What’s the meaning and future of luxury beauty?

Below is a deep-dive on the meaning and future of luxury beauty with Reuben Carranza, CEO, Kate Sommerville-an iconic luxury beauty, skincare brand, sold across the most prestigious retailers and clinics across countries as well as DTC, and with Maya Crothers, Founder, Circcell-a luxury beauty, skincare brand, aiming to disrupt the category, currently sold at Neiman Marcus and a select few spas in the US as well as DTC.

Q1. How do you define the luxury skincare category? What are the top 3 things that a consumer looks at to perceptually place a brand in the luxury category vs any other skincare category? Do you think a few(other) natural/organic brands overlap with the luxury skincare category or no(have you defined your own category)? How is your luxury skincare brand unique vs all the other luxury skincare brands?

Reuben Carranza, CEO, Kate Somerville

I believe consumers look for skin products that perform and deliver on the skincare need they are seeking. This is the most important factor. The experience of using the product is next. The feel, the scent, the packaging, the look, and feel are essential. Then there is the brand story. What does the brand stand for? What is the purpose, is there a founder that embodies the brand, etc. These are all elements that influence a brand’s positioning. The price point also plays a role and tends to segment brands into luxury. When a brand can deliver on the above, it can be clinical-based like Kate Somerville or natural/organic-based.

Maya Crothers, Founder, Circcell

On the surface, luxury has to do with channel, packaging, and messaging. Beyond this initial first impression, the product must perform and provide a sensual experience, or the customer will not return. I do see some overlap between natural/organic and luxury but not firmly and solidly.

We do feel we’re leaders here providing formulations that bring the sensual aspect of clean/natural brands but still providing real performance and beautiful packaging. We feel there is not another brand that brings the breadth and depth of performance-based ingredients as cleanly and luxuriously as we do. We also use FSC certified packaging and are switching the few plastic vessels we use to PCR vessels. As new technologies become available, we migrate to stay as clean and eco-friendly as we can. We never sit still. Our formulations/packaging constantly change to provide the best experience possible for our customer.

Follow up:

Great answer. What is your USP vs other luxury brands? Does value ever factor in luxury brands meaning there must be price tiers within the luxury category for brands to compete against each other? And is there a minimum price below which a brand cannot be luxury at all?

Reuben Carranza, CEO, Kate Somerville

Ours is a clinically-based, luxury with prestige beauty brand. Other brands talk about what’s not in their products. We push the formulation boundaries, so the line performs with minimal irritation. There are a lot of doctor brands; ours is born from a clinic. We push ingredients delivering benefits without a lot of downtime.

Kate is not a dermatologist but a cosmetic esthetician, she knows dermatologists and knows that you can transform the individual if you can heal the skin. Philosophy is not just about products but teaching how they can do their own routines. Consumers will rarely do complicated routines; we help them understand and make it easier for them.

A price tier defines in the eyes of a consumer whether a brand is luxury or not. Some people cannot spend a higher amount. Our higher-end rich formulation products would retail for 150 dollars, but we also have acne products for 25 dollars.

Brand and its approach, story, DNA are the elements in a consumer’s minds in a prestige or luxury category. In the past, distribution channels were artificial ways luxury and prestige were defined.

With the rise of DTC and omnichannel, the beforementioned perception is giving way to what a brand stands for and the whole experience including the delivery of performance.

You need a point of view, reputation of delivery, an experience, and a broader range of price for luxury and prestige.

Consumers who need high-performance skincare will sacrifice other categories for out of reach priced skincare if it’s going to deliver what it says. Skin, unlike hair, is worn 24/7 and is the biggest organ; it creates a lot of issues. Consumers are willing to move to a higher price point if they find something that works.

Challenge for luxury brands has been to create opportunities for people to try. Instead of discounting, use gifts, sample sizes, including with retailers, to make trials happen. How do I invite consumers into the category without diluting the brand?

We offered deluxe samples of our $150 peptide to our low-end priced serum consumers, and they were then ready to move up to $80 products, almost doubling the business.

This way, you can bring a consumer into the luxury category with your brand, upsell them into a mid-tier product without discounting the brand 50% and still support your positioning.

Maya Crothers, Founder, Circcell

We are a small homegrown brand. We do things the way we like to because it feels right and because these are the types of products that make sense for the lifestyles of so many women I know.

Circcell’s strategy is not primarily driven by a spreadsheet, each product feels honest like it was just the type of product that was missing from your regimen….even with that relatability, we are bringing real science with a deep dedication to clean.

Our typical customer isn’t price sensitive…but value still matters. Efficacy, performance, textures, committing to clean packaging, these elements all add value.

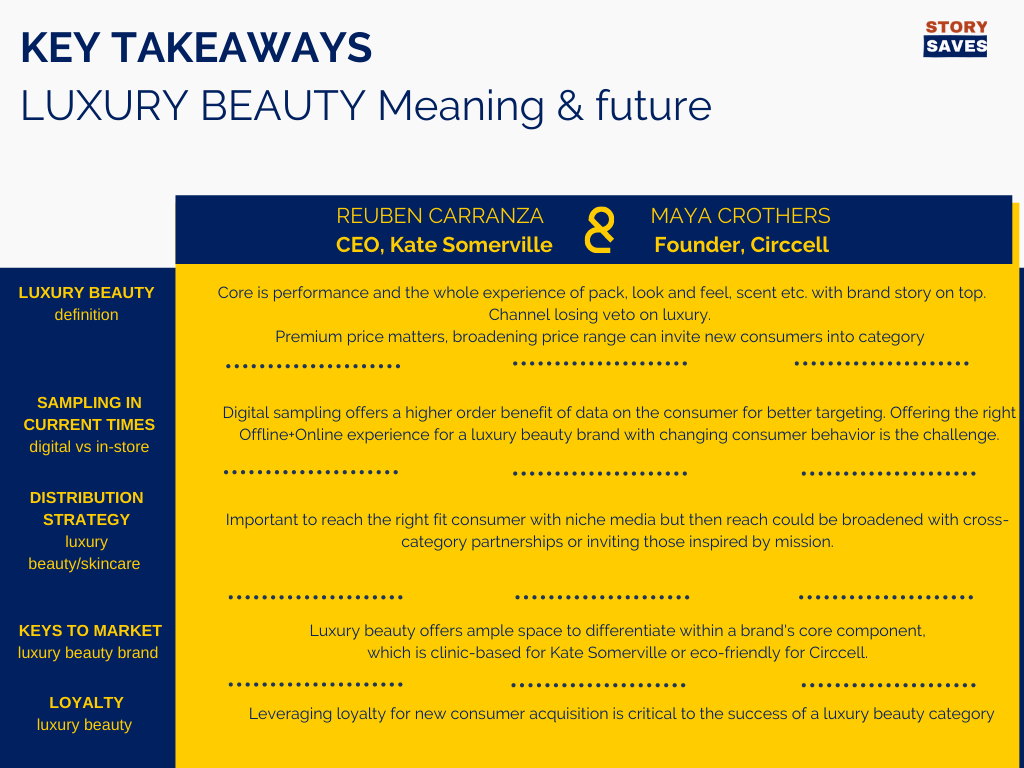

Summary & Key Takeaway

Reuben Carranza, CEO, Kate Somerville

For a brand to be luxury: Performance/delivery of the product is the most important, along with the whole experience of scent, packaging, look and feel etc, along with the brand story, purpose, DNA, founder embodying the brand, and the price tier.

With the rise of DTC and omnichannel, proxy of luxury perception due to distribution is giving way to what the brand stands for, and the whole experience including delivery.

Kate Somerville is a clinic-born and clinical first, luxury beauty brand with a prestige that enables consumers to achieve extreme benefits without downtime by pushing the ingredient formulation boundaries.

Maya Crothers, Founder, Circcell

For a brand to be luxury, the core is about the product’s performance/delivery and a sensual experience and then a layer of packaging, channel, and messaging on top.

Circcell is a leader in delivering the sensual experience and performance with clean ingredients and our formulation and packaging is in a constant state of evolution. We combine real science with a dedication to clean, offering honest products that people can relate to.

Key Takeaway:

Performance/delivery of the product and a holistic, sensual experience with the product/brand are at the core of the luxury beauty category.

The brand could drive both the core DNA, or you could layer messaging on top.

Channel is losing its veto on luxury with the rise of digital/omnichannel.

Premium pricing matters, but broadening the price range can invite new consumers into the category and your brand.

Q2. With sampling considered such a significant driver of sales and repeat sales in the luxury skincare category, how do you plan to overcome the challenge of sampling in the current times?

Reuben Carranza, CEO, Kate Somerville

The current environment is challenging for consumers and brands alike. Sample sizes and deluxe samples are a way we are allowing consumers to sample products via e-commerce and with online orders with our retailers.

We’re not alone in this, seeing this with many brands. Sampling at the retail store level is still a big challenge. Consumers and retailers alike are still not comfortable. We won’t really know how sampling will evolve at the retail store level until we start getting to a better place in terms of safety.

Maya Crothers, Founder, Circcell

We have begun offering two free samples at checkout with every DTC order. We provide foil pack samples to our spa and retail partners to distribute directly to their customers and to include in shipments to their customers. We also are about to launch a sampling initiative with Odore – a UK company that creates direct mail sampling campaigns to target demographics. So, even with brick and mortar slowing down since Covid, we are still finding ways to get samples into the consumer’s hands.

Follow up:

Is there a digital alternative to sampling with VR or AR, and do you think sending samples via digital can make up for in-store sampling? Cost of shipping is there with digital sampling, but you think you can target better? What are the benefits of sampling via digital vs in-store?

Reuben Carranza, CEO, Kate Somerville

Business is up double digits. The category is up during covid. Nothing replaces in-person experience when doing in-store sampling. Covid has reset everything, and for everybody, we are students in that.

Nothing will ever replace in-store. It is a matter of time when it is safe. Retailers and brands will find a new way to make it happen in-store. We were providing deluxe side packets. With digital, it is possible, unlike before, to know about consumers, provide the right consultation and the right samples; purchase history helps in sampling right supplementary or complementary products.

E.g., If a consumer is buying our acne products online, we know they are very open to moisturizing products. We could then introduce them to sample sizes or deluxe samples via our own DTC or online retailer partners.

More than AI, the most significant area of exploration should be the shift in consumer behavior.

E.g., 90% of consumers are doing online consultations. Once things open, the consumer might continue to use online more than before COVID. The question is how to differentiate online from in-store for the consumer or how to create a seamless experience between store and online?

Stores were the biggest talking points earlier, and online was for fulfillment and replenishing. Now, that dynamic for shopping and discovery, which was assumed to happen at the store, is happening online in the last few months. Online has become equally important now.

Physical distribution is not a hindrance anymore. Consumers’ discovery has to move to an online environment, which is a challenge for the brands. Post covid, consumers will do it both online and offline, and it will be a challenge for brands. The whole dynamic has changed! Now ecosystems of online and offline will be seamless, and anything in between.

The brand that figures out the above dynamic of offline versus online for shopping, discovery and education and offers the right experience will win.

It is not about the distribution or price segment anymore.

Maya Crothers, Founder, Circcell

There are pros and cons to both, but some digital sampling types give us direct access to our consumer. If we ship you a sample, we have your contact and demographic info vis a vis the cost of shipping a small sample. This is a reasonably cost-effective way to build up a targeted customer database.

Summary & Key Takeaway

Reuben Carranza, CEO, Kate Somerville

In-store experience will always matter, digital sampling provides data and better targeting vs in-store. Physical distribution and price segment don’t matter as much and with the changing consumer behavior, a brand that figures out providing the right luxury experience combining offline and online will win.

Maya Crothers, founder, Circcell

Digital sampling gives direct access to consumer with more information to help build a targeted database.

Key Takeaway

Digital sampling offers a higher order benefit of data on the consumer for better targeting. Offering the right Offline+Online experience for a luxury beauty brand with changing consumer behavior is the challenge.

Q3. What is your distribution strategy for your luxury skincare line as opposed to a mass or a premium or a wellness skincare brand? Where would you never distribute? If luxury is limited by distribution, how do you plan your growth strategy with limited distribution?

Reuben Carranza, CEO, Kate Somerville

We choose distribution channels that allow us to connect with consumers seeking clinical-based skincare solutions and deep connections with discerning skin consumers. The current environment, driven by Covid, has disintermediated routes to market for everyone.

We will always look for routes to market to consumers to connect and pair the right products to the consumers seeking results. E-commerce allows us to connect directly with consumers, but we also believe in the need for consumers to experience the brand in a retail environment, and we believe that will come back.

Maya Crothers, Founder, Circcell

I’m not sure we would ever say never…..but at the moment, we probably would not distribute through national drug store/grocery chains. Like everyone else in the industry, we are hyper-focused on DTC, and Amazon is taking a larger role for prestige/luxury beauty.

We began as a spa brand, and we still love this channel. We continue to focus on supporting our spa partners and growing this channel. International is becoming more in focus for us as well. We still love the retail channel. Neiman Marcus is currently our only national retail partner but we are looking at other partners in the luxury space. Small, independently owned boutiques are also looking attractive. We have a solid growth strategy in place with our current distribution, which is a mixture of digital advertising, e-mail marketing, and PR activities.

Follow up:

Have you thought about the non-consumers of luxury and why they are not consuming luxury skincare? Maybe they value clinical and high-performance skincare but are overwhelmed by the thought, and digital could be a route to introduce them to the category?

Reuben Carranza, CEO, Kate Somerville

From the consumer’s lens, some don’t have skin issues, are neither looking at solutions at any cost nor are looking for any special skincare products. Olay is ok with them.

But we may have other consumers with skin issues, and high-performance needs, and these people will find what they are looking for and pay more if it works.

The big challenge for a luxury and prestige brand is how to get to those types of consumers? Niche and selective media are an option. Influencers play an important role in luxury and prestige. Authenticity matters more versus influencers that are just a gun for hire.

We nurture a very strong ecosystem of the word of mouth, affiliates, and targeted digital ads.

The company you keep is critical for luxury brands. Partnerships, even in different categories, help you reach a broader segment thereby inviting new consumers to the category and for your brand. E.g., Kate Somerville partnered with Verb hair care, a clean haircare brand, for a product giveaway, and it was a win-win for both the brands.

Maya Crothers, Founder, Circcell

We are of a size that we have plenty of room to grow within the firmly established customer base of luxury consumers, domestic and international. Personally, I am not comfortable with a super hard sell. I prefer a good fit. If along the way we inspire some outsiders to join our mission, the more the merrier.

Summary and Takeaway:

Reuben Carranza, CEO, Kate Somerville

Reaching the right consumer who needs high-performance products and is willing to pay for those is a challenge you can overcome with niche and selective media and authentic influencer partnerships. Broadening reach is possible with the right brand partnerships in different categories.

Maya Crothers, Founder, Circcell

Prefer a good fit over a hard sell. In the future, reach could be broadened by those outsiders who are inspired by our mission.

Key Takeaway

It is important to reach the right fit consumer who needs high performance and is willing to pay with niche media and distribution.

To broaden the reach, it helps to partner across categories and find people motivated by the mission.

Q4. What are the key differences in marketing a luxury skincare brand versus a prestige, premium, mass, or wellness skincare brand? Do you consider yourself a luxury or a prestige skincare brand, and why?

Reuben Carranza, CEO, Kate Somerville

We are a clinical-based, luxury prestige skincare brand. We embrace active ingredients that are safe and efficacious and deliver results, and we perfect the formulations in our clinic with real consumers. We focus on ensuring consumers can find the right product to deliver the right outcomes based on their skin concerns. What makes us different is the ability to get specific on the right products for the specific concerns.

I see luxury and prestige in a similar light and consider Kate Somerville skincare as both but primarily a luxury brand – a focus on the experience in packaging, look and feel of the product, and performance that warrants a higher price point.

Maya Crothers, Founder, Circcell

The luxury space is all about the 360-degree experience for the consumer, from packaging to textures, to scents to performance to distribution. Each element has to be hit right for the customer to feel the luxury experience. This can be especially tricky with the emphasis on clean and eco-friendly. We have challenged ourselves to find eco-friendly packaging and environmentally friendly preservatives and emulsifiers that maintain our luxury look and feel, while meeting consumer demands (and our own personal expectations) for cleaner offerings.

Follow up:

For the future, would you like to focus on both prestige and luxury together or choose one over the other?

Reuben Carranza, CEO, Kate Somerville

We try to do both. We prioritize luxury now that the routes to market are getting blurred. Prestige brands were defined by a very narrow route to market: very selective distribution. We are a kind of glamourous luxury brand with a celebrity component, but we believe we are more of a luxury glam clinical brand. The experience we design is a product that feels, performs, and looks great.

Maya Crothers, Founder, Circcell

We focus primarily on performance and deliver this performance in a way that appeals to the luxury consumer. With this, we constantly evolve to become more eco-friendly. Eco-friendly is a moving target and and can feel like more of a path than a destination – we don’t separate this from our primary mission of performance.

Summary and Takeaway:

Reuben Carranza, CEO, Kate Somerville

We are a clinical-based, luxury glam brand.

Maya Crothers, Founder, Circcell

We are focused on our mission of performance with eco-friendly as an inseparable element of our brand.

Key Takeaway

Luxury beauty offers ample space to differentiate with a brand’s core component, which is clinic-based for Kate Somerville or eco-friendly for Circcell.

Q5. Is the loyalty % for a luxury skincare brand higher vs mass or premium skincare brand? Why or why not? What is critical to your success: Loyalty/consumer acquisition?

Reuben Carranza, CEO, Kate Somerville

I believe loyalty to a brand is driven by the brand’s performance regardless of price tier or distribution channel.

If you’re a higher price brand, the expectation for performance is that much higher – you need to deliver! If you deliver, you will have stronger loyalty and repurchase.

The consumers we have invited into our house, loyal, we have to ensure that they are always coming back.

At the same time, we need new rooms in the house, for new channels and consumer segments, without alienating existing consumers.

We will continue to delight loyal consumers while creating more loyal consumers out of acquiring new consumers.

Maya Crothers, Founder, Circcell

I can’t speak to other brands or categories, but our loyalty has always been very high. Our challenge has not been keeping consumers but acquiring customers. Our consumer is highly sought after, and we continue to see this in the rise of CPM costs.

Our sweet spot digital audience recently has risen to $100/CPM, which is quite high and has risen by multiples since Covid.

Summary and Takeaway:

Reuben Carranza, CEO, Kate Somerville

Loyalty is driven by the performance of the brand regardless of its price tier or distribution channel. Kate Somerville is focused on converting new consumers into loyal while taking care of the current loyal consumers.

Maya Crothers, Founder, Circcell

Our loyalty is very high and our focus and challenge is acquiring new consumers amidst rising CPM costs.

Key Takeaway

New consumer acquisition is critical to a brand’s growth and while taking care of loyal consumers help in retention and upselling, leveraging loyalty for consumer acquisition is a good route to reduce cost per acquisition.

Q6. What is the future of luxury skincare considering that physical sampling and experiences are giving into digital/omni-channel/tech experiences, brick and mortar stores(clinics) are yielding to e-commerce/DTC?

Reuben Carranza, CEO, Kate Somerville

I believe the future for skincare is bright! Consumers will continue to seek out solutions for their skincare needs. What is exciting is that the options for consumers to connect with brands is expanding. The acceleration of e-commerce has allowed further access to brands and options like virtual consultations, tech-enabled assessments, and the evolving ingredient and formulation landscape is making skincare an exciting category to be a part of.

Consumers at all price tiers will continue to seek out brands that deliver results and inspire them. Consumers will still want to discover in a retail environment, and they will still want to have facials and services once the safety levels return. I am very excited about the future of skincare.

Maya Crothers, Founder, Circcell

The future of luxury is very bright. Our customer is not as price-sensitive as other types of consumers, making us resilient in the face of today’s political and social issues.

Our customer has smoothly transitioned over to the digital world and is looking to the digital community, influencers and peers to provide what the in-store experience has provided in the past.

We continue to have face-to-face opportunities through our spa channels and retail partners and look for creative ways to get samples into the consumers’ hands. Liberal return policies and easy return shipping give the consumer comfort in taking a leap of faith on purchasing without physically touching the product.

Summary and Takeaway:

Reuben Carranza, CEO, Kate Somerville

Very excited about the future of skincare. Luxury and clinical beauty space has been transformed by digital but consumers will still want to discover in a retail environment, post-covid.

Maya Crothers, Founder, Circcell

The future is very bright. The consumer is not price-sensitive and has transitioned to digital even though we continue to have face to face opportunities with our spa and retail partners. Liberal return policies and easy return shipping matter more than ever.

Key Takeaway

The future of luxury beauty is very bright. Digital has transformed the landscape and will matter equally along with offline post-covid.

Luxury Beauty is about the performance of products at the core and the holistic experience, which can be layered with brand messaging on top or have the brand’s core DNA drive the whole experience and the product.

Rueben explained how Kate Somerville’s clinical-based, luxury and glam, skincare brand has adapted to the digital world and that in-store experience will still be critical to both their brand and luxury beauty category as a whole. In the end, according to Reuben, the brand that figures how to play within the dynamic of online plus offline, would be the one that will make the most of the changing times.

Maya considers the continuous evolution of eco-friendly and clean as her focus for differentiating Circcell skincare in the luxury beauty category. She also believes that digital will matter equal to offline for luxury, and that liberal return policies and easy return shipping matter more than ever.

While Maya Crothers and Reuben Carranza shared their not so divergent perspectives on the definition of luxury beauty, the role played by channel and price for the luxury category, the importance of loyalty versus new consumer acquisition, the one thing they both share in totality is the excitement around the future of luxury skincare.

While I wish Reuben and Kate Somerville along with Maya and Circcell all the best for the coming times, I have no doubts in my mind that each is determined and very clear on taking their respective brands to the next level, come what may.

Would love to hear your thoughts on the meaning and future of luxury beauty?

ROHIT BANOTA, Founder of StorySaves, has transformed dozens of beauty brands with brand story, strategy and innovation for sharp and profitable(aim 10x), organic growth kickstarted from day 1 and powered by digital

He has over 17 years of marketing and business experience growing consumer packaged brands including with startups and MNCs like P&G Beauty and Grooming.