisis mainly by delaying their timelines for making important buys. “Typically urban and younger, they are more likely to rent than to own, and they spend on experiences rather than stuff (with the exception of consumer electronics).”

These could be one of the highest hit with restaurants and services businesses closing due to the pandemic. At the same time, they are saving money that they would otherwise spend on dining and wining outside, which they could very well spend on stockpiling hygiene and grocery or buying other essentials.

I had hardly 2 respondents within the above segment and that could be because of the response panel or maybe the current situation has everyone worried to some extent or the other.

For your brand, study your current consumer base, especially your brand tribe(loyal), with a Voice of Consumer survey to understand which segment they fall into, along with understanding their thought process and current behavior.

You have to focus on the changes in your loyal fan base‘ thinking, beliefs, attitudes and behaviours, and how these changes are trending over and above the aggregate trends.

Four Product Categories for Marketing Beauty during the Pandemic Crisis:

The HBR report also classifies products into four categories. “All consumers consider basic levels of food, shelter, and clothing to be essentials, and most would put transportation and medical care in that category. Beyond that, the assignment of particular goods and services to the various categories is highly idiosyncratic.”

From my consumer survey of 40 respondents, I have specified these product categories for skincare, body care, hair care, and makeup within the beauty industry. This overlay might not be 100% accurate but makes sense more or less.

Also, as the consumer survey shows, different categories of consumers classify products differently.

Essentials

are needed for survival or perceived as integral to physical and mental well-being.

Non-Essentials

I have added another category, to HBR report, called non-essentials, which means those products that have low functional and low treat utility for the consumer.

Here is how the overall panel classified beauty products during the pandemic crisis:

Skin Care:

Hand cream, face cleanser, and sunscreen are considered essential, are the least hit, by over 91.43%, 80%, and 77% of consumers, respectively.

Sleeping mask-71.43%, chemical peel-60%, toner-57.14%, face oil-48.57%, and anti-blemish and fragrances are considered as non-essentials, neither treat nor essential, by most of the respondents overall.

Makeup:

Each of the typical makeup products had more number of people citing it as non-essential than those who considered them as either treats or essentials.

42.86% for lipstick, 54.29% for foundation, 42.86% for concealer, 48.57% for nail paint, 62.86% for primer, 57.14% for highlighter, 51.43% for bronzer consumers considered these as non-essentials meaning neither treats nor essentials.

Body Care and Personal Care:

Body and face wash, soaps, sanitisers(now), hair shampoos( for a select few) are still essentials but dry Shampoos and hairstyling products are no longer essentials.

Deodorant and Lip care were considered essential by 71.43% and 74.29% consumers, respectively.

Treats

are indulgences whose immediate purchase is justified for indulgence or stress-relief, especially during current, stay at home situation.

Skin Care:

51% for essential oils, 28.57% for night face creams and 25.71% for skin/face treatments considered these as treats by more people than by those who consider these as non-essentials.

Makeup:

Bronzer-42.86%, concealer-34.29%, nailpaint-25% and highlighter-28.57% were classified as treats by respective percentage of respondents.

Body Care and Personal Care:

Body masks and treatments would fall into this category. Because of more bathing and personal time, the frequency of these treats is likely higher.

Postponables

are needed or desired items whose purchase can be put off. Professional products and durables would fall into this category including beauty and hair equipment.

Expendables/Luxury

are perceived as unnecessary or not needed. Very highly-priced, luxurious items by luxury brands along with high-end, prestige services at salons/spas could classify as expendables.

Current Observable Consumer Behaviour because of Pandemic Crisis

Consumers are looking for more safety/health than performance unless the performance is directly related to hygiene and safety like disinfecting from bacteria and viruses etc.

People are highly concerned about their immunity and have more time at home because of lack of travelling for work, groceries and entertainment. Also, they are spending more time in the bathroom.

Physical and mental health are becoming more important than before. Quite a few are slogging less than usual and living more holistically, meaning they are not all about work during these times, apart from those who need to slog to keep their jobs or put in extra hours to meet the surge in demand.

For the experimental types, there is more time to experiment with their looks with a lower risk of embarrassment.

For brick and mortar stores, there is more focus on delivery and warehousing than showcasing. Stockpiling for hygiene focused essentials is a big trend since there is a fear of inadequate supply.

Home-based fitness has picked up, with brands like Tonal reporting 5X YOY sales.

In our survey, home-based fitness is up for net 26% of respondents, virtual socialising is up for net 50% of respondents, video conferencing for net 40% of respondents, Netflix and online content consumption is up for net 55% of respondents and net 58% of respondents are indulging and de-stressing more at home. Remote working has skyrocketed.

There is an opportunity for a mental shift in individual and collective consciousness towards “we are all together in this” as the whole world has come together to fight the common enemy so to speak.

Few commonly cited phenomenon and how would they play out during these times:

Lipstick effect, meaning smaller treats(luxuries), like lipsticks, do better during a recession, will matter but more for skin/face care luxury/treatments than for makeup treats because of the quarantine.

The survey of 40 consumers revealed that over 80% of them are using much less makeup than before and more are using skin and body care for indulgence versus nail paints, lipstick, etc. because of the relative benefit of indulging in skincare versus makeup.

Makeup is impacted due to the effort-benefit theory. Since there is hardly anywhere to go, the returns on spending elaborate effort and time on makeup are very low.

Even with video conferencing, you are interacting with people you know well enough on a relatively smaller screen without being prominent and without the excitement of being the center of attraction of hundreds of eyes, friends, colleagues, strangers and acquaintances alike.

The same time spent indulging on skin, face and body will provide you a higher, double benefit of looking good and self-care with the feeling of much-needed relaxation and rejuvenation.

Direct To Consumer has increased across the board for the period of crisis and will accelerate the trend towards e-commerce. This trend favors Indie Beauty brands because of logistics, out of stock, and delivery issues surrounding the brick and mortar and big beauty brands.

Recommendations for Marketing Beauty Brands during the Pandemic Crisis

Overall Consumer Behaviour for Marketing Beauty during the Pandemic Crisis

Let me elaborate on the consumer behavior/trend because of both financial and pandemic reasons and recommend brand tactics for beauty brands by consumer segment for each of the product categories:

Only net 10% and net 20% of total respondents reported reduction in skincare and body care usage respectively. Bathing has shown an increase in frequency for net 2.86% of consumers. Makeup, hairstyling and fragrances are worst hit with a reduction in frequency for approx. 80%, 70% and 60% of respondents respectively.

Very Careful Right Now and Worried about Long-Term

They will stay with the financial side of the trend and would be leading the trend for “careful but hopeful” consumers.

Compared to the past, net 40% of this segment, in our survey, reported reduced frequency of skincare currently whereas makeup frequency is down for net 80% of respondents.

There is no net change in bathing frequency, hair care frequency is down for net 60% of respondents , body care frequency is down for net 40% of respondents, fragrances and hairstyling frequency are each down for net 80% of respondents.

Compared to other segments, this segment has the least rich routine for the day with hardly any hobbies, indulgence between waking up and going to sleep in the night.

Virtual socialising is up for 80% of this segment, more than any other segment, unexplained by spread of age groups or unemployment.

A possible explanation could be that they are feeling too down to proactively work on a busy routine and instead choose to speak to/ virtually socialise with others for comfort.

Essentials

Consumer behaviour for marketing beauty during the pandemic crisis:

They are stockpiling essentials for body/personal care/home care, without any deals, focused on sanitisation and hygiene.

Hand cream, face cleanser, sunscreen, lip care are the least hit essentials and in this particular order.

For skincare essentials, beyond personal hygiene, they will seek lower-cost product, private labels, or attractive price deals.

They have drastically reduced their makeup essentials purchase. Bath essentials like body wash, lotion, gels are not hit at all. Body moisturizer, deodorant and body butter are the least hit for body care.

Dry shampoos are the worst hit as compared to hair shampoos.

Most of the makeup essentials like a lipstick, foundation, concealer, nail paint etc. are considered as non-essentials by them leave alone treats.

Beauty brand and marketing tactics during the pandemic crisis:

Emphasize price, especially to connote higher value and acquire new consumers from brands playing in the higher-price segment for your body/personal/home care/skincare and makeup essentials.

Offer discounts and deals or lower pack sizes at lower price on essentials(beyond hygiene) within body, skincare, haircare and makeup.

Target share of voice for market share by pushing your perceived value advantage(point D), and you will achieve the objective at a lower cost than usual.

Make sure you are converting website visitors to subscribers for all the new and extra traffic. Execute email flows reinforcing your perceived value advantage for all the new and current consumers.

For new consumers, send out frequent voice of consumer surveys to understand the reason for switch to your brand and use that info to convert them into repeat and loyal consumers.

For brands that are currently struggling with this segment, and has higher-priced essentials for makeup and skincare, along with those that do better significantly in the brick and mortar retail than DTC, you could launch a fighter brand, both at DTC and brick and mortar, at an attractive price point with higher perceived value than other competitors for same or lower price.

The above would protect your current brand from dilution and help you acquire new consumers for DTC at a much cheaper rate. You could decide to keep this brand or phase it out, post the crisis.

Treats

Consumer behaviour for marketing beauty during the pandemic crisis:

This segment won’t buy higher-priced treats without deals. They are not a big segment for stress-relieving treats like mists, body and face masks, essential oils etc., but could buy if offered high-value deals.

Night face cream is a marginal treat for a few and lipstick, nail paint and highlighter are considered as treats but by very few respondents.

Beauty brand and marketing tactics during the pandemic crisis:

Improve affordability by shrinking sizes of treats or offering great deals for treats, and by cashback and discounts.

Create content, including for email flows, sensitive to current situation with messaging around “you deserve an escape/indulgence” supplemented with a deal to show doing your part for your loyal consumers.

This segment is more likely to use multi-purpose products at the lowest cost for treats like skin/face care masks and night face creams. They will prefer low cost indulgences-discounted even more by monthly subscription with an option to cancel out.

Refillable brands that offer treats at very economical prices and deals on top will fare better for this segment.

For both essentials and treats (slower-moving, beyond hygiene), innovate with price promotions beyond simple discounts.

Block their cupboards and increase the share of their cupboard for both essentials and treats. This will pay off subsequently during and after the crisis.

More than educational videos on Instagram, organize social parties for this segment to boost their morale and meet their need for a welcome diversion.

Postponables

Consumer behaviour for marketing beauty during the pandemic crisis:

It is the last priority for this segment and needs to make solid investment sense to them.

Beauty brand and marketing tactics during the pandemic crisis:

Stress on the huge cost of postponing such as lack of ritualistic maintenance of skin and hair without hair and beauty equipment leading to permanent damage or higher cost of correction later versus maintenance.

Offer subscription, exceptional deals or pay over period-of-time offers for expensive treatments, concentrates and home use irons, blow-out dryers, hair removers, skin lifting gadgets etc. or these won’t move at all.

You could shift your focus to low-cost and high-value hair clippers, trimmers, scissors, hair color for touch-ups etc., which would have a need considering the closure of hair salons.

Expendable/Luxury

Consumer behaviour for marketing beauty during the pandemic crisis:

This segment will likely eliminate all shoppin for this category. Stay at home is also a deterrent for this category of prestige products and services especially at top-rung salons, spas and stores.

Beauty brand tactics during the pandemic crisis:

Expensive salons and spas, prestige and professional skin, makeup and hair care brands can offer online tutorials on do-it-yourself free of cost with great deals on online purchase of products.

Careful Now but Hopeful for the Long-Term

They are spread across every income level and are the biggest segment, and as things go south, about the pandemic and the economy, they are most likely to move to the “very careful and worried about the long-term” segment.

As found in our survey, they have richer and more set routines with exercise, work, family time, hobbies, cooking, Netflix, meditation, indulgences as compared with the previous segment.

30% of this segment does skincare multiple times/day in spite or because of the pandemic, and close to 60% does it every day, including weekends.

Even though for 29% of this segment, skincare frequency in the week has gone down over the past but for approx. 25%, skincare frequency has gone up versus before, meaning skincare frequency is down for net 4%, hardly significant, of the consumers versus before the crisis.

Net 67.5% of this segment consumes hair styling less than before.

Net 50% of this segment consumes fragrances less than before. Net 12% of this segment consumes body care less than before. Net 31% of this segment consumer haircare less than before. Net 4% of this segment bathes more frequently than before. Net 60% of this segment consumes makeup less frequently than before.

30% of this segment each cited natural/organic, which could be because of hopeful about long-term( as there are low-income respondents, but hopeful about future) and hygiene as the biggest drivers for buying skin/body care currently.

Price, anti-microbial properties and favourite brands with deals were each cited, separately, as the biggest driver by 12.50% of the segment.

The before could be because of more time as well as the need for indulgence because of stressful work. Since, this segment is hopeful about the long-term and more likely to be employed, they are more willing to consume in exchange for stress-relief.

Skincare, body care and bath products are the biggest opportunities.

However, their purchase of beauty might be more conservative compared to current brands they are exhausting.

Virtual socialising is not as high as for slam on the breaks(careful and worried about the long-term). This could be because of more set and rich routines around remote work, personal life and hobbies.

Essentials

Consumer behaviour for marketing beauty during the pandemic crisis:

Hand cream, face cleanser, sunscreen, lip care, skin/face treatment and night face cream are the least hit essentials in the order of reduction in consumption.

Body/ Personal/Homecare focused on hygiene are stockpiled, even without attractive deals.

For skincare essentials, they will seek favorite brands at deals and can move to brands with a higher value, which will be worsened by the fact that they are stockpiling on body/personal/home care hygiene products.

You could also see an uptake in adaptogenic skincare for this segment because of higher incomes and health consciousness.

More time at home, plus lack of stepping out for a walk maybe because of remote working, could be the reason for more me-time spent in the bathtub/ shower leading to the fact that bathing is the only activity with net +ve % of people reporting higher frequency.

Beauty brand and marketing tactics during the pandemic crisis:

Encourage stockpiling of your brand essentials for face/personal/body/bath/haircare beyond hygiene with good deals.

Ration Face/body/personal/home care( focused on hygiene) for DTC, to ensure you touch as many consumers as possible for more frequent repeat purchase.

Highlight hygiene elements along with natural/organic/clean features of your brand/products to meet the long-term sensitivity of this segment.

Multi-purpose products, without reducing prices or even without very attractive bulk deals, will do great with this segment.

Emphasize your brand story to prevent losing them to higher-value brands.

Keep your messaging sensitive to the situation. Be authentic and offer slightly better value than other times with deals and combo packages etc.

Treats

Consumer behaviour for marketing beauty during the pandemic crisis:

Since they are more optimistic about the long-term, they will not stop buying the indulgences if offered the right deals.

Intensive skincare with masks, including night time masks and essential oils that nourish, help cope with stress, and are multi-purpose would help with this segment as they would like to have treats + stress-relief and deals in as many categories as possible.

Beauty brand and marketing tactics during the pandemic crisis:

Reward loyal consumers with bonus loyalty points and offer these points and rewards ever more frequently, on top of the sales discounts and cashback offers.

Advertise/Storytell as moral raisers and as more affordable versus more luxurious items and alternatives.

It is critical to emphasize your brand story for treats/indulgences to avoid being replaced by cheaper/higher value alternatives.

Block their cupboards and increase the share of their cupboard for higher value treats.

Postponables

Consumer behaviour for marketing beauty during the pandemic crisis:

According to HBR, “This segment will delay significant purchases, repair over replace, seek value, and low ownership costs rather than additional features and will negotiate hard at the point of sales for dryers, irons and skin lifting gadgets” etc.

They would seek home fitness equipment( with how to stay healthy content/tutorials) at highly effective cost or would repair existing equipment with the right deals.

Beauty brand and marketing tactics during the pandemic crisis:

Stress on the huge cost of postponing such as lack of maintenance of skin/hair/body leading to permanent damage and offer subscription, flexible payment plans, and really good deals.

Repair services can be marketed to this segment, who will try to prolong the life of a dryer, iron or a fitness machine rather than buy a new one.

Because of stay-at-home behavior, they would consider an end-to-end service from pick-up, repair, to delivery back higher in value.

Expendables/Luxury

Consumer behaviour for marketing beauty during the pandemic crisis:

They will deeply curtail the purchase of luxury and prestige products.

Beauty brand and marketing tactics during the pandemic crisis:

Sign up consumers for future “expendable/luxury” launches and promote D-I-Y alternatives at their homes with tutorials and your products.

Financially Well Off

Your loyal consumers in this segment( or if this is your primary target segment) will continue buying at pre-pandemic levels, especially when it comes to essentials and treats.

These are also more likely to be older than the other segments, 45-50 plus years of age, investors, successful business owners or have been in leadership roles for last 7-10 years and are the top 5% of the consumers by income.

Bathing has increased in frequency for net 20% of respondents and skincare and body care both have decreased in frequency for net 20% of respondents.

Essentials

Consumer behaviour for marketing beauty during the pandemic crisis:

Essentials will not be an issue here at all because of the price. They will stockpile on essentials with their favorite brands, face/body/personal/homecare focused on hygiene, and continue buying other skincare and body care essentials without worrying about deals.

Hand cream, face cleanser, skin/face treatment, sunscreen, eye care, lip care, face oil, and night face cream are the least hit essentials and in this particular order.

They need to look at their best during business presentations, virtual interactions with people as they need to maintain a consistent image and look, since these people are looked up to by most.

Hence, makeup will matter to them even though consumption would be a little below than before.

Lipstick and nail paint are essential for 50% of respondents while they use lip gloss and eyebrow pencil more than the other segments.

Beauty brand and marketing tactics during the pandemic crisis:

For skincare and makeup essentials continue telling your brand story.

Treats

Consumer behaviour for marketing beauty during the pandemic crisis:

Skincare, body and personal care treats here will do better than other segments without any deals because of the added focus on mental and physical health. Essential oils and chemical peels are considered treats.

Elaborate masks and treatments might go well with them since with more time on their hands by staying indoors; they could view it as an opportunity to take care of their tough skin challenges, because of slightly older age group.

For both essentials and treats, high-end, clinical plus safe, hygiene-focused, expensive CBD/therapeutic and adaptogenic skin and body care could do very well with them.

Beauty brand and marketing tactics during the pandemic crisis:

Appeal to a social cause or larger than self-cause that they can support during these times.

Emphasize brand story for the feeling of “this brand is for select few like me” backed by product quality of treats.

A specific creative idea for content and advertisement could stress “you need to be on your best game, both physically and mentally, during these tough times, to inspire all those who look up to you.”

Another creative storytelling idea could be an “exclusive escape” during the crisis for skin and body care treats and “feel good” messaging for makeup.

For makeup, communicate benefits of your makeup products especially for virtual socialising and video conferencing etc.

You could also promote your treats as the right gift for friends and family for indulgence and de-stressing in these times.

Postponables

Consumer behaviour for marketing beauty during the pandemic crisis:

They will seek higher quality for the price and will negotiate at the point of purchase. Virtual fitness equipment will be purchased if not yet.

At-home treatments with gadgets will replace trips to salons and spas, for skin lifting & tightening.

With fitness apps like Tonal gaining market share, virtual workouts will increase and these people, with their image consciousness, would like to look at their best on camera, an opportunity for makeup.

Beauty brand and marketing tactics during the pandemic crisis:

Promote savings on dryers, irons, skincare gadgets and home fitness etc.

High-tech home-based spas and salons( think tonal) with D-I-Y tutorials could disrupt the market.

Expendables/Luxury

Consumer behaviour for marketing beauty during the pandemic crisis:

Professional and Prestige skin and hair care products will take a hit during these times and for times to come because of the inability to go outside more than because of affordability.

Beauty brand and marketing tactics during the pandemic crisis:

Move away from “flaunting storytelling” for luxury brands/products and emphasize social causes, health benefits and supporting a local business etc.

Email newsletters customized for the current sentiment are better than outright promotion on social media, in particular, if you are looking for engagement on the posts.

For makeup, more subtle lipstick shades might do better than more gaudy ones.

High-end clinical brands, with clean and safe ingredients, that have therapeutic benefits for skin/body and face would do well.

You could promote DTC for professional/prestige products as D-I-Y alternatives with ample tutorials. They are the least likely to learn a new behavior, but if you make it very easy for them, with a dedicated tutor, and leverage artificial intelligence, with dedicated virtual assistants/personal assistants, they might give it more than a shot.

There is an opportunity for launching consumer durables focused on extra and automated(think mechanized sanitisation) hygiene for this segment.

Live for Today Consumers

Live my life to the fullest no matter what, hardly any savings

These are younger, urban, and the most likely to be unemployed at this time. They are most likely to adopt virtual, social hangouts.

Essentials

Consumer behaviour for marketing beauty during the pandemic crisis:

Personal, body and home care focused on hygiene will be bought same as before without stockpiling as much because they are less likely to have families, and are also worst hit by unemployment.

Almost 100% of less than 35 age group cites more virtual socialising than before, but still, they are putting on less makeup than before.

Beauty brand and marketing tactics during the pandemic crisis:

Promote as “indispensable” for your skincare/makeup essentials with a little bit of a deal to compensate for their extra purchase of hygiene/care essentials.

Treats

Consumer behaviour for marketing beauty during the pandemic crisis:

For those not hit by unemployment, they would continue buying favorite brands at pre-recession levels with the exception of makeup, hair styling and fragrances etc.

This is also the segment that is least in fear about the pandemic and hence not that health-conscious nor too worried about the future but will take precautions for health. Fitness and aesthetics are strong attractions for them. Unless unemployed, they are not likely to save money.

Beauty brand and marketing tactics during the pandemic crisis:

Promote the current situation as all the more reason to indulge, de-stress, and seize the moment. Offer a little cash discount for your treats.

Postponables

Consumer behaviour for marketing beauty during the pandemic crisis:

This segment could buy fitness equipment and beauty gadgets with good deals if it’s affordable and aligns with their cash flows.

Beauty brand and marketing tactics during the pandemic crisis:

Offer flexible payment plans on durables.

Expendables/Luxury

Consumer behaviour for marketing beauty during the pandemic crisis:

Hesitant to buy anything new because of financial uncertainty.

Beauty brand and marketing tactics during the pandemic crisis:

Offer flexible payment plans and brands/products with exciting brand story and personality.

“Launch exciting products as must-haves with an aspirational brand story.”

Responsible brand story and storytelling will resonate better with this segment because of their environmental consciousness.

Innovation

Skincare that tackles blue light and innovative makeup focused on indoor environment and for the camera, which makes them look great on virtual socializing, and social posts could be tried and adopted fastest.

Cutting edge innovation, ahead of the curve, will appeal to them, especially with indoors becoming a trend.

Big Opportunity for Marketing Beauty during the Pandemic Crisis

Build routines and rituals with education and creative storytelling

In these turbulent times, your brand tribe matters the most. Build routines for regular buyers and rituals for your most loyal fans.

How? During the crisis, almost each one of your consumers is staying at home most of the time. First, study the daily routines and the availability, during the day, of your most loyal consumers with a survey and create 2-3 segments of their stay at home life.

a. Design an elaborate/ideal routine for your products, customised for their typical day, with a step by step process for particular times of the day with specific applications, etc.

b. The routine will become a ritual when you associate an emotional meaning to the routine. This could be achieved with emotional storytelling around the routine with the current context in mind.

c. As a founder/brand educator/marketer do live videos on Instagram, showing these routines yourself according to a daily with a flexible weekly schedule. Do a recap of the videos. Explain and repurpose into social posts and lead them to website pages, where these routines are again explained in detail.

d. Post designing the routine education book/guide/videos share the entire weekly calendar with your audience via email/messaging and let them self-select into their choice of day and time.

e. Invite all your loyal fans to do these rituals with you on Instagram/Virtual social right before you start the ritual. Reward your participants with loyalty points and special gifts and deals for attending and participating.

f. Always start a routine with an essential and build a treat into it later for making sure that treats are not as badly impacted and essentials do really well and post-pandemic, each does better.

g. Request them to send their progress reports, pics and questions and share with every one of your followers on both the website and social media.

h. Use this ritualized education and consumption to create breakthrough results for your loyal fans and let this become an ingrained behaviour and ritual in their lives built around your brand. You will sell much more/loyal(regular) consumer during the quarantine as well as continue the sales post-crisis.

Do it for 21 days and get them to habituate on the right routines for good.

Post quarantining, you will have to slightly modify the routines with options like weekday express and lazy weekend options.

More Brand and Beauty Marketing Tactics during the Pandemic Crisis

Triage

(For “very careful and worried about long-term” and “careful but hopeful for the long-term” consumer segments)

Reduce variety and complexity for essentials and treats to save you both cost and time, and focus on further increasing the value of existing good performers by offering additional quality or slightly better deals.

Part with uncertain, inventory consuming products on life support that are unlikely to survive because of the crisis induced behavior.

The above includes unnecessary variants of essentials and treats and postponables and luxury products that might be out-of-sync with the new reality.

Your main goal is to prevent losing consumers, so focus on your best-selling products, beyond hygiene focused essentials, and offer good deals on those.

Don’t move down market, especially for middle to high-income segment “careful but hopeful” segment.

Avoid the temptation to reduce your pricing or offer huge price deals and be viewed as cheaper than the high-value brands that target lower-income( to your target) consumers. The before will alienate your loyal consumers and invite stiff backlash from strong competitors.

Better to offer higher perceived value, bundled deals hovering maximum around 25%-30% higher value than the usual value, but with still slightly higher pricing than the cheaper/private label brands.

Innovation

(Mainly for “careful but hopeful” “financially well-off” and “live for today segments”)

For “financially well-off” and “careful but hopeful” incremental innovation across all skin/body/personal/home/hair care factoring health and hygiene, thus offering higher perceived value, will see a surge.

There is a big opportunity for transformational innovation for makeup brands because of the change in consumer behaviour.

As explained before, this is because of the effort-benefit effect which dominates the lipstick effect in the current scenario.

But another context provides a window of an opportunity for makeup brands:

The fact that during a financial crisis, women might actually want to look even better than ever before, because of evolutionary thinking, since, now, the number of deserving men is going to be fewer in number, which makes finding the right partner tougher.

If you combine the effort-benefit with the above evolutionary theory, there is a solution for makeup brands:

1. Promote content citing that others are lowering their game but you should go high, especially for those segments like “careful but hopeful” and “live for today”, because of their age brackets.

2. Think long-term consequences of how can a makeup product make someone stand out on video, with a much smaller screen, or for the social distancing environment, and create a brand story/storytelling with product features, around the new need, that give an edge within this new environment.

Natural-looking makeup and smaller-sized makeup products could see a rise because of both acquired habit of minimal makeup and perceived reduced quantity need for makeup.

There is an opportunity for innovation by launching disruptive brands for dryers, irons, and skin lifting gadgets etc. by reducing cost of ownership or complexity of use and service.

Top of the rung professional/prestige brands that innovate and build a new category, like home-based spas with D-I-Y alternatives, that bring the cost of a spa down by a magnitude(like 10x) could disrupt the market.

For luxury/prestige and top-rung professional brands and salons and spas, claims around sanitization, hygiene of store staff with minimal human interaction and maybe touch-free spas/stores could disrupt the market as well.

D-I-Y alternatives with professional products, in conjunction with virtual consultations, would help professional brands. For example, ship hair color and kits to consumers and then offer paid virtual consultations on application.

A few more smart ways to market beauty brands during this pandemic crisis with content

1. Explore social media beyond Instagram, like Pinterest, with more time for producing and sharing content.

2. Advertise brands jointly with another brand in a different product category that targets a similar consumer segment.

3. Create a low-cost, emotionally compelling campaign with multiple short videos and posts with a common creative idea.

4. Bring out your unique founder personality with the videos to connect with your fans at a fundamental level.

5. Collaborate as a community of Indie beauty brands and launch a creative campaign promoting Indie beauty brands as standing together during these tough times.

Consumer research

It’s critical that you track how your consumers are prioritising, reallocating budgets, switching between brands, and redefining quality and value.

Use online survey portals for your existing subscribers and new buyers. One of the objectives of the surveys would be to find out whether consumers will go back to brands, stay with a substitute, or welcome innovation.

Conclusion

The pandemic is driving the current economic crisis in the market, and hence the situation is far more complicated than caused by a recession/depression alone.

With findings from an exhaustive consumer survey of 40 respondents and phone interviews with 10 Indie beauty founders and,

In line with HBR article, I have shown four psychographic segments:

1. Very careful right now and worried about the long-term

2. Careful now but hopeful about the long-term

3. Financially well-off and

4. Live for today

along with four product categories

a. Essentials

b. Treats

c. Postponables-durables and

d. Expendables(luxury),

as defined by an HBR report on “how to market during a downturn”, and added another category “non-essential” which has low functional and treat utility for the consumer.

and then overlaid current consumer behaviour induced by pandemic such as

social distancing, stay at home, work from home, hyper-sensitivity around hygiene, virtual socialising and video conferencing, DTC spike, mental health etc. to explain the current resultant consumer purchase behavior by consumer segment and beauty product category.

During the crisis, body/personal/home care are stockpiled by each and every category of consumers because of hygiene consciousness.

For essentials, “very careful right now and worried about the long-term” segment would move to private label or cheaper brands whereas “careful now but hopeful about future” segment would prefer to buy their current brands but with good deals.

Financially well-off consumers are most likely to stockpile body/personal/skin/homecare essentials with their favourite brands the most without any kind of deals. They will also be willing to pay a premium for these essentials for extra assuredness on hygiene, and health.

Live for today consumers would stockpile the hygiene essentials a bit but not as much because of low disposable income and hardly any family. They are also likely to continue buying all essentials and treats at pre-recession level discounted for the extra purchase of hygiene essentials and indoor behaviour, which will result in more skincare purchase than makeup across the spectrum.

Any beauty product category for treats, postponables, and luxury would be a worse hit for “very careful right now and worried about the long-term” and “careful now but hopeful about future” than for “financially well off” and live for today with least impact on the latter well off because of purchasing power and higher confidence in spending.

Based on the intersection of your most loyal consumer segment and product category, choose the pertinent brand tactic to market your beauty brand/products during the pandemic crisis as explained above and in the Chart 3.

Treats and luxury will do better for financially well-off if promoted as “for select them”.

Live for today is least health-conscious and would continue buying unless adversely impacted by unemployment, would prefer exciting products and flexible payment plans.

Because of the pandemic, skincare indulgence is up whereas both makeup essentials and treats are down.

Postponables such as hair and skin gadgets would need good deals to move overall or need to stress value over visiting for services at salons and spas which are anyways closed.

A very big opportunity is to create routine and rituals around your beauty products during this crisis leveraging the consumer’s stay at home behaviour.

Innovation focused around the change in consumer behaviour of virtual socialising and video conferencing, is an opportunity for makeup.

Let’s make this report a living document. Please leave your feedback and inputs in the comments. All beauty brands need to come together and contribute in creating a collaborative document to help us all navigate and transform as winners out of this sudden and imposed, unwelcome change.

For a free, detailed report on current consumer behaviour survey and on post-crisis strategy to win in your beauty category, please enter your email id below!

ROHIT BANOTA, Founder of StorySaves, has created, transformed and grown dozens of beauty consumer brands across North America using proprietary Brand Story, Innovation Strategy and Brand Tribe frameworks and processes.

He has over 15 years of marketing, brand, and innovation experience growing consumer packaged goods including startups and MNCs like P&G-Beauty and Grooming and AB InBev.