Direct-to-consumer pricing makes founders feel confident. You control the narrative, the value & story, the experience and the price.

But the moment you step into retail, the rules flip. The psychology of comparison replaces the psychology of persuasion.

Most beauty founders underestimate how brutally this shift hits.

Here’s why DTC pricing rarely scales, and what actually fixes it.

1. IN DTC YOU CONTROL THE BATLEFIELD

✓ No side-by-side comparison

Your shopper never sees the competitor’s price, packaging or value story at the exact same moment. You own the frame.

✓ No pricing pressure

There’s no immediate reference point telling her you’re too high or too low. She evaluates only what you present.

✓ No competing signals

Your claims stand alone instead of sitting in a sea of “clean,” “vegan,” “firming,” and “anti-frizz” promises.

You define the value, and the shopper accepts it.

This is the hidden superpower of DTC.

2. DTC BEAUTY BRANDS WIN DTC IN 2 WAYS

✓ Premium pricing for unique, high-quality ingredients

Strong sourcing, elevated storytelling and ingredient transparency justify a higher ticket. Consumers reward what feels rare or superior.

✓ Lower pricing while still offering high-quality formulas

If you offer unusually strong value for money, conversion accelerates without eroding trust.

In both cases:

Margins stay healthy.

Consumer value feels obvious.

You feel in control.

3. BEAUTY RETAIL BREAKS THE DTC LOGIC

✓ Your price sits beside their price

If the shopper sees a $28 competitor next to your $42 SKU, you’ve already lost half the battle.

✓ Your claims sit beside their claims

A shelf of “hydration,” “repair,” and “shine” products shrinks your differentiation in seconds.

✓ Your value sits beside the entire aisle

The shelf becomes the judge. Not your website. Not your ads.

The pricing freedom you enjoyed evaporates the moment you enter retail.

4. BEAUTY RETAIL PRICING CHALLENGE

✓ Your hero SKUs must balance two conflicting forces:

• Price: Signals value and drive profitable repeat.

• Margin: Now squeezed by wholesale cuts, retailer terms, co-op fees and slotting.

This is the moment most DTC transitions break.

The model no longer funds growth the way it did online.

5. WHY MOST DTC BEAUTY BRANDS STRUGGLE WITH RETAIL PRICING?

✓ They walk into retail with DTC price assumptions + DTC value perception

They assume the shopper knows their brand, understands their ingredients, and trusts their claims. Retail shoppers do not.

✓ Retail shoppers compare first and convert second

She is not loyal yet. She is scanning… fast. If value isn’t instantly obvious, price collapses.

But if you lower price to “fit in,” your margins die.

If you keep DTC pricing, your velocity dies.

This is the paradox that kills most DTC brands in retail.

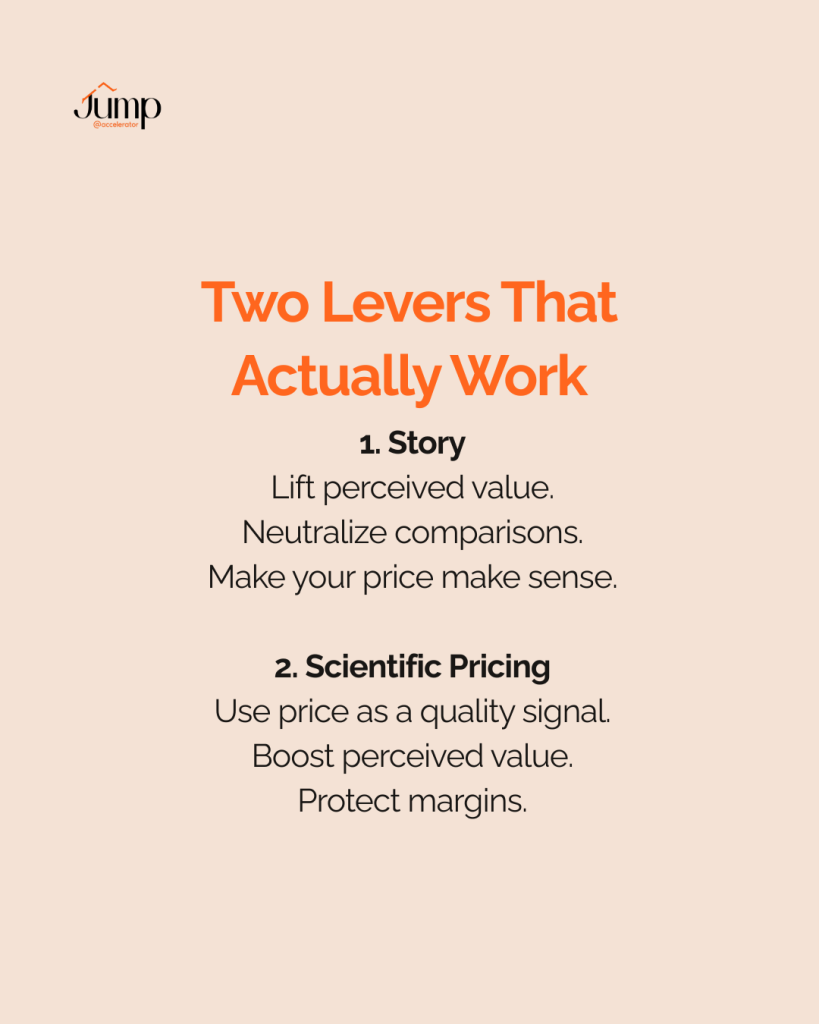

6. TWO LEVERS FOR DTC BEAUTY BRANDS AT RETAIL

1. Story

✓ Lift perceived value

Clear emotional and functional relevance increases what the shopper believes your product is worth.

✓ Neutralize comparisons

A powerful story reframes the shelf so competitors feel irrelevant.

2. Scientific Pricing

✓ Use price as a quality signal

In beauty, price is perception. A higher price can communicate superior quality when strategically anchored.

✓ Boost perceived value

Smart pricing ladders and promotional architecture help the shopper justify the purchase.

✓ Protect margins

Structured pricing prevents the erosion that destroys retail health.

Or

you open a new channel with no competition

If you can build a whitespace channel: PRO, spas, salons, derm offices, boutique retail, you gain back the pricing freedom DTC once gave you.

Summary

• DTC pricing works because you control context; retail removes that control

• Retail shoppers compare instantly, forcing your price to defend itself

• Most DTC brands fail because value perception doesn’t survive the shelf

• Three solutions work: a compelling story, scientific pricing, or a channel without competition

Speed of sticky scale for female beauty founders

Jump Accelerator: 70+ beauty brands impacted

-We will evaluate your fit with our 10X Growth Solutions or the Ultimate Scale Cohort.

-For 10X Growth solutions, we look to partner with 1-2 startups/quarter and for the Ultimate Scale Cohort 2-3 startups for 2026.

Limited slots and a rigorous evaluation of your scale up potential fit & readiness.