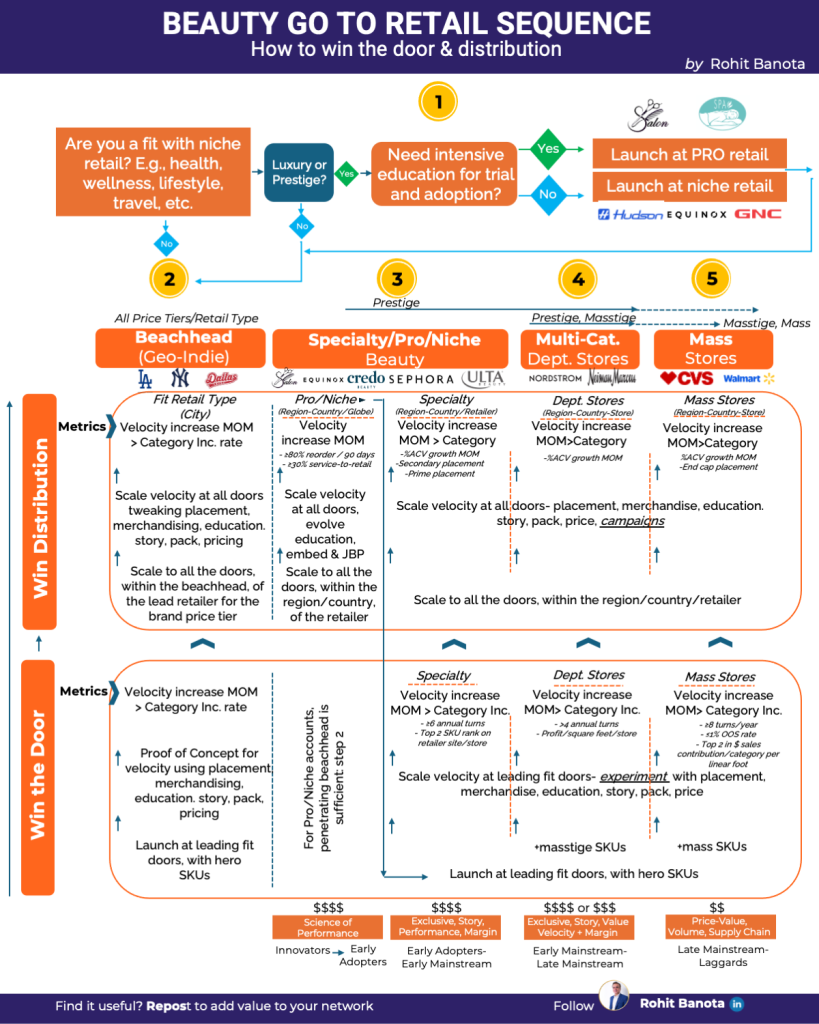

You don’t build a winning brand by being everywhere, but you earn your way there, one door and one proof point at a time.

This retail sequence breaks down how beauty brands progress from niche credibility to national scale, defining what “win the door,” and “win the distribution” actually mean.

Step 1-Fit with Niche?

Are you a fit with niche retail? E.g., health, wellness, lifestyle, travel, etc.

YES:

Are you a Luxury/Prestige brand?

- Yes → Do you need intensive education for trial and adoption?

- Yes → Launch at PRO retail

- No → Launch at niche retail

- Go to Step 2

- No → Go to Step 2

NO:

Go to Step 2

Step 2-Beachhead-Geo: Lead Cities

Applies to ALL price tiers and retail types

Examples: LA, NYC & Dallas are lead cities that usually start all health and beauty trends in USA.

🎯 Goal:

Validate & optimise velocity & penetration of a door, and then penetration of distribution in the beachhead before regional expansion.

⚙️ Win the Door

- Launch at leading fit doors, with hero SKUs

- Proof of concept for velocity using placement, merchandising, education, story, pack, pricing

Metrics

- Velocity increase MoM > Category Increase Rate

🚀 Win the Distribution

- Scale to all doors within the beachhead (for the lead retailer at your price tier)

- Proof of concept for velocity using placement, merchandising, education, story, pack, pricing

Metrics

- Velocity increase MoM > Category Increase Rate

Step 3-Specialty/Pro/Niche Retailer

(Region-Country-Retailer)

This stage has two parallel vertical components that represent two distinct but complementary paths of expansion based on your retailer fit.

🧪 (a) PRO / NICHE RETAIL PATH

(E.g., salons, spas, clinics, wellness, travel, lifestyle retail)

⚙️Win the Door

- You can skip it as the previous step, step 1, is sufficient for proof of concept for the PRO/niche accounts.

🚀 Win the Distribution

- Scale to all doors within the region/country/retailer

- Scale velocity across all doors through

- Scale velocity at all doors, by evolving education, embedding the products in their routines & Joint Business Partnership

Metrics

- Velocity increase MoM > Category Increase Rate

- ≥ 80% reorder within 90 days

- ≥ 30% service-to-retail conversion

Consumer / Price Tier Fit

Price Tier | Consumer Stage | Focus |

$$$$ | Innovators → Early Adopters | Science of Performance (education + credibility driven) |

Post Winning the Regional-Country Distribution, there is an option to

- Scale through the PRO/niche channel globally OR

- Start from winning the door via (b) specialty retailer path in region/country

💄 (b) SPECIALTY RETAIL PATH

(E.g., Sephora, Bluemercury, Credo, Anthropologie, Ulta Beauty)

⚙️Win the Door

- Launch at leading fit doors with hero SKUs

- Scale velocity at leading fit doors- experiment with placement, education, story, pack, price, merchandise

Metrics

- Velocity increase MoM > Category Increase Rate

- ≥ 6 annual turns

- Top-2 SKU rank on retailer site or in-store category

🚀Win the Distribution

- Scale to all doors within the region/country/retailer

- Scale velocity at all doors- placement, education, story, pack, price, merchandise campaigns

Metrics

- % ACV Growth MOM

- Secondary/Prime placement

- ≥ 6 annual turns

- Top-2 SKU rank on retailer site or in-store category

Consumer / Price Tier Fit

Price Tier | Consumer Stage | Focus |

$$$$ / $$$ | Early Adopters → Early Mainstream | Exclusive · Story · Performance / Value · Velocity + Margin |

Step 4-Multi Category Department Stores

(Region-Country-Store)

(E.g., Nordstrom, Neiman Marcus)

Win the Door

Win the Door

- Launch at leading fit doors with hero SKUs + masstige SKUs

- Scale velocity at leading fit doors- experiment with placement, education, story, pack, price, merchandise: Beauty Boutique

Metrics

- Velocity increase MoM > Category Increase Rate

- >4 annual turns

- Profit/square feet/store

Win the Distribution

Win the Distribution

- Scale to all doors within region/country of that retailer

- Scale velocity at all doors- placement, education, story, pack, price, merchandise: experiential campaigns

Metrics

- Velocity increase MoM

- % ACV growth MoM

- >4 annual turns

Consumer / Price Tier Fit

Price Tier | Consumer Stage | Focus |

$$$ / $$ | Early Mainstream → Late Mainstream | Exclusive · Story · Value · Velocity + Margin |

Step 5-Mass Stores

(Region-Country-Store)

(E.g., Walmart, Target, CVS)

⚙️Win the Door

- Launch at leading fit doors with hero SKUs + mass SKUs

- Scale velocity at leading fit doors- experiment with placement, story, pack, price, merchandise

Metrics

- Velocity increase MoM > Category Increase Rate

- ≥8 turns/year

- ≤1% OOS rate

- Top 2 in $ sales contribution/category per linear foot

🚀Win the Distribution

- Scale to all doors within region/country of the retailer

- Scale velocity at all doors- merchandise, placement, education, story, pack & price campaigns

Metrics

- Velocity increase MoM

- % ACV growth MoM

- Endcap placement

- ≥ 8 turns/year

- ≤ 1% OOS rate

- Top-2 in $ sales contribution / linear foot

- Profit / sq ft / store

Consumer / Price Tier Fit

Price Tier | Consumer Stage | Focus |

$$ / $ | Late Mainstream → Laggards | Price-Value · Volume · Supply Chain |

Summary: Retail Progression by Brand Type

Brand Type | Retail Progression Path | Consumer Type | Price Tier | Key Success Drivers to (Win the Door) | Key Success Drivers to “Win” (Win the Distribution) |

| Prestige (Pro / Niche Path) | Professional / Niche Retail → Regional → Global Scale or Crossover to Specialty | Innovators → Early Adopters | $$$$ | • Education-led proof of performance (clinics, salons, spas, wellness) • Expert endorsement & credible before/after results • Hero SKUs paired with backbar + retail offerings • ≥80% reorder in 90 days and ≥30% service-to-retail conversion | • Scale to all regional/country accounts |

|---|---|---|---|---|---|

| Prestige (Specialty Path) | Specialty → Department Stores → Select Mass (Premium Aisle) | Early Adopters → Early Mainstream | $$$$ /$$$ | • Launch hero SKUs with strong story, clinical or performance proof • Proven velocity in Beachhead cities (LA, NYC, Dallas) • Distinctive packaging, PR/editorial traction, 50%+ retail margin | • Maintain MoM velocity > category growth • %ACV growth MoM • Secondary → Prime placements (endcaps, campaigns) • Sustain ≥6 annual turns |

| Masstige | Department Stores → Mass Retail | Early Mainstream → Late Mainstream | $$$ / $$ | • 4–6 annual turns in department stores • Beauty Boutique for story, education & experience • Hero SKUs + masstige SKUs | • Maintain MoM velocity > category rate • %ACV growth MoM as distribution widens • ≥4 turns/year; ≤3% OOS • Top-2 in $/linear ft & strong profit per sq.ft. |

| Mass | Mass Retail → Broader Mass Chains (Regional → National) | Late Mainstream → Laggards | $$ / $ | • Value-price hero SKUs • Proven regional velocity & OTIF ≥95% • Optimized price–pack for high-volume retail • Flawless promo execution | • %ACV growth MoM (chain-wide) • ≥8 annual turns • Endcap/seasonal placement • ≤1% OOS; maximize profit/sq.ft./store |

Abbreviations:

-%ACV=% of average category value($)

MOM=month on Month

OOS=Out of Stock

OTIF= On Time & In Full shipment

Jump Accelerator: 70+ beauty brands impacted

Results-based, faster & profitable scale for female founders

We will evaluate your fit with our 10X Growth Solutions or the Ultimate Scale Cohort.

For 10X Growth solutions, we look to partner with 1-2 startups/quarter and

for the Ultimate Scale Cohort 2-3 startups for 2026.

Limited slots and a rigorous evaluation of your scale up potential & readiness.