There has been a great skew against funding for female founders, co-relating with the huge gap between female-founded companies and their male counterparts However, a recent report from Pitchbook indicates that that may be slowly changing.

Pitchbook reports that during the first three quarters of 2021, female founders in the tech market gained over $30 billion in investments. This increase is more than 82% of the amount in 2020, which makes it the highest number thus far. Female-founded companies are now expected to receive at least $40 billion in investments, with the volume estimated to increase by 30% per year.

This is partly because women have made gains in the venture ecosystem. Recently, there has been an increase in females becoming general partners in some of the largest venture capital firms. The Pitchbook report also shows that the largest gains came during the earliest venture stages, with the number of women angel investors increasing by 66% since 2018. With more women holding more leadership roles in the venture capital landscape, more women-led businesses are now being funded.

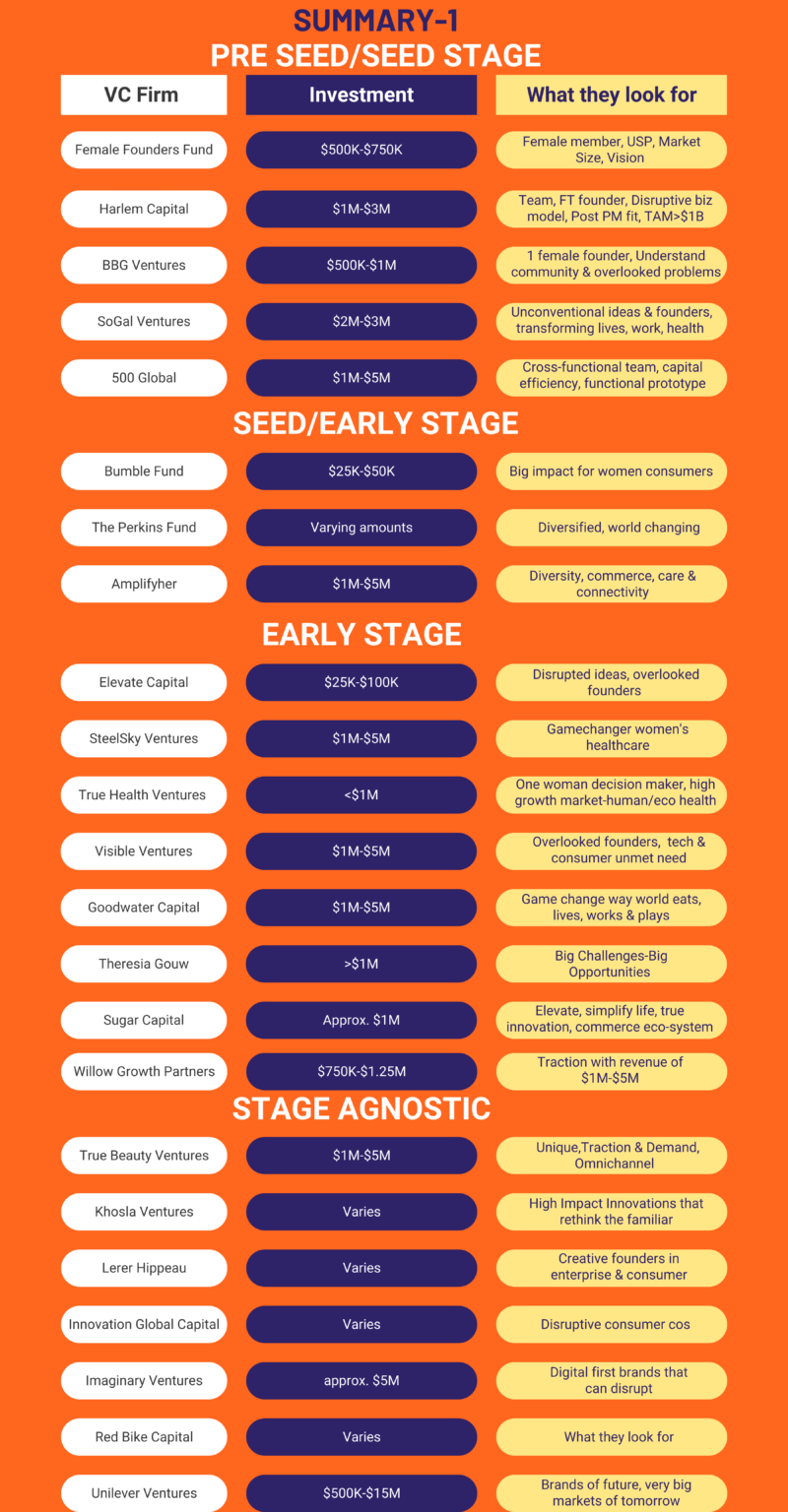

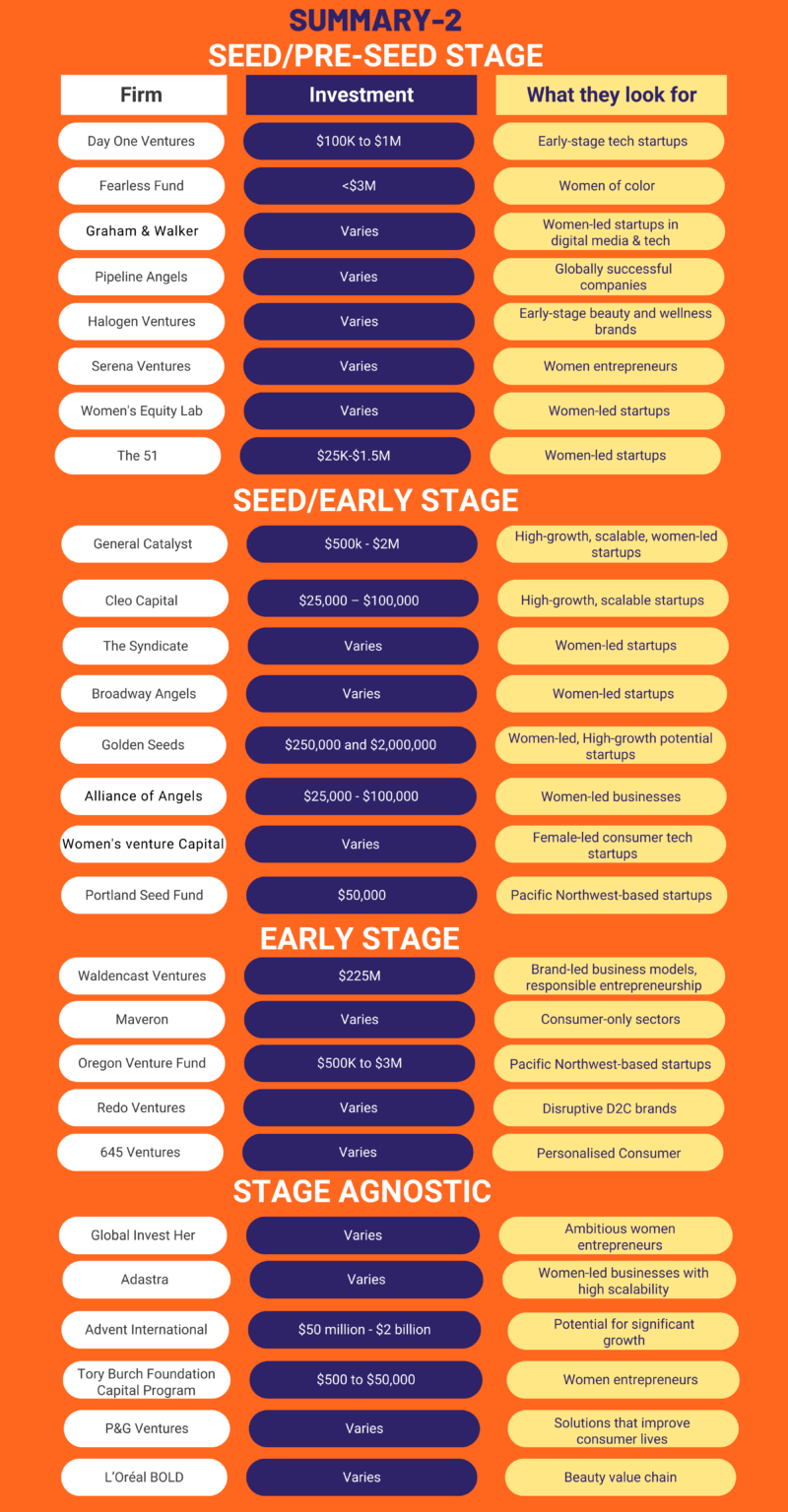

Female-focused venture capital firms have a wide range of portfolios, including different industries such as tech, healthcare, fashion, education, beauty, and more. The amount these firms invest depends on the development stage of the business.

At the seed stage, investments range from less than a million to $3 million. The early stage typically ranges from $5 million to $25 million. Meanwhile, businesses at the growth or late stage of development receive about $10 million to $100 million worth of investments.

48 Female-Focused Venture Capital Firms Funding Female Founders of Beauty Brands in 3 Stages

Here are 48 female-focused venture capital firms funding beauty brands.

SEED/PRE-SEED STAGE

1. Female Founders Fund: Funding Female Founders

Who they are

Founded in 2014 by Anu Duggal, the Female Founders Fund was created with the belief that women will build the companies of tomorrow. Since then, they have become the leading source of institutional capital for female companies at the seed stage with an enterprise value of over $3 billion.

Their mission/purpose around female startups

Female Founders Fund noticed the discouraging percentage of venture capital dollars that went toward female-led companies, despite women dominating the workforce and starting businesses at a rate 1.5 times higher than the national average. Thus, the firm was launched to invest in the next generation of female talent.

Stage and amount they invest

As seed investors, they focus on investing during pre-launch and post-launch. Their investment amount ranges from $500,000 to $750,000.

Additional resources they offer

Additionally, they offer other resources such as reading materials to help you better understand venture capital, fundraising, board meetings, and market strategies.

Portfolio of beauty brands

- Cay Skin – founded by Winnie Harlow, Cay Skin is a new daily suncare, skincare, and body care line designed to keep all types of skin tones glowing and protected. Its mission is to create sustainable products that can make everyone feel confident about their skin.

- Ceremonia – rooted in Latinx heritage, Ceremonia is a clean hair care brand designed to feed your hair from the roots and beyond. With unparalleled formulas, consumers can celebrate the longevity of healthier hair.

What they’re looking for

To earn their investment,

- The founding team must have at least one female member.

- The company also needs to express what makes them special and uniquely qualified for solving the problem they plan to address.

- A clear understanding of the market size and competition is also important, as well as the levers that drive a business model.

- Lastly, they need to know what your long-term vision is for the business.

How to Apply

You can submit your pitch through the email found on their website. You can also access their website’s Pitch submissions page anytime.

2. Harlem Capital: Funding Female Founders

Who they are

Harlem Capital was founded in 2015 to change the face of entrepreneurship. The company is based in New York and aims to diversify its portfolio and support various businesses across all verticals.

Their mission/purpose around female startups

They also aim to address the disparity faced by women and entrepreneurs belonging to minorities by investing more heavily in them, instead of waiting for other venture capital firms to do it.

Stage and Amount they invest

The venture capital firm focuses on companies at the seed stage, with investments ranging from $1 million to $3 million.

Additional Resources They Offer

Harlem Capital recommends other resources pick for diverse founders, such as Product Hunt, Pitchbook, Term Sheets, etc.

Portfolio of beauty brands

- Beauty Bakerie founded in 2011 by Cashmere Nicole, the brand’s mission is to sweeten the lives of others. The brand has also been very vocal about the different injustices that span different issues from disparities within the beauty space to serious issues such as The Black Lives Matter Movement, The Muslim Ban, missing children, etc. earning them the title “activists of makeup.”

What they’re looking for

Before investing, Harlem Capitals looks for the following criteria:

- Resilient and high-quality management team with at least one full-time founder

- Disruptive business model that solves an important problem

- Attractive valuation in capped or priced Seed Round (ownership target of at least 10%)

- Four to seven years of investment realization horizon

- Post-product market fit

- Large market size of at least $1 billion with positive demand drivers

- HCP’s ability to offer strong added value

How to Apply

You can send your pitch anytime. To apply for funding, you can fill out the form found on their website. You will be given a Deck Template for reference.

3. BBG Ventures: Funding Female Founders

Who they are

Founded by Susan Lyne and Nisha Dua in 2014, BBG Ventures is currently one of the most active female-focused investors in the country. The company is based in New York and targets investments in software, commercial services, digital media, mobile, TMT, and SaaS industries.

Their mission/purpose around female startups

BBG Ventures was created to give female founders that crucial investment they need to push them to do great things. The company supports female leaders with big ideas and aims to reshape the way we live with the kind of companies they empower.

Stage and Amount they invest

Seed or Pre-Seed rounds are typically what they lead or co-lead, with a sizable initial check ranging from $500,000 to $1 million.

Additional Resources They Offer

The company also offers job opportunities to those interested.

Portfolio of beauty brands

- Radswan – as an influencer-led beauty brand, Radswan’s goal is to transform the design, sourcing, and sale of natural black hair wigs, clip-ins, and extensions. They are the first to build a customer-centric e-commerce experience that focuses on offering high-quality synthetic hair products at accessible prices.

- Starface – a skincare brand bringing a new approach to treating acne, the top skincare concern. With clinically proven, affordable, clean, and fun products, they have managed to win over Gen Z and made breakouts look Instagram-worthy.

What they’re looking for

The company’s investment guidelines include:

- The startup should have at least one female founder.

- The founder should understand the community and the problem deeply.

- The company is looking to tap solutions in education, health, work, well-being, climate, and other overlooked market segments.

How to Apply

If you wish to pitch your idea to BBG Ventures, then fill out their Inbound Pitch form anytime.

4. SoGal Ventures: Funding Female Founders

Who they are

As the first women-led next-gen venture capital firm, SoGal Ventures aims to invest in next-gen billion-dollar businesses that unapologetically benefit not just the people, but the society and the planet as well.

Their mission/purpose around female startups

SoGal capitalizes on three of the biggest investment opportunities today: undervalued founders, underserved problems, and undercapitalized geographies. Their portfolio mainly consists of health and wellness companies led by passionate female CEOs.

Stage and Amount they invest

SoGal Ventures typically invests in seed-stage businesses, with a capital range of $2 million to $3 million.

Additional Resources They Offer

SoGal Ventures offers their partners support and guidance throughout the funding rounds, and the team also helps in brainstorming directions and understanding target markets.

Portfolio of beauty brands

- Function of Beauty – a hair care brand that was created with the belief that no size fits all. Everyone deserves to have a product tailored just for their hair. With the right formula and the right testing sessions with professionals, they were able to rewrite the rules of beauty by putting you in charge.

- Winky Lux – a beauty brand that offers skincare and makeup. Winky Lux believes that life is all about creating joy. They leave impressions and push past boundaries to see what they can and can’t do.

What they’re looking for

SoGal Ventures loves unconventional ideas and founders. They are looking for companies that can help transform how the world lives, works, and stays healthy.

How to Apply

Access their submission form anytime to send your pitch.

5. 500 Global: Funding Female Founders

Who they are

With $2.7 billion worth of assets under management, 500 Global invests in markets where technology, capital, and innovation can drive economic growth and unlock long-term value.

Their mission/purpose around female startups

Their mission is to use entrepreneurship as a means of uplifting people and economies around the world. The VC company believes in scale and diversification. The fund companies across the world.

Stage and Amount they invest

500 Global invests around $1 million to $5 million in companies that meet their criteria.

Additional Resources They Offer

Startups can join their seed accelerator and founder programs that help companies tap a community of like-minded people and explore their curriculum on culture, marketing, sales, product design, and more.

Portfolio of beauty brands

- Althea, Inc. –The No.1 Digital Destination for all things K-beauty – Shopping, Lifestyles & Trends

- Amused Co. – Amused Co. is the first digital platform for preloved luxury fashion in Saudi Arabia. They pride themselves on their curated inventory that includes handbags, accessories, shoes, and jewelry from famous, high-end brands.

What they’re looking for

The following is a selection of pre-defined metrics that 500 Global has built to determine whether or not to invest in a company:

- Cross-functional team with decent expertise

- Capital-efficient businesses

- Having a functional prototype

- Good scalability

How to Apply

You need to apply for the company’s Accelerator program, and on the demo day, you can then present your pitch and tap their expansive network of investors.

6. Day One Ventures: Funding Female Founders

Who are they?

Day One Ventures is a San Francisco-based venture capital firm with a nationwide reach. They are known for their wide industry focus, which spans machine learning, fintech, marketplaces, consumer products, impact investing, health, mental health, and technology for Generation Z.

Their mission/purpose around female startups

While Day One Ventures doesn’t specifically focus on women-led startups, they are committed to fostering innovation, supporting impactful solutions, and identifying disruptive potential across a broad spectrum of industries. They value diversity and inclusivity and are open to exploring investment opportunities with startups demonstrating promise and potential, regardless of the founder’s gender.

Stage and amount they invest

Day One Ventures primarily focus on the pre-seed to seed stages, and occasionally Series A, of startup funding. They typically invest between $100K to $1M, making them a valuable source of initial capital for emerging beauty brands looking to make their mark.

Additional resources they offer

They offer additional resources, such as mentoring, networking, and business development opportunities.

Portfolio of beauty brands

They have not invested in any beauty brand yet but I believe they will be open to a consumer brand that intersects with tech, marketplace and health.

What are they looking for?

Day One Ventures seeks startups that are developing innovative solutions across their areas of industry focus. While they don’t explicitly concentrate on the beauty industry, they welcome ventures from the consumer products sector, which could include beauty brands. The firm looks for startups with robust business models, innovative product offerings, and a clear market opportunity.

How to Apply?

Potential applicants can visit Day One Ventures’ website for more information about their investment process and to explore potential opportunities for collaboration.

7. Fearless Fund: Funding Female Founders

Who are they?

Fearless Fund is a venture capital firm based in Atlanta, Georgia, extending its reach across the United States and Canada. They dedicate their efforts to backing Women and Women of Color in the food and beverage, beauty, and technology industries.

Their mission/purpose around female startups

Fearless Fund is deeply committed to the goal of bridging the vast funding gap faced by Women and Women of Color in business. They aim to nurture and empower these overlooked entrepreneurship demographics.

Stage and amount they invest

Fearless Fund operates primarily at the pre-seed, seed, and Series A stages of startup development. Their investment size is typically no larger than $3M, and they typically seek at least 10% ownership in the businesses they invest in. This level of support can provide substantial assistance to early-stage beauty brands looking to grow and significantly impact the industry.

Additional resources they offer

They offer various grants to women-led ventures, help them get venture ready and organize VC summits.

Portfolio of beauty brands

- BREAD BEAUTY SUPPLY: It is a hair care brand focused on essential hair care products for textured hair. They offer a streamlined range of goods to simplify hair care, emphasizing effectiveness and ease.

- AMP BEAUTY LA: It is a platform aiming to revolutionize beauty shopping. Their mission is to support emerging beauty brands and become the go-to beauty destination for all textures and all shade.

What are they looking for?

Fearless Fund is primarily looking for ventures led by Women and Women of Color in the food and beverage, beauty, and technology industries. They seek out promising brands with innovative product offerings, a solid business model, and the potential to make a significant impact in their respective industries.

How to Apply?

If you are interested in seeking investment from Fearless Fund, you can visit their website for more details about their investment process and criteria and to find information on how to initiate the application process.

8. Graham & Walker: Funding Female Founders

Who are they?

Graham & Walker is a venture firm that supports and invests in female entrepreneurs. They are involved in sectors like B2B Technology, B2C Technology, Healthcare, and Consumer industries.

Their mission/purpose around female startups

Graham & Walker’s mission is to activate the potential of all women in business through programs, community, and early-stage capital investments.

Stage and amount they invest

Graham & Walker primarily invests in seed-stage startups, but the exact investment amount isn’t specified.

Additional resources they offer

Graham & Walker provides support through programs and community-building activities for their portfolio companies.

Portfolio of beauty brands

They have invested in women-focused startups that combine tech and wellness, such as Seven Starling, which offers “Mental healthcare for every stage of motherhood” and a fashion brand Panty Drop, which is “Reimagining panty design for EVERY BODY”

What are they looking for?

They are looking for startups with the potential to become influential players in the Nasdaq, led by visionary women founders.

How to Apply?

You can apply here and send in your pitch deck!

9. Pipeline Angels: Funding Female Founders

Who are they?

Pipeline Angels is a network of new and seasoned women investors changing the face of angel investing by creating capital for women social entrepreneurs.

Their mission/purpose around female startups

Pipeline Angels’ mission is to increase diversity in the startup ecosystem by providing capital and support to women-led startups focusing on social and environmental missions.

Stage and amount they invest

Pipeline Angels primarily invest in seed-stage startups, but the specific investment amount isn’t disclosed.

Additional resources they offer

Pipeline Angels’ broad network of seasoned investors can provide valuable mentorship and guidance to portfolio companies.

Portfolio of beauty brands

- Mented: Mented Cosmetics is a beauty brand that prides itself on its inclusivity, celebrating all hues and skin tones. The founders established the company on the belief that everyone should have representation in the world of beauty.

- LAMIK Beauty: Catering to multicultural women, LAMIK Beauty offers a vegan makeup line crafted from natural and organic ingredients. The brand showcases its dedication to clean, quality makeup while focusing on the diverse beauty needs of women from various backgrounds.

What are they looking for?

Pipeline Angels is particularly interested in startups led by women, non-binary, and transgender women, LGBTQ+, Agender, Two Spirit, and People of Color with a social or environmental mission.

How to Apply?

Fit startups can visit the Pipeline Angels site and apply to 2023 Fall Pitch Summit here!

10. Halogen Ventures: Funding Female Founders

Who are they?

Halogen Ventures is a Venture Capital fund based in Los Angeles, California, focusing on early-stage consumer technology startups with a female in the founding team.

Their mission/purpose around female startups

Halogen Ventures is dedicated to investing in companies that are breaking ground in the consumer space and are led by female founders.

Stage and amount they invest

Halogen Ventures invests in pre-seed, seed, and Series A stages, but the exact amount isn’t specified.

Additional resources they offer

The Halogen Fellowship in Venture Capital is a summer program that emphasizes gender dynamics and seeks to tackle the issue of inadequate equity, diversity, and funding within the venture capital industry.

Portfolio of beauty brands

- Tinted: Tinted is a beauty brand that prioritizes the creation of cutting-edge, clean formulas suitable for all skin tones, especially deeper complexions. From inception, Tinted has strived to minimize its environmental impact, thereby committing to both environmental sustainability and diversity. This makes Tinted a significant player in Halogen Ventures’ beauty portfolio.

What are they looking for?

Halogen Ventures is interested in startups creating innovative consumer technologies in a broad range of sectors, from fashion and interior design to social media and fintech.

How to Apply?

For application details, female founders can visit the Halogen Ventures website.

11. Serena Ventures by Serena Williams: Funding Female Founders

Who are they?

Serena Ventures, led by tennis superstar Serena Williams, is a venture capital firm that has provided seed funding to more than 60 companies since 2014.

Their mission/purpose around female startups

Serena Ventures’ mission is to invest in products and ideas that unlock value for investors, doors for founders, and opportunities for everyone to live better.

Stage and amount they invest

Serena Ventures doesn’t specify the amount they invest, but they provide seed funding to startups.

Additional resources they offer

They help in implementing unique strategies, undertaking ambitious initiatives, and leveraging a worldwide network of investors, business leaders, and influencers.

Portfolio of beauty brands

- WILE: Through the utilization of plant medicine and rigorous clinical studies, WILEs aim to unravel and embrace the powerful hormonal capabilities and intricate intricacies of adult women from within, removing the mystique surrounding them.

What are they looking for?

Serena Ventures looks for startups led by women, People of Color, Black and LatinX founders who can provide value to investors and society.

How to Apply?

Entrepreneurs interested in funding can visit the Serena Ventures site for more information on how to apply.

12. Women's Equity Lab: Funding Female Founders

Who are they?

The Women’s Equity Lab was launched in 2017 to promote women entrepreneurs in Victoria, BC. It’s supported by the National Angel Capital Organization, the Capital Investment Network, and Osler, Hoskin, and Harcourt, LLP.

Their mission/purpose around female startups

Women’s Equity Lab aims to reduce the gender gap in venture capital by actively supporting and funding women-led businesses. Their vision is to cultivate a more balanced and inclusive startup ecosystem.

Stage and amount they invest

Women’s Equity Lab typically invests in seed-stage startups, but the exact amount isn’t specified.

Additional resources they offer

Women’s Equity Lab provides women entrepreneurs access to a robust network of industry professionals, mentors, and potential business partners.

Portfolio of beauty brands

- Three Ships: Effective skincare backed by natural ingredients and real science

What are they looking for?

Women’s Equity Lab is sector agnostic and seeks to fund women-led startups with high growth potential, does prefer Canadian early-stage companies (Series A or earlier)

How to Apply?

Interested & fit startups can visit the Women’s Equity Lab’s application page on their site to fill out a detailed form.

13. The 51: Funding Female Founders

Who are they?

The 51 is a Financial Feminist™ platform where investors, entrepreneurs, and those who aspire to be, unite to build mutual wealth and social/environmental impact. They focus on democratizing access to women-led capital for women-led businesses.

Their mission/purpose around female startups

The 51 aims to reshape Canada’s venture capital landscape by harnessing the untapped women’s wealth. They are creating a critical mass of women investors and making Canada the center for women-powered capital.

Stage and amount they invest

The 51 has an M51 Founder Lab program for women and gender-diverse founders who are thinking of raising $25K-$1.5M in pre-seed money within 6-8 months of application.

Additional resources they offer

The 51 offers a platform for sharing knowledge and experiences, becoming influential investors, innovators, and consumers, and building the Financial Feminist™ economy.

Portfolio of beauty brands

- Blume: Blume is a lifestyle brand with a focus on puberty for Generation Z, providing a range of community resources, educational materials, and safer personal care products.

What are they looking for?

The 51 looks for innovative, women-led, Candian businesses with the potential to make a significant social or environmental impact.

How to Apply?

Entrepreneurs interested in partnering with The 51 can visit their website for more information and application instructions.

SEED/EARLY STAGE

14. Bumble Fund: Funding Female Founders

Who they are

Founded by Whitney Wolfe Herd in 2014, Bumble Fund was created with the sole goal of helping advance gender equality by letting women make the first move. Throughout the years, their mission has remained unchanged.

Their mission/purpose around female startups

Bumble Fund was created with equality in mind. They focus on businesses that are primarily founded by women of color as well as those belonging to the minorities.

Stage and Amount they invest

Bumble focuses on investing in businesses at the seed or early stage. The average check size is $25,000 to $50,000 depending on the business needs.

Additional Resources They Offer

The company’s Bumble Bizz offers opportunities for networking and business connections.

Portfolio of beauty brands

- Shearshare – founded by the tech visionaries, Courtney Caldwell and Dr. Tye, their mission is to be the top engine of wealth and job creation for the beauty and barber industry.

What they’re looking for

Bumble Fund chooses companies that solve a problem that disproportionately impacts women.

How to Apply

Download Bumble Bizz to stay tuned for pitch competitions and other opportunities to send your application.

15. The Perkins Fund: Funding Female Founders

Who they are

The Perkins Fund was founded in 2016 by Sonja Hoel Perkins, an industry veteran. The fund focuses on long-term, lasting relationships with entrepreneurs.

Their mission/purpose around female startups

The fund’s goal is to mainly support high-technology companies that can fill the market’s unmet need that only a combination of marketing savvy, technology, and hard work can solve.

Stage and Amount they invest

Typically, the fund invests in less than 10% of a round. The company invests in all stages– seed, early, and late-stage funding.

Additional Resources They Offer

Besides fundraising, The Perkins Fund also offers value in terms of general business strategy and market positioning.

Portfolio of beauty brands

- Femly – a line of 100% certified organic cotton products focused on period care that delivers to your door!

What they’re looking for

If you look at their portfolio, you can see how they have ensured diversification, and the company emphasizes empowering businesses that can potentially change the world.

How to Apply

If you wish to reach out to them and apply for an investment, you can visit their website anytime or shoot them an email at contact@theperkinsfund.com.

16. Amplifyher: Funding Female Founders

Who they are

As a venture capital firm, Amplifyher Ventures dedicates itself to investing in diverse leadership teams that possess a unique ability to create flywheel growth effects in new markets.

Their mission/purpose around female startups

The firm sees women not as underfunded but as untapped. The firm was built in order to arm women with the capital and resources they need to build their own C-suites.

Stage and Amount they invest

Investing about $1 million to $5 million, Amplifyher Ventures focuses on commerce, care, and connectivity.

Additional Resources They Offer

The team can offer the most value to founders in commerce, tech-enabled innovations, and connectivity. They also have advisors who can help share expertise in media, brand-building, science, and technology.

Portfolio of beauty brands

- Live Tinted – founded by Deepica Mutyala, a South Asian businesswoman and entrepreneur. Live Tinted aims to change the narrative about beauty and celebrate beauty for different colored skins, especially when tinted.

- Aavrani – Aavrani combines ancient, all-natural rituals and a modern-day routine that has been clinically proven. It aims to make women around the world feel more comfortable in their own skin.

What they’re looking for

The company is looking for diversity in leadership teams that can impact new markets. The firm is eager to give opportunities to women and address the significant gap in financing.

How to Apply

Fill out the company’s contact form to reach out, and include a brief description and the main details about your startup’s fundraising plans.

17. General Catalyst: Funding Female Founders

Who are they?

General Catalyst is a globally operating venture capital firm in San Francisco, California. The firm has a wide focus, including the Consumer, Enterprise, Fintech & Crypto, and Health Assurance sectors, backing ventures led by women and people of color.

Their mission/purpose around female startups

General Catalyst is committed to creating a more inclusive and diverse entrepreneurial ecosystem with “Responsible Innovation” that furthers intentional innovation, enhances diversity, and builds a healthier society.

Stage and amount they invest

General Catalyst provides funding across a range of startup stages, including Early Stage Venture, Late Stage Venture, and Seed, typically investing between $500K to $2M. This substantial financial backing can significantly aid women-led beauty brands looking to scale and evolve.

Additional resources they offer

They offer specialty strategies, including financial modeling for sustainable consumer acquisition.

Portfolio of beauty brands

- Beauty Pie: It operates as an online platform that provides its members with access to luxury beauty products without the typical retail markups. They offer an extensive range of items sourced from prestigious labs worldwide, effectively democratizing access to luxury cosmetics.

What are they looking for?

While General Catalyst does not exclusively target the beauty industry, they are open to opportunities within the consumer sector, which could include beauty brands. The firm prioritizes ventures that are trying to take the world forward with a positive impact on the society.

How to Apply?

Interested founders can learn more about General Catalyst’s investment process and how to approach them for potential investment opportunities through their website.

18. Cleo Capital: Funding Female Founders

Who are they?

Cleo Capital is a San Francisco-based venture capital firm targeting underrepresented founders. Their attention spans various sectors, including fintech, legal tech, insurtech & health tech, and more.

Their mission/purpose around female startups

Cleo Capital seeks to balance the entrepreneurial landscape by investing in women and people of color, demonstrating a commitment to diverse perspectives and innovation.

Stage and amount they invest

The firm caters to early-stage ventures with investment amounts ranging from $500K to $1M.

Additional resources they offer

The specifics of additional resources offered by Cleo Capital aren’t detailed, but they work with founders from day zero.

Portfolio of beauty brands

- StyleSeat: It is an online platform for beauty and wellness professionals and their clients. It allows professionals to showcase their work, connect with new and existing clients, and build their businesses.

What are they looking for?

Cleo Capital values disruptive innovation in their focus industries. They focus on strong business models, growth strategies, and clear market opportunities.

How to Apply?

Interested parties should visit Cleo Capital’s website to inquire about potential investment opportunities.

19. The Syndicate: Funding Female Founders

Who are they?

The Syndicate is an investment syndicate and membership community for black female angel investors. They focus on sectors such as Media, FinTech, FemTech, Mental Health, Community Platforms, and Work.

Their mission/purpose around female startups

The Syndicate aims to increase diversity within the startup ecosystem by building the largest black women angel investors and advisors community. They believe that increasing the number of diverse check writers, advisors, and independent board members will multiply the effect on diversity within the venture capital industry.

Stage and amount they invest

The Syndicate focuses on Seed and Series A rounds. The exact amount they invest is not disclosed.

Additional resources they offer

As a community for black female angel investors, The Syndicate offers networking opportunities, mentorship, and advisory roles for startups, helping them grow and succeed.

Portfolio of beauty brands

There aren’t any mentioned.

What are they looking for?

The Syndicate looks for startups in a range of sectors, from media and fintech to mental health, that are run by black women and have a high growth potential.

How to Apply?

Startups interested in The Syndicate can visit their website for application details.

20. Broadway Angels: Funding Female Founders

Who are they?

Broadway Angels is an angel investment group made up of world-class investors and business executives who all happen to be women. Their expertise is particularly strong in the Information Technology sector.

Their mission/purpose around female startups

As an all-women angel group, Broadway Angels endeavors to break the glass ceiling for women entrepreneurs, leveraging their collective industry experience to create opportunities for startups led by women.

Stage and amount they invest

While the specific investment amount isn’t specified, Broadway Angels invest in a variety of companies nationwide in the USA.

Additional resources they offer

Beyond financing, they provide a wealth of industry experience and connections, aiding in strategic planning, networking, and growth.

Portfolio of beauty brands

- FEMLY: a personal care brand on a mission to set a new benchmark for period care. Femly enhances the restroom experience for individuals and locations requiring a healthier alternative by offering period products made from organic cotton and innovative patent-pending dispensers.

What are they looking for?

Broadway Angels look for high-growth potential startups, particularly in the Information Technology sector, helmed by women, but are open to other opportunities as well.

How to Apply?

To seek funding from Broadway Angels, prospective applicants can visit their website for more details and contact information.

21. Golden Seeds: Funding Female Founders

Who are they?

Golden Seeds is an angel investment firm based in New York City with additional chapters in Atlanta, Boston, Dallas, Houston, and Silicon Valley. They specialize in sectors such as B2B Technology, B2C Technology, Healthcare, Consumer Tech, and Tech-enabled products.

Their mission/purpose around female startups

Golden Seeds is dedicated to funding early-stage, high-growth startups led by women, who are experts in their domain.

Stage and amount they invest

Golden Seeds typically invests between $250,000 and $2,000,000 in seed-stage startups.

Additional resources they offer

While the specifics aren’t detailed, the presence of multiple chapters suggests a robust network and resource pool for the startups they invest in.

Portfolio of beauty brands

While they don’t seem to have invested in a beauty brand, the focus on healthcare and consumer products tells that they may consider a beauty brand that fits the criteria.

What are they looking for?

Golden Seeds is interested in startups led by women that offer innovative solutions in their focus sectors.

Golden Seeds seeks out companies that exhibit the following characteristics:

- Capable management team with specialized expertise in their respective industry.

- Business model with scalability potential.

- Target market size of at least $500 million.

- Limited capital expenditure requirements.

- Opportunities that can be expedited and enhanced with the support and guidance of their investors.

- Products or services in the beta stage of development, incorporating feedback from clients or potential clients.

- “Proof of concept” revenue or significant pilot programs, excluding healthcare bio/pharma, diagnostics, and medical device companies.

- Plausible exit strategy within a 5-8 year timeframe.

- Valuation at the time of first funding generally below $10 million.

- Typically seeking a first round of funding ranging from $250,000 to $2,000,000.

For consumer product companies, there are additional criteria to meet:

- Annual run rate revenue exceeding $1,000,000.

- Gross margins surpassing 40%.

How to Apply?

For application instructions, you can apply here!

22. Alliance of Angels: Funding Female Founders

Who are they?

The Alliance of Angels is the largest and most active angel group in the Pacific Northwest, specializing in funding seed and early-stage startups across various sectors, including hardware, consumer, information technology, and life sciences.

Their mission/purpose around female startups

While the Alliance of Angels does not specify a mission centered around female startups, they are likely to have both female and male angels who are interested in funding female founders.

Stage and amount they invest

They typically invest $25,000 – $100,000 into a startup and may invest more in future funding rounds. Each year, they invest $10M+ into 20+ companies.

Additional resources they offer

In addition to funding, the Alliance of Angels provides guidance, networking opportunities, and mentorship from seasoned angel investors.

Portfolio of beauty brands

- Clarisonic: David Giuliani founded Clarisonic and was sold to Loreal.

What are they looking for?

They seek high-potential startups in hardware, consumer, information technology, and life sciences sectors at the seed and early stages of development.

How to Apply?

To apply for funding with the Alliance of Angels, visit their website, read the screening process and follow the application instructions provided.

23. Women's Venture Capital Fund I & II: Funding Female Founders

Who are they?

The Women’s Venture Capital Fund I & II is another venture capital fund based in Portland, Oregon. They focus on backing women-led ventures in the SaaS, Consumer Internet, and Educational Tech sectors, specifically within the Pacific Northwest and California.

Their mission/purpose around female startups

The Women’s Venture Capital Fund I & II is deeply committed to supporting women entrepreneurs. They understand women’s unique challenges in obtaining funding and aim to bridge this gap, fostering the growth and success of women-led businesses in the tech and internet sectors.

Stage and amount they invest

The Women’s Venture Capital Fund I & II primarily operate at the Series A stage of startup development. The specific investment amount they provide is not publicly available.

Additional resources they offer

The fund provides breakthrough insights, great networking, and ongoing support.

Portfolio of beauty brands

They look to invest in consumer brands even though they have not yet invested in beauty.

What are they looking for?

The Women’s Venture Capital Fund I & II targets women-led businesses in the SaaS, Consumer Internet, and Educational Tech sectors, particularly those based in the Pacific Northwest and California. The investment focus is on early-stage (A/B) companies that are generating revenue and exhibit high-growth potential. These companies are led by management teams that prioritize inclusivity, specifically including women in leadership positions.

How to Apply?

To apply for funding at the Women’s Venture Capital Fund I & II, eligible ventures can email their pitch deck at deals@womensvcfund.com.

24. Portland Seed Fund: Funding Female Founders

Who are they?

Portland Seed Fund is a venture capital firm based in Portland, Oregon. They have a wide area of interest, including:

- Apparel & Outdoor

- Business Applications

- Clean Tech, Communities

- Consumer Internet

- Developer Tools

- Edtech, Fintech

- Food & Beverage

- Marketing Applications

- Medtech

- Retail & Ecommerce

Their mission/purpose around female startups

While the Portland Seed Fund does not specifically target women-led startups, they value diversity and innovative potential across various sectors, welcoming applications from all promising businesses.

Stage and amount they invest

The Portland Seed Fund operates at the Early Stage Venture and Seed stages, typically investing $50,000. This early-stage financial support can provide a critical boost to emerging beauty brands.

Additional resources they offer

They also run a non-resident business accelerator program designed to connect entrepreneurs with Oregon’s expanding startup ecosystem. The program serves as a platform for entrepreneurs to access the region’s mentors, advisors, capital, customers, and employees.

Portfolio of beauty brands

- Alleyoop: Alleyoop stands out as a multi-functional beauty brand that revolutionizes efficiency in personal care. By meticulously crafting products that serve more than one purpose, Alleyoop turns the conventional approach to beauty on its head, offering consumers the ability to simplify their beauty routines without compromising on effectiveness.

What are they looking for?

Portland Seed Fund focuses on making investments in outstanding early-stage companies that are based in Portland and the wider Pacific Northwest region. The fund adopts a sector-agnostic approach and maintains a diverse set of investment criteria, enabling it to opportunistically support startups with strong management teams and significant growth potential in various industries.

How to Apply?

The program is conducted for each new cohort, approximately once per year. They have a continuous investment approach where they invest in new businesses without adhering to a formal application period.

If a business is headquartered in the Pacific Northwest and meets the aforementioned Investment Criteria, they are encouraged to submit an expression of interest in receiving investment from the fund through Gust.com. Additionally, the program organizers can be found at in-person pitch events across Oregon, and updates about these events can be obtained by following them on Twitter.

EARLY STAGE

25. Elevate Capital: Funding Female Founders

Who they are

This capital fund values inclusivity and funds underserved entrepreneurs such as women and ethnic minorities. They have funded over 27 startups and their total investment stands at $37 million.

Their mission/purpose around female startups

Elevate Capital was founded to provide help to underserved and overlooked entrepreneurs.

Stage and Amount they invest

Elevate Capital focuses on businesses at their early stage at $25k to $100k per investment.

Additional Resources They Offer

The firm also offers other resources such as videos, news, and blogs. Elevate Capital believes in the opportunity to invest early and offers these entrepreneurs mentorship.

Portfolio of beauty brands

- Hue Noir – A beauty brand that aims to change the face of beauty by placing multicultural women at the forefront of the modern beauty movement. Hue Noir develops everyday makeup solutions that are innovative and ideal for customers that own nuanced skin tones.

What they’re looking for

Their portfolio is diverse, and they tap companies with disruptive products and ideas to bring to the market.

How to Apply

Visit their application page to access a short questionnaire and share your vision.

26. SteelSky Ventures: Funding Female Founders

Who they are

SteelSky Ventures is a female-focused venture capital firm that aims to invest in companies that can provide women with better access, care, and outcomes in healthcare.

Their mission/purpose around female startups

They hold the belief that women’s healthcare is a global market opportunity that has the potential for exponential growth.

Stage and Amount they invest

The firm invests around $1 million to $5 million in entrepreneurs at the early stage of their businesses.

Additional Resources They Offer

You can subscribe to their newsletter to join their network and receive regular insights on their ventures and initiatives.

Portfolio of beauty brands

- JoyLux – A menopausal platform with life-enriching solutions using clinically validated, proprietary tech-powered equipment

What they’re looking for

Companies that receive investment funding from SteelSky Ventures are those that can make a significant change and cause ripples in the women’s healthcare landscape.

How to Apply

For those who are looking to raise funding, fill out their form to submit your pitch.

27. True Wealth Ventures: Funding Female Founders

Who they are

True Wealth Ventures was created to invest in highly scalable, women-led businesses that improve human and/or environmental health.

Their mission/purpose around female startups

There is value in the impact of women and that is what the firm wants to capitalize on, especially when women-led companies have proven to deliver higher returns.

Stage and Amount they invest

The firm invests in companies that are still in their early stage with a check of up to $1 million.

Additional Resources They Offer

Check their news and events page to follow their updates. They also have experienced advisors to back up their partners.

Portfolio of beauty brands

- Dermala – is a skincare brand that develops personalized acne treatments for you. It has a unique approach to fighting acne by utilizing the human microbiome.

What they’re looking for

True Wealth Ventures focuses on investing in women leaders who have proven to be able to financially outperform men-led companies. The company should also have high-growth markets in human and environmental health. Lastly, at least one woman should be of significant decision-making influence on the company.

How to Apply

Share your big idea anytime by filling out this form.

28. Visible Ventures: Funding Female Founders

Who they are

Visible Ventures, previously known as Victress Capital, is dedicated to investing in bold and diverse teams that create superior consumer experiences and in the technologies that power them.

Their mission/purpose around female startups

The vision of the firm is to ensure a level playing field for entrepreneurs for generations to come. 74% of their partners are led by women, and the company operates within the consumer and technology industries.

Stage and Amount they invest

The firm invests in businesses that are in their early stage, with funds ranging from $1 million to $5 million.

Additional Resources They Offer

They also offer news resources to keep visitors up to date.

Portfolio of beauty brands

- Blume – An award-winning skincare brand that ensures healthy skin instead of perfect skin. With gentle ingredients that are good for your body and the environment, they have set a new standard for skin, body, and period care.

- Droplette – A skincare brand that uses technology created by MIT scientists to repair the skin. Droplette helps consumers improve their skin from within.

What they’re looking for

Visible Ventures are searching for overlooked entrepreneurs that aim to address the unmet needs within the technology and consumer industries. If you’re interested in pitching your company to them, visit their website and access the form available.

How to Apply

Fill out the questions in their Pitch Submission form anytime.

29. GoodWater Capital: Funding Female Founders

Who they are

Goodwater Capital offers a lower bar of entry so more promising business ideas can explore the field and find their footing. Then they help teams that are ready to scale move from successful startups to market leaders. Finally, the profits that Goodwater earns are funneled back into their Portfolio Companies to increase the affordability and accessibility of the products.

Their mission/purpose around female startups

As the world’s first regenerative investment platform, Goodwater Capital aims to empower exceptional entrepreneurs and help change the world for the better.

Stage and Amount they invest

Goodwater Capital invests early-stage capital to entrepreneurs, handing out checks worth $1 million to $5 million.

Additional Resources They Offer

The VC firm offers entrepreneurial guidance and equips founders with a startup curriculum, insights, software, data, and access to an exclusive community.

Portfolio of beauty brands

- Memebox – a consumer company providing customers with Asian beauty products. They offer different products from different trusted brands from South Korea, in particular.

What they’re looking for

Goodwater seeks out brilliant entrepreneurs whose startups can change the way the world lives, eats, works and plays. The firm invests in companies that address and fix diverse and pressing problems in housing, food delivery, education, healthcare, beauty, etc.

How to Apply

Join Goodwater Genesis, the company’s seed-stage investment program to send your application.

30. Theresia Gouw: Funding Female Founders

Who they are

Theresia Gouw is the founder of Acrew Capital. With a net worth of $500 million, Forbes has named her the wealthiest female venture capital investor in America. Theresia believes that investment is what fuels the American dream of growth and opportunity.

Their mission/purpose around female startups

Her firm focuses on software and security technology and thrives by embracing diverse perspectives for driving the best outcomes. They support female founders and minorities as they believe that wealth creation should be made accessible to the broader population.

Stage and Amount they invest

Theresia offers early-stage capital to those looking for a long-term partner who can write them a check for at least $1 million.

Additional Resources They Offer

Their website has a Journal page for news, updates and insights. They post thoughts from their crew to help brands and budding companies thrive.

Portfolio of beauty brands

- Birchbox – a beauty startup considered to be the pioneer of beauty subscription boxes. Founded in 2010, the company now has millions of subscribers, reporting a $485 million valuation in just four years.

What they’re looking for

Theresa looks for entrepreneurs who are uniquely suited for transforming big challenges into bigger opportunities

How to Apply

Visit Acrew Capital and follow their socials to stay tuned for pitching opportunities.

31. Sugar Capital: Funding Female Founders

Who they are

Founded in 2020, Sugar Capital is a venture capital firm that invests in seed-stage, early-stage, and growth-stage companies from different industries.

Their mission/purpose around female startups

Their goal is to support women-led businesses and allow them to scale and grow. They are looking to back startups driven to shape the future of commerce.

Stage and Amount they invest

The firm invests funds worth $1 million in deserving entrepreneurs and businesses at the early stage.

Additional Resources They Offer

You can follow their newsletter or socials for more insights and updates.

Portfolio of beauty brands

- Starface – a beauty brand that has developed hydrocolloid acne stickers that are meant to protect and heal blemishes

- Exponent Beauty – the business behind fresher beauty products and packaging preventing oxidation and degradation of unstable active ingredients.

What they’re looking for

Sugar Capital hones in on the commerce ecosystem while bringing true innovation to the table. They are looking for companies whose products can elevate and simplify everyday life.

How to Apply

Access their startup submission form to send your pitch.

32. Waldencast Ventures: Funding Female Founders

Who are they?

Waldencast Ventures is an innovative holding company and investment fund headquartered in New York with an additional office in London. The firm specializes in the incubation and acceleration of early-stage beauty and wellness brands.

Their mission/purpose around female startups

While specific information about Waldencast Ventures’ mission around female startups is not explicitly stated, the firm’s broader vision is to “Build a global beauty and wellness multi-brand platform by creating, nurturing, and scaling the next generation of conscious, purpose-driven brands.” Most of the beauty brands they work with are women-founded.

Stage and amount they invest

Waldencast Ventures invest in early-stage companies, providing substantial funding to help these companies scale and achieve profitability rapidly. The firm entered into $225m Term Loan and Revolving Credit Facilities, indicating a strong capacity to support significant investment initiatives.

Additional resources they offer

Waldencast Ventures provides industry-specific operational expertise to their portfolio companies, offering more than just financial investment. The firm’s resources and guidance aim to assist brands in quickly creating scale and profitability.

Portfolio of beauty brands

- [Coat]s: This skincare brand is clinically proven and dermatologist-approved, with a strong presence on social media platforms like TikTok. [Coat]s is on a mission to provide accessible skincare specifically designed for younger skin, prioritizing skin health without overly harsh or aggressive formulas.

- Whind: Fusing science and sensoriality, Whind is a beauty brand inspired by Morocco’s rich heritage. They offer a unique beauty experience, combining enjoyable usage with efficacious results. The goal is to promote healthy, happy skin that radiates a natural glow.

What are they looking for?

Waldencast Ventures seeks to invest in innovative and unique beauty and wellness brands that place responsible entrepreneurship at the heart of their operations. These brands should demonstrate a strong brand-led business model and potential for rapid scale and profitability.

How to Apply?

You can reach out to them directly via their site’s contact page for more accurate and updated details about their investment application process.

33. Maveron: Funding Female Founders

Who are they?

Maveron is a venture capital firm located in San Francisco, California, with a nationwide scope. They are deeply interested in backing women-led businesses across consumer products, information technology, e-commerce companies, and education. Direct to Consumer is core to their investment thesis.

Their mission/purpose around female startups

Maveron has shown commitment to supporting women entrepreneurs, understanding the need for gender balance in entrepreneurship, and the unique vision and innovation women bring to the business world.

Stage and amount they invest

Maveron specialize in providing funding at the Early Stage Venture and Seed levels. The specific investment amount they provide is not publicly available.

Additional resources they offer

A versatile team that understands operations as well as investing and can help you with hiring right along with strategy.

Portfolio of beauty brands

- Nécessaire: Nécessaire is a clean beauty brand based in Los Angeles. The company specializes in creating self-care essentials for skin health and overall personal wellness. Notably, Nécessaire prioritizes transparency in its business operations and maintains a strong commitment to eco-friendly practices.

What are they looking for?

Maveron is particularly interested in consumer products, which could include beauty brands. They seek strong business models, innovative product lines, and significant market potential. As a firm supporting women entrepreneurs, they would be particularly interested in women-led businesses that meet these criteria.

How to Apply?

For more information on the investment process and application at Maveron, interested entrepreneurs can visit their website.

34. Oregon Venture Fund: Funding Female Founders

Who are they?

Oregon Venture Fund is a venture capital firm based in Portland, Oregon. They specialize in a wide range of sectors, including:

- Advanced Materials

- Cleantech

- Energy

- Real Estate

- Finance and Investing

- Marketing and Sales

- Life Science and Health

- Consumer Products

- Services

- E-commerce

- Software and Media

- Education

- Entertainment

Their mission/purpose around female startups

Oregon Venture Fund is dedicated to fostering a more inclusive entrepreneurial ecosystem and sees the value and innovation that women-led businesses bring. They’re committed to supporting these businesses, particularly within their sectors of interest.

Stage and amount they invest

Oregon Venture Fund provides funding for Early Stage Venture, Seed, and Venture stages, offering $500K to $3M per round. They also have the capacity to allocate up to $10M for each portfolio company, providing significant financial support for growing businesses.

Additional resources they offer

They dedicate time, expertise, funding, and help with the network so founders get access to the right people and resources.

Portfolio of beauty brands

They have invested in consumer products, including health and fashion brands, and I am sure if they find a beauty brand that fits their thesis, OVF would want to invest.

What are they looking for?

Oregon Venture Fund is interested in a variety of sectors, including consumer products, which could encompass beauty brands. They seek ambitious entrepreneurs with high growth potential at any stage, based in Oregon or SW Washington.

How to Apply?

Entrepreneurs interested in Oregon Venture Fund can visit their site and apply here.

STAGE AGNOSTIC-PRE/SEED/EARLY/GROWTH/LATE

35. True Beauty Ventures: Funding Female Founders

Who they are

The firm invests in companies that can meet consumer demand in the beauty, wellness, and personal care sectors. The company has funded multiple small beauty businesses and is committed to helping scale emerging brands in the beauty and wellness industry.

Their mission/purpose around female startups

True Beauty Ventures was built to help women-led businesses scale into resilient, successful, and long-lasting beauty brands. They believe that greater opportunities and stronger returns are created and delivered from more equitable access to capital and investment in diversity.

Stage and Amount they invest

The firm pursues $1 million to $5 million investments from seed entrepreneurs to growth stage-series C.

Additional Resources They Offer

True Beauty Ventures also offers news and insights resources to keep visitors updated on industry-related events.

Portfolio of beauty brands

- AQUIS – a haircare brand heralding a revolutionary science-based approach to restoring your hair’s natural strength, beauty, and vitality. AQUIS studies the biology of your hair, offering products that strengthen it from the inside out.

- Crown Affair – they believe that understanding how to care for your hair is the first step to loving it. Each of the products they offer has been developed to work with all of their other products, forming not just a routine but a ritual for more beautiful and healthier hair.

What they’re looking for

True Beauty Ventures focus solely on brands in personal care, beauty, and wellness. They seek brands with the following criteria:

- Compelling and differentiated

- Demonstrably superior product

- Proven consumer traction and demand

- Has an omnichannel sales growth strategy

How to Apply

You can visit their website anytime and fill out their contact form for inquiries and for sharing your big ideas.

36. Khosla Ventures: Funding Female Founders

Who they are

Khosla Ventures aims to support great entrepreneurs who possess the determination to build companies with lasting significance. The firm does not simply stop at investment but is willing to get its hands dirty and do the work needed to raise a company from the ground up.

Their mission/purpose around female startups

Khosla Ventures support high-impact innovations that rethink the familiar. The firm offers solid support in terms of business strategy and long-term results.

Stage and Amount they invest

Their investments can be split into two funds, one for seed-stage businesses and one for early-stage to growth-stage businesses.

Additional Resources They Offer

Other resources are also available such as growth marketing assistance, team building, blogs, and forums.

Portfolio of beauty brands

- NakedPoppy – an online platform that curates beauty brands, rigorously screening them for harmful toxins so consumers can stay safe.

What they’re looking for

To qualify for funding from Khosla Ventures, you must address the following in your pitch:

- Overview of the problem you’re trying to solve

- Your qualifications to lead this opportunity, as well as the skill set of people you work with

- Financial statements and milestones that you have and have yet to achieve

- Reasonable assumptions on your target market & competition

How to Apply

Submit your business plan on their website to apply for their funding.

37. Lerer Hippeau: Funding Female Founders

Who they are

Lerer Hippeau is a venture capital firm that offers support to entrepreneurs who shake the status quo. They’re always seeking good people with amazing ideas and aren’t afraid of doing hard things.

Their mission/purpose around female startups

They support a lot of women-led startups, but to them, it’s all about creativity and truly backing up movers and shakers in the enterprise and consumer sectors.

Stage and Amount they invest

From the seed-stage to the early-stage to late stage, Lerer Hippeau is drawn to entrepreneurs with a lot of creativity.

Additional Resources They Offer

Other than investment funds, the firm also provides career opportunities and industry insights with its newsletter, socials, and other initiatives.

Portfolio of beauty brands

- Prose – a haircare product line that studies the customer’s scalp needs, lifestyle habits, goals, and environmental exposure in order to create a product formula that can cater to that

What they’re looking for

The VC firm seeks to fund companies in the consumer, digital media, e-commerce, emerging technology, as well as the enterprise software industry.

How to Apply

You can contact them via their email: contact@lererhippeau.com

38. Innovation Global Capital: Funding Female Founders

Who they are

A San Francisco-based venture capital firm, Innovation Global Capital aims to not only follow the future but to actually build it. They build disruptive companies that can transform industries with sheer innovation and technology.

Their mission/purpose around female startups

The firm invests in the world’s digital transformation, providing charitable funding to entrepreneurs who can contribute to the betterment of society. The playing field is equal for as long as the startup qualifies as a next-generation consumer company.

Stage and Amount they invest

Innovation Global Capital invests in seed-stage, early-stage, and late-stage companies, guiding the next generation of innovative companies to grow and scale.

Additional Resources They Offer

Since the company does proprietary investing, its partners can expect value and maximize the company’s global expertise.

Portfolio of beauty brands

- Alchemy 43 – a cosmetics injectable clinics operator that aims to bridge the gap between beauty industries and medical aesthetic

What they’re looking for

The firm is always in search of disruptive companies in dynamic environments.

How to Apply

Access their contact form to submit your inquiries and pitch.

39. Imaginary Ventures: Funding Female Founders

Who they are

Founded in 2017, Imaginary Ventures aims to support the most exciting businesses across the consumer landscape. They have quickly risen to the top and have established themselves as a leading venture capital firm.

Their mission/purpose around female startups

The company has funded a lot of startups in the beauty and wellness industry, many are led by passionate women founders who employ innovation and sustainable business strategies.

Stage and Amount they invest

Imaginary Ventures invests growth capital at around $5 million worth in women-led businesses that have proven themselves to be capable of great things in the industry.

Additional Resources They Offer

The firm has a network of operators, business leaders, and advisors that their partner companies can tap.

Portfolio of beauty brands

- Glossier – a beauty brand with a philosophy that skincare comes first. They aim to emphasize and celebrate the beauty of natural skin tone and facial features.

What they’re looking for

The firm prioritizes digital-first brands and powerful technology solutions that can potentially change the consumer ecosystem. They back brands in the consumer and commerce enablement categories.

How to Apply

You can contact them via email at hello@imaginary.co.

40. Red Bike Capital: Funding Female Founders

Who they are

Founded in 2021, Red Bike Capital is a Latinx and female-led investment fund located in New York early-stage, fast-growth startups fueling the economy & making a difference to people.

Their mission/purpose around female startups

The fund focuses on fintech, marketplace, health, and wellness brands. They do invest in startups founded and led by women.

Stage and Amount they invest

They invest in early-stage, fast-growth startups fueling the economy & making a difference to people.

Additional Resources They Offer

Their website has an insightful blog on venture capital and growth equity. You can also subscribe to the company’s newsletter for more insights and updates.

Portfolio of beauty brands

- Hero Cosmetics – Hero Cosmetics is the maker of the Mighty Patch which was acquired by Church & Dwight for $630 million.

What they’re looking for

The fund focuses on fintech, marketplace, health, and wellness brands. They do invest in startups founded and led by women.

How to Apply

Sign Up for their newsletter and drop them a line on their site.

41. Unilever Ventures: Funding Female Founders

Who They Are

Unilever Ventures is the venture funding division of Unilever that has been supporting founders working on brands of tomorrow for the last 20 years.

Their mission/purpose around female startups

They don’t outrightly claim to focus on female-founded brands but they have backed quite a few female-led health and beauty brands

Stage and Amount they invest

They are a stage agnostic fund that invests $500K to $15M from seed stage to series C/D.

Additional resources they offer

Unilever Ventures helps with industry expertise and global networks across the supply chain, distribution and marketing to funded brands.

Portfolio of beauty brands

- Beauty Bakerie – Cashmere Nicole founded Beauty Bakerie in 2011 with the drive to be sweeten the lives of people.

- True Botanicals – Clean and eco products, clinically proven to deliver high performance.

- ByBi Beauty – A Pro-planet beauty brand for everyone, delivering healthy and radiant skin.

What they are looking for

They invest in brands of future and tech that would help them succeed in very big markets.

How to Apply

UV has two offices in London and Mumbai and you can email them.

42. Willow Growth Partners: Funding Female Founders

Who They Are

Willow Growth Partners offers early-stage growth funding to founders creating game-changing consumer brands of tomorrow.

Their mission/purpose around female startups

They don’t outrightly claim to focus on women-led beauty brands, but many ventures funded in the categories they typically invest in are female-led.

Stage and Amount they invest

They typically invest $750K-$1.25M during early stage of a brand.

Additional resources they offer

They help with critical hires using their networks, help with fundraising, board support, and operational expertise.

Portfolio of beauty brands

Bubble Skincare – Founded by Shai Eisenman, it’s a new-school skincare fixing old-school skincare problems

- Kosas Cosmetics – Founded by Sheena Yaitanes, Kosas is a clean makeup for skincare freaks

What they are looking for

- Traction with revenues of around $1M-$5M

- Health & Wellness, Beauty, Personal Care, Apparel & Accessories, Food & Beverage, Baby & Home.

How to Apply

You can get in touch with them here: hello@willowgrowth.com

43. Tory Burch Foundation Capital Program: Funding Female Founders

Who are they?

The Tory Burch Foundation Capital Program is an initiative based in New York with a nationwide reach. They focus on supporting women-owned businesses across all sectors and industries.

Their mission/purpose around female startups

The Tory Burch Foundation Capital Program is committed to empowering women entrepreneurs, specifically focusing on Women and Women of Color. The program recognizes the need for greater inclusivity and diversity in the entrepreneurial landscape and aims to provide the financial support necessary for these businesses to thrive.

Stage and amount they invest

The Tory Burch Foundation Capital Program provides funding at various stages, including Startup/Seed, Early, Expansion, and Later. They offer microloans ranging from $500 to $50,000, providing a wide range of financial support options for women-owned businesses at different stages of growth.

Additional resources they offer

The Tory Burch Foundation Capital Program provides a range of resources from education to tools like ‘Funding Finder’ tool. This helps women entrepreneurs identify suitable funding options, recognizing that funding needs evolve with business growth. It serves as a key resource for women navigating the complexities of business funding.

Portfolio of beauty brands

- Vamigas: A wellness and beauty brand inspired by botanicals from Latin America, sold in thousands of stores across the USA.

- 54 Thrones: A skincare brand that pays homage to 54 countries of Africa, its culture & people. The product formulations use ingredients ethically sourced from cooperatives and artisans across Africa.

What are they looking for?

The Tory Burch Foundation Capital Program seeks to support ambitious women-owned businesses who are having an impact across all sectors and industries. For Women of Color Grant Program, this is the criteria:

- The business must be a for-profit enterprise and must be majority-owned, at least 51%, by a woman of color.

- Preference is given to businesses that have been operating for one to five years.

- The business should be established under United States law and currently operating within the United States.

- It is strongly preferred that the business is generating revenue, with a minimum annual revenue of $100,000.

How to Apply?

Fit brands can apply at the Tory Burch Foundation Capital Program’s relevant fund page.

44. Advent International: Funding Female Founders

Who are they?

Advent International is a global venture capital firm based in Boston, Massachusetts. They have a wide focus that includes Business & Financial Services, Healthcare, Industrial, Retail, Consumer & Leisure, and Technology sectors.

Their mission/purpose around female startups

While Advent International does not specifically focus on women-led startups, they value inclusivity and partner with high-quality management teams to build sustainable value in companies, driving growth through operational improvements, strategic repositioning, and market expansion, both domestically and internationally.

Stage and amount they invest

Advent International provides substantial business funding, typically investing $50 million to $2 billion for equity in companies with enterprise values of $50 million to $5 billion and above. They often take a majority shareholding in a company, providing considerable financial and strategic support.

Additional resources they offer

In addition to their deal team, which remains involved throughout the entire investment lifecycle, they harness operating resources from their in-house Portfolio Support Group and third-party Operating Partner program. The collective utilization of these resources underscores their strongly operational approach to investing.

Portfolio of beauty brands

- Orveon Global: This is a collective of prestige beauty brands that are dedicated to fostering transparency, co-creation, and making a significant sustainable cultural impact. Their commitment to superior quality and honesty differentiates them in the beauty industry.

What are they looking for?

Advent International is interested in various sectors, including Retail, Consumer & Leisure, which could potentially encompass beauty brands. They look for businesses with a high-quality management team, strong growth strategies, and the potential for operational improvements and market expansion.

How to Apply?

Founders interested in Advent International can visit and apply through the dedicated site page for their geography.

45. Ad Astra Ventures: Funding Female Founders

Who are they?

Ad Astra Ventures is an early-stage investment firm that’s deeply committed to supporting powerhouse, mission-driven female founders in developing scalable businesses, particularly those in the education sector.

Their mission/purpose around female startups

Ad Astra aims to achieve equality across the venture table, recognizing that existing models for building and growing startups are often not designed with women in mind. Their mission is to change the venture capital landscape by actively supporting and investing in women-led startups.

Stage and amount they invest

Ad Astra Ventures operates nationwide in the USA but does not specify a particular funding range.

Additional resources they offer

Ad Astra understands the unique needs of female entrepreneurs and offers an array of resources tailored to their success. They provide advice, guidance, and a network of like-minded individuals to ensure founders have the necessary tools to succeed.

Portfolio of beauty brands

- ESAS Beauty: ESAS Beauty is a fragrance with benefits, offering functional scents that aid in wellness-oriented living.

What are they looking for?

Ad Astra seeks mission-driven female founders developing scalable businesses.

How to Apply?

To apply for funding with Ad Astra Ventures, visit their site and drop a message on the Connect page or you could email them at info@adastra.ventures. You could also follow them on social and engage.

46. Global Invest Her: Funding Female Founders

Who are they?

Global Invest Her is the first online platform dedicated solely to funding for women entrepreneurs. Their geographical focus is North America and Europe, with Latin America to follow soon.

Their mission/purpose around female startups

Global Invest Her aims to help women entrepreneurs understand the funding journey and increase their access to capital. They are committed to driving gender equality in entrepreneurship and funding, with a vision that spans globally.

Stage and amount they invest

While the specific investment amount isn’t mentioned, their global reach offers diverse funding opportunities for women entrepreneurs.

Additional resources they offer

Global Invest Her provides an online platform where women entrepreneurs can connect, share funding information, and access exclusive interviews with successfully funded women entrepreneurs and investors.

Portfolio of beauty brands

- SWAKE: Their products are designed to have exceptional durability, ensuring long-lasting performance. They offer all-day coverage, are resistant to sweat, and instill a sense of confidence when worn.

What are they looking for?

Global Invest Her seeks ambitious women entrepreneurs in need of funding, who have the potential to create a virtuous cycle of changing perceptions around funding women-led businesses.

How to Apply?

To get help with funding from Global Invest Her, visit their website and sign up for free programs or paid plans

47. L’Oréal BOLD-Funding Female Founders

Who are they?

L’Oréal BOLD (Business Opportunities for L’Oréal Development) Ventures is the venture capital fund of L’Oréal, the world-renowned beauty and cosmetics company. The fund is dedicated to investing in startups that are poised to redefine the landscape of beauty and wellness. They invest in:

- Brands

- Tech for Beauty

- Science for Beauty-Advanced innovations in biotech or green science

Their mission/purpose around female startups

While not explicitly focused on female startups, L’Oréal BOLD Ventures aims to partner with extraordinary entrepreneurs who are shaping the future of the beauty industry.

Stage and amount they invest