Every founder dreams of hearing: “We’re listing your brand.”

But beauty retail buyers don’t list brands for how inspiring they sound, they list brands that help them grow the category profitably and predictably.

Their shelves are shrinking. Their inboxes are overflowing.

Your brand has 5 minutes, even less, to prove it can make their job easier and their results stronger.

Let’s unpack what retail buyers truly want, and how to give it to them.

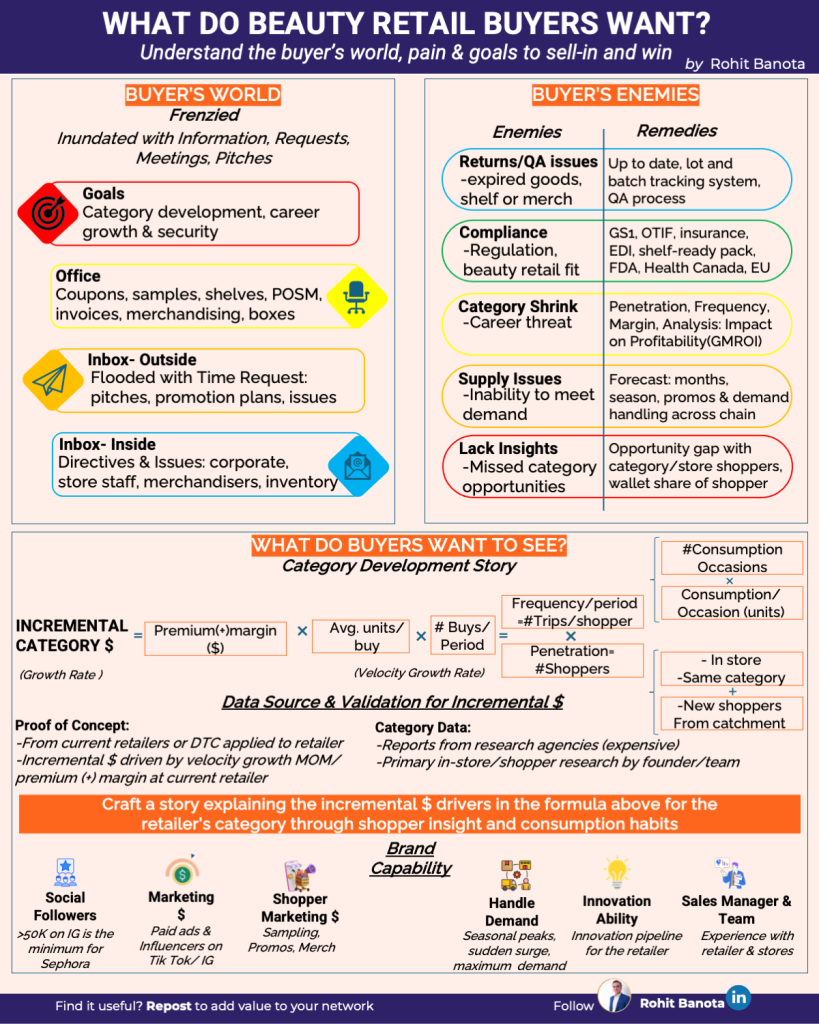

1.The Beauty Buyer’s World Is Frenzied

Retail buyers live in constant overload.

Their inboxes are split between corporate directives, store-level issues, and brand requests.

Every day brings new samples, invoices, and promotions to approve.

Their goals?

Grow the category, protect their job, and minimize risk.

If your brand doesn’t simplify their day, it won’t survive their shortlist.

2. The Beauty Buyer’s Enemies and Remedies

Buyers don’t lose sleep over your clean story or serum texture.

They worry about returns, compliance, and missed category growth.

| Buyer’s Enemies | Remedies You Must Offer |

|---|---|

| Returns / QA issues — expired goods, wrong lots, shelf clutter | Build QA and lot tracking systems; show expiry and recall readiness. |

| Compliance gaps — packaging, regulation, retail fit | Be GS1-ready, OTIF-compliant, insured, and shelf-ready (FDA, Health Canada, EU). |

| Category shrink — career risk | Prove penetration, frequency, and margin improvements (impact on GMROI). |

| Supply issues — out-of-stock risk | Show forecasts for months and seasons; demonstrate cross-chain demand handling. |

| Lack of insights — no shopper data | Present opportunity gaps from category/shopper research and wallet share analysis. |

3. What Beauty Buyers Actually Want to See – The Category Development Story

Retail buyers don’t buy your product.

They buy your category impact story.

That story must show how your brand grows incremental category dollars ($).

Here’s the formula:

INCREMENTAL CATEGORY $ (Growth Rate)

= Premium(+) Margin($) × Avg. Units/Buy × # Buys/Period (# Shoppers*#Trips/Shopper)

-Frequency/period=#Trips/Shopper are an effect of #Consumption Occasions*Consumption Occasion(units)

-Penetration=#Shoppers =In-Store (non-category + category) + New Shoppers from catchment areas.

Each part of this formula shows where your brand adds measurable value:

Premium(+) Margin($):

Your ability to generate higher profit per unit – through clean, clinical, or prestige positioning.Avg. Units/Buy:

The number of products typically purchased together. Multi-SKU baskets (e.g., serum + toner + moisturizer) increase transaction value and category velocity.# Buys/Period = # Trips/Shopper:

How often your target shopper returns to buy. The more occasions or reasons to use the product, the higher the repeat rate: a key driver of sustainable velocity.# Shoppers:

The penetration you bring – how many unique shoppers you recruit, either from inside the category or from adjacent ones.

Deeper Levers Behind the Formula:

- Frequency/Period = # Trips/Shopper

is driven by: # Consumption Occasions × Consumption Occasion (units)

Example: When a body oil transitions from a weekly indulgence to a daily ritual, you 5X the usage occasions, and therefore trip frequency.

- Penetration = # Shoppers

is built from:

In-store (non-category + category shoppers) + New shoppers from catchment areas

This means converting shoppers already buying the category but not your unqiue + premium margin products, other beauty subcategories (e.g., buying skincare but not haircare from the retailer) and bringing new traffic from the retailer’s surrounding area.

Show how your brand increases any of these levers – margin, basket size, frequency, or penetration — through shopper insight, trial, or placement strategy.

That’s what makes your pitch not just about your brand’s growth… but about their category’s growth.

Data Source & Validation for Incremental $

Buyers don’t just take your word for it. They want proof.

Proof of Concept:

Data from current retailers or DTC results applied to a new retailer.

Show incremental growth driven by velocity (month-over-month) and premium margin.

Category Data:

From research agencies – expensive but credible.

Or, from primary shopper research by your team: in-store interviews, trip diaries, POS data, or founder-led observation.

Your pitch must connect these insights to how the retailer’s category will grow through your presence.

“Craft a story explaining incremental $ drivers for the retailer’s category through shopper insight and consumption habits.”

4. The Beauty Brand Capability Checklist – What Every Buyer Assesses

Buyers mentally evaluate your retail readiness within minutes.

Here’s what they look for and what each means in practice:

| Capability | What It Means to Buyers |

|---|---|

| Social Followers — >50K is the minimum for Sephora | You already have awareness and demand. They won’t need to build it for you. |

| Marketing $ — Paid ads & influencers on TikTok / IG | You can sustain visibility and traffic — not rely solely on the retailer’s push. |

| Shopper Marketing $ — Sampling, promos, merchandising | You’ll invest in driving trial and shelf movement post-launch. |

| Handle Demand — Seasonal peaks & sudden surges | Your supply chain is reliable during holiday and promo spikes. |

| Innovation Ability — Pipeline for the retailer | You’re not a one-hit wonder; you can refresh and expand the category. |

| Sales Manager & Team — Experience with retailers | You understand retail ops, lead times, compliance, and communication cadence. |

If even one of these boxes is unchecked, the buyer’s risk radar lights up.

Summary

Retail buyers don’t just want inspiration, they want impact.

They prioritize brands that:

1. Drive category growth, not just sales.

2. Reduce operational headaches.

3. Prove demand with real data.

4. Show retail readiness in execution and team.

If you can articulate your incremental $ story with clarity and credibility, you’ll not only get listed, you’ll become a buyer’s easiest “yes.”

Jump Accelerator: 70+ beauty brands impacted

Results-based, speed of scale for female founders

-We will evaluate your fit with our 10X Growth Solutions or the Ultimate Scale Cohort.

-For 10X Growth solutions, we look to partner with 1-2 startups/quarter and for the Ultimate Scale Cohort 2-3 startups for 2026.

Limited slots and a rigorous evaluation of your scale up potential & readiness.