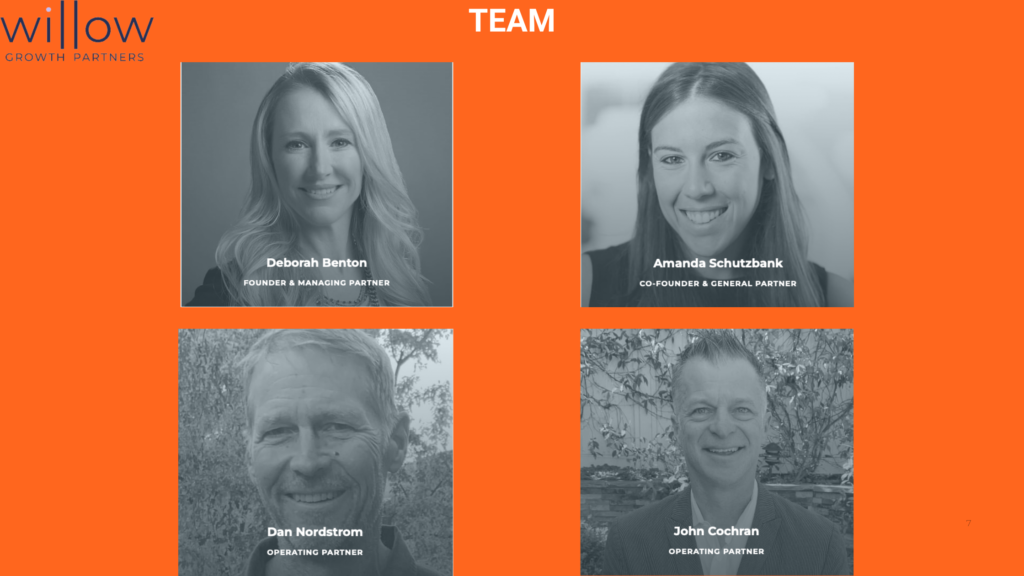

In this beauty investor Q&A feature, Deborah Benton, Founder & General Partner of Willow Growth Partners, discusses the role of the first institutional investor, the types of investors who will make in beauty and wellness, and what you need to succeed as a founder!

Before investing, Deborah was President and COO at Nasty Gal and COO at ShoeDazzle. She also held key roles as EVP of Inside Sales at Teleflora and led operations at eToys in eCommerce’s early days. Deborah holds an MBA and a BA in Health from Queen’s University, Canada.

Q1: Willow Growth Partners has funded around 20 diversity-led beauty & wellness brands; how much do you invest, and what do you look for?

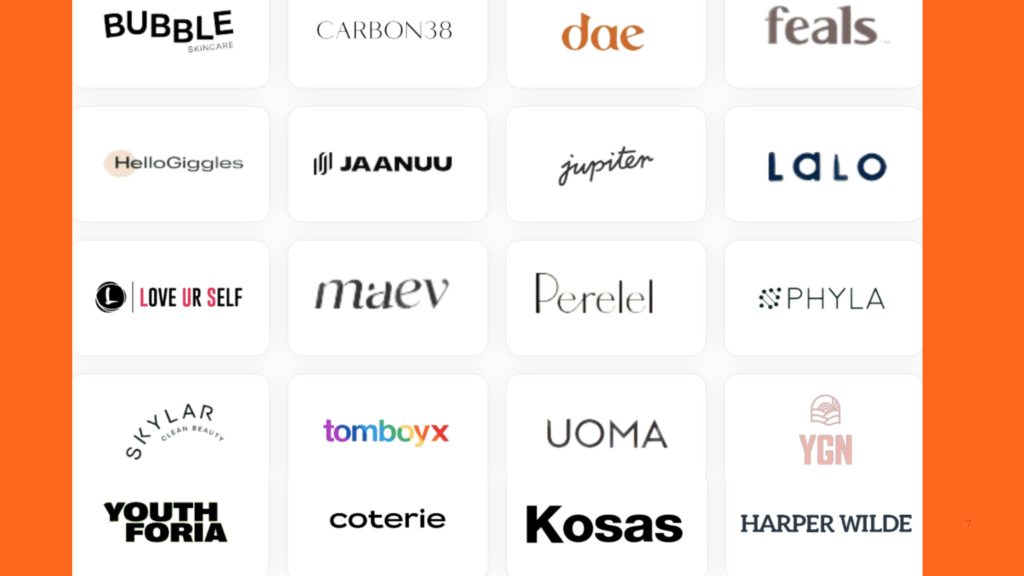

BEAUTY PORTFOLIO

Deborah:

At Willow, we are in the process of closing a new fund and are more excited than ever to deploy fresh capital into beauty and wellness brands. Our thesis and stage remain exactly the same: we are looking for powerful consumer brands doing $1M – $5M in TTM revenue with strong fundamental metrics, including margin profile, clear evidence of repeat purchasing, MoM revenue growth and growing velocities (if in retail). We back values-led brands founded by extraordinary people, passionate about the problems they are solving, and with clear reason and credibility to lead and scale the brand.

Q2. With digital advertising getting expensive, retail becoming tougher & supply chain woes continuing to be challenging. How do you see the funding amounts (and revenue that interests you) evolving in the near future?

Deborah:

We prefer to lead the first institutional round, which, generally, is between $2M and $4M, take the board seat, and work closely with the founder, supporting wherever we can bring value. When we lead, we will generally write $2 – $2.5M, and if we’re participating with an

aligned lead, we can write smaller checks. I don’t believe that the first institutional round size should change much, but perhaps how it is deployed, given the digital CAC challenges, may evolve.

Q3. Is there a trend around investors wanting to fund beauty and wellness brands? Who(type) is getting fed up with the sector, who will up the momentum, and who will move on?

Deborah:

I think in the heyday of virtually zero-cost capital; there were many tourist investors in the beauty and wellness category, as well as more tech-oriented funds that still occasionally dabbled in the brand’s world.

We’re seeing most of those types of investors leave the category; candidly, I believe this exodus will lead to a healthier ecosystem overall. Too much capital went into the system, at undisciplined valuations, with little category expertise around the table, and with lofty and unrealistic scaling and exit expectations, ultimately leading to value destruction, suboptimal investment outcomes,

and more painfully, terrible founder experiences.

The best investor partners are those with category expertise, ideally, significant operational experience, and a deep passion and understanding of the consumer.

At Willow, we are deeply committed to and focused on consumer brands and are tremendously excited about the future of consumer; with our new fund, we are doubling down on consumer brands. Choosing an investment partner is one of the most critical decisions a founder can make: aligned values, collaboration, transparency, passion, and a shared vision of the path forward … these are the most essential criteria of decision

When selecting a partner, do your own due diligence and choose wisely!

Q4: How do you see the role of the 1st institutional investor evolving and differ from an investor who doesn't lead a round? Why should beauty and wellness brands choose Willow Growth as their first institutional investor?

Deborah:

At Willow, we prefer to lead the first institutional round of financing, which is typically in the $2 – $4M range. As lead investors, we work with the founder(s) on the terms of the raise, take the board seat, and encourage founders to view us as an extension of the team.

We want to be the founder’s first call in good times and challenging ones; we are truly in the trenches when needed. That first 12 – 24 months post-raise is a critical time for young brands: building the team, infrastructure, and processes, ensuring margin profiles are sound, optimizing the supply chain, and solidifying reporting, operational metrics, and KPIs.

Occasionally, we will participate alongside another lead consumer

funds investor with whom we feel we are well aligned, but for the most part, given our operating expertise and knowledge and our desire to actually work alongside our partner brands, our preference is to lead.

Generally, even when we lead, we won’t write the entire check. We will work with the founder to identify smaller investors and angels to join us in the round, people who bring unique experiences, skill sets, or a specific value that is additive to the brand.

Given our sole focus on consumer brands, our values of collaboration, transparency, and true partnership, combined with our operating

expertise, understanding, and empathy for founder challenges and obstacles, we believe that we are the best partner of choice for brands at this earliest stage of their lifecycle.

Q5. What are the 3 most common mistakes you see founders making in their fundraising efforts or pitching their ventures to you?

Deborah:

1. Not clearly identifying the brand’s unique superpower, differentiating elements, and the reason why it is the brand in their category to win.

The consumer brands world is highly competitive, and categories

are often saturated. Founders need to very quickly establish

why/how what they are building is something different, how that

difference is defensible, and what the founders bring to the table

proving that they are the ones to do it.

2. Not demonstrating a clear understanding of the basic economics of their business model. You can’t manage what you can’t measure, and you can’t scale successfully scale what you don’t know.

You don’t need to be a CFO or accountant. You do need to understand basic financial fundamentals.

3. We at Willow value values such as transparency, collaboration, respect, and teamwork. Founders should remember that we are assessing for values and cultural fit with Willow at every touchpoint, including all communications and interactions.

It doesn’t mean that our way is the only right way. However, we know what’s right for us and what we believe will make a strong, enjoyable, and successful partnership in the long run.

Q6: What traits are common to all the super successful beauty founders you funded?

Deborah:

Founder traits: Vision, passion, drive, tenacity, resilience, grit, mental fortitude, courage, collaboration, integrity. The best founders are maniacally focused on their consumers and community – understanding them, communicating with them, delighting them, serving them, over-delivering and exceeding their expectations.

SUMMARY

Willow Growth Partners seeks to fund and support values-driven beauty and wellness brands with strong growth fundamentals.

- Investment Criteria: Seeks beauty/wellness brands with $1M-$5M revenue and strong growth metrics.

- Funding Rounds: Typically leads with $2M-$2.5M investments, sometimes smaller checks alongside aligned leads.

- Sector Trends: Exit of “tourist investors” strengthens discipline in beauty/wellness funding.

- Lead Investor Role: Takes board seat, supports in infrastructure, supply chain, and metrics setup.

- Founder Mistakes: Not defining uniqueness, lacking financial knowledge, failing to show values alignment.

- Successful Founder Traits: Vision, resilience, consumer focus, and a commitment to exceed customer expectations.

Looking to fundraise?

Attract 3,000+ Beauty & Wellness investors in North America using full canvas info on Jumpurse

&

Book 3-5 investor meetings/day on Jumpurse fundraising platform