In recent years, venture capital funding has experienced significant growth and expansion. However, funding for women founders has yet to witness the same level of progress.

Shockingly, in 2022, ventures established solely by women received a mere 2.1% of the total investment amongst venture-funded startups in the United States.

Nonetheless, focusing solely on this number would be overlooking the bigger picture. The landscape for female entrepreneurs is gradually evolving, as evidenced by the upward trajectory of VC funds for startups founded or co-founded by women. 2022 marked the emergence of numerous women-led funds, incubators specifically designed for female founders, and the birth of innovative new enterprises.

Women Founders Outperform Men

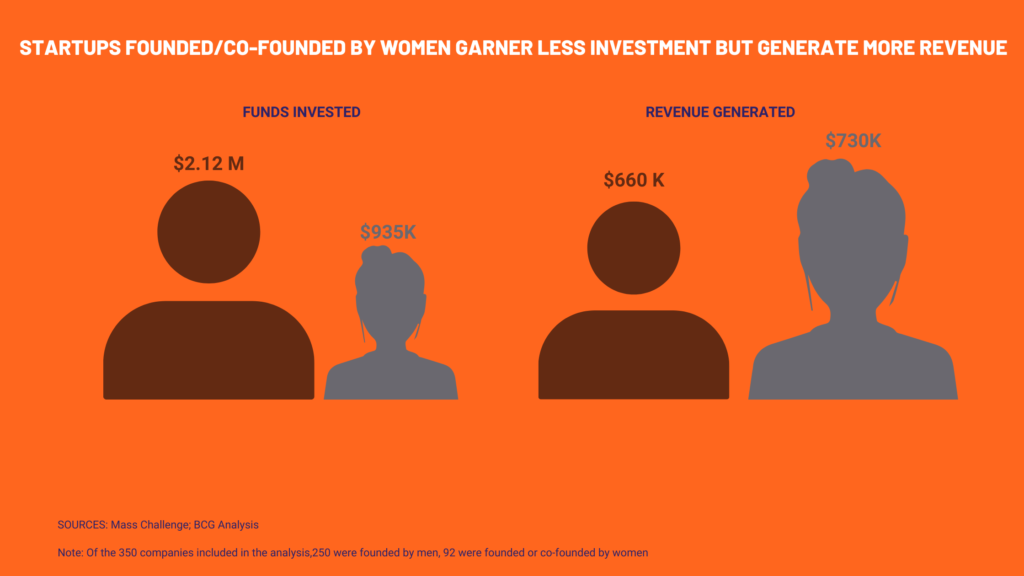

According to a BCG study, Investments in ventures founded or co-founded by women exhibit an average of $935,000, regrettably falling short of the average $2.1 million invested in companies established by male entrepreneurs. This stark contrast emphasizes the existing disparity in funding allocation.

Surprisingly, these women-led ventures have demonstrated superior results, generating a cumulative revenue that surpasses their male-founded counterparts by 10% over five years. Specifically, female-founded startups amassed an impressive $730,000, whereas male-founded companies recorded $662,000.

When evaluating the efficiency of converting investment into revenue, companies led by women shine as excellent financial investments. These startups generated an impressive 78 cents of revenue for every dollar of funding received. In contrast, male-founded startups struggled to match this success, generating a mere 31 cents for every dollar invested.

Additionally, statistics from Springboard indicate that even a small degree of gender diversity is beneficial, with startups featuring at least one female founder outperforming all-male teams by 63%.

These statistics underscore the existing gender-based funding disparities and highlight the untapped potential and financial prowess of companies founded and co-founded by women. We can foster a more equitable and prosperous entrepreneurial landscape by recognizing and embracing the immense value they bring.

The findings are statistically significant, ruling out factors like education levels and pitch quality that could influence investment amounts. This comprehensive analysis reinforces the validity of observed funding disparities and highlights the need for equal opportunities for women entrepreneurs.

Findings from Pitchbook Report

PitchBook Data published a report on “Women Founders” in the Venture Capital Eco-system (with support from Beyond The Billion, J.P. Morgan, Pivotal Ventures & Apex Group Ltd)

There is some silver lining and movement in the right direction.

Women founders had higher valuation growth during the early stage and lesser decrease in valuation during the late stage vs. male counterparts

Angel Funds and unicorn deal amount for women founders reached their second-highest annual levels

Women-founded brands outperformed the broader market around the median time it takes to exit

But, women-founded startups still have only approx—1/5th of the total VC deals.

What could be the big reason?

-Decision-making authority for writing cheques wrests with men in most VC firms

-Only 4.5 % of firms have a woman decision-maker team

-It’s understood that women chequewriters are more likely to invest in female founders, mandating more representation.

According to a study by HBR, Venture capital remains predominantly male-dominated, resulting in a significant gender imbalance among venture-backed entrepreneurs and VC investors. Companies founded solely by women receive less than 3% of all venture capital investments, while women account for less than 15% of chequewriters. The skew, presumably, perpetuates a cycle where male investors tend to favor startups led by men, aligning with their comfort zones [source 1]. In response to these disheartening statistics, policymakers, business leaders, and investor groups advocate getting more women involved in venture financing. The idea is to empower women to invest in female talent that may otherwise go unnoticed, providing an opportunity for them to reap the benefits of investing in underrepresented women.

But is having more women investors a complete solution to funding more women founders?

It seems seeking support from female investors for female entrepreneurs appears beneficial. However, recent research conducted by the HBR team reveals a contrasting perspective. The study analyzed over 2,000 venture-backed firms in the United States and found that women-led firms whose initial round of VC funding exclusively involved female partners were twice as likely to face challenges in raising subsequent financing rounds. Surprisingly, this trend remained consistent across factors such as funding size, industry, geographic location, and investor prestige. In contrast, the gender composition of first-round investors had no significant impact on the ability of male-led firms to attract future investment.

What causes this disparity?-Attribution Bias

BCG conducted an experiment involving over 200 MBA students and investors to understand the driving forces behind this disparity. They presented a fictional startup pitch delivered by either “Laura” or “David,” with funding attributed to either “John” or “Katherine.” Interestingly, when Laura received funding from John, she received comparable ratings to David. However, when Laura’s funding came from Katherine, both male and female participants evaluated the pitch less favorably and perceived Laura as less competent.

This phenomenon can be linked to attribution bias, where individuals tend to attribute someone’s situation to their identity or character rather than external factors. When a male investor backs a female founder, it is assumed that she earned the investment due to her competence and the strength of her startup. On the other hand, if a female investor supports a female founder, her investment success is often attributed to her gender rather than her competence. Consequently, new potential investors may perceive a female founder as less competent if she has only received backing from female investors, regardless of her qualifications.

Analogous results w.r.t. Affirmative Action

Research has shown analogous effects with affirmative action, where individuals perceive female employees hired through affirmative action as less competent than equally qualified individuals who were not. Even if two women possess exactly the same competence, the information that one was an affirmative action hire diminishes the perception of her competence.

For female founders seeking capital, it is essential to note that raising funds solely from female investors can be a risky strategy for long-term success. Female investors are still relatively fewer in number, often concentrated in earlier-stage investments with smaller funds. Ultimately, female founders will need to attract male investors to facilitate growth. Research suggests that raising at least some capital from men initially can make it easier to attract further investment.

While those in positions of power must address bias and ensure fair evaluations, female founders in today’s imperfect world may benefit from casting a wider net and involving a diverse team of VCs in the first fundraising round. Mixed-gender coalitions tend to outperform single-gender ones in advocating for gender equity. Both male and female VCs need to work together in supporting women-led startups and promoting a more balanced landscape.

I know of some very committed and competent all-female funds doing a great job. Just being cognizant of this bias can further help them improve their portfolio performance over the long-term.

8 Ways Venture Eco-System Can Fund More Women

- Democratize Information by Beauty Accelerators uniting and sharing data on all funding-ready women-founded beauty brands seeking funding and bringing together all women & men interested in hearing pitches beyond just the VC firms. Use a portal or create a dedicated section on your website for the same. Jump accelerator is going to lead the way.

- Accelerators should design the intake process involving women, giving them a say in the decision-making team. Why? Because specific insights resonate with women, the woman on the panel can identify and see if there is potential for scale.

- Stories of Women founders overcoming typical startup challenges both valiantly & smartly despite greater odds against them in contrast to their (female + male counterparts(no shaming), so we can learn from female founders, will help change the perception! Keep the story format instead of deep dives.

- Demystify founder traits and make it easier to identify success drivers and how you can spot them without gender bias, attribution bias, or affirmation action, esp. those who outdo their male counterparts. This is to bring certain success-driving feminine traits to the fore. Evolution should take it beyond gender to teach the thought process and actions taken by those successful and how to identify the causal characteristics. This content must be shared and taught at all accelerators and VC firms.

- Investors interested in funding women should unite, especially around a category like beauty, which is super-intuitive to women, and at every growth stage. This seems counter-intuitive as FOMO drives investors’ participation in a deal. Please note that FOMO has a trade-off with proper evaluation of a startup and its due diligence. Also, remember how many ventures you invested in out of FOMO and failed. Smaller investors must lead this endeavor since they usually lack the best networks to access the information first. The big will follow suit.

- Mixed-Gender coalitions to overcome the attribution bias and the affirmative action bias. Late Growth Stage Funding- Series C and onwards need more representation of women. In contrast, more men in the early stage can also help overcome attribution and affirmative action bias.

- Existing Female Focused funds could explore partnerships with later-stage funds, if not vertically integrate, to ensure subsequent round success for their portfolio brands.

- All Pros passionate about bringing this change should speak to female founders periodically and then introduce them to their networks after having known them over an extended period. Create an event in your calendar: call it Woman’s Week! and send it out to your audience on social media and speak to at least 5-10 women founders consistently every week.

3 Ways Women Founders Can Up Funding Odds

Unique resonant insights for women-tailor story by audience

-Only female: Help them relate in a way you know only you can; use inside lingo, insights that all women relate to instantly

-Only male: Try to find out their preference; focus on your traction, future, and tailor your story for them

For a mixed-gender audience, you need to bring the two together.

Stories Women Love, And Men Dig

The story affects both men and women but men prefer stories about hunting. In contrast, women are biased toward stories of nurturing. Try to create a nuanced story with details inviting them into the world you wish to create.

Women read more fiction than men. My theory is that it is a man’s world and women vicariously live in an alternative world through reading fiction.

There are more credible theories that attempt to explain the “fiction gap,” with cognitive psychologists highlighting women’s higher empathy and broader emotional range as factors that make fiction more appealing to them. Early-stage research suggests that women may have more sensitive mirror neurons, potentially explaining their attraction to empathetic engagement in fictional works. According to Brizendine, reading demands patience and the ability to deeply connect with characters, qualities that women are more interested in and proficient at.

The simple takeaway is that women are more likely to connect with your anecdotal consumer insight, and for men, you need to help them cross the bridge.

When presenting to men, keep the story around the kill! The killing that everyone will make and what the end game is the consumer, whose problem you are solving for means. Goal Posts, End change, metrics, and precise results indicators are essential.

Another approach worth trying is combining empathetic & anecdotal consumer insight with a fact-based, quantitative benefit for the consumer with the business’s goals, metrics, and milestones.

Also, with men, be more assertive and clear on what you need, and don’t back down or justify. Less self-effacing and more confident.

Seek more referrals from influential people you meet

Men and women are often willing to contribute but may need more clarity on how to do so. Communicate the change you are trying to make in the life of your target consumer and then quantify the impact before asking for a recommendation.

Pre-empt preventative questions with promotional approach

“Why does this matter? Well, regardless of whether you are a man or a woman, if you get asked preventative questions, you are five times less likely to raise money, period,” says Greenwood.

Fortunately, there is a silver lining. By identifying and acknowledging preventative questions, one can acquire the skills to respond proactively, significantly increasing the likelihood of success. You could start learning independently or go to a network or a coach for guidance.

Summary

Even though women founders still receive a meager percentage of all funding, this is changing in the beauty category with the emergence of women-focused investors and firms.

To everyone’s surprise and my delight, women-led startups outperform men-led gigs by 10%-63%, according to BCG and Springboard research data, respectively. Not just that,

-Women founders experienced more significant valuation growth in the early stages and less decline in later stages than their male counterparts.

-Angel funds and unicorn deal amounts for women founders reached their second-highest annual levels in 2022

-Women-founded brands outperformed the broader market in terms of median exit time.

There is a notion that having more women investors and upping the percentage of women in the investing teams is the way forward.

While this certainly helps in the seed to early stage, it can be debilitating during the later rounds of funding as attribution bias and affirmative thinking can prevent women from receiving cheques from both male and female founders.

You can also read about 11 mistakes beauty founders make here!

8 ways the venture eco-system can further help fund women

- Accelerators of the world should share data on all women-led startups seeking funding.

- Need more women in the accelerator intake process.

- Stories of Women founders’ performance and traits vs. Men.

- Identify success drivers by demystifying founder traits without gender bias, attribution bias, or affirmation action. Understand the distinctive characteristics of female founders who outdo their male counterparts.

- Community of Investors of the world uniting for women.

- Mixed-gender coalitions with Late Growth Stage Funding- Series C and onwards need more representation of women, and more men in the early stage can help.

- Female-Focused funds need to look at all funding stages.

- All Pros passionate about bringing this change should speak to female founders periodically and then introduce them to their networks after having known them over an extended period. Create an event in your calendar: call it Woman’s Week! and send it out to your audience on social media and speak to at least 5-10 women founders every week.

3 ways female founders can up their chances of fundraising

- Tailor your pitch and story, factoring how both men and women perceive and like stories, with consumer insight and impact.

- Seek more referrals, especially from the influential men & women you meet

- Pre-empt preventative questions with a promotional approach

Need help with your pitch deck or evaluating whether you are funding-ready? Book a complimentary call here!

Jump Accelerator hyper-grows women-led, early-stage beauty brands with a custom fit, full & fundamental solution based on the first principles of science & emotion