How does your beauty retailer build its funnel using different categories and claims?

Beauty retailers broaden reach with diverse funnel entry points.

Categories with entry-level products (e.g., cleansers or sunscreen) positioned in accessible price ranges attract new shoppers from a broad base of consumers.

Mid-tier, premium & prestige categories, such as anti-aging treatments or masks, are used to upsell and retain loyal customers seeking more specialized solutions and acquire consumers on the spectrum of less price sensitivity.

On top of this, retailers create specialized claims such as “clean,” “eco,” “planet aware”, to further healthify their funnel by appealing to specific and trending consumer preferences, driving loyalty

Generally, products “exclusively” available at a retailer help get traffic, attract new consumers, and generate repeat traffic.

Every retailer then fine-tunes the above funnel strategy.

Let’s take the example of Sephora Skincare(USA):

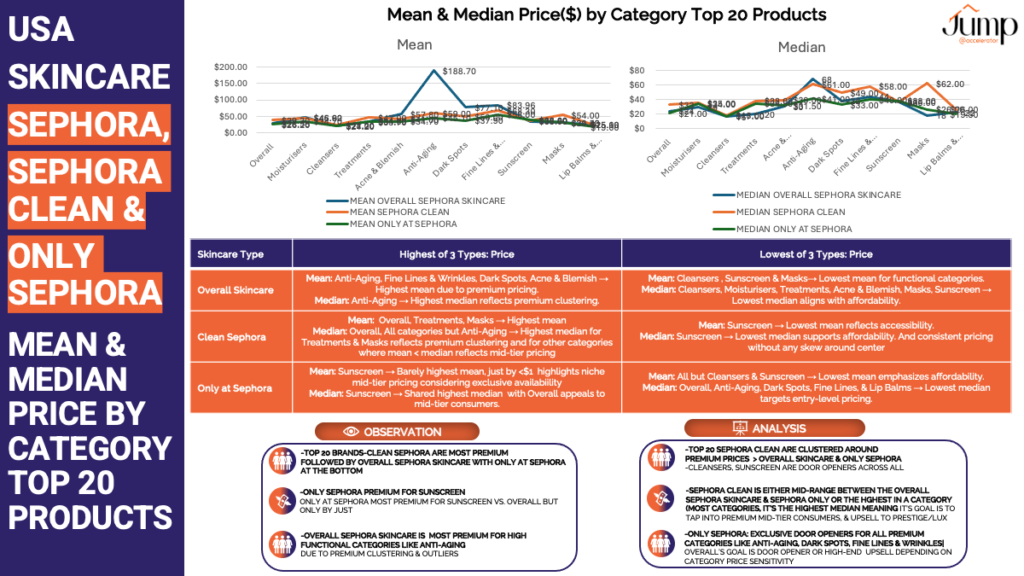

TOP 20 BRANDS MEAN AND MEDIAN COMPARISON FOR OVERALL SEPHORA SKINCARE, SEPHORA CLEAN SKINCARE & ONLY AT SEPHORA SKINCARE

OBSERVATIONS

-TOP 20 BRANDS: CLEAN SEPHORA, THE MOST PREMIUM

Followed by Overall Sephora Skincare, with Only at Sephora at the bottom.

–ONLY SEPHORA BARELY PREMIUM FOR SUNSCREEN

Only at Sephora is barely premium for sunscreen compared to Overall, but only by a small margin, as all can serve as door openers or funnel entry points.

-OVERALL SEPHORA SKINCARE IS MOST PREMIUM FOR HIGH FUNCTIONAL CATEGORIES LIKE ANTI-AGING

The above is mainly due to premium clustering and outliers.

ANALYSIS

-TOP 20 SEPHORA CLEAN ARE CLUSTERED AROUND PREMIUM PRICES > OVERALL SKINCARE & ONLY SEPHORA

Cleansers and sunscreen are door openers across all.

-SEPHORA CLEAN IS EITHER MID-RANGE BETWEEN THE OVERALL SEPHORA SKINCARE & SEPHORA ONLY OR THE HIGHEST IN A CATEGORY

For most categories, SEPHORA CLEAN has the highest median, meaning the goal is to tap into premium mid-tier consumers and upsell to prestige/luxury.

-ONLY SEPHORA: EXCLUSIVE DOOR OPENERS FOR ALL PREMIUM CATEGORIES

Like anti-aging, dark spots, fine lines, and wrinkles.

-OVERALL SEPHORA SKINCARE’S GOAL IS DOOR OPENER OR HIGH-END UPSELL

With very high-performance brands, depending on category price sensitivity.

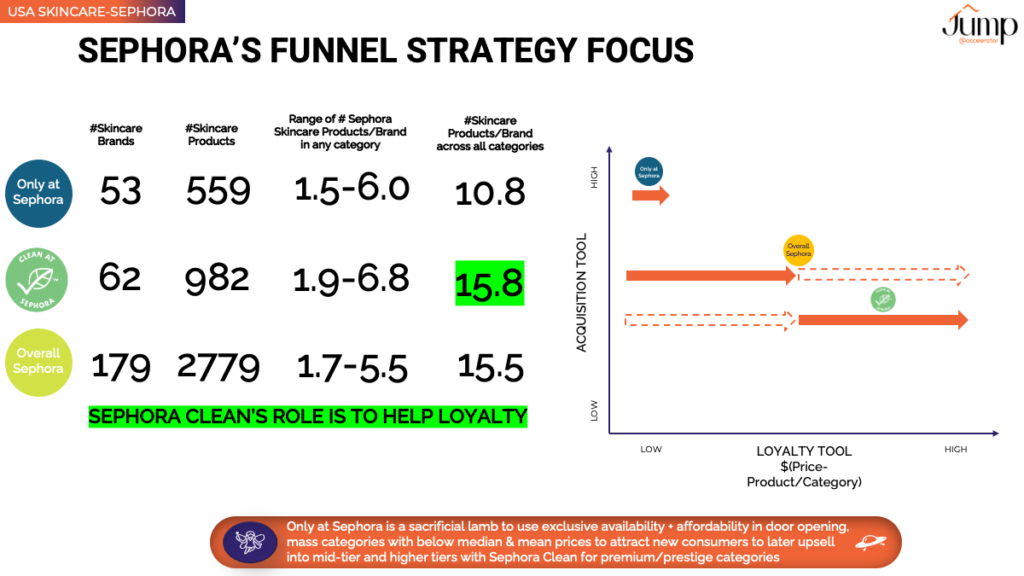

SEPHORA'S FUNNEL STRATEGY & EACH CLAIM'S ROLE

Only at Sephora Skincare:

includes 53 brands and 559 products, with an average of 10.8 products per brand across categories. It focuses on exclusivity and affordability, making it a strong acquisition tool for new and price-sensitive customers.

Only at Sephora has fewer products per brand compared to Clean at Sephora and Overall, which reinforces its focus on functional, entry-level categories.

Clean at Sephora:

It contains 62 brands and 982 products, with an average of 15.8 products per brand, the highest across all three. It emphasizes premium pricing and clean, sustainable beauty, serving as a loyalty tool to retain eco-conscious, higher-spending customers.

Clean at Sephora offers a broader assortment per brand, reflecting its clean beauty offerings’ depth and premium positioning.

Overall Sephora Skincare:

This umbrella category encompasses both “Only at Sephora” and “Clean at Sephora,” alongside other brands. It features 179 brands and 2,779 products, with an average of 15.5 products per brand, reflecting the balanced nature of this segment to appeal to both new and returning customers.

It also means that the non-clean or exclusive skincare products at Sephora have the highest average number of products/brand=19.74 & it also shows existing potential for Sephora Clean brands with 19.74-15.8=average 3.96 products/brand.

Overall Sephora Skincare caters to the most diverse consumer base across price points and preferences.

SUMMARY

Only at Sephora is a sacrificial lamb used to use exclusive availability and affordability in both door-opening, mass categories with below median and mean prices, and even more so for premium categories like anti-aging and dark spots, to attract new consumers and later upsell into mid-tier and higher tiers with

Sephora Clean for premium/prestige categories.

Overall Sephora Skincare is there to fill all the gaps in product categories.

Whether you are in the top 20% of your category at a beauty retailer, looking to break into the top 20%, or want to start selling to any beauty retailer like Sephora, you need to understand how the retailer organizes the different categories and claims and how it helps further the retailer’s funnel and category goals.

And, instead of wasting thousands of dollars, now you can

“UNLOCK SEPHORA’S 2024 SKINCARE CODE for 2025 SUCCESS!”

A Deep Dive Report-a must for a skincare founder, investor, brand, category or a shopper marketer:

-11+ sub-categories, pricing, formulas, ranks, and growth opportunities.

The report offers observations, insights and custom recommendations to

-Top Sephora Brands

-Sephora Growth Brands

-Sephora Aspirant Brands(want to place-sell to retailer)

250+ slides that cover

-179 USA skincare brands & 2779(*4940) products within 11+ different skincare categories at Sephora USA

-62 Sephora Clean brands & 982 products within 11+ skincare categories at Sephora USA

-53 Only at Sephora brands & 559 products within 11+ skincare categories at Sephora USA