Future of beauty retail is omnichannel, especially for those beauty brands, with most sales happening at brick and mortar stores before covid-19. Brands need to align their post-covid strategy with the future of beauty retail to leverage this opportunity to grow and profit.

According to Mckinsey, 85% of beauty sales happened at brick and mortar pre-covid, while in a matter of 3 months, we have jumped forward ten years in both business and digital consumer adoption.

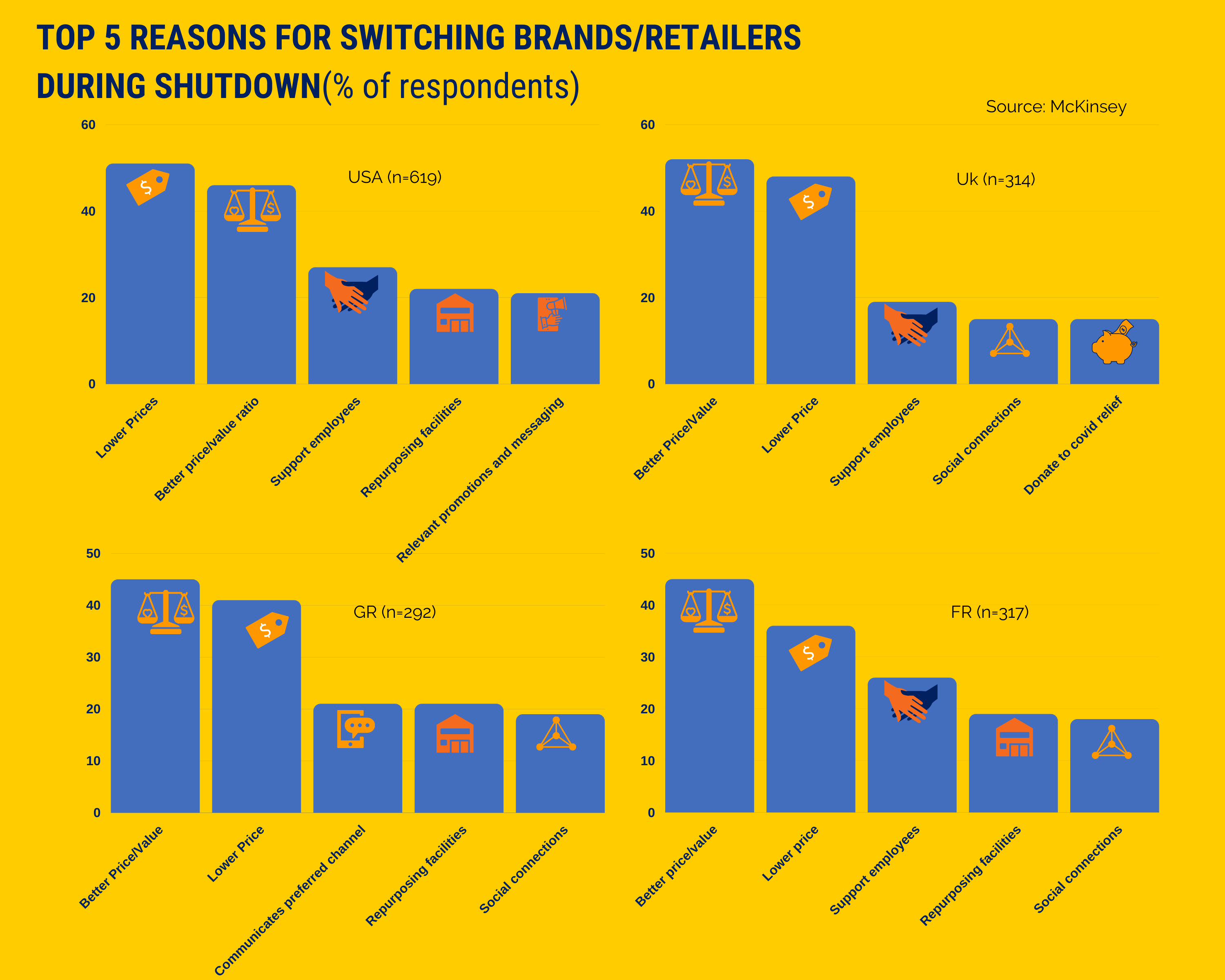

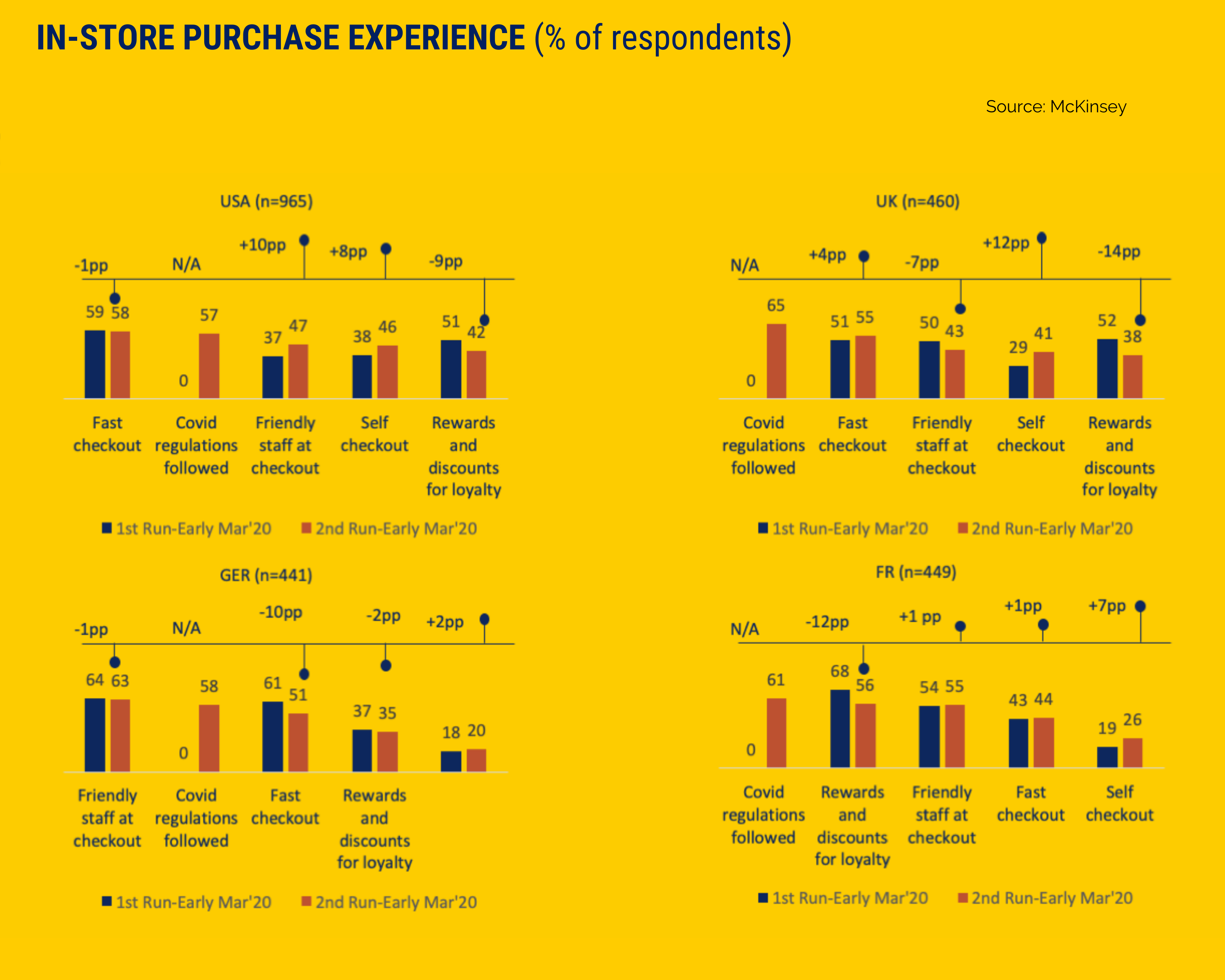

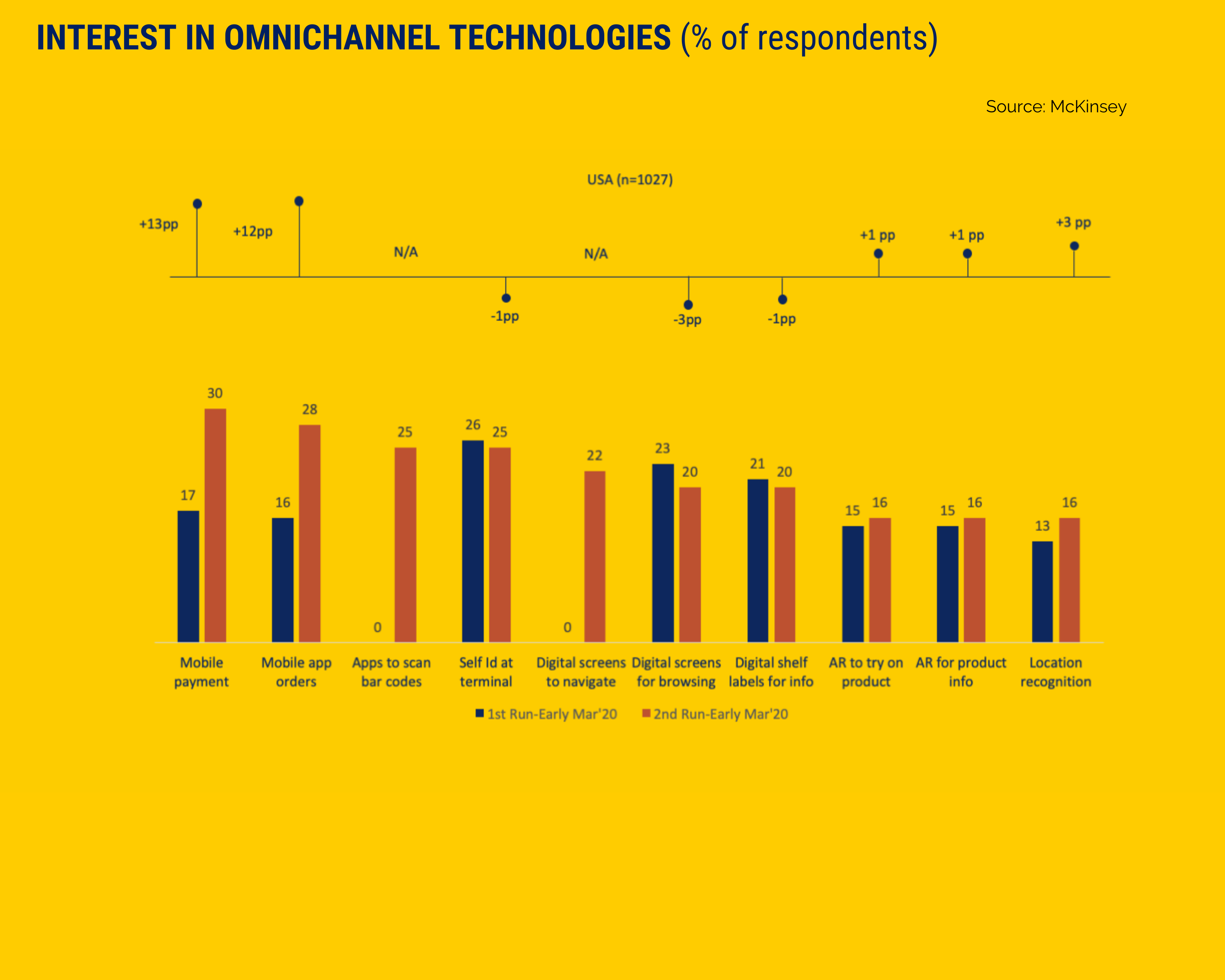

McKinsey surveyed more than 2,500 consumers in the USA, the UK, France, and Germany and a few shopper behavior trends seemed obvious: “an acceleration to online and omnichannel, a shock to loyalty, convenience redefined with technology, branding purpose more relevant now than ever and in-store tech is way below expectation.”

Below are the results of the survey:

1. Consumers did not stick to their familiar brands but switched

2. E-commerce expectations have changed

3. Safety and convenience are critical drivers for stores

4. Limited in-store tech available

(35% of consumers reported not seeing any)

I have combined the above observations and inferences with tactics already employed by beauty brands & retailers and the recommended tactics they could use further to elevate the experience for each trending shopper behavior and successfully revive shopping for all beauty categories with an omnichannel strategy.

Elevate Shopper Experience with Omnichannel-Future of beauty retail

At the core, a triangle of productivity+fun+purpose is critical to elevating the shopper experience.

How to elevate the experience for each of the observed shopper behavior with an omnichannel strategy:

1. Shopper Behavior: Faster

Shoppers want to be in and out as fast as possible, navigate the store quicker, and find what they are looking for faster.

Offline(Retailer)Initiatives:

Drive through, curbside pick up, fast zone at the store (closer to the entry), helpful and knowledgeable staff, home-delivery, in-app shop then carry home.

To grow sales, retailers could use digital-signages at curbside, merchandising for windows, mobile app messages, when right at curbside, for timed promotion to induce impulse buy with ready to ship inventory.

Online(Retailer)Initiatives:

Clear descriptions, images, and loading speed are critical not to lose the shopper for e-commerce. (ref-chart 2 &3)

Brand Role:

Buy on Brand app/site+pick up in-store(those who want the items right away), the brand gets free credits for in-store marketing equivalent to the lost margin( do the math).

Retailer(store) will have offers bundled with the referred purchase to upsell and thereby make up for the in-store marketing credits doled out to the brand. Everyone wins.

Provide digital signages to the store and co-plan promotions with retailers for an impulse buy at curbside pick up.

The use of radio, AM/FM, could be done for announcing these personalized promos by locality relevant to impulse buy during curbside pick-up.

Beauty Category Applications:

Use past purchase data to send personalized messages for all beauty products on offer while at curbside pick up.

For makeup, brands and retailers can offer virtual try-on messages via the mobile app, while the shopper is waiting, with offers on the same shades merchandised on the windows & have vending machines with makeup products and fragrances at curbside/drive-through kiosks.

2. Shopper Behavior: Bulk Sizes: Buying in Bulk

With reduced trips to stores, the shopper is buying products in bigger sizes.

Offline(Retailer) Initiatives:

In-store purchase via mobile app along with mobile checkout with the option of free home delivery or pick-up later to leverage this behavior for multiple categories.

e.g. You can use Sephora’s mobile app to find out-of-stock products while you are inside the store or search for special offers via their loyalty membership.

This could be used to test the response to bulk sizes of the fastest moving products.

With — out of store — you can virtually check the colors and sizes of different products, add to your cart for later in-store pickups.

This creates a continuous loop leading to sales.

The app also lets you connect to your physical gift cards updating your balance online whenever you spend money with it.

Online(Retailer) Initiatives:

Move the shopper to bigger sizes confirming their reduced trips to stores and not having to wait for days when they run out along with showing the savings in dollars.

Brand Role:

Provide bulk sizes for all fast-moving items offering higher profitability per square feet without taking more shelf space.

Beauty Category Applications:

Very relevant to body care, hair care, skincare routines, and rituals products.

3. Shopper Behavior: Proximity

Preference for stores closer to home.

Offline(Retailer) Initiatives:

Open smaller format, neighborhood stores for online buy, and pick up within an hour/now along with personalized inventory and messaging for the locality, including promotions, for the store.

e.g., Nike is opening 150-200 small, neighborhood stores for personalizing store experience.

Online(Retailer)Initiatives:

Promote the closeby store for “pick up now” options and use it to upsell online.

Brand Role:

Work with the stores for personalized promotions for the locality and message consumers to fuel sales from stores. Track referred sales to demand store marketing credits.

Beauty Category Applications:

Offer beauty services such as hair color, threading, waxing, pedicure, and manicure with local staff in the store following hygiene practices. Offer sampling with sanitized testers for fragrances, administered by local staff with coupons for next visit/online buy and pick up from the store.

Leverage shoppers for local referrals to drive traffic to the store.

Become a part of the community by promoting a cause with local volunteers.

4. Shopper Behavior: Convenience + Simplicity

In line with a faster experience, shoppers want convenience provided by digital within a store.

Offline(Retailer) Initiatives:

Mobile payment, digital/mobile pre-order, and pick up at the store. Digital screens for browsing categories, customizing(personalizing) products, navigating the store, and social media shopping.

Seamless integration of offline and online for consistent, omnichannel experience to enable buying at any channel without losing any shopper information from one channel to the next. e.g. a shopper could open her mobile app to revisit her shopping cart for a special product with a special offer, inspect the color/shade/pack etc., then checkout via the app, while at the physical store, and pick up the purchase herself.

Online(Retailer) Initiatives:

Virtual try ons, chats and finders.

Brand Role:

Helping retailers customize (personalize) product suggestions.

Beauty Category Applications:

Skincare brands can help retailers with online quizzes and digital tools like flow charts to help shoppers find personalized products. Also, offer online skincare consultations to store shoppers and tutorials to the store staff.

5. Shopper Behavior: Safe Shopping-Contactless

Due to fear of infection, shoppers are not willing to touch and feel things in the stores, and they are very hygiene conscious.

Offline(Retailer) Initiatives:

Self-checkout and mobile payment, follow and assure the shopper of regulation and guidelines for hygiene.

Vending machines with samples and products to buy for assured sanitization of products bought instead of from open-shelves, with mobile payment.

Online Retailers:

Promote sanitized and same-day home delivery.

Brand Role:

Personalizing ( for the locality) products for digital display and offering vending machines for single-use testers and purchasing products.

Beauty Category Applications:

Single-use paid testers( e.g., a set of 3 for $1) but free with the purchase of a beauty product from the vending machine or use a virtual try-on mirror on the vending machine operated with touchless, gesture mobile tech.

6. Shopper Behavior: Personalization

Hyper-personalized store experience, so shopping is more efficient and satisfactory.

Offline(Retailer) Initiatives:

Hyperlocal messaging, personalized inventory, digital finder, and recommendation tools for the sales associate.

The retailer needs to understand which categories and localities demand will peak to stock accordingly and introduce new products.

The penetration of 5G will help the retailer collect broad and unique insights for the individual shopper to target real-time messaging and promotions for both in-store and in-app communications, leveraging technology like facial recognition VR and AR driven services.

Colored baskets at Sephora are a simple yet very effective way of personalizing the shopper experience.

Jean-Emmanuel Biondi, principal of retail, wholesale, and distribution at Deloitte, says, “Customer trips will be more planned to maximize the time they spend in the store and, therefore, reduce the risk level from a health standpoint.”

The future is understanding the customer on a personalized level, not a segment level, to push specific promotions as you walk by the aisle of your favorite product or products that you’ve bought multiple times in the past,” Biondi explains.

Stéphane Girod, professor of strategy and organizational innovation at IMD Business School, cites the example of the French beauty brand Clarins’ consultants using mobile and CRM systems to help clients find the right products. “Hyper-personalisation is about superior CRM management and staff who really know their clients.”

Online(Retailer) Initiatives:

Virtual try ons, virtual consultations, tutorials, chats, and finders.

Brand Role:

Help with content for consultations, tutorials, and personalization, messaging for promotions.

Beauty Category Applications:

Charlotte Tilburry rolled out new virtual experiences for its DTC business, including gifting fairies, virtual try ons, live chat and consultations, product finders, tutorials, tips, and online events.

Apart from improving the productivity of the shopping experience for the above shopper behaviors, there are two more drivers to elevate the shopper experience as a whole.

Fun( ref: Blue Ocean Strategy, Utility driver of an experience)

In the current scenario, shopping has lost its charm as a fun experience, especially for beauty shoppers, due to safety and hygiene concerns.

Offline (Retailer) Initiatives:

In-Store Launches-Early bird offers sent to the mobile phones to accept the offer and pick up at the store during the launch event.

Small, Local Surprises-Event tickets, free coffee, cookies, home-use samples with digital coupons to promote the in-store experience as a delight.

Brand Role:

Support the above small surprises and sampling by partnering with other local vendors.

Plan new product launches at stores with influencers, VIP guests, and leverage PR and early bird offers and privileges to drive traffic to the store.

For every trip, ensure that shopper buys and saves money on a portion of the planned purchase before reaching the store to increase the shopper’s cart size while at the store.

Purpose

According to the Mckinsey report, In the throes of the pandemic, rather than sticking to familiar stores and brands, consumers did the opposite. (refer-chart 1).

“Shoppers were attracted to brands or retailers that stood behind their employees during covid, such as by upping their wages, offering extra sick leave, or reimbursing employees for lost wages. In Germany and the US, consumers also switched to brands and retailers that repurposed their facilities to help reduce the spread of the virus along with those that led socially responsible COVID-19 initiatives.”

Lululemon, set up a $2 million financial aid fund for brand ambassadors who own a fitness studio. In the US, the Midwestern grocer Hy-Vee collaborated with DoorDash for delivering free grocery to senior citizens, expectant mothers, and those thought to be at high risk for COVID-19.

McKinsey sees brands driven by purpose as an important driver of growth.

Rethink loyalty rewards at the intersection of productivity+fun+purpose as consumers are looking to and have switched brands to induce more shopping trips and increase the cart size.

Conclusion

A clear way to revive the brick and mortar stores and bring shoppers back for beauty retail is by a well thought out omnichannel strategy.

Brands have a lot to gain from the resurgence of brick and mortar stores as around 85% of beauty sales took place via stores before COVID.

Instead of letting covid cripple store shopping, retailers could use omnichannel to elevate the shopper experience, even beyond pre-covid, to not only sustain their businesses but hopefully thrive in a highly uncertain future.

According to McKinsey, consumers have switched from their preferred brands, and the brand/store purpose has become an attraction for shoppers.

Clear descriptions, images, and speed of e-commerce have become very important, safety and convenience are critical drivers of the in-store experience, and the use of in-store tech is highly under-utilized compared to shopper expectations.

To elevate the shopper experience, the stores need to offer higher productivity around trending shopper behaviors and make shopping fun and purpose-oriented.

We saw how 6 trending shopper behaviors: faster, bulk sizes, proximity, convenience+simplicity, contactless and personalization can be made more productive for the shoppers by integrating offline and online shopping and the role that brands could play with omnichannel strategy and tactics.

Beauty Brands could also use stores as brand touchpoints in partnership with the retailer by bringing the story to life, personalizing products with education, promotions and launching new products within a store to further elevate the shopper experience and reap the rewards as a result.

Feel free to share your thoughts by commenting below on the omnichannel strategy as an answer to the pandemic and way forward for beauty brands and retailers?

ROHIT BANOTA, Founder of StorySaves, has transformed dozens of beauty brands with brand story, strategy and innovation for sharp and profitable(aim 10x), organic growth delivered from day 1 and powered by direct to consumer.

He has over 17 years of marketing and business experience growing consumer packaged brands including with startups and MNCs like P&G Beauty and Grooming.