Learn how to design a post-COVID strategy for your beauty brand and win the future beyond winning during pandemic crisis.

Whether blue ocean or not, a strategy is about winning and continue winning, well into the future, in a particular environment. This definition holds more truth than ever, at this time, since nobody knows for sure what the future environment looks like in a post-COVID world.

Once you know what the future looks like, you could invest resources in strategic programs to either differentiate or beat the competition to help you win.

This article covers, amongst other details,

1. COVID related/accelerated consumer behavior trends for three scenarios with projections for fightback and post-COVID phase.

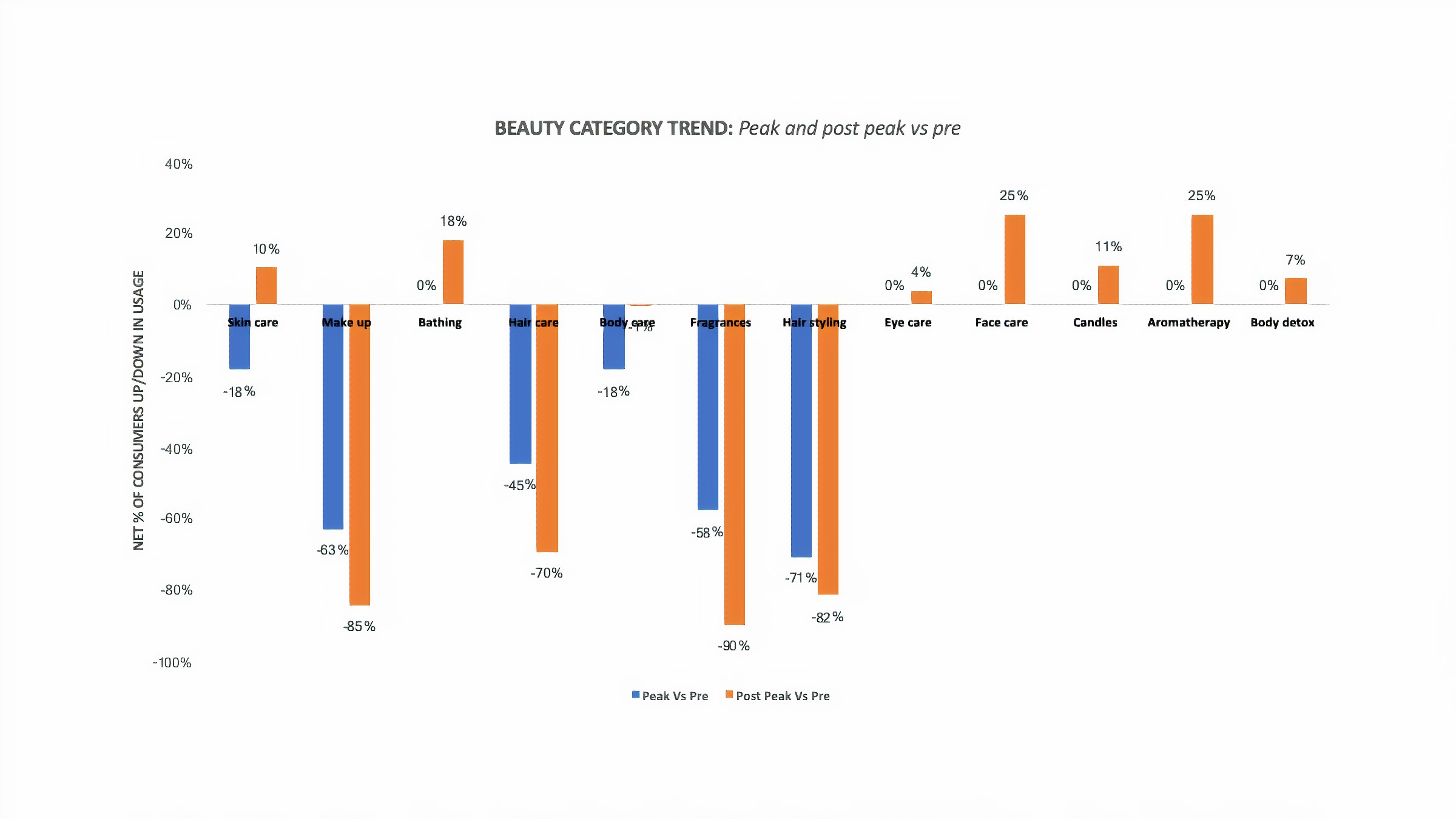

2. Beauty categories trend from peak to post-pandemic vs. pre-COVID.

3. Beauty Categories-Skincare, Makeup and Hair Care

a. Analysis of COVID related/accelerated consumer behavior drivers

b. Beyond-COVID category drivers

c. Competitors-Possible New launches and Entrants

d. Retailer/Channel-COVID influenced drivers/inhibitors

e. Summary of analysis of COVID related/accelerated consumer behavior drivers, competitor, retailer/channel-COVID related drivers and beyond-COVID category drivers.

f. Recommendations for brands-skincare, makeup, and haircare

4. How to create Post-COVID Strategy for your Beauty Brand

There are two phases and three scenarios( my assumption) possible on the road to the post-COVID future.

a. The first phase is the fight back, which is post-peak and includes various stages of partial lockdowns and no lockdown but before the widespread availability of a vaccine.

b. The second phase starts once the vaccine is available for the masses and could be called post-COVID.

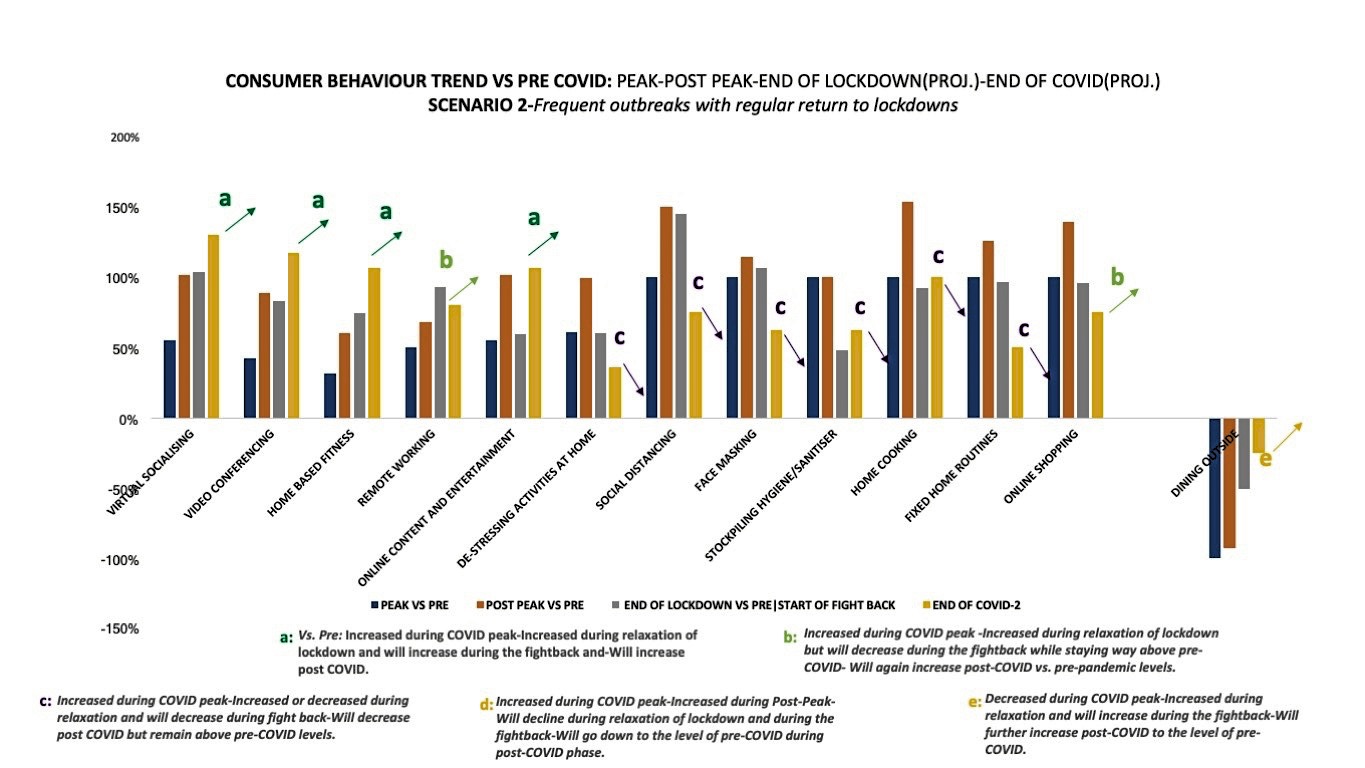

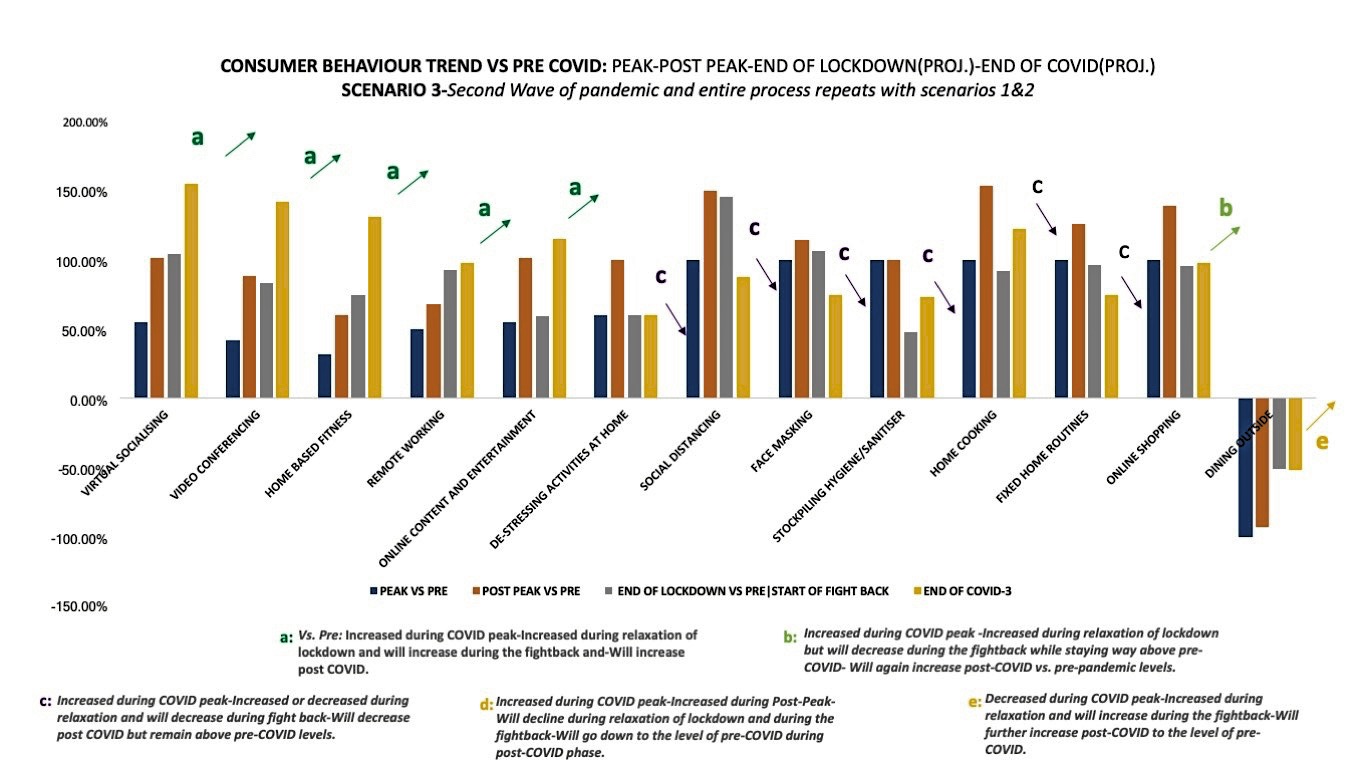

Following are the three scenarios, I predict, that will impact the above 2 phases:

Scenario 1: Gradual/fast downward trend of pandemic infections with occasional outbursts.

Scenario 2: Frequent spikes in pandemic infections with different degrees of lockdown throughout the fightback phase.

Scenario 3: A second wave of the pandemic, a new peak of pandemic infections and death, and then the entire process repeats with a combination of scenarios 1 and 2.

Playing for the end game: After the end of the COVID environment, post availability of a vaccine.

What would be the new normal?

Nothing is going back to the way it was barring a few exceptions. Certain behaviors will go back to close to pre-COVID while others will get hugely accelerated, impacting consumption and demand for beauty and wellness.

While it is critical to survive today, you must position yourself to win the fightback phase and be ready to win the post-COVID demand.

A lot of change in consumer behavior, which impacted the demand for beauty, was due to the environment. Equally, closure of brick and mortar stores and subsequent less traffic was responsible for the decline in sales.

Methodology of the survey for observing COVID-related trends:

I surveyed 40 consumers, experiencing various degrees of lockdowns, across USA, CA, and EU, and took their responses on their change in consumption habits of different beauty categories, from peak pandemic onwards and their behavior patterns versus during peak-pandemic. My earlier survey had consumer responses during peak-pandemic versus pre-COVID.

COVID Related/Accelerated Consumer Behavior Trend Plots-Peak Pandemic-Post Pandemic-Projected Fight Back and at the End of Fight Back Phase/Start of Post COVID with Three Scenarios-

( Net % increase/decrease of consumers)

Five types of behavioral trends:

a. Vs. Pre: Increased during COVID peak-Increased during relaxation of lockdown and will increase during the fightback and-Will increase post COVID.

Scenario 1&2 have the same consumer behaviors within this trend:

Virtual socializing, video conferencing, home-based fitness, and online content and entertainment.

These are genuinely accelerated trends and significant drivers of behavior change. A few out of the above could experience a bit of a dip during the start of the fightback phase, but that would be temporary.

Scenario 3: Remote working is an additional consumer behavior following the trend, unlike scenarios 1 &2. Increases over higher levels of the end of fight back phase vs. scenarios 2 & 1.

b. Vs. Pre: Increased during COVID peak -Increased during relaxation of lockdown but will decrease during the fightback while staying way above pre-COVID- Will again increase post-COVID vs. pre-pandemic levels.

Scenarios 1&2 have the same consumer behaviors in this trend:

Remote working and online shopping. These would eventually accelerate over pre-COVID but will be balanced to some extent by back to work and physical shopping experience etc. in the short-term, while again starting their upward trend post COVID.

Scenario 3: Online Shopping is the only behavior in this trend type, unlike scenarios 1&2, which also had remote working with it. Increases over higher levels of end of fight back phase vs. scenarios 2 and 1.

c. Vs Pre: Increased during COVID peak-Increased or decreased during relaxation and will decrease during fight back-Will decrease post COVID but remain above pre-COVID levels.

Scenario 1: Social distancing, stockpiling hygiene and sanitizer, home cooking, and face masking follow this trend.

These behaviors will be relevant for some time even after post COVID but not significant drivers. Any change wrought due to these would stick for some more time out of momentum and habit but might fizzle out with time.

Scenarios 2 &3: Destressing at home and fixed home routines are additions to this trend type. Decline starts from much higher value versus scenarios 1 & 2.

d. Vs. Pre: Increased during COVID peak-Increased during Post-Peak-Will decline during relaxation of lockdown and during the fightback-Will go down to the level of pre-COVID during post-COVID phase.

Destressing activities at home and fixed home routines will adhere to this trend type. These should go back to pre-COVID days, and any change wrought will cease to exist.

Only Scenario 1 shows this trend for the above behaviors.

e. Vs. Pre: Decreased during COVID peak-Increased during relaxation and will increase during the fightback-Will further increase post-COVID to the level of pre-COVID.

Dining outside is the only behavior following the above trend.

All three scenarios show the same trend for the above consumer behavior.

Beauty Categories

For our survey respondents, skincare consumption was up for net 20% of consumers over the peak pandemic/lockdown period, makeup was further down for net 20% of consumers, and hair care was again down for net 25% of consumers over the peak low.

Caveat: Some of the respondents might have compared the “current time” with pre-COVID instead of the peak-COVID period. Therefore, instead of the actual %, it is better to note the trend.

Skincare improved over peak low, whereas haircare and makeup got worse overall.

The fightback phase will lead to the new normal, but the direction might not always be uni-directional for consumer behavior or the beauty category demand.

How I Predict the End of Fightback Phase/Post-COVID Consumer Behavior and Demand for Beauty Categories?-The End Game

a. Plot observed consumer behavior values against various lockdown stages to find the co-relation and assume the state of consumer behavior in the future, all three scenarios, based on secondary info backing our data.

b. Plot the observed consumption values of the beauty category with the corresponding consumer behavior values and find the correlation between the specific beauty category and the particular consumer behavior.

c. For the high correlation(R square>=0.8) of consumer behaviors, insert the future consumer behavior value( step a) for three scenarios to calculate the future demand of a particular beauty category.

Caveat: The correlation between consumer behavior and particular beauty category is more likely to be true during the pandemic-influenced phase, which means the fightback phase, and post-COVID, the correlation could very well float away from the observed correlation coefficient here.

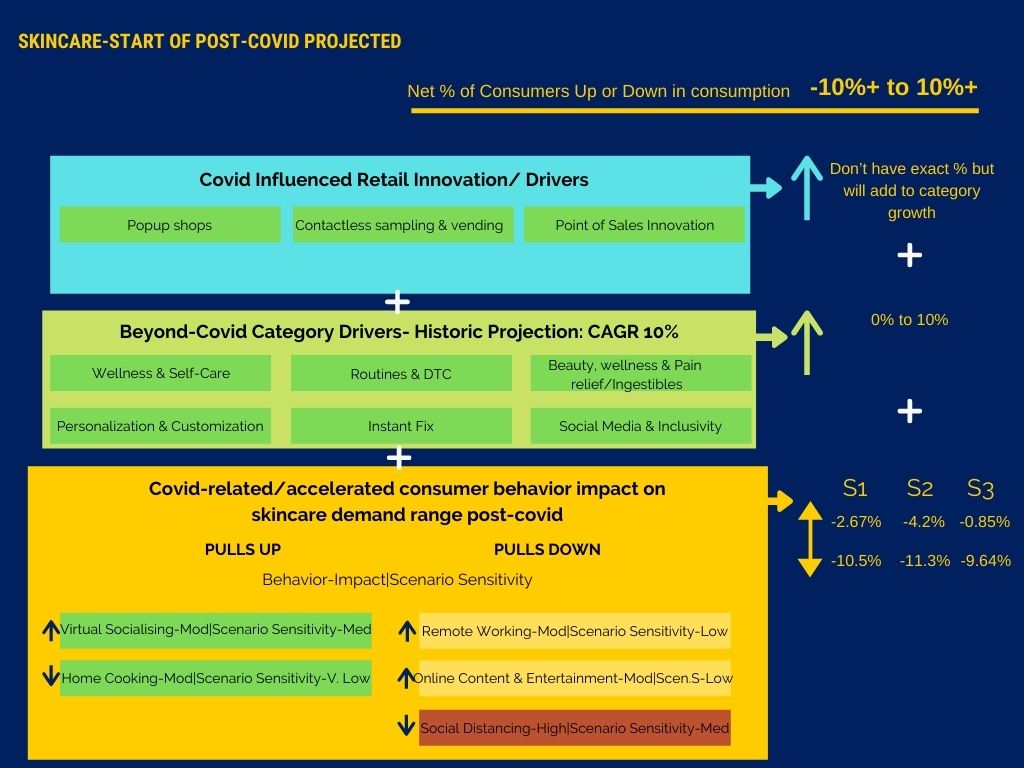

SkinCare

The Post-COVID predicted range of skincare with net % of consumers increasing their consumption over pre-COVID.

Based on only COVID related behavior trends

Scenario 1: -2.6% to -10.55%

Scenario 2: -4.21% to -11.41%

Scenario 3: -0.85% to -9.64%

The above scenarios account for the co-relation between clearly observable, altered, accelerated consumer behavior trends for our survey respondents, and their skincare usage during COVID. We need to combine them with other, beyond COVID trends, factors driving skincare.

Analysis of COVID Related/Accelerated Consumer Behavior Drivers-( Scenario 1 for illustration)

Drivers:

Virtual Socialising:Impact=Mod|Scenario Sensitivity=Med +Home Cooking:Impact=Mod|Scenario Sensitivity=Very Low

Vs

Inhibitors:

Remote Working:Impact=Mod|Scenario Sensitivity=Low+Online Content and Entertainment:Impact=Mod|Scenario Sensitivity=Low+Social Distancing:Impact=High|Scenario Sensitivity=Med

Remote working is assumed to decrease during the fightback/post COVID because of back to work rush but then again could increase post-COVID.

When Remote working falls, skincare increases during fight back/post-COVID, but if the trend increases post-COVID year on year, it will cause a decline in skincare. This trend results in skincare decline because maybe remote working eats into the time required for skincare.

Also, it could be that when remote working increases beyond a point, skincare drops.

Online content and entertainment too would decline a bit, from peak high, but will increase during the fightback and post-COVID as well. It will temporarily cause skincare to increase but eventually will decline.

The initial increase could be driven by overall more time at home, leading to an increase in online content and entertainment and skincare, but eventually, entertainment at home would eat into skincare time.

During the fightback phase, skincare increases over peak low(peak pandemic) and approaches pre-COVID levels.

Post-COVID Skin Care Vs Consumer Behaviour-Ref Chart

Virtual socializing increase will pull up skincare due to savings in time, maybe. In contrast, home cooking decrease will pull up, again perhaps due to savings in time if it translates to food delivery. In contrast, remote working and online content and entertainment will pull skincare up(correlate with) in the short-term before pulling down post-COVID.

The decline in home cooking has its limit as it will likely not go below a certain level overall.

Social distancing decrease will cause a reduction in skincare demand/usage as maybe makeup will gain back importance. Social distancing is relevant mainly until the vaccine is available.

There might be some form of social distancing in practice post-COVID as well, especially at stores and entertainment venues, but since social distancing can only go down to 0%, it can only pull skincare down to a certain level.

For traffic at stores, supply side, social distancing does cause a decrease in sales. Having said that, during peak-pandemic, skincare was only down for 20% of our respondents over pre-COVID levels even though brick and mortar stores account for over 70% of total sales. Maybe, they found an alternative DTC brand/portal.

Therefore, reduction in social distancing will increase the volume of shopping at stores, which can also increase skincare purchases and counter the pull of cannibalization by makeup.

Basically, virtual socializing vs. remote working+online content and entertainment will decide if skincare increases or decreases due to COVID induced/accelerated behavior drivers.

Need to deep dive to understand the exact cause of skincare increase/decrease correlation with the above behaviors.

Skincare has to battle the two trends, remote working, and online content and entertainment, to overcome the downward pull.

Before COVID, online content and entertainment(just the streaming), had a 20% CAGR which accelerated during COVID by 50%. Social Media usage too increased by 50% during COVID. Remote working is assumed to grow at over 50%(assumption) during peak-COVID.

(Note: Need to study these behaviors in detail and deduce the causes for skincare decline beyond the apparent time consumption.)

During post-peak, relaxation of lockdown, every skincare category has grown over peak pandemic.

Highest growth occurred for hand cream-net increase in consumption for 25% of consumers, moisturizer and face mask each had a net increase for 17.86%, and face cleanser, deodorant, and essential oils saw a net increase in consumption for net 14.29% of consumers over peak-pandemic.

The above categories are going to lead the increase in skincare during the fightback phase.

Beyond-COVID Skincare Category Drivers

Health Consciousness and Self Care

Wellness has become a crucial driver of skincare, and this trend is here to stay. With pandemic having accelerated awareness around self-care and mental health further, skincare is going to benefit a great deal from this trend. Work-related stress and environmental pollution will also add to the growth of self-care with skincare.

Fuelling this trend are natural, clean beauty, traditional herbs, and now CBD beauty, which along with calming and destressing in the moment, reassure consumers of reversing the adverse impact of the environment on their skin.

Routines and DTC

Routines and rituals are driving the category with subscription boxes and multi-step treatments, seeing an increase in sales. DTC is a big factor in fuelling this driver since it brings the price down for a consumer and saves on the hassle of time/shopping and keeps available the tools for the routine.

Social Media Wow and Inclusivity

Gartner L2 report shows that skincare brands get 40% more engagement on IG vs. color cosmetics and a 44% increase in follower growth.

With the latest trend on inclusivity, coinciding with COVID, skincare will bring more diverse consumers and brands into the foray.

Personalisation and Customisation

No matter what trend impacts skincare, and how badly, if a brand can solve a consumer’s problem with a personalized and customized solution, the brand will earn consumer’s love.

Virtual advisors & A.I driven algorithms recommending the perfect product will undoubtedly lead to growth in the category.

Instant Fix

Products that help consumers see an instant reduction in bags or lines or increase in brightening or evening of skin tone will see an uptake.

Beauty, Wellness and Pain Relief Or Ingestibles

Eir NYC is one such brand that sells skincare with herbs and therapeutic effects for pain relief etc. A lot of CBD infused skincare brands are also taking this route, e.g. Vertly.

Bobby Brown, the legend, recently launched Evolution 18 with supplements for gorgeous skin, shiny hair, and overall glow.

Competitors: New Launches & New Entrants

Fragmentation of DTC

With DTC at a very attractive stage and yet not too competitive, you will see many new entrants, and the total convenience of it will propel the category forward. Over time, you will see online retailers(e-tailers) and subscriptions boxes posing a threat to a brand’s DTC business, but the category will grow and benefit.

Clean Beauty

New entrants will continue to emerge with clean and non-toxic substitutes for conventional categories, and with a price premium, and by bringing new consumers, they will grow the category further.

Niche Categories

Niche and specialized skincare, whether for a particular segment, body part like the butt, eyes, or neck, etc. will also result in higher penetration and price elevation of category.

Retailer/Channel-COVID Influenced Drivers

Traffic inside the store would still be down over pre-COVID, even though skincare demand will bounce back, retail can only hold so much traffic with social distancing in place, and with consumers worried about safety, sales could suffer a bit.

Rush to leave the store is another factor that will impact discover and unplanned purchase, which can be over 60% of the total shopping cart(Ref: Consumer Insights: Findings from Behavioral Research-Joseph W. Alba). But this holds relevant only during the fightback phase as post-COVID, traffic should build up inside the stores.

Sampling, which is a significant driver of sales in beauty, would be impacted as well due to fear of contact, especially during the fightback and might lag even afterward.

The above could be countered to an extent by curbside pickups, beauty pop up stores, vending machines, and contactless sampling, etc.

But for curbside pickups, all the other options cost money and will take time to evolve into a perfect replacement with their learning curve but are doable and will change the course of retail forever.

Summary of Analysis of COVID Related Consumer Behaviour, Beyond COVID Drivers, Competition Activity and COVID Influenced Retail

Online content and entertainment and remote working will pull skincare down post-COVID as will the reduced traffic and social distancing at stores during the fightback phase.

On the other side, beyond-COVID accelerated/impacted drivers like wellness, routines and DTC, personalization, social media, and retail improvisation will pull back skincare and further grow it.

Demand for skincare is there and would reach close to pre-COVID levels with a strong chance of even increasing over pre-COVID with a focus on beyond COVID drivers.

Still, the big challenge is going to be availability and discovery at stores.

Alternative channels, like DTC will try to plug the availability gap, but, since 85% of beauty sales happen at brick and mortar, beauty popup shops along with vending machines and contactless sampling will be critical to tapping in to the demand.

Eventually, skincare will increase over pre-COVID, during the post-COVID phase or maybe even during the fightback phase, but for a second wave and frequent spikes here and there leading to various degrees of lockdown.

Post-COVID, it is all a matter of overcoming fear of socializing and touching at stores and friendly policies, for skincare to grow.

And if, during the fightback phase itself, retailers and brands can successfully implement popup stores, vending machines, and curbside pickups, skincare could bounce back even more sharply irrespective of a second wave.

With skincare growing at approx. 10% on average in the last few years, which is a reflection of beyond COVID drivers, post-pandemic, skincare could be in the range of -10% to +10% growth over pre-COVID, irrespective of the length of fight back phase and state of the pandemic.

Recommendations for SkinCare Brands-Post COVID Beauty Brand Strategy

Innovation

Blue Light

Skincare to protect from blue light for digital binging or virtual socializing is a clear opportunity.

Blue light protection, along with UVA/UVB, in sunscreens and blue light protection in night time skincare would do well.

You could have a new product/category for blue light protection or incorporate blue light protection into existing products.

Another example of skincare innovation around blue light impact could target eye care or anti-aging due to digital stress.

Digital has permeated the life of all age groups. Still, you could target digital stress worsening aging and toxicity for the older demographic.

In contrast, it could be products and categories exclusively for digital stress and pollution for the younger demographic.

Routines

If you target financially well-off consumers, older demographic, seriously consider launching complete skincare routines around self-care, especially for your loyal fans, to increase their consumer lifetime value.

Up Your Clean and Conscious Game

Elevate your clean and conscious standard without compromising on performance to help you get in the consideration set of younger demographic. In contrast, it will get you higher penetration with older demographic. Choose to target one out of the above two segments and not both.

Create a clean standard, like Drunk Elephant or Clean Kiss Lifestyle, to help consumers understand your commitment to the cause.

Partnership with Digital Platforms and Video Conferencing Portals- as the recommended skincare line for digital care

Leverage your clean and conscious standards to promote your blue light protection/category of products to digital platforms as they, too, would be interested in taking care of their users. A little harder and very competitive, but the first movers stand to gain a lot.

Personalization and Customization

With consumers spending more time digitally, they will come to accept personalization as a given and a minimum. Provide a personalized digital experience on your site and leverage data to customize skincare products for them.

A simple quiz could help you recommend the right fit products and personalize the experience. If you take it to an extreme with reward points, customized formulations, etc. you would be able to score over competition. Customization is not a fit for every brand, though.

Leverage Wellness+Pain Relief Trend

Innovating with a skincare category or brand with pain relief using CBD or other therapeutic ingredients, on the lines of EIR and Vertly, would not only help reverse the downward pull of home-based fitness on your skincare brand but turn it into an advantage.

Storytelling

Advertising on Streaming Services

Experiment with telling a richer brand story on online streaming sites like HULU to capture consumers at the right time, when they are relatively free to absorb information. Relevant for a younger audience less than 35.

HULU claims to outperform purchase intent on other platforms by a margin of 20:1, meaning it takes 20+ ad exposures on other platforms to outperform purchase intent delta achieved at HULU with one exposure!

For small businesses, HULU lets you run ad campaigns for as low as $500, and your ad can stream next to award-winning shows and network hits, etc.

Social Media

Edit your narrative with the changing times. Factor consumer behavior trends highlighted above like online content and entertainment, remote working, virtual socializing, home cooking, etc. to convey the feeling that you get your consumers. Weave your brand story/product benefits in the day of consumers’ lives around the trends mentioned above.

Distribution and Point of Sales

DTC

Focus on your brand’s DTC channel with subscription models and highly attractive reward points, beyond the run of the mill, targeting your brand tribe.

Focus on your differentiation from online retailers like Sephora etc. A replenishment model, and personalization, aligned with your brand story, could help you hold on your own.

Alternative Channels

Beauty Popup Shops with Safety Promise

Again a great way to tell a brand’s story first hand, touch and feel product samples, and a direct to consumer experience without sharing margin or traffic with other brands.

Low-cost popup stores inside malls could help overcome the issue of social distancing and fear of checking out inside the stores.

Sampling and products vending machines with digital tutorials and Q&A-H5

Instead of launching exclusive to your brand popup stores and vending machines, you could bring the cost down by forming partnerships with non-competing brands in makeup, fragrances, color cosmetics, etc. This will also make retailers save space and prioritize as many brands as possible for contactless shopping.

Avoid touch and instead, go contactless for the video/menu screen as well as for shopping buttons, and credit card scan, etc.

For both popup shops and vending machines, study a day in the life of the consumer and think out of the box for placement.

Leverage Digital Time for Virtual Sampling

Collaborate with digital sampling apps like Sampler and Peekage for contactless sampling to drive sales and profits.

The more the scenario worsens from frequent spikes and regular lockdowns to the second wave of the pandemic, the more seriously you need to take the above recommendations, especially the ones related to COVID influenced and accelerated consumer/shopper behavior. Implement the ones that fit strongly with your brand during the fightback phase itself and not wait for the end of COVID.

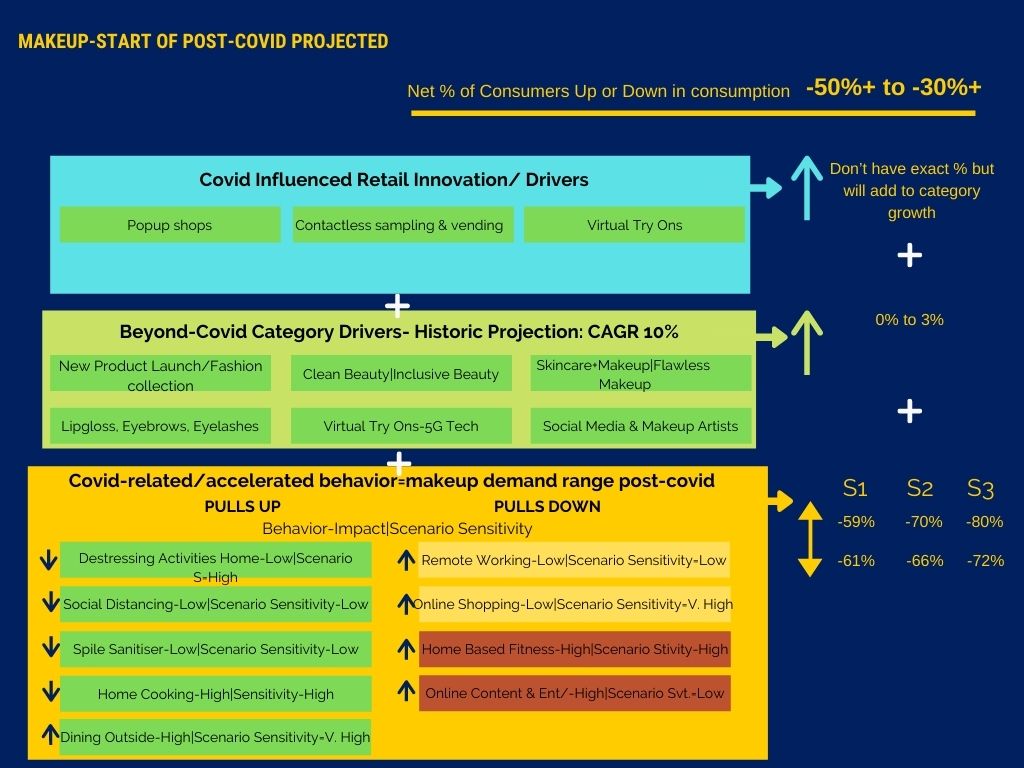

MakeUp

Post-COVID predicted range of makeup with net % of consumers increasing their consumption over pre-COVID.

Based on only COVID related behavior trends

Scenario 1: -59% to -61%

Scenario 2: -70% to -66%

Scenario 3: -80% to -72%

The above scenarios account for the co-relation between clearly observable, altered, accelerated consumer behavior trends for our survey respondents, and their makeup usage during COVID. We need to combine them with other, beyond COVID trends, factors driving makeup.

Analysis of COVID Related/Accelerated Consumer Behavior Drivers

Inhibitors

Home Based Fitness: Impact=High|Scenario Sensitivity=High+Remote Working:Impact =Low|Sensitivity=Low+Online Content & Entertainment:Impact=High|Sensitivity=Low and Online Shopping:Impact=Low|Scenario Sensitivity=V. High

vs

Drivers

Destressing Activities at Home:Impact=Low|Sensitivity=High+Social Distancing:Impact=Low|Scenario Sensitivity=Low+Home Cooking:Impact=High|Sensitivity=High+Dining Outside:Impact=High|Scenario Sensitivity=V. High+Stockpiling Hygiene: Impact=Low|Scenario Sensitivity=Low

Home-based fitness, remote working, online content and entertainment and online shopping are going to grow.

The before trends will result in a decrease in makeup eventually, either during the fightback phase itself or post COVID, much more than the increase possible in makeup with decline in destressing activities at home, social distancing, home cooking, stockpiling hygiene and increase in dining outside.

During the fightback phase, makeup will increase from peak low, during peak pandemic, but stay way below the pre-COVID levels.

Remote working, and maybe online content and entertainment will decrease in the short-term, from peak high, especially with lockdowns opening during the fightback phase. Eventually, it will again increase either towards the end of the fightback or post-COVID.

Even online shopping is going to increase beyond peak level, achieved during full lockdown, eventually, post-COVID, but it will first come to a level between pre and peak( by decreasing from peak).

It will then increase, leading to a decrease in makeup because no need to put on makeup at home while shopping online and because consumers are not as comfortable buying makeup online.

During post-peak, with relaxation in lockdowns, Lipstick at 32% net consumers below peak low usage, foundation at 29% net consumers and concealer and highlighter each at 21.43% net consumers below peak low usage are the worst hit for makeup. In contrast, eyeliner and eyelashes were up for 4% net consumers over peak low.

During the earlier phase of fight back, we will see a sharp rise in nail paint, eyeliner, and eyelashes. In contrast, Lipstick will bounce back during the second half and post COVID even though it will stay way below pre-COVID numbers for initial post-COVID phase and the future hence is uncertain.

Beyond-COVID Category Drivers

Product Launches Aligned with Fashion

One of the biggest drivers of makeup category globally is new product launches. You can take advantage of fashion apparel’s noticeable absence in launching collections by introducing new trends to the market beyond makeup with new product launches as an integral part of those trends.

With a clear focus on eyes, brows and lashes and mascara, you could introduce new products combined with a few of the below drivers and trends.

Clean Beauty

To win back lost consumers or those who reduced usage/frequency because of their fear of harmful cosmetics, you could leverage clean cosmetics claims while also encouraging younger demographics to try the products.

Skincare+Makeup

Brands like Tower 28 and Glossier have already reaped the benefits with this trend. e.g. Tower 28’s Lip Jelly is both a gloss and a hydrating moisturiser. This category is still growing and far from crowded.

Heavy and Flawless Makeup

The total opposite of natural-looking makeup, this is about picture-perfect makeup. Boundaries between professional and retail brands are blurring, and offering the heavy but flawless look with DIY is an opportunity.

Selfie-Believe it or Not

Over the past couple of years, skincare has hogged all the limelight on platforms like Instagram due to the whole self-care and clean beauty rage.

Social media and the selfie offer an excellent opportunity to revive the face makeup category or propel it forward.

Inclusive Makeup Products-Foundations, Lip Shades etc.

With the recent black lives matter movement and the focus on diversity and inclusivity, makeup products with shades that fit the color tones of multi-cultural skin tones offer an opportunity for growth.

Technology-5G-Virtual Try Ons

While there is still a long way to go for virtual try ons to replicate or come close to the actual sampling experience, it could help open the door for further conversation with a makeup inquisitive consumer.

L’Oréal’s chief digital officer Lubomira Rochet speaks of their virtual try on tool, Modiface, “We have clear analytics that show the time spent on the website is doubled on sites with the try-on experience,” she says. “It triples the conversion rate.”

Benefit cosmetics leveraged augmented reality technology to boost conversion rates by 80%.

Social Media Live with Makeup Artists

A one on one live session with makeup artists on IG can improve the engagement and help consumers experiment right with their makeup products leading to higher satisfaction and sales.

Lipgloss, Brows and Eye Lashes

Even if there is a second wave of the pandemic or frequent spikes of COVID hampering the return to post COVID, eyebrows, and lashes offer the best possible growth avenue for makeup brands.

Competitors: New Launches & New Entrants

You won’t see run of the mill new entrants with incremental innovations in makeup posing a significant threat to incumbents.

Truly innovative and disruptive new entrants could sweep share off the floor of dominant players.

Like mentioned before, eye makeup, including mascara, lashes, and brows, offers an attractive market for new players with clean brands, virtual try ons and A.I powered brands.

Inclusive brands are going to surface and become more successful with every major retailer wowing to support diversity.

Retailer/Channel: COVID-Influenced Drivers

(Refer the section under skincare).

Store traffic and then willingness to try on samples or products in the store will be key to driving makeup back to where it was.

Curbside pick up will work for regular buyers purchasing repeat. Cross-selling and up-selling will drive an increase.

Summary of Analysis of COVID Related Consumer Behaviour, Beyond COVID Category Drivers, Competition Activity and COVID Influenced Retail

Makeup as a category has not been increasing over 3% CAGR.

During the fight back phase or even post COVID, when combined with COVID-influenced drivers, makeup will likely stay -50% to -30% below pre-COVID but will bounce back with brick and mortar stores going to pre-COVID days of shopping.

Channel specific innovation to drive the point of sales, successful digital sampling, and virtual try ons matter more for makeup than skincare and hair care.

Eyeliner, lashes, and brows can offer an impetus.

Remote working, online content and entertainment and online shopping growth will pull makeup down but beyond-COVID drivers have to be leveraged big time to bring makeup back to pre-COVID levels.

God forbid, if there is a second wave or frequent spikes and back to lockdowns, makeup might skid around 10 points further down during fight back and start of post-COVID phase.

Recommendations for Makeup Brands-Post COVID Beauty Brand Strategy

Innovation

Makeup for Home-Based Virtual Fitness

Leverage the home-based fitness trend to launch makeup compatible products, e.g., non-melting makeup to be shown off during virtual fitness sessions.

Partnering with digital fitness companies like Mirror, home-based fitness companies like Tonal or dozens of fitness apps would help promote these products.

Makeup for Remote Working

Think of a makeup brand for remote working professionals that helps elevate the look/makes one prominent on a digital screen.

Leverage Face Masks

Transparent face masks with compatible makeup kits and products that don’t stain the mask.

For the younger demographic, launch exciting designs of transparent face masks, coupled with matching lip gloss and nail paint, that help them express aspirational identities.

Instant Makeup for Dolling Up

A clear driver for the younger demographic who believe in instant gratification. e.g. Doll10 is a brand that helps you get fully dolled up in less than 10 mins.

Makeup has taken a hit wth them since they have not formed a habit of it yet plus are most likely to be unemployed and hence at home. Focus on instant fix makeup for this segment that makes a statement about their identity.

The younger consumer likes to try new exciting things, products with flashy packaging and effects on themes that resonate whether comics, games, pop music etc.

Re-launching as socially responsible brand can help revive your makeup brand when aligned with product, packaging and story innovation.

Leverage Technology-(5G on the horizon)

Virtual try ons like augmented reality for visualising texture, trying more extreme shades and looks, smart mirrors with AI and AR to replace makeup testers inside the store and online will boost sales.

You could also connect these mirrors to your social community and brand tribe for getting real-time feedback on what looks best on you!

Product Categories

Eyes and brows are a great opportunity during fight back phase leading to post covid success. For lips, innovation of care+gloss could be well received.

Storytelling

Leverage Dining Outside

Partner with events, entertainment companies and busy restaurants to organize makeup+dine parties. With reduced % of people going for makeup, brands should look at building higher affinity with niches using brand story for higher usage and frequency, and using the same to revive the category.

Makeup Fashion and Social Media

Desperate times call for desperate, but well thought out measures.

Unparalleled makeup education online targeting makeup for the current times will help stimulate interest and sales.

Launching seasonal, avant-garde fashionable trends around your makeup products, will help you get the eyeballs and influence purchases, especially with the absence of apparel fashion brands launching seasonal collections.

Counter-Segment

Understand segments that will indulge less in home-based fitness, remote working and online content to increase penetration and frequency and usage for that segment.

Financially Well Off Segment

This segment is a little older and not worried about economizing.

Makeup for tough skin challenges, with exclusivity storytelling for this segment, to conceal and present a better version of self, is likely to do better.

Leverage this segment as influencers(sign them up-they are underused) with storytelling around how they are always at their best during online socializing and video conferencing. They are looked up to by other segments, in and below their age group, and hence penetration with them can influence the new behavior of making up during online calls and socializing.

Inclusive Makeup Products

Launch inclusive makeup products/categories for different skin tones around different ethnicities and geographies.

Pricing on Best Selling and New Launches

With volume taking a hit, price will be an important determinant of profitability. A 1% increase in price delivers 11.1% increase in profitability versus 1% increase in volume, which delivers only a 3.3% increase in profits. (Ref: Prof. Ken Wong, Queen’s)

Re-launch existing best-seller makeup products with incremental innovation(link): a new ingredient, or packaging to offer higher value at a higher price point to help offset the negative growth for the category.

Point of Sales/Channel

Brick and mortar is a big driver of makeup sales since it is not a big hit with online shopping.

-Entice them with both safety measures and reward points to come to stores

-Innovative Kiosks and popup shops with contactless and at a distance-beauty advisor, with the aid of a digital screen operated remotely by the advisor. Facilitate contactless buying of products as well as sampling of products for homes via smartphone apps. Best way is to offer samples with purchase along with coupons to buy the products from the store(online) or brand DTC.

-Virtual Try ons like smart mirrors mentioned above will help increase the conversion to sales within stores without the need for beauty advisors.

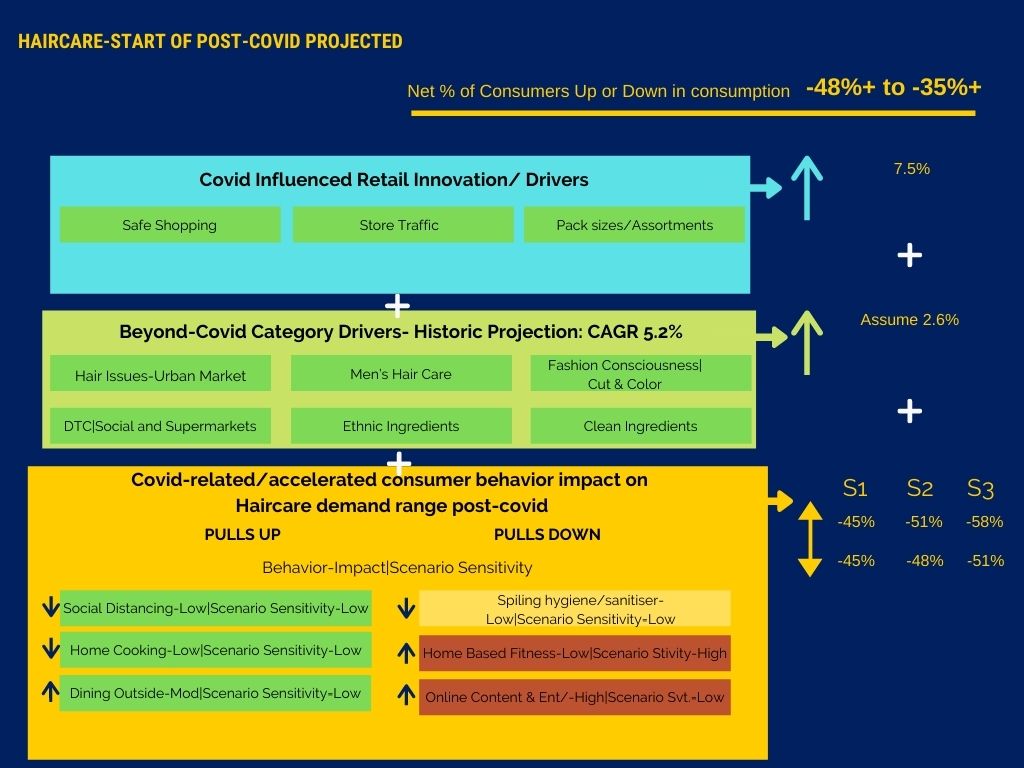

Hair Care

Scenario 1 range: -45%

Scenario 2 range: -48% to -51%

Scenario 3 range: -51% to -58%

Fight back direction for hair care is the same as post-COVID direction. It recovers from the post-peak low which was even lower than the low during peak pandemic.

Hair color, shampoo, and conditioner showed a further decline of 10% each compared to peak pandemic low with dry shampoo the least hit. I did not measure the peak pandemic low for individual product categories within hair care. Still, overall, haircare consumption, during peak pandemic, was approximately down for net 45% of our respondents below the pre-covid level.

The above scenarios account for the co-relation between clearly observable, altered, accelerated consumer behavior trends for our survey respondents, and their hair care usage during COVID. We need to combine them with other, beyond COVID trends, factors driving hair care.

Analysis of COVID Related/Accelerated Consumer Behavior Drivers

Drivers:

Social Distancing:Impact=Low|Scenario Sensitivity=Low + Home Cooking:Home Cooking|Impact=Low|Scenario Sensitivity=Low + Dining Outside:Dining Outside|Impact=Mod|Scenario Sensitivity=Low

Vs

Inhibitors:

Home Based Fitness:Impact=Low|Scenario Sensitivity=High +Online Content and Entertainment:Impact=High|Scenario Sensitivity=Low+Stockpiling Hygiene: Impact=Low|Scenario Sensitivity=Low

As noted earlier, social distancing will only go down up to a point and post that will reduce very slowly to zero but cannot go negative. The same goes for home cooking. Dining outside strongly co-relates with an increase in haircare, with the apparent cause being at your best self compared to merely stepping out.

But again, dining outside will only increase up to a point. Reduction in home cooking and dining outside are highly likely to be substitutes except for food delivery.

On the contrary, home-based fitness and online content and entertainment will increase year after year as the pandemic has accelerated the trends.

Clearly, home-based fitness plus online content and entertainment will counter the upward pull of social distancing and dining outside on haircare.

Since reduction in social distancing does not result in high impact pull up of hair care, it boils down to upward pull of dining outside vs downward force of home-based fitness and online content and entertainment.

During the fight back phase, home-based fitness and online content and entertainment can experience a bit of a decline compared to peak pandemic levels, before again increasing post-COVID.

Thus, haircare will bounce back sharply when combined with a reduction in social distancing and increase in dining outside during the fightback phase as long as the second wave does not hit us.

In the event of a second wave of pandemic or frequent return to lockdowns, countering the downward pull of home-based fitness and online content could be critical to stopping the drop.

Beyond-COVID Category Drivers

Hair Related Issues for the Urban Market

Issues such as dryness, split ends, excess oil and sebum production, hair loss have increased the awareness regarding hair care products driving demand.

Haircare for Men

Hair maintenance for men-dandruff, color, and hair loss as well as hair issues related to changes in climate, pollution, heat or cold, and due to use of hard water for hair washing.

DTC and SuperMarkets

Haircare is the highest online bought beauty category and is bought at supermarkets without any education.

Fashion Consciousness

Hair color, especially at salons, is driven by fashion consciousness and the latest observed and recommended trends.

Ethnic Ingredients

Haircare brands have been incorporating ethnic ingredients to cater to the ethnic consumer. e.g., oil-based shampoos are targeted at South Asian consumers who traditionally treat their hair with oil.

Competitors-New Entrants & New Launches

Clean ingredients trend is eating into the share of conventional brands.

Men’s brands and inclusive brands or brands focused on a particular segment, issues and channel could enter the market to leverage shift towards Direct to Consumer.

Retailer/Channel: COVID-Influenced Drivers

Haircare brands usually have a high throughput at stores without elaborate sampling or education with beauty advisors. Hair shampoos, conditioners, and hair color for grey coverage sell off the shelf pretty well.

Hair salons will re-open and will slowly start to see an increase in traffic, but the fashion colorings will likely stay below the erstwhile numbers.

Summary of Analysis of COVID Related Consumer Behaviour, Beyond COVID Category Drivers, Competition Activity and COVID Influenced Retail

During the fight back phase, a slight decline in home-based fitness and online content and entertainment and a decrease in social distancing along with a very moderate increase in dining outside will cause hair care to bounce back from peak low. However, it will stay much below the pre-covid level.

Hair care will be pulled down again by further increase in home-based fitness and online content and entertainment even though dining outside will increase usage.

Even though COVID-accelerated trends hurt the hair care category, certain other beyond-COVID trends could be leveraged to soften the blow and speed up recovery.

Men’s hair care, brands and products targeting specific issues attributed to current environmental pollution, stress and lifestyle, fashion consciousness, and DTC penetration would counter the negative impact of COVID accelerated and induced behavior.

Haircare was growing at CAGR of 5.2%, which we could safely assume to be nullified.

Considering 60% sale for haircare happens at brick and mortar, and assuming stores across North America operate entirely from September, plus assuming that traffic stays around 50%, it is safe to assume that brick and mortar could add another 60%*1/4*50%=7.5% consumers to haircare with positive consumption over pre-COVID.

The above means a range of -45%+7.5%=-37.5%*( approx.) for scenario 1, and -50%+7.5%=-42.5%* for scenario 2 and -55%+7.5%=-47.5%* for scenario 3 respectively, at the start of post-covid.

Recommendations for Hair Care Brands-Post COVID Beauty Brand Strategy

Innovation

Home-Based Fitness

Home-based fitness trend can be leveraged to create customized haircare products like dry shampoos and washes for fitness regimes and hair color that withstands sweat and secretions etc.

Why home-based and not just fitness? Because of the ability to reach them with various online fitness apps and a sudden inflection in trend offering an opportunity to cash in early on a change in behavior.

Also, the online fitness apps have fragmented into various categories from yoga to cycling and hundreds more, helping you access and target the exact niche that fits your brand.

Virtual Lighting

You could create a hair color palette that is compatible with virtual lighting, especially the camera and screen light.

Grey Hair

Haircare for grey hair is another virtually untapped opportunity.

Hair Issues and Loss

The survey shows that bathing has gone up for a net 20% of consumers, over pre-COVID. Frequent bathing, accompanied by a hair wash, could aggravate the urban issue of split ends, hair loss, and dryness. Innovating specifically for these issues with clean ingredients could help increase profitability.

Hair loss products targeting men are again an opportunity that will work irrespective of a lockdown.

Storytelling

Fashion Parades

Outside events with fashion parades sponsored/organized by hair color brands are significant for new product launches beyond the influencers with the scalable reach of social media live.

Partnerships

For the financially well off consumers, collaborations with high-end restaurants and hotels for sampling kits and coupons for DTC and collaborations with premium home-based fitness brands like Peloton, Tonal, and apps like Noom, etc. could be leveraged to promote hair care brands targeting the fitness-oriented consumer.

Social Cut and Color Workshops

For the decline in hair care due to online content and entertainment, which could be due to time cannibalization, and not going outside, haircare brands, esp. color brands, can up their creativity on social media.

E.g., they could do live online workshops on cut and color showcasing the latest trends and fashion parade models and produce creative content to entertain consumers and fans and increase your brand power or profitability as a result.

Point of Sales

Simplest of vending machines outside/inside the retail stores could up the volume of haircare to counter the fear of shopping inside the store.

DTC

Haircare is the largest selling category online as it is the least touch and feel versus makeup, fragrances, etc. You could sell bigger pack sizes, better value for money, and sell assortments for higher profitability/consumer.

10 Steps to Create Post COVID Strategy for Your Beauty Brand

1. Study the change in your most loyal consumer’s as well as non-consumer’s behavior and consequent demand/usage and shopping behavior using a survey of a few hundred consumers and then deep dive with 1:1 interviews with 10-15 of them.

2. Plot consumer behavior changes against consumption and shopping data. Look for drivers and inhibitors that impact brand consumption and purchase.

3. Derive correlations between dominant consumer behavior impacting brand with brand category demand. Dig deep to uncover causal relations.

4. Confirm causal relations through 1:1 interviews with insights.

5. Predict future, post-Covid behaviors using a few assumptions to arrive at the future behavior patterns leveraging correlations, causation, and consumer insights from previous points.

6. Evaluate beyond-COVID category drivers as discussed above for each of skincare, makeup and haircare.

7. Evaluate point of sale COVID and non-COVID drivers as discussed above for each of skincare, makeup and haircare.

8. Summarise the opportunity and forecast demand and sales for your brand, corresponding to behavior patterns in the future. The worse the scenario, the more weight you need to give to COVID-influenced drivers for your strategy along with beauty category drivers and point of sales innovation.

9. Evaluate the current strategy with story and positioning against the opportunity to see if it strengthens or weakens your case to win the consumers of the future.

10. Create final strategy by choosing strategic pillars( out of recommendations above) aligned with Strategy or create a new Strategy for the opportunity using insights and behaviors.

e.g., Let’s assume a majority of your loyal consumers are younger and have significantly adopted home-based fitness, and it seems that this trend is only going to go up post-COVID and that this behavior, as predicted above, is going to bring your sales of makeup down drastically.

And, this new trend has caught up with non-consumers of makeup too, and their likelihood of using makeup has gone further down.

Next, let’s say your loyal consumers believe in instant gratification, you could choose to innovate with instant makeup products with exciting packaging and brand personality coupled with a social cause and inclusivity storytelling to win with them and increase your profitability.

Then, launch new categories and products, whether skincare, haircare, or makeup, for solving their beauty problems brought on by the new behavior, form partnerships with fitness apps and equipment brands for both promotion and distribution, and increase your brand profitability for years to come.

Conclusion

There are two imperatives: One to survive and second to win fight back and the post-COVID, which is the end game.

Previous article, I covered how to win during the pandemic induced recession and is relevant to peak pandemic and the initial fight back phase.

The latter half of the fightback tactics need to evolve from mere survival to winning both the fight back and the post-COVID phase. The change in consumer behavior will get consolidated, and the consumer and the industry feel and know that the end is not that far.

After survival, play for the end game!

a. We studied changes/acceleration in consumer behavior due to the COVID crisis and looked at beyond COVID drivers with predicted impact on demand for the beauty categories post covid.

The predictions, for consumer behavior, were made on certain assumptions and plots of consumer behavior versus various degrees of lockdown and observed trends in the market.

b. For every beauty category, we plot its co-relation with all relevant(high co-relation of over 0.8) consumer behaviors.

Based on projected consumer behavior, as mentioned in point a, in 3 different scenarios, we predict the growth or decline of the beauty category based on drivers vs inhibitors observed during COVID.

We then looked at beyond COVID drivers for the beauty category, competition and new entrants possible, and retailer/channel tactics to summarise the situation for a particular beauty category in the future, post-COVID.

We studied three beauty categories: Skincare, Makeup, Hair Care,

There were three kinds of major consumer behavior trends.

1. Ones that increase or decrease during the fightback phase and reach a limit/flatten/with little growth hence during or post-COVID.

2. Those that increase or decrease during the fightback phase but change direction around post-COVID.

3. Ones that grow during the fightback phase as well as post-COVID.

These are predictions, and the actual percentage increase or decrease is not as significant as the general direction and the broad range.

For Skincare:

Remote working and online content and entertainment could bring skincare down, whereas overcoming fear of socializing at stores and retailer side innovation in curbside pickups, beauty popup stores, and vending machines will pull skincare up to levels of pre-COVID.

With a little extra focus on beyond-COVID drivers like beauty and wellness merged with pain relief, routines and DTC, personalization, and customization, skincare could well grow over pre-COVID.

Hand cream, face mask, cleanser, and moisturizer will lead the recovery and beyond.

With digital permeating our lives, blue light skincare both as a new category and individual products protecting from digital light is an opportunity to grow skincare.

For Makeup:

Post-Covid, increase in remote working, online content and entertainment, home-based fitness, and online shopping are projected to reduce the usage of makeup.

Strategizing in advance can help you be the first to leverage these trends to your advantage.

Reduction in destressing activities at home, social distancing, home cooking, and stockpiling hygiene as well as an increase in dining outside, will pull makeup from the peak low. Still, these would not be able to counter the downward impact of behaviors mentioned above as those are increasing at faster rates and have a more significant impact.

Also, brick and mortar stores are critical to makeup bouncing back. In the absence of a proactive strategy and tactics, makeup could well stay 30% to 50% below pre-COVID and worsen with any pandemic/lockdown relapse.

Eyeliner, lashes, and brows can bring relief to the category followed by nail paints and lip gloss.

New product launches, fashion, trendy collections, and innovation for home-based fitness, remote working, and video conferencing behavior could help recover the category faster.

5G technology for virtual try ons, instant fix makeup for younger generations, clean makeup for tougher skin challenges at a premium price point for financially well off consumer will help.

Inclusive makeup brands and product launches, creative social media campaigns to entertain along with 1:1 live sessions with makeup artists, rewards to entice consumers to brick and mortar and safe, touchless vending, sampling, and purchase will help recover the category.

For Hair Care

During the fightback phase, home-based fitness and online content and entertainment can experience a bit of a decline from the peak, and coupled with a reduction in social distancing and increase in dining outside, haircare will increase from peak low levels.

Eventually, towards the end of the fightback, and the start of post-COVID, home-based fitness and online content would again start to increase(assumption) and would overcome the impact of dining outside to keep hair care below pre-COVID levels.

Hair related issues, hair care for men, fashion consciousness, and DTC can be leveraged to bring hair care up along with retailer curbside pickups and contactless vending machines.

Best case scenario, hair care would be approx. 30% below pre-COVID but it need not be.

New product launches for home-based fitness, hair loss and grey hair, online cut and color workshops, partnerships with fitness brands/locations/apps as well as outside events can help bring the category closer to pre-covid in 2021, which means post-COVID.

For all beauty categories, re-evaluate your digital media options beyond Instagram. Think of all the other ways you could tell your brand story right in the moment the consumer is most motivated to hear/see whether on digital streaming platforms, online fitness apps, or virtual socializing platforms.

Clean beauty, personalization and customization, DTC, retail innovation and inclusive products and brands are common growth-driving trends for all beauty categories.

It is critical to create a complete picture of post-COVID scenarios, factoring consumer behavior, category drivers, competition activity, retail and direct to consumer evolution and then create a strategy to win the consumer’s love and share of wallet based on your brand’s existing strength or with capabilities you could develop.

For a free consulting session on how you can analyze and predict your brand’s sales and profitability and create a strategy to win both the fightback phase and post-COVID, please book a session here: Free Consultation

Learn how you could win both the fightback phase as well as post-covid whether you have a skincare, makeup, haircare, hairstyling, bodycare, fragrances or an aromatherapy brand!

Learn how you could win both the fightback phase as well as post-covid whether you have a skincare, makeup, haircare, hairstyling, bodycare, fragrances or an aromatherapy brand!

ROHIT BANOTA, Founder of StorySaves, has created, transformed and grown dozens of beauty consumer brands across North America using proprietary Brand Story-Led Strategy, Innovation Strategy and Brand Tribe frameworks and processes.

He has over 17 years of marketing, brand, and innovation experience growing consumer packaged goods including startups and MNCs like P&G-Beauty and Grooming and AB InBev.

Another notable trend is the rise of do-it-yourself (DIY) beauty care. Many beauty salons have closed, and even in places where they have not, consumers are forgoing services because of concerns about close physical contact. In addition, many consumers will likely face economic difficulties after the COVID-19 crisis, given the loss of jobs and savings. In McKinsey s survey of UK consumers, 66 percent believe their finances will be affected for at least two months because of COVID-19, and 36 percent say they are cutting back on spending.

Absolutely, Savannah! Could not agree more. DIY is for sure a trend and is very strong at the moment since salons and spas are closed or consumers are avoiding the visit. Many consumers are already facing economic difficulties, as mentioned by you.

However, post-COVID, consumer sentiment is likely to rise but for sure, there is uncertainty around whether they will visit salons or not. Post-COVID, meaning post-vaccination, would consumers visit salons or prefer to do it themselves is not certain.

Make sure to read the new blog post that I would be publishing in a day or two on 10 steps to creating post-COVID strategy. The new post elaborates on the current post and provides more clarity.