Premium Pricing is the biggest driver of a brand’s long-term profitability followed by cost reduction and then by volume increase.

Profit Impact Of Premium Pricing Vs Cost Vs Volume

As shown in the chart above, a

1% change in Price creates a change in operating profit of 11.1% .

1% change in Variable Cost creates a change in operating profit of 7.8%.

1% change in Volume creates a change in operating profit of 3.3%.

If there is one quantitative factor that can serve as a torch bearer for your brand to be successful, Premium Pricing is that factor. It also happens to be the most casually and superficially chosen factor.

How to achieve premium pricing for your brand?

1. Identify Target Segment For Premium Pricing

Type of consumer

Don’t just target who everyone is targeting. Too often, I see health and beauty brands targeting Yoga moms or health conscious mothers. These are overused target segments. Actually, target who none is targeting.

Such targeting, who none is aiming for, may seem a smaller addressable market size initially but total addressable market size is a useful metric only if there is a BIG opportunity cost to your CPG brand investment.

Is there another bigger target market size that you are guaranteed to do well with, and have proportionate resources to create awareness and achieve distribution for the same? If not, target whom none is targeting no matter how small that might seem to start with. Target smallest viable audience, which, if profitable, is enough to sustain your business.

Also, targeting a segment, which none is, can help you have a unique value proposition for that segment thereby helping your case with premium pricing.

Needs based segmentation

Start with need based segmentation and then define the segment with demographics, behaviour etc. If it seems that all the segments are taken, which is never the case, redefine the segment using psychographic needs and emotional enemies that haunt the segment.

For example, in natural skin care, you could first segment on following needs: Socialite-radiance, Minimum Hassle-non-sticky, Worrier-lasting natural effect, Sensory-texture and fragrance. Then define demographics, lifestyle factors, price sensitivity and product size for each of the segments to do a relative evaluation of which segment is most attractive and profitable.

Persona

Post defining your segment, develop a persona of a single consumer in your target segment. Coupled with volume and behavioral characteristics, persona will help in crafting all communication, positioning, pack sizes and promotion.

Willingness to pay

( This is identified in conjunction with the value proposition you make to the consumer, covered under Step 3)

A thorough analysis of what your target consumer is willing to pay and for what? Is she price sensitive and willing to pay less and demands minimum acceptable quality or does she value differentiation and willing to pay a price premium?

Findings from this process feed into the definition of your target segment covered above under “Needs based segmentation”. Uncovering willingness to pay for your target consumer is explained in detail under Step 3, point A.

2. Competitors To Map For Premium Pricing

(Direct and Substitutes)

Rarely Exploited: Big enough gap

Too often, I see brands trying to price alongside close competitors, in a cluttered space, when they should be doing the exact opposite. If they don’t price alongside, tendency is to price below, which again is a mistake as you don’t want to leave money on the table.

Here is how premium pricing is achieved in a big enough gap

- Much Higher quality vs lower price brand, Ideally, your price point should be 15%-20% above the lower price brand while offering close to 50% higher quality.

- Slightly higher quality to similar price brand: Price at the same point as competitor but offer 20%-30% higher quality.

In either case, offer at least 30% higher value/perceived value vs both the below and same priced competitor.

Out of the above 2,

Option 1; Premium Pricing (15%-20%) over competitor with much higher quality (40%-50%) is a better option than option B. because you are seen without a competitor for that price segment and also you auto appeal to consumers inclined towards or comfortable with the price range and of course, your margins can be higher.

Your Value Proposition For Premium Pricing

Once you have developed an understanding of who your target consumer is, of their willingness to pay and mapped competition, you have to create a value proposition that will enable you to charge premium pricing.

All of the below value propositions and subsequent positioning could be functional or emotional with the latter commanding a higher pricing premium.

(Adapted from Prof. Ken Wong’s Notes)

A. Are you solving a problem no one else does

For an uncontested innovation, In the absence of a competitive benchmark of quality, you will use information you collected on your target segment & their willingness to pay to arrive at a premium pricing.

Add to that, the relative importance of problem being solved for them versus other brands and products they purchase, and how their willingness to pay increases or decreases with the brand and category type.

For example, there is not any health food packaged snack, in my knowledge, which is fresh meaning maybe made the same day as sold. If you develop a protein bar or kale chips that are consumed the same day as created, then you are solving a problem no one else does.

For natural skin care, if your brand uses an app to moisturize the skin with some kind of rays, without using any physical product, you are solving a problem no one else does.

Next step is to define the segment that will be the most motivated by this offering. Alternatively, you could start with target segment first to identify a problem none else is solving.

Now, find out relative importance of this problem versus buying fresh food for lunch and versus moisturizing skin with physical products respectively.

How much do they pay for those solutions? And depending on relative importance vs “the reference”, decide on charging a premium over current options of snacks that are not fresh and physical moisturizers respectively.

Then, to get really specific, use willingness to pay consumer surveys and acid tests to arrive at premium pricing.

Consumer surveys would ask questions like:

-At what price would you consider the product to be too expensive: Give a price range, for example, for a protein bar give a range from $1 to $10.

-At what price would you consider the price to be so low that quality cannot be good: Give a range between $1.00 to $10.00 for example.

-At what price would you think product has started to get expensive and you will have to give some thought to buying it?: Give a range between $1.00 and $10

-At what price would you consider the product to be a good deal?: Give a range between $1.00 and $10.00

Acid test would show 3 different combinations of solution/product features and price. Based on the options picked up by your target segment, you could uncover the price they are willing to pay for a particular quality of product.

Parallel to importance of the problem, dig deep to uncover whether this segment is value oriented, story oriented, price or time sensitive, and accordingly alter the value proposition to command a price premium.

B. Same Problem, Unique Solution

a. Unique Solution as measured by consumer: How she frames the problem is the key and not how you define your solution.

Does the consumer say

-I want the model that has the most……………?( Against an attribute)

-I want the best “deal”( Against value point)

-I want the one that is the best under these conditions( Against End Use)

-I want the one that this kind of person needs(Against end user)

-I want the one that DOES NOT have/do………? ( Against product class)

-I want the one that is not like……….?( Against a specific competitor)

For example,

For the same problem of dry skin,

The consumer can say:

I want a moisturizer that is not sticky at all and is quickest to absorb within a second

OR

I want a moisturizer that lasts throughout the day in dry, winter conditions

Similarly,

For the same problem of snacking with a nutritious protein bar, a consumer can demand:

I want a protein bar with the most grams of protein

OR

I want a protein bar with real food ingredients

OR

I want a protein bar that does not have crap ingredients like…

b. Since, competition exists for the problem you are serving, you have to maintain and improve this differentiation with continuous improvement.

Continuous improvement could be in the form of creating an augmented solution with added features and services to create a highly differentiated solution, and top it up all with an experience for your consumers.

You could add features like regulates mood swings to the natural skin care line or balances energy levels for your protein bar.

You need to be efficient in pursuing uniqueness and improving at it: How has your solution become better in last 1 year with simultaneous increase in margins?

Both framing of problem and the augmented solution together will help you achieve relative value proposition advantage versus competitors and substitutes and help you charge premium pricing.

For exact pricing, use substitutes and direct competitors as a benchmark. Calculate your relative quality advantage and accordingly charge a premium.

For example, If you offer double the number of protein grams in your real food protein bar versus closest competitor, you could charge a premium of 20%-30%. More on how to calculate price versus competitors and substitutes, refer C below.

C. Same Problem, Same Way With Higher Real Quality ( Relative)

Quality is all non-price criteria buyer considers in making a purchase. It includes functional features, look and feel, brand image and reputation.

Quality is a relative concept and competition maybe different in kind.

The key is to determine how your target segment defines quality. Quality means different things to different people meaning

a. Different people use different set of criteria to define quality for the same product. For example, for some, a moisturizer that is non-sticky and provides lasting effect is quality, whereas to others, a moisturizer that is lightweight and no residue could be high quality.

b. Even with same set of criteria, different people put different emphasis on them. For example, for a segment that defines moisturiser’s quality in terms of shine, non-stickiness and lasting effect, there could be sub-segments that place different weight on each of the criterion. For example: One could weigh Shine-50%, non-sticky-30% and lasting effect-20% whereas someone else might weigh Shine-50%, Non-Sticky-40% and lasting effect-10%. ( Total being 100%)

c. Different people might do different evaluations of performance on same criteria for a brand. For example: one person might rate (1-5) a product 5 on shine, 4 on non-sticky-and 4 on lasting effect whereas another might rate the same product as 4 on shine, 5 on non-sticky and 5 on lasting effect.

Knowing how your consumer defines quality can help you reduce cost too by weeding out all the unnecessary costs which do not contribute to quality.

With the above in mind,

Uncover the purchase criteria of your target segment with acid tests and use Voice of consumer surveys to assess relative quality and improve your value proposition.

For Luxury beauty brands or very high end health food brands: Quality, if not defined, could mean nothing or everything.

If you play on quality of your brand, putting quality front and center of communication, supporting claims are important for positioning.

Higher Quality usually means premium pricing as long as your target segment is willing to pay.

How to arrive at the exact price?: Use Value Pricing.

Value = Quality/Price. You could either provide very high relative quality and charge a slightly premium pricing or provide little higher quality and charge the same price as competitor.

Tip: 30% higher value is a good enough premium for the consumer to switch from current option, even to a higher priced brand.

I would recommend pricing in a gap by offering much higher quality and little higher pricing, while still delivering 30% higher value, as you want to auto appeal to consumers who are willing to pay and comfortable within that price range, as they won’t have any competitor for the same price.

Here is how to calculate relative quality advantage and value advantage:

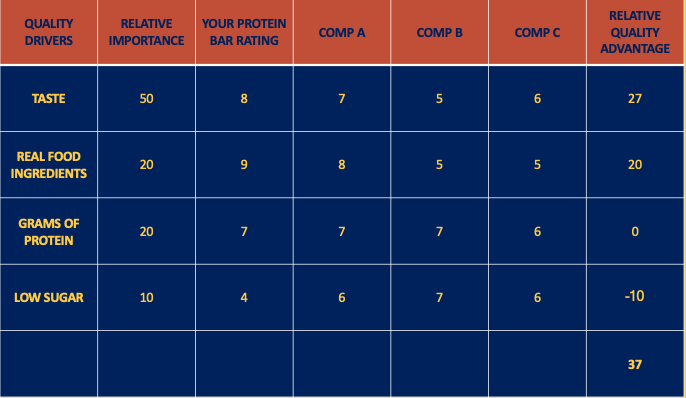

Let’s say, YOUR protein bar competes with 3 other bars and they all have following characteristics:

Taste ratings are shown for your understanding and ultimately ratings for taste and other parameters too are given by the consumer.

Below is the voice of consumer when rating YOUR Protein bar versus competitors A, B and C.

For a difference of 1 point, there is no relative quality advantage for YOUR protein bar and for more than 1 point difference in rating vs a competitor, you get relative advantage points=relative importance column.

The overall quality advantage for that parameter is the average of 3. For example, For taste, YOUR bar has a rating of 8 compared to ratings of 7, 5 and 6 for three competitors.

Compared to Comp A, YOUR bar has zero relative advantage since difference is only 1 point but compared to B &C, it gets 40 points each. Now for relative quality advantage, add the individual advantages over A, B&C and then divide by 3, which is equal to (0+40+40)/3=27.

If you calculate like above, YOUR bar has 37 points advantage over A, B and C.

Relative Value Advantage=Relative Quality Advantage/Price.

Considering that all bars are priced at $3.00, YOUR Bar has 37 points value advantage over the competition.

A 30% relative value advantage is enough to tilt a consumer’s preference in favour of a brand.

D. Perceived Quality and not Real Quality on common features

This mainly applies to categories where it is very difficult to compare one brand from the other especially before and even after purchase.

Consumer lacks resources, knowledge, time or interest to make a rational decision.

If your target segment is generally uninformed or uninterested, they will use heuristics to decide & measure quality.

The trick is to identify the heuristics for such categories and target segment.

For example, for a brand claiming to be clean in beauty or health food snacks, showcasing all the bad ingredients, that your brand does not have, is a good proxy for actual ingredients inside being clean.

The more bad ingredients you claim to not have, the cleaner your brand will be perceived. To make it palatable and presentable, chunk the information under similar headings.

How to Price: Relative quality is key. If the consumer is using proxies/heuristics she is going to evaluate you relatively on heuristics. Calculate your relative quality on these heuristics versus competition and go by the same rule of 30% higher value advantage. Calculate as illustrated above in Point C.

Typically, Industry progresses and marketing costs increase as you move from A to D but there is one exception to the rule! Refer the next point:

E. Uncontested Plane To Make Comparison Irrelevant

Quality when not defined or compared means nothing or everything. If you create an uncontested plane with a powerful brand story, quality can be assumed to be there without any need to rationally evaluate. Why? Because the story takes precedence over individual component comparison!

Create a powerful brand story by using the framework of Surprise + Emotional Transformation + Coherence.

How to Price?: Just like Part A, where innovation is a product, an uncontested plane is an innovative story, and thus, offers ample room to charge premium pricing. How to arrive at exact pricing is by studying your target segment, their willingness to pay and the emotional resonance of the story with them.

You could do a conjoint analysis to check the combination of story and price your target segment is willing to pay or much simpler do an acid test(like explained in point A) with 3 different options of stories, price and products and give it to around 10 of your target consumers, and see which option appeals to them the most. One of the options need to be your story.

Conclusion

Premium Pricing is the most important, and most neglected, strategy to set your health and beauty consumer packaged goods brand up for success with high profitability both in short-term and long-term.

Unless, you solve a problem that none else does, or you create an uncontested plane with a powerful brand story, you will be evaluated on quality.

Always, start with your TG, Value Prop and evaluating competitive landscape.

Check where your value proposition falls on the spectrum of

-Solving a problem no one else does

-Same problem, unique solution

-Higher real quality

-Higher perceived quality

-Powerful Brand Story on an uncontested plane

and accordingly charge a premium pricing.

One rarely exploited strategy is to price in a big enough gap. I would recommend pricing in a gap by offering much higher quality and little higher pricing, while still delivering 30% higher value than close competitors.

The above approach helps you auto appeal to consumers who are willing to pay within that price range, as they won’t have any competitor for the same price.

Avoid the temptation to shortchange premium pricing and just go ahead. The whole point of the above exercise is to uncover or design a way to charge premium pricing and be successful at doing so.

Even better and rarer exploited strategy, for a health and beauty CPG, is a powerful brand story to create an uncontested plane and make comparison irrelevant for most premium pricing and margins.

Is your brand’s perceived value index >30?

Get in touch for a free consultation!

WANT 3 FREE TIPS ON ACHIEVING PREMIUM PROFIT?

Achieve profitable growth

ROHIT BANOTA, Founder of StorySaves, has transformed dozens into envied beauty brands for sharp and profitable growth, kickstarted from day 1 with “strategic brand story” and “story-led brand strategy” & powered by digital.

He has over 17 years of marketing and business experience growing consumer packaged brands including with startups and MNCs like P&G Beauty and Grooming.