Design Post-Covid strategy for your beauty brand in 10 steps by first studying how consumer behavior has changed during COVID and projecting the evolution of these behaviors post-COVID along with the resultant consumption for your category and brand.

In the previous article, we focused on the first 4 steps of the 10 steps to Post-COVID strategy, but did not elaborate much on classifying consumer behaviors and consumption patterns for ease of understanding and formulating strategy.

This article covers amongst other topics,

-10 Steps to creating post-COVID strategy for beauty brands

-Consumer Behavior Change-Beauty Impact vs Pre-COVID

-Step 5: Predict Post-COVID sticky consumer behavior and consumption pattern

-Step 6: Evaluate Beyond-COVID drivers

-Step 7: Evaluate Point of Sales Behavior & Communication Media Preference

-Step 8: Summarise 4 different Strategic Opportunities for 4 different Scenarios

-Step 9: Evaluate the Current Brand Strategy against each Strategic Option

-Step 10: The Process of Elimination for Strategic Options to arrive at a Singular Strategy

10 Steps to Post-Covid Strategy for Beauty Brand

For steps 1-4, refer the chart above. I won’t elaborate on those here as these were covered exhaustively in my previous article, as mentioned before( 2nd paragraph).

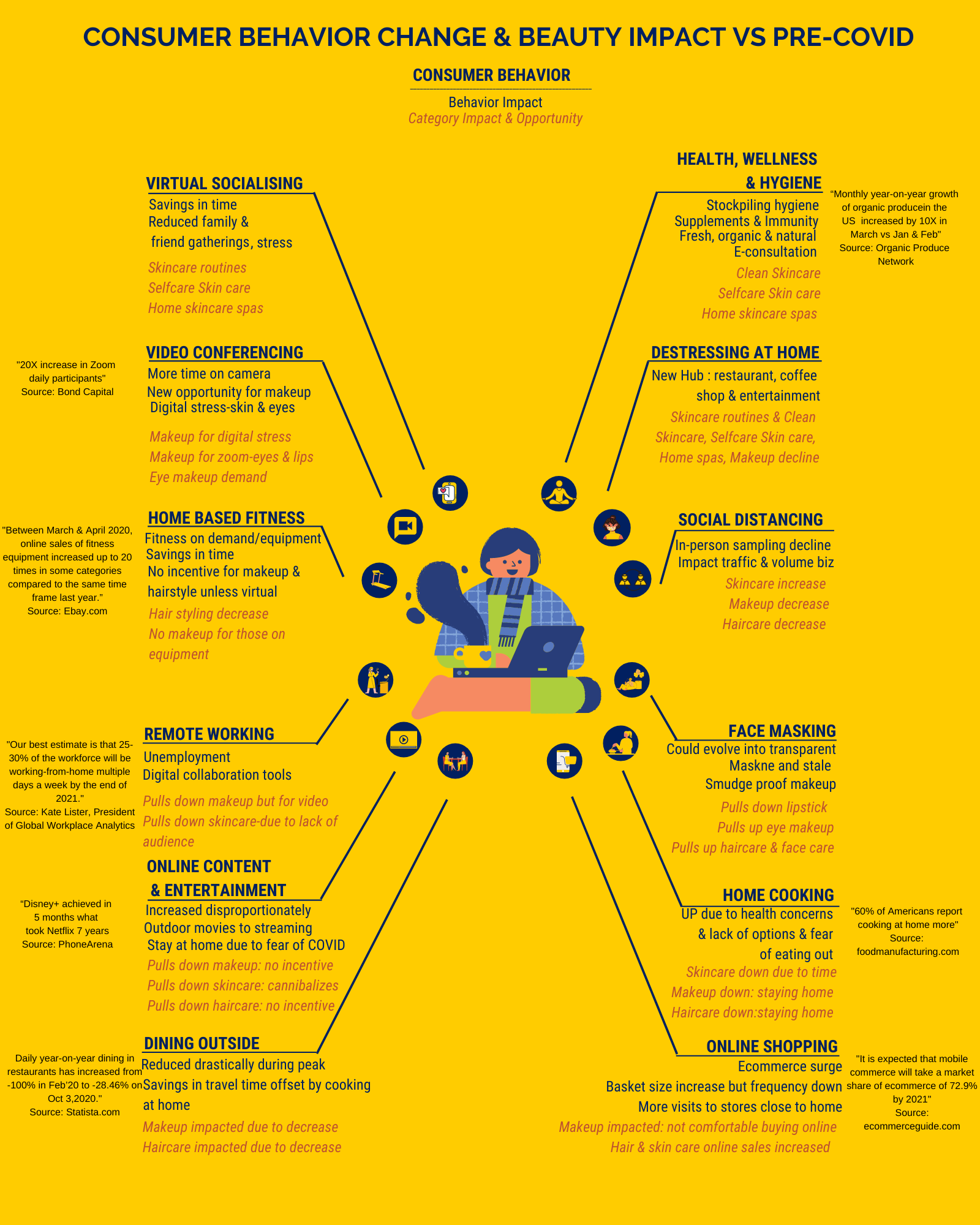

Consumer Behavior Change and Beauty Consumption Impact-During Covid vs Pre-COVID

The above chart shows prominent consumer behaviors during these times and their relevant impact on a beauty category’s consumption with examples from skincare and makeup.

The above behavior will vary by consumer segment and geography. On how to market to different segments during COVID, please refer to my article: how to market beauty during pandemic crisis.

Here is an example of the difference in consumer behavior by geography.

“In Italy, for example, fewer than 10% of consumers out of 60% who shopped online during the pandemic found the experience satisfactory”, according to a McKinsey article.

This means that e-commerce might not be a sticky shopper behavior for the majority of Italian consumers.

On the contrary, “the majority of Chinese consumers have indicated that they will continue shopping online post-pandemic.”

According to the cited McKinsey article, Gen Z, for example, which already had a high penetration of digital, is unlikely to exhibit a significant increase but are much more likely to be financially impacted by the crisis due to a high percentage employed within the gig economy.

The above is something my other article also concludes.

Also, “the financially well-off segment has hardly experienced any economic struggle and have more means of digital acceleration and adoption compared to segments that are not that well-off.”

Therefore, the stickiness of the consumer behavior will vary by segment and geography.

Step 5: Predict Post-COVID Sticky Consumer Behavior and Consumption Impact

There are only three scenarios of COVID possible: a steady decline in spread towards post-COVID, intermittent surges and declines, or a second wave and then a steady decline towards post-COVID with mass immunity as a result of the second wave or availability of a vaccine. A third wave is highly unlikely.

These would only impact the magnitude but not the type and direction of a consumer behavior with an exception or two.

They will impact the post-COVID strategy to the extent the new consumer behaviors are new & sticky, existing & permanently accelerated, new but temporary, and existing with temporary acceleration.

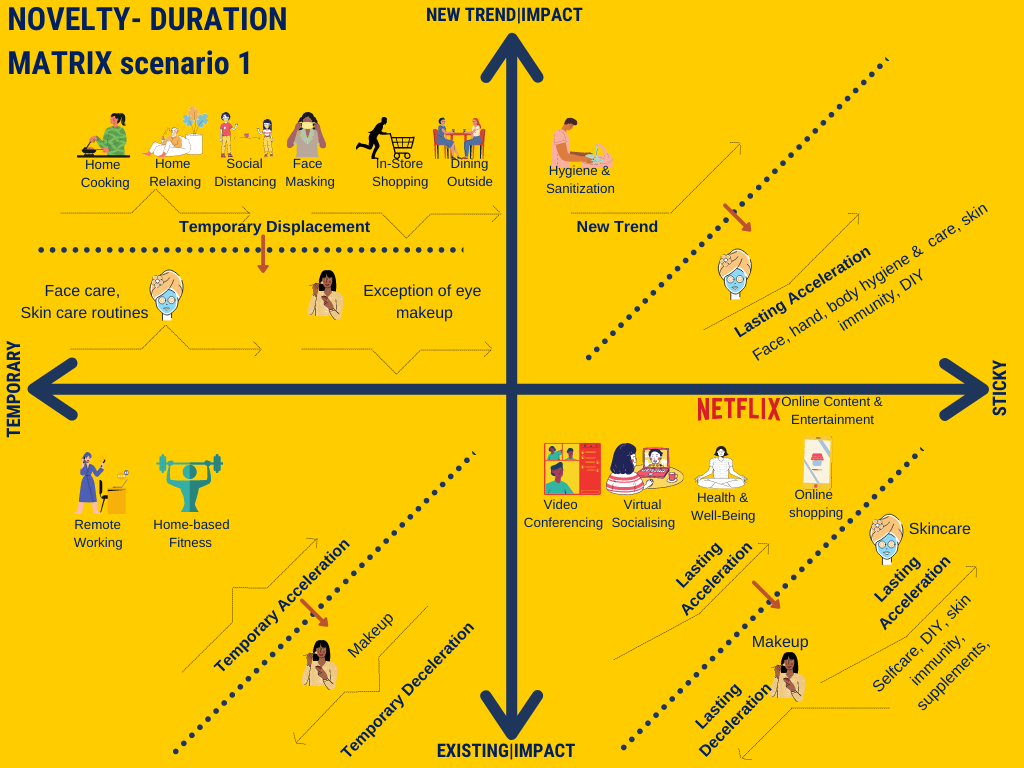

Behavior Novelty and Duration Matrix with Demand Impact

(Adapted from BCG Henderson Institute and StorySaves blog)

Scenario 1 (examples of Skincare & Makeup)

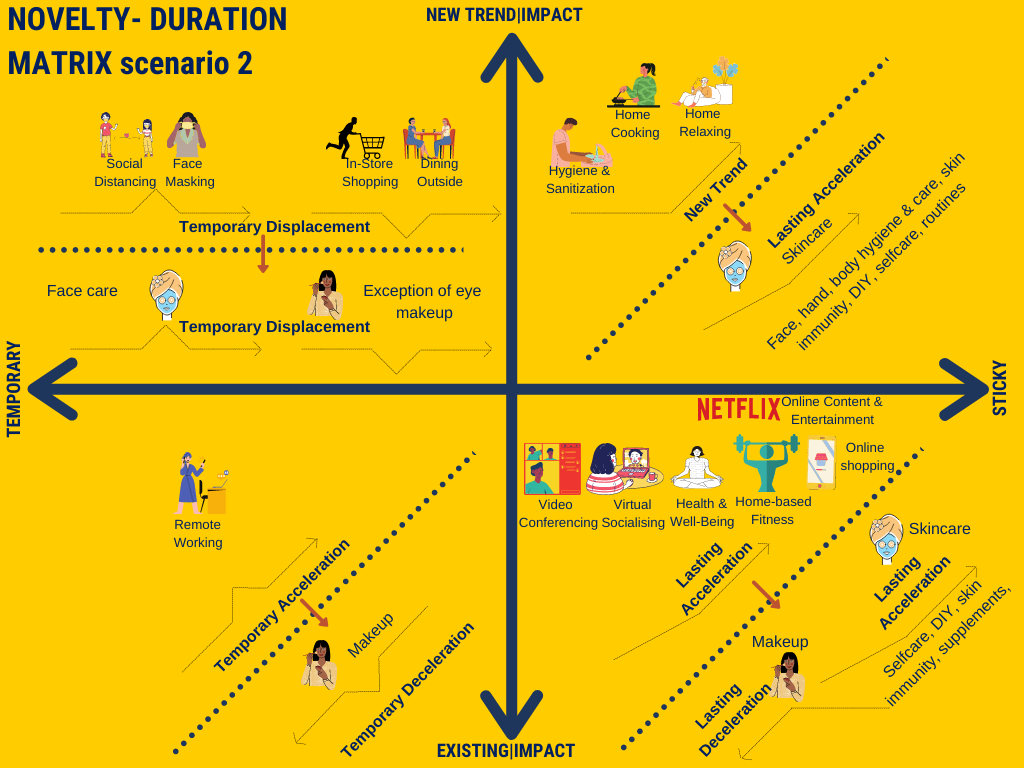

Scenario 2 (examples of Skincare & Makeup)

The matrix has 2 axis

Y axis-Novelty of the trend: Existing or New

X Axis-Duration of the trend: Temporary or Sticky

Scenario 1 & 2 are both possibilities to show how to use the novelty-duration matrix for strategy making. You must create alternative scenarios.

Steps 1 to 4 of the 10 steps strategy creation process will help in placing consumer behaviors in their respective quadrants.

The resultant consumption behavior of a category/brand might not be in the same quadrant as the causal consumer behavior.

Quadrant 1: Temporary Shift of a New Trend: Displacement

Scenario 1: Increase in-home cooking, relaxing activities at home, face masking, and social distancing are all examples of displacement, a temporary shift of a new trend. Once, we reach the post-COVID phase( post Vaccine phase), these behavioral trends are highly unlikely to persist.

The decrease in brick and mortar store shopping and dining outside too are examples of temporary displacement.

Scenario 2: Increased face masking and social distancing and decreased dining outside and in-store shopping would fall within this quadrant.

Resultant Consumption Demand/Behavior/Impact

The resultant increase in face care and routines for skincare due to face masking and relaxing at home respectively or for the decrease in makeup products such as lipstick might or might not be a temporary displacement and could very well persist beyond COVID, in either scenario.

Quadrant 2: Temporary Acceleration of an Existing Trend: Boost

Scenario 1: Boost in remote working and home-based fitness are trends that fall in this quadrant. These trends would continue their pre-COVID growth rates but not the acceleration they received during COVID.

Scenario 2: Boost in remote working trend only might fall within this quadrant by returning to pre-COVID growth rate.

Resultant Consumption Demand/Behavior/Impact

Again, the resultant demand for a beauty category might or might not continue to accelerate depending on how sticky the boost in consumption was.

For example, a boost in virtual fitness classes might continue even after home-based fitness goes back to pre-COVID growth rate as might the makeup decline even after people start working out in gyms again.

Quadrant 3: A new trend that is going to stick: Innovation

For both scenarios 1 & 2, a new and accelerated trend of hygiene and sanitization is highly likely to stick even beyond-COVID as a precautionary measure both by consumers and all the marketplaces, offices, and public places.

In scenario 2, both home relaxing and home cooking trends are projected to be sticky outlasting covid.

Resultant Consumption Demand/Behavior/Impact

Hygiene consciousness is likely to cause a lasting acceleration in demand for face care, hands, and body hygiene. Please note that the resultant demand is not in the same quadrant, which could be the case for any other resultant demand as well.

We have not yet seen the extent of innovation that will likely emerge out of this trend of hygiene consciousness.

Relaxing at home is likely to influence the stickiness of skincare routines.

Quadrant 4: Lasting Acceleration of an existing trend: Catalyst

Acceleration in behaviors such as video conferencing, virtual socializing, online shopping, online content and entertainment, and health and well-being are all examples of lasting acceleration.

For scenario 2, I have also added home-based fitness to this quadrant.

Resultant Consumption Demand/Behavior/Impact

The deceleration in lipstick( unless you innovate) and acceleration of self-care skincare, skincare supplements, skin immunity and DIY(unless salons and spas innovate) are all highly likely to stick.

The home-based fitness trend in this quadrant, scenario 2, is likely to further lead to a decline in makeup.

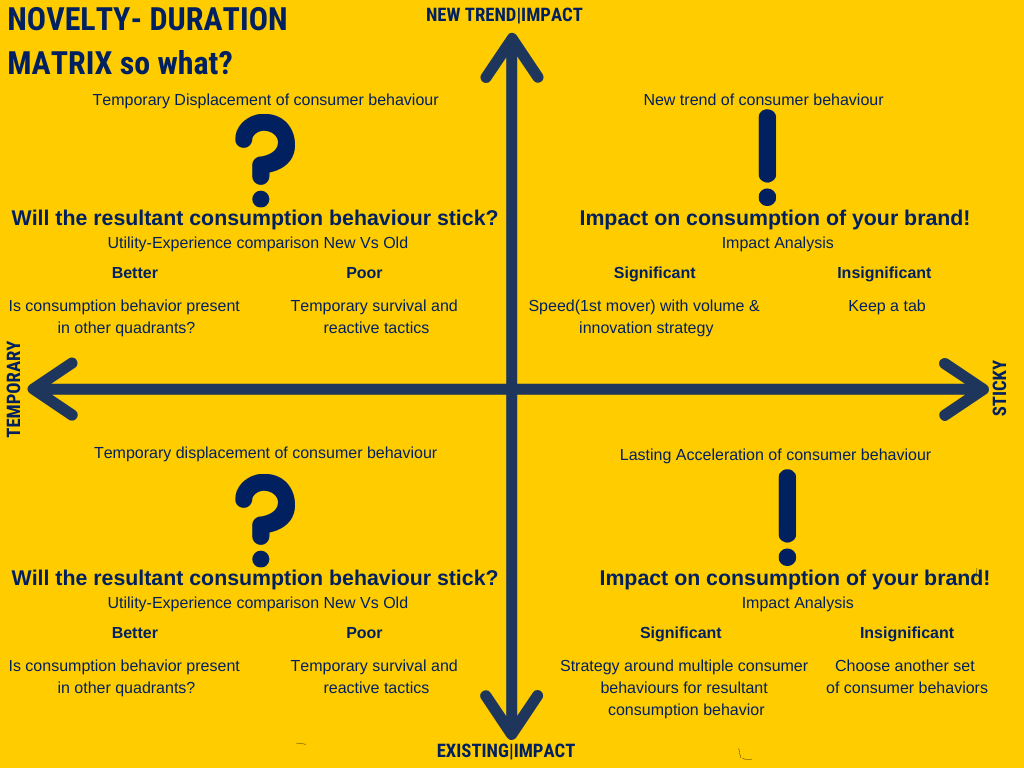

Novelty-Duration Decision Making Matrix

Purpose of each quadrant for decision making:

Quadrants 1 & 2: Will the resultant consumption behavior stick beyond COVID?

(even when the causal consumer behavior is temporary)

First, check whether the user experience-utility during COVID is better compared with the anticipated post-COVID.

If yes, consumption behavior is highly likely to stick. You need to then check if the same consumption behavior is also present in other/due to other quadrants.

If no, employ temporary survival & reactive tactics during the covid crisis.

Example: Skincare Routines: Utility-Experience Charts Comparison

VS

Skincare Routines saw a huge uptake during COVID due to stuck at home, de-stressing at home, and savings in time due to lack of travel etc.

Scenario 1: Post-COVID, people won’t be as limited to their homes and might not have the luxury of the time similar to during COVID. So, will the skincare routines stick or not?

As you can clearly see from the charts, post-COVID, skincare routines will be difficult to use due to time constraints and will compete with outdoor fun activities for relaxation and therefore are unlikely to stick.

COVID is not going to reverse the ultimate trend of people getting busier in their lives. For work, even if there is time saved due to lack of travel, the same time will be used to become more productive, whether with more meetings or working harder to realize your goals.

And, for fun, time will be filled with whole lot of outdoor activities such as dining outside, movies, shopping etc. post-COVID or even indoor fun activities such as browsing online content and entertainment etc.

Elaborate skin routines will see a decline post-COVID and are not going to be sticky.

Scenario 2 will be different, of course! With home relaxing becoming a sticky behavior, the resultant consumption of skincare routines is likely to stick too because of more time saved due to not traveling and for relaxing at home.

Example: Makeup-Lipstick-Utility-Experience Charts Comparison

VS

Scenario 1: Lipstick offers much higher utility and better experience post-COVID due to in-store purchase, virtual try ons(in-store) and no masks and thus will bounce back for sure.

So, the decline in lipsticks due to masks and lack of safe shopping in stores is only temporary( factoring for online shopping, content and entertainment and innovating for video conferencing etc. still needs to be done though)

Quadrant 3: Impact on consumption behavior/demand for your brand

(since the causal consumer behavior is going to be sticky so the question becomes how much of an impact on the category and your brand does it have)

Check for the impact on consumption demand for your brand,

If Significant: Go for speed with volume and innovation strategy with 1st mover advantage around behavior & resultant consumption pattern of your brand factoring category, substitutes and complementary products’ consumption.

If Insignificant: Keep a tab on behavior, category, substitutes and complementary products.

Example,

Hygiene, immunity, and sanitization are trends that are going to outlast COVID, and yet we have not seen a single brand that has a strategy well thought out to capture the market post-COVID, but, they will emerge soon for sure.

Since, this is a new trend and initially, demand outstripped supply by a huge factor, brands were happy to just provide a minimum solution.

But, now that supply and demand match for the basic need of hygiene and sanistisation, your brand needs to take the trend to its logical conclusion post-COVID and then work backwards to create a value innovation and be the 1st to capture significant market share.

Maybe what chewing gums did for the breath, sanitizer needs to do for hands, face, mouth, and nose? Different formats, sizes & USPs would emerge at the very basic.

Quadrant 4: Impact on consumption behavior/demand for your brand

Instead of one consumer and consumption behavior/demand, as in quadrant 3, here you need to account for multiple consumer behaviors.

Check for the impact of multiple consumer behaviors on the consumption of your brand.

If Significant: Create a strategy around multiple consumer behaviors impacting the consumption of your category and brand.

Why factor multiple consumer behaviors? You want to separate your brand from the rest of the pack and move miles ahead to capture as much of the demand as possible since the behaviors in quadrant four are not new, and other brands too would have these changes on their radar.

If Insignificant: Check another set of consumer behaviors to focus on.

e.g. Create a strategy for producing and marketing lipstick that serves the dual purpose of being prominent and friendly with video conferencing as well as with in-person interactions and helps de-stress.

Then, using online content and entertainment platforms such as HULU for promoting the content with demos for the look and feel around video conferencing and offering immediate purchase and virtual try ons would help.

How to identify which consumer behaviors and resultant consumption demand to focus on for strategy creation?

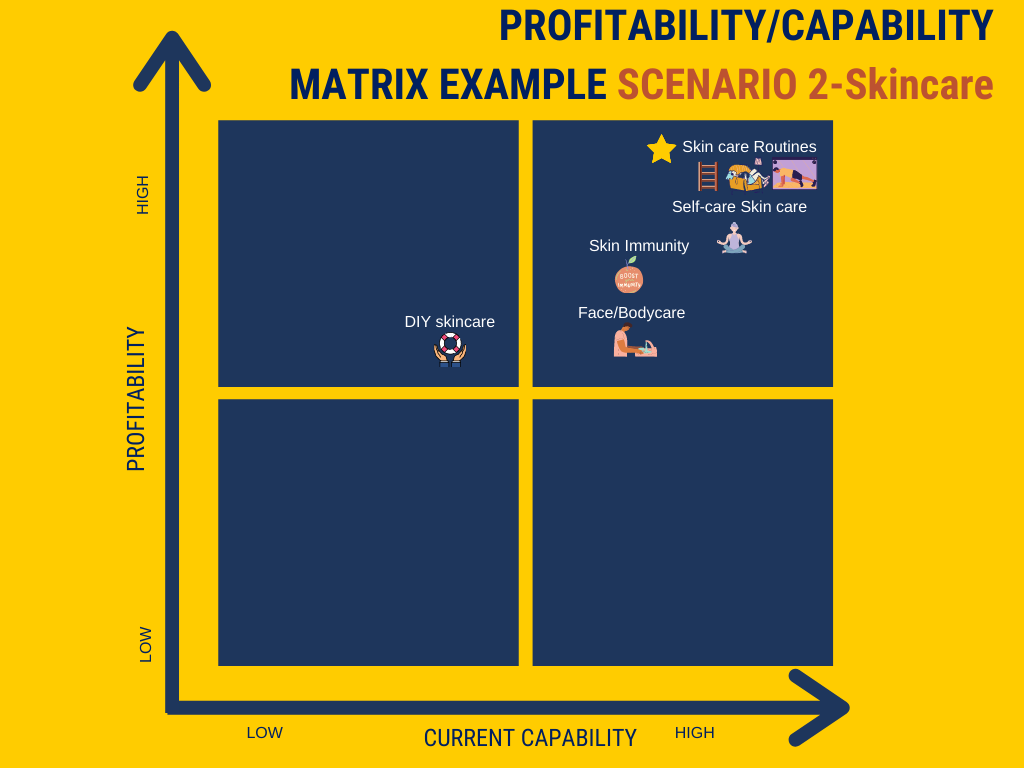

First, look for sticky consumption behaviors/patterns present in both quadrants 3&4 and estimate their impact on brand profitability vs capability needed. Study the causal consumer behaviors in 3&4 (sticky) post-COVID.

Then, look for sticky consumption behaviors/patterns in Quadrant 3 or Quadrant 4 individually and estimate their impact on brand profitability vs capability.

Plot all consumption behavior/patterns with causal consumer behavior on profitability vs capability matrix.

Repeat the plot for scenario 2 as well.

Plot examples-Chart 10 & 11.

Pick consumer behavior/consumption behavior that is in the top right quadrant from the high profitability-low capability quadrant.

We have now 2 different scenarios of high profitability-consumption behavior/patterns. Make sure that these 2 scenarios are as different from each other as possible(Ideally).

From the two charts shown above, for example, we picked self-care skincare and skincare routines as two consumption patterns/behaviors for two alternative scenarios, to create strategies around.

Remember, you could combine two consumption patterns too to choose a niche consumption behavior.

Step 6: Evaluate Beyond Covid Drivers

Refer the previous article where I have elaborated on beyond-covid drivers for skincare such as inclusivity, personalisation and customisation, instant fix, clean skincare etc. .

For makeup, beyond-covid drivers included fashion, skincare+makeup, inclusive makeup, and technology etc.

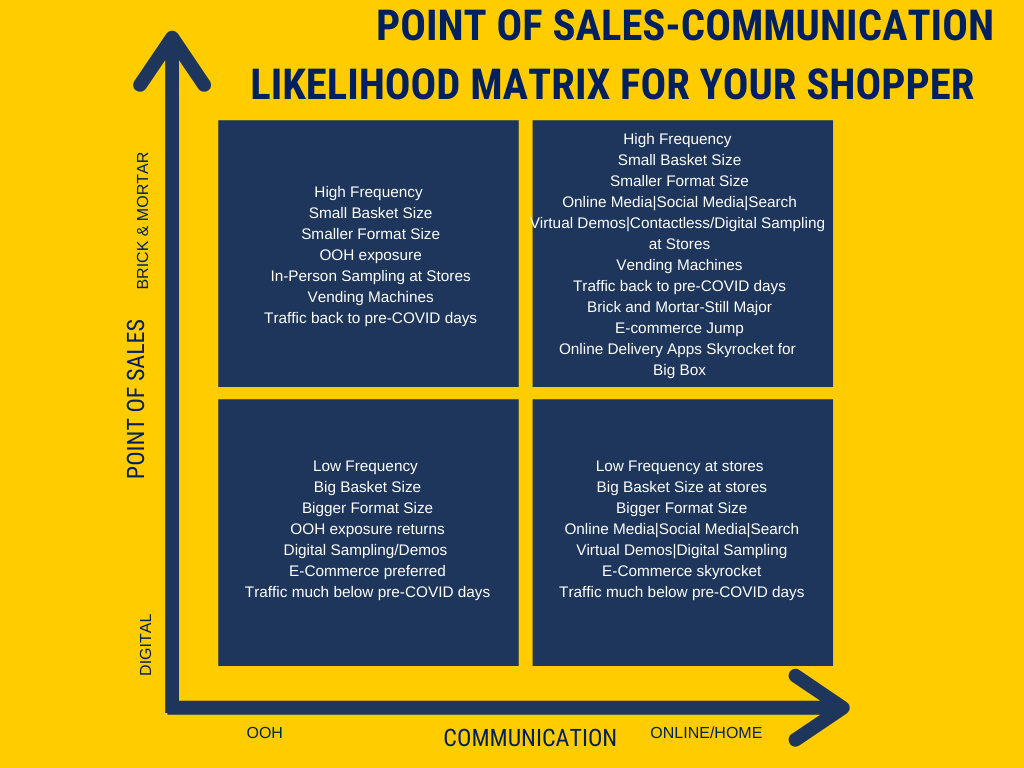

Step 7: Evaluate Point of Sales(POS) Behavior & Communication Media Preference

Utility-Experience comparison charts for shopper behavior and media preference during COVID vs post-COVID would help you evaluate POS(point of sale) and communication media preferences respectively of consumer post-COVID.

( Have not shown the charts here, but use the framework from charts 6-9 to do this analysis).

Below is an example of summarising current trends for POS & communication preferences.

E-Comm: Only going in one direction due to better user experience on specific utility drivers of convenience, savings in time, and better comparison of deals, same-day delivery, etc.

Basket Size(Offline): It has increased due to a reduction in shopping trips, mainly due to fear of COVID and the pain of safe shopping. Post-COVID, this could very well return to pre-COVID levels unless there is value in sticking with the same. Might regress to the mean.

Frequency(Offline): Currently, frequency of shopping has decreased, but it will go up post-covid as the decrease in frequency is driven both by lack of fun shopping and fear of COVID. Might regress to the mean.

Proximity(Offline): People are visiting stores closer to their homes more often than distant ones. This trend might not be as dominant post-COVID as the overall value proposition of big box stores with assortment and pricing will compete against proximity.

Format Polarization: Small and big sizes are the current trend because of utility and frequency of need of a particular product, but again, format sizes could very well regress to the mean.

Communication Media: OOH(Out of Home) has declined, and online has increased by leaps and bounds and will continue to grow, but OOH might rebound. Remember, current media trends will lead brands to go online more. OOH could become less-cluttered as a result, and offer better ROI.

Now bucket all post-COVID scenarios for each of POS & Communication Media preference together into four most likely yet mutually exclusive (different) scenarios.

Use post-COVID POS & Communication Media Preference matrix to determine the top 2 most likely scenarios out of 4 combinations.

How to choose the top 2?

Let your team compare each shopper behavior and communication preference’s utility-experience during COVID versus projected post-COVID to determine the top 2 most likely scenarios. Also, stay in touch with all the retailers to know their plans in advance.

Factor variations by consumer segment and geographies.

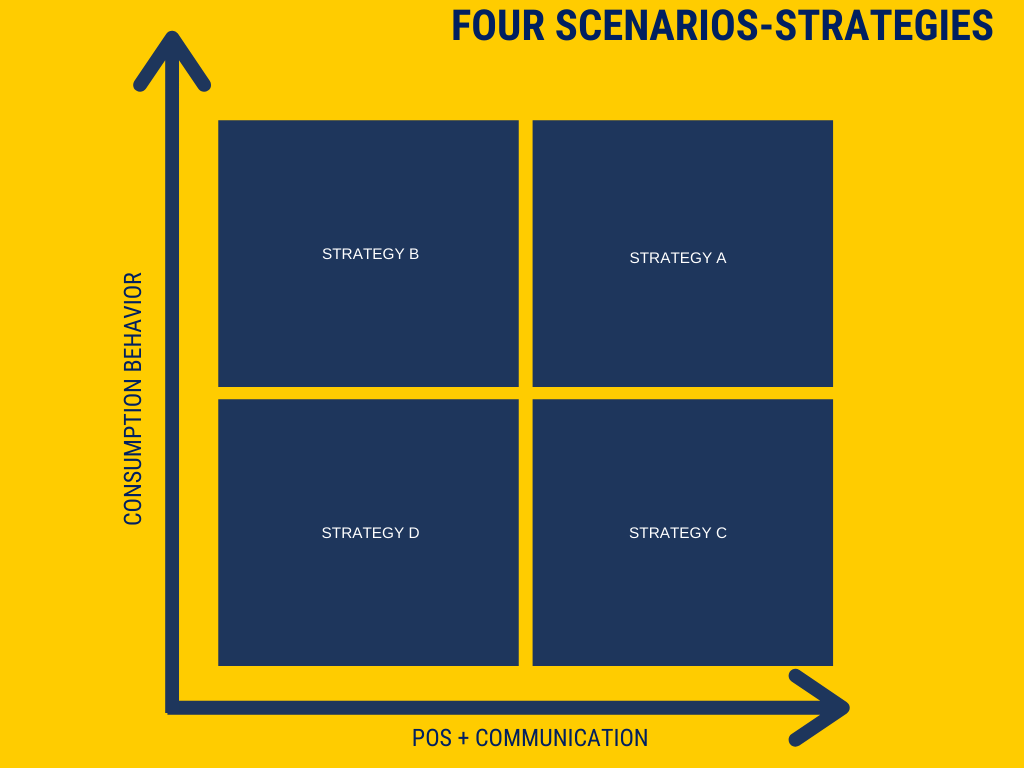

Step 8: Four Strategies for Four Scenarios

Plot the top 2 different Consumption Patterns/Consumer Behaviors from charts 10 & 11 vs two most likely scenarios from POS-Communication matrix from chart 12 on a chart and you will have 4 different strategies to choose from.

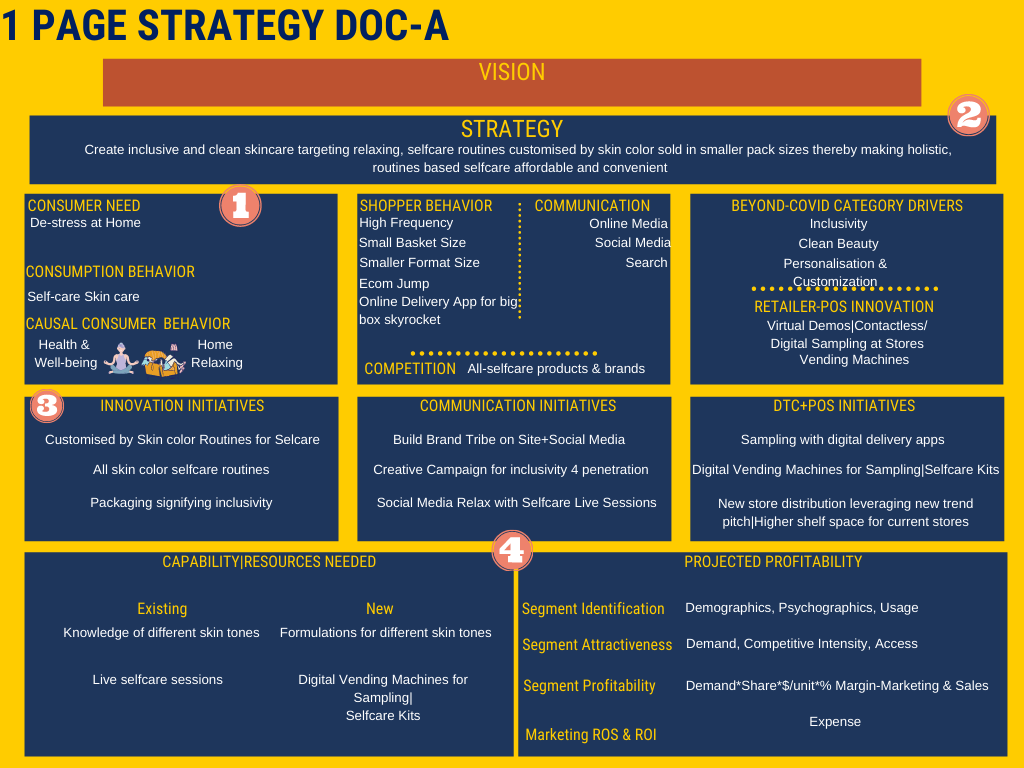

Create a one-page strategic document for each of the four opportunities mapping chosen consumer behaviors, consumption behaviors, shopper behaviors projected, beyond-covid drivers, Post-COVID POS, and communication media trends and calculate projected profitability, volume competition anticipated and capabilities needed.

You have 4 strategies for 4 mutually exclusive scenarios(ideally). Scenarios are mutually exclusive but strategies will have common elements.

Vision stays the same and each of these strategies should take you to your Vision. Capabilities needed will have commonalities amongst them.

Step 9: Evaluate Current Strategy( During Covid) against the 4 Opportunities

Find out the delta in capability needed for each vs current strategy and plot timelines for developing those capabilities.

Continuously observe for and measure consumer behaviors/consumption behaviors in each of the 4 strategies, observe and measure POS & Communication Media trends and tweak each of your strategies based on the evolution of these observed trends.

Step 10: Evaluate each Strategic Option on a Pre-defined, Regular Interval and Observe Process of Elimination(POE)

The objective is to arrive at a singular strategy within a reasonable time frame but before the availability of a vaccine and much before the general market understands the impact and permanence of relevant consumer behavior, point of sales, and communication trends.First, start moving in the direction shared by each strategic option by building new capabilities common to all strategies.

Prioritize strategies on likelihood of the scenario as we move closer to post-COVID. Likelihood of a scenario will veto profitability, and you need to re-strategize/improve a strategy for the most likely scenario to further increase profitability.

When do you commit to unique capabilities for a new strategy and by that a new strategy?

When you start seeing the trend in Consumer Behavior/Consumption Demand/Behavior/Point of Sale and Communication Media preference post-second wave or the absence of it, the period for which in my estimate would be Oct’20-Feb’21.

The second wave, when it happens, will likely determine the ultimate consumer sentiment. It is not the number of cases but the hospitalization rate, treatment equipment ratios, and fatality rates that will determine the post-COVID behavior the most.

Conclusion

There is tremendous uncertainty around whether things will go back to pre-COVID, stay the way they are now, or evolve into something else.

With all the uncertainty around the new normal post-COVID, creating a strategy seems almost impossible.

I showed you a framework with 10 steps to create a post-COVID strategy for your beauty brand by first reducing the strategy to 4 choices and ultimately one singular strategy.

In steps 1-4, you survey and speak to consumers to determine which of the consumer behaviors, that are relevant to your brand’s demand, have undergone a significant change. You then plot a chart showing the consumer’s new normal as shown in chart 2.

In step 5, we plot these consumer behaviors on a Behavior Novelty-Duration matrix(adapted from BCG Henderson Institute and StorySaves primary research), classifying the consumer behaviors into four categories:

Boost-temporary acceleration during covid,

Displacement-temporary shift during covid,

Catalyst-lasting acceleration of an existing trend and

Innovation-a totally new trend.

We then plot the resultant consumption demand for your brand category on the same Novelty-Duration matrix. The resultant consumption demand need not be present in the same quadrant as the causal consumer behavior.

The whole objective of Novelty-Duration matrix is to

a. Predict which resultant consumption demand is sticky enough for the causal, non-sticky consumer behavior to last post-COVID and should be factored in the strategy.

For evaluating stickiness, we compare utility-experience for the consumption behavior/demand post-COVID versus during COVID. If consumption behavior/demand is going to stick, we determine the significance and whether this consumption behavior is also present in other quadrants. If it is not sticky, then you can employ tactical measures to gain sales during the time of the pandemic.

Quadrants 1&2 answer the question of stickiness for a consumption behavior/demand.

b. Determine the impact of sticky consumer behavior on consumption demand/behavior as significant or insignificant.

If the impact is significant for a new trend( quadrant 3) you should aim for a volume strategy and capture as much demand as possible and be the first to do so. If insignificant, keep a tab on the consumer behavior’s evolution to predict if its impact on consumption could become significant.

If the impact is significant for an existing trend(quadrant 4), that has been accelerated permanently, create a strategy around multiple consumer behaviors and consumption behaviors to prevent imitation.

Quadrants 3&4 answer the question of the impact of sticky consumer behavior on consumption demand.

We pick the top 2 consumption demand/behaviors and consumer behaviors from the profitability vs capability matrix.

In step 6, you choose from beyond-COVID category drivers such as clean, natural, personalization etc. and in step 7 you evaluate Point of Sale-COVID influenced drivers such as shopper behavior: frequency of visits to a store, basket size, store proximity preferred, time spent shopping etc. along with retailer side innovation such as virtual sampling and vending machines etc. and the projected communication media preference of consumers.

Again, you could compare user-utility experience for point of sales behaviors and media consumption during versus post-COVID to predict future shopper behavior and media preference.

Step 7 gives us the top 2 point of sale-media preference combinations.

In step 8, we summarise four strategies for four mutually exclusive scenarios matching the top 2 consumption behaviors from step 6 with the top POS-media preferences from step 7.

Create a one-page strategy doc for each strategy.

In step 9, evaluate the delta between current strategy /tactics employed during COVID and all 4 strategies. Look at common capabilities needed and start developing those.

Finally in step 10, evaluate each strategic option against the likelihood of the scenario at a pre-defined interval and use the process of elimination to arrive at a singular strategy which helps you become insanely profitable against the most likely scenario.

For a free post-COVID strategy call for your brand, feel free to book a time with me here: Free Strategy Call

ROHIT BANOTA, Founder of StorySaves, has transformed dozens of beauty brands with brand story, strategy and innovation for *10X organic growth delivered from day 1 and powered by direct to consumer.

He has over 17 years of brand, marketing and innovation experience growing consumer packaged brands including Indie Beauty Brands and MNCs like P&G Beauty and Grooming.