Learn how to create an Innovation Strategy for your health and beauty CPG craft or disruptive brand and win over the market without spending heavily on promotion?

Innovation Strategy is a well-designed factory to identify and screen opportunities, across categories and varying timelines, allocate budgets, develop new products, launch and measure progress to achieve strategic brand objectives furthering brand story or creating a new brand story by not just staying relevant with brand tribes but growing them, by offering a stronger meaning, to grow the brand organically.

Innovation Strategy provides fuel to and enriches your Brand Story, keeps your tribes engaged, acquires new consumers, who are your potential tribes, and, also, finds and owns new market spaces with or without a new brand story.

Innovation is a new way of doing things, be it product, service or a business model, which adds more value than current solutions to both the consumer and the brand.

Thomas Edison, the greatest innovator ever, said: “Innovation is 1% inspiration and 99% perspiration.”

A sentiment shared by Vijay Govindrajan, Coxe Distinguished Professor of Management at Dartmouth’s Tuck School of Business and the author of The Three Box Solution and Reverse Innovation.

He says, “Innovation is not creativity. Creativity is about coming up with the big idea. Innovation is about executing the idea — converting the idea into a successful business. We like to think of an organization’s capacity for innovation as creativity multiplied by execution.”

His formula for innovation=creativity*execution. If either of these values =0, then innovation=0.

But creativity is sexier and easier to accomplish as compared to execution since execution is about rigorous checks, making hard choices and managing trade-offs to ultimately make it happen in the real world.

Innovation Strategy(Factory) and Brand Story

Brand Story leads Innovation because

1.If you have already identified an emotional and functional pain point of a consumer segment, and have a coherent brand story with a core promise to overcome their emotional enemy, then, launching an innovation within the “same category” by improving current products, under the same brand, should be a fit with the existing brand story.

2. Generally, health and beauty CPG brands follow a master brand architecture. One umbrella brand with multiple products underneath. If you launch an innovation with the same master brand/strongly endorsed by master brand in a “new category or create a new space within the same macro category” targeting different/premium set of consumers, success is determined by the perceived fit between your master brand and the new category drivers. (Marketing Science Institute)

e.g. Lululemon launched Lululemon “Self Care” (strongly endorsed brand) to its active consumers with a core emotional promise of cool and high performance body care products, which is a fit with its existing business’ core promise of cool and high performance active wear.

Apple offered IPAD with the same (as for IPOD, MacBook, IPhone) core emotional promise of “simplifying technology and making gadgets cool” and the target segment was younger professionals.

Why Innovation Strategy and Not Just Innovation?

Developing new products in isolation is fulfilling the fancies of an entrepreneur, who is inclined to bring every new idea to her consumers, or of a corporate marketer, who seeks visibility or has a mandate, without a holistic framework and a well-thought out stage gate decision process, thus competing for precious resources of time and money and possibly losing out on what is truly important.

Why Innovation Strategy for Health and Beauty CPG Brands?

Most of health and beauty CPG brands are an innovation to an extent that they have innovative ingredients, innovative products, and even business models etc., are smaller and nimbler, and have an anti-mass/convention stance.

Strength of these HABA CPG brands is innovative offerings, and not quite marketing or promotion.

There are 3 ways a HABA CPG brand can grow organically without investing heavily in promoting or marketing itself:

1. Brand Story: Communicating the brand story by leveraging tribes.

2. Brand Tribes: Leveraging brand story to create tribes for both higher profitability per consumer as well as profitable and high lifetime value, new consumer acquisition.

3. Innovation: Leveraging incremental innovation for higher profitability with current consumers and tribes as well as leveraging groundbreaking innovation for acquiring highly profitable, with high lifetime value, new consumers who are potential tribes, in same category or by creating new market spaces.

A and C are fuel for current and prospect brand tribes to further brand story and expand their clan. Storytelling helps provide content to tribes for advocacy and engagement, and Innovation keeps the solution/offering to brand tribes ahead of market, with enhanced meaning along with helping the brand acquire new, profitable consumers, who will become and help acquire potential tribes of tomorrow.

Innovation Strategy: Types of Innovation

(Adapted from P&G’s Innovation Factory and Innosight’s framework)

Before initiating the innovation strategy, divide all your products into different stages of evolution from introduction to growth to maturity to decline. Now look at actual awareness level of a product and penetration amongst innovators, early adopters, rest of consumers and most important your tribes (penetration level).

Commercial Innovation

Involves no change to product but is about innovative storytelling. New packaging is also an example of commercial innovation. Creating a new brand story for the master brand could also be commercial innovation.

Product Evolution Stage: Introduction and high growth stage.

Products with low but growing sales and high profit margins. These products have penetration only with a few innovators and early adopters. Most of early adopters and early majority of your target consumer base are not aware of the product.

Tell your brand story innovatively, using the VICE DUH? framework leveraging your tribes/ advocates to generate awareness and trial amongst majority of your online subscriber base as well as with early adopters and influencers, outside of your subscriber base, in your target segment. Use tribe purchase data and testimonials as reason to believe.

Measurement

NMC($): Net Marketing Contribution (Quarterly)=Gross Margin-Sales and Marketing Expenses

MROI(%): Marketing Return on Investment (Quarterly)=NMC/ Sales and Marketing Expenses*100%

Timelines

Immediate roll out within 3 months.

Examples

Fenty’s Digital launch,

Benefit’s Browmobile Competition,

Kelloggs partnership with Crayola: Packaging Innovation-X+Y framework combining Kelloggs packaging with creativity of Crayola Crayons.

Sustaining Innovation: Beyond Line Extensions

Here, you make incremental improvements and keep product afresh, so as not to lose those consumers, who are more prone to fall for next fad or an incrementally better product. A few new consumers are also acquired with Sustaining Innovation.

Product Evolution Stage: Slow/Late Growth and Maturity stage.

Products with high penetration, close to 100%, of brand tribes-loyal and advocates, as well as over 70% of current consumers. Products with highest sales and profits (not just profit margins).

Target 100% “penetration and advocacy” by brand tribe: loyal and advocates, along with 90%-penetration of all your consumers (those who at least buy 1 product).

Leverage brand tribes to achieve awareness and interest with all of the non-consumers of your target segment: online subscribers, frequent retail store traffic(beyond buyers) and with outside of retail store traffic (who aren’t yet aware)- for new consumer acquisition.

Examples

Adding fragrances or going free and clear, going 100% organic, an extra blade in a razor, longer lasting moisturizer etc.

Measurement

Backward looking: Yearly NMC-Net Marketing Contribution, MROI-Marketing Return on Investment

Forward looking: Brand Health: Satisfaction with incremental/trendy benefit in core promise, Increase in Loyalty-Number of loyal consumers and average purchase/frequency of purchase by loyal consumers, Increase in awareness and interest.

Time Horizon

6 months to 1 year depending on trend’s projected life. Higher the trend’s projected life, more time to profit from. Horizon is influenced by time to bring a line extension to market.

Transformational Innovation

Create an altogether new product/service offering with an “order of magnitude” better than existing performance (breakthrough) by creating a new market space and new demand, something better known as Blue Ocean. In this case, the Blue Ocean is created, more often, than not, from within a red ocean, by redefining the boundaries of the category.

“In a study of business launches in 108 companies, we found that 86% of those new ventures were line extensions-incremental improvements to existing industry offerings-and a mere 14% were aimed at creating new markets or industries. While line extensions did account for 62% of the total revenues, they delivered only 39% of total profits. By contrast, the 14% invested in creating new markets and industries delivered 38% of total revenues and a startling 61% of total profits”-Blue Ocean Strategy by W. Chan Kim and Renee Mauborgne.

Also, large R&D budgets are not key to creating new market spaces. Blue Ocean is more a matter of strategic thinking and application with managerial decisions than of resources.

Examples

1. Olay Total Effects created a new category, whereby, it introduced a medical grade skin care product in high-end, non-medical retail at a premium price point with virtually no competition at all. Olay Total Effects was an “order of magnitude” better product and used strongly endorsed by master brand architecture.

2. The Ordinary by DECEIM is yet another example of transformational innovation that offered a product with an order of magnitude better performance, for the price, as well as created new demand for nerdy and non-consumers at 1/3rdto 1/5ththe price point, creating a blue ocean. Architecture is of an independent brand or weakly endorsed by DECEIM.

3. Goop and Glossier, are also examples of transformational innovation products by a new entrant brand. Both have created a blue ocean by redefining boundaries of existing categories. Goop combines content with beauty and fashion, and Glossier combines online blogging and feedback with skin care products.

Product Evolution Stage: Maturity and Early Decline

These products (barring new entrants), before transformation, could have declining or stable sales and profits, high level of awareness, close to 90%, amongst the universe of target consumers.

Measurement

Net Present Value of Future Profits ( for screening).

Backward looking: Yearly NMC, MROI.

Forward looking: Brand Health: Satisfaction (Rational) and Delight (Feelings) on core promise and on Benefits.

Time Horizon

1-2 years.

Disruptive Innovation

Disruptive Innovation is very difficult to predict but you could make an attempt by extrapolating trends in tech, regulation, society and morality in to the future and foresee ownable opportunities.

Five Basic Tenets of Disruptive Innovation

As laid out by Clayton M. Christensen, one who originally came up with the concept of disruptive innovation, are

1. Target low-foothold consumers, who are willing to pay much less and need lesser quality and are not targeted by incumbents/major players or mass brands. Mass brands are usually focused on their most profitable and demanding consumers and ignore the lesser demanding consumers.

2. Or Target new-market foothold consumers, who have not yet been served and are non-consumers because of complexity of solution or price.

3. Disruptive Innovation does not catch up with mainstream consumers, and disrupt, till quality reaches the mainstream standard.

4. Disruptive Innovation is a path and not a product/service. This innovation, over a period of time, becomes mainstream and changes the market dynamics. Your assignment is to try to plot the path, for a product/service, from now to the ownable opportunity in future using advancement in tech, regulation and morality/values as a guidepost.

5. Some disruptive innovations succeed and some don’t.

Examples

IPhone, post its first launch as a sustaining innovation, got onto a disruptive path, and replaced laptop, with apps on the phone connecting to internet, when it connected a network of application developers with phone users and ushered in a new business model.

Netflix, post launch, moved from an online directory of movies with physical shipment to online streaming of movies with the development of technology for online streaming.

Measurement

Real Options Approach: Every brand should work on at least 2-3 potentially disruptive innovation ideas. Go slow, don’t invest too much money and, don’t measure success with hardcore numbers but have a real options approach, meaning, the team has the option but not an obligation to move further.

Time Horizon

Varies. It is a path and usually takes number of years and different types of disruptive innovation take different amount of time with technology and regulation as one of the key drivers.

Please note: UBER is not a disruptive innovation.

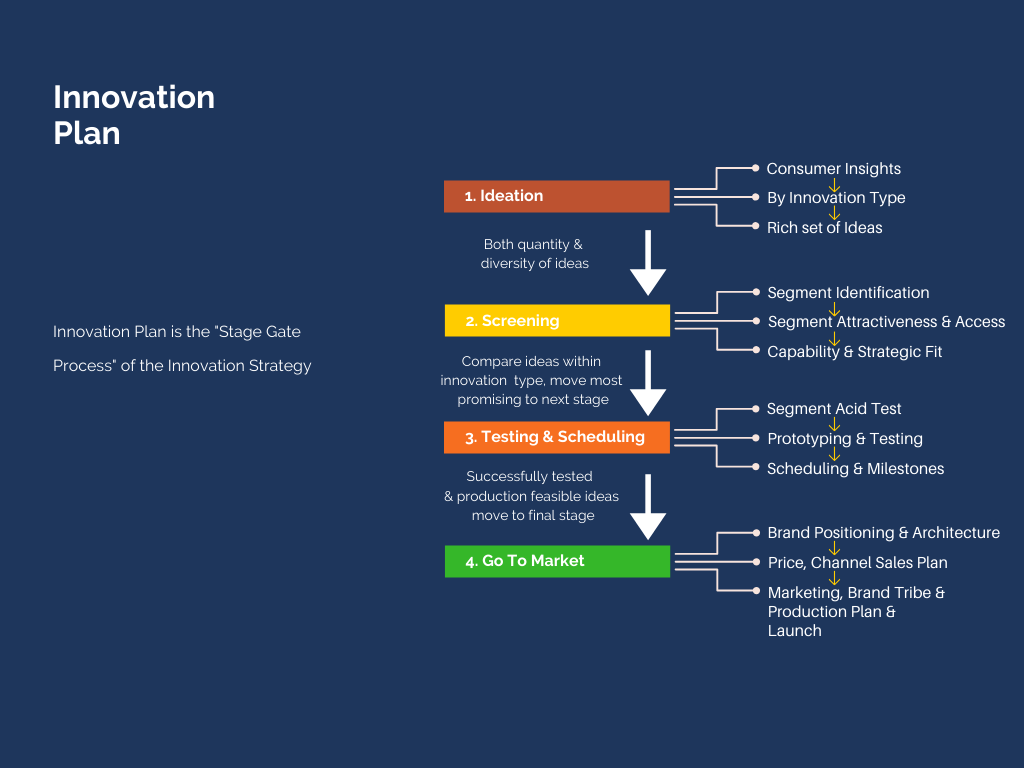

Innovation Strategy: Innovation Plan

Innovation Strategy-Innovation Plan: Stage 1-Ideation (by Innovation type)

Commercial Innovation

Consumer Insight

Both quantitative and ethnographic research is advisable for finding that key consumer insight, most pressing, unmet need, especially how it is framed in their minds and talk, to design your innovative storytelling.

For research, use both your innovators and early adopters.

Ideation Framework for Storytelling

VICE DUH? framework for content type.

Pick one out of these which aligns well with your brand story.

VI-Visual Impact. E.g. Nike’s Cotton Shoe Campaign.

C-Cause Storytelling. E.g. Dove’s Real Beauty Campaign.

E-Emotional High. E.g. Nike’s campaign with Colin Kaepernick.

D-Demo Extreme. E.g. Blendtec’s “Will it Blend” viral YouTube video campaign.

U-Unthinkable, includes incongruent. E.g. A German Beer ad showing men cradling their beer bellies like pregnant moms.

H-Humour. E.g. Dollar Shave Club’s viral YouTube video campaign.

Sustaining Innovation: Beyond Line Extensions

Consumer Insight

Both quantitative and ethnographic research is advisable for finding that key consumer insight, for incremental improvement and key influencing trend, to base your innovation design on.

For research, you could leverage current loyal and repeat consumers who are very trendy. Segment all your current consumers by their loyalty: oldest consumers with highest number of orders and highest order value/year and then check how trendy they are with a survey.

Do a quant survey using a cloud based platform like ZOHO or Google Forms and for ethnographic research, do a video call with at least 5-10 of these consumers.

For a list of trends and features, check out fashion, food and beauty blogs along with product launches by competitors, and substitute products and ask your consumers to rank these trends and features by preference.

Ideation Framework: X+, Y+, Z+, X+Y

X+: X is a feature/benefit of your product that consumer insight pertains to and + signifies making incremental improvement in the same. For example, a consumer insight could be “increasing level of insecurity” with organic washing and % organic could be a feature that helps overcome this feeling. Raising to 100% organic will be an incremental improvement.

Another example could be adding a trendy fragrance, like sandalwood, to your skin care products.

X+Y: Here, you could combine 2 different features and benefits of two different products in to one. E.g. If a consumer insight is around the need/trend to minimize time/hassle of using 2 different products for 2 different needs during travel or busy days.

Dry Bar Double Standard shampoo and conditioner and Attitude 2-in-1 shampoo and conditioner are an innovation that combine 2 products into 1.

Similarly, St. Ives Gentle Smoothing Scrub and Mask, Glossier Balm dotcom (hydrates skin and chapped lips) are examples of X+Y Innovation.

For trends, X+Y means your product(X) +trend(Y). Create such combinations and ask your survey respondents to rank in descending order. E.g. Face Oil(X)+Sandalwood fragrance(Y)

Transformational Innovation

Consumer Insight

You need to target Innovators/trend influencers who would validate/give feedback on the order of magnitude or the blue ocean innovation, in markets distant from yours and are unexplored and non-consumers.

As a health and beauty startup, you could use social media to reach them via a survey. Let them confirm by self-selecting themselves into early adopters or influencers.

Or you could use an influencer platform or just plain connect with influencers on social media and request a brief survey.

Ideation Framework

Order of Magnitude/Blue Ocean: ERRC Grid-Eliminate, Raise, Reduce, Create.

E.g. For Olay Total Effects, P&G identified a whitespace between mass and prestige segment for Oil of Olay to create a new skin care category for 30+ women and moved away from grandma’s cold cream category.

ERRC Grid applied to create Olay Total Effects:

Create: New benefits such as healthy glow and healthy skin beyond just anti-wrinkle(anti-aging), toning, reduction of pores, smoothing skin texture etc., positioned as holistic skin care for 30+ women.

Eliminate: Did away with positioning as skin care for 50+ women

Raise: Increased the performance with medicinal grade ingredients.

Reduce: Priced between mass and prestige, thereby making a medicinal grade product more affordable.

ERRC Grid applied to create The Ordinary brand by DECEIM.

Create: Instead of offering common parlance lingo on product ingredients, it created hyper scientific, nerdy explanation of ingredients and formulations.

Eliminate: Fancy packaging and labelling with lab like look of the pack. Saved cost without impacting value and core promise to end consumer: Highly functional, super affordable and safe beauty.

Raise: Number of active and clinically approved ingredients.

Reduce: Price of products to 1/5thof the industry standards by creating own formulas, manufacturing, packaging, selling direct to consumer.

Disruptive Innovation

Consumer Insight

Interaction with experts in their respective fields for inputs on tech, policy and regulation and evolving morality.

You could also read books and watch videos on YouTube and Linda.com by renowned experts in their fields. E.g. Try googling technology shaping health and beauty trends and you will find plethora of information.

Ethnographic research and consumer focus groups (usually expensive) could be studied to see the rate of change of consumer’s life by the factors cited earlier.

For research,

1. Identify non-consumers of category: Demographics and market types that do not buy currently because of complexity of solution or price. Unearth what makes the solution complex and costly for them.

2. Identify low foothold consumers, who are much less demanding and need a good enough product for a much lower price. Unearth what features with what quality they consider good enough.

Ideation Framework

For Non-consumers of Category:

Once you know simple features and “quality” along with willingness to pay for these consumers, look for alternative ways (to current) to offer the same at a reduced cost.

Project (and hope) how advancement in technology would help in improving the quality of these simplified features cost effectively for non-consumers and simultaneously project the path to taking quality mainstream.

For Low Foothold Consumers:

Use Bare Bones Framework. Reduce the quality of the product, to basic benefits, with bare minimum features (ones they need) that bring down your cost drastically and help you serve the low foothold consumer with minimal need within their affordability.

Project (and hope) how you would improve the quality of the product/service with advancement in technology and eventually bring it mainstream at quality comparable to current alternatives but at a much lower price.

Remember Disruptive Innovation is a path and not a product/service and some disruptive innovations succeed and some don’t.

A Few Ideas for Disruptive Innovation in Health and Beauty could be:

For consumers, who cannot afford and don’t have time to go to SPAs for elaborate skin treatments-an online portal with Artificial Intelligence that diagnoses with images and a brief questionnaire, and sells personalized treatments which are easy to apply by self, and cost a fraction as there is no service and overheads involved.

There is potential to disrupt the skin care SPAs when the quality of treatments and their personalized effectiveness matches those of SPAs, especially when enough and rich, before and after, data is available for Artificial Intelligence.

Make sure to have both a good quantity and a diverse set of ideas for every innovation type to move to next stage of the Innovation plan.

Innovation Strategy-Innovation Plan: Stage 2: Screening

The ideation frameworks will yield multiple ideas for each type of innovation but you need to screen the most promising ideas and ones that are a strategic fit with your brand story.

Screening involves below 5 steps: Segment Identification, Segment Attractiveness, Segment Access, Capability and Strategic Fit

Segment Identification

This is the first step in screening any idea.

Core Need

Always start with need based segmentation. Consumer Insights have already given you the unsolved need, which you have ideated upon for innovation ideas.

Differentiating Benefit:

While solving the core need, what is the differentiating benefit you offer.

Demographic:

Age, location, family status etc. Knowing this helps you with selecting media, forecasting sales and segment profitability.

Psychographic:

Values, attitudes and opinions. This helps in positioning, designing advertising and content amongst others.

Volume-Based:

This helps in designing promotions, product innovation, packaging, pricing etc.

Segment name is the emotional pain/benefit that the core differentiating benefit solves and, one that is aligned with the complete segment identified.

Below is an example showing how to identify a segment for a skin care brand/product:

Segment Name: Visibility Maximiser

Core Need:

Minimum hassle skin care

Differentiating Benefit:

Keep the skin glowing throughout the day

Key Demographic:

Young, single, professional, busy women 25-30 years of age

Psychographic:

Freedom, feminism, equality

Price Sensitivity:

Medium

Product Size:

Small and convenient tube

Product Type:

Non-stick, quick absorbing cream or gel

Always identify more than 1 segment (at least 3) to compare and confirm.

Segment Attractiveness

Segment attractiveness is calculated by studying competition intensity, segment demand-consumer lifetime value and segment profitability.

Low Competition Intensity

Look at both direct and substitute competitors. A common mistake marketers make is that they don’t look at substitutes. An important question to ask is “what business are we in” or “what problem does the innovation solve” to identify all that you compete against.

For example, Cirque De Solei is in the entertainment business and not circus business. Tata Harper is in Rest Assured & Relax (both for safety and beauty) and not just beauty business. Bite Beauty is in “edgy without risk” life (beyond beauty).

Consumer Lifetime Value

Let’s take the example of “visibility maximizers” from above with a few assumptions applied:

Average Purchase-Consumer Price (1 tube): $50

Gross Margin:75%( assume)

Cost to Serve: 50%( distributor 25% + retailer 25%)- did not factor M&S for maintenance

Net Margin/Purchase: $12.5

Number of Buys/Year: 6(assume)

Net Margin/Year: $75

Average Lifetime: 5 years (use current as benchmark).

(Calculate retention rate % : Number of consumers carried forward to next year (without new consumers acquired) /Number of consumers in previous year*100.

Average Lifetime=1/(1-retention rate%)

e.g. If retention rate is 80%, average consumer lifetime=1/(1-0.80)=5 years)

Discounted to Present (5% discount rate) Lifetime Value per Acquisition: $324.71

Acquisition Cost/consumer: $50(average for online (e.g. Facebook cost/acquisition with an average purchase of $50) + average for brick and mortar (e.g. cost/acquisition with demos for average purchase of $50)

Consumer Lifetime Value(CLV): $274.71=Lifetime Value per Acquisition-Acquisition Cost/Consumer

CLV will increase with time (not factored here) for repeat and loyal consumers as you will both cross and up-sell.

CLV takes precedence over segment profitability as long as segment profitability meets a minimum desirable value. Total addressable market size is not relevant but how much of the pie you can possible have.

Segment Profitability

Continuing with the example of visible maximisers from above, and applying a few more assumptions for the purpose of demonstration:

Segment Size-Number of women in USA and Canada=50%*(370 million+37million=407 million)=203.5 million. Assuming 10% of women are between 25 and 30 years of age=20.3 million, out of which assuming 50% are single=10.15 million and 50% of these are also professional= 5 million (approx., did not calculate segment growth rate)

Probability of Sales over 5 years (fraction of total segment who could be made aware, try, and adopt): 0.50 (awareness*distribution % you can achieve in (1styear+2ndyear*4/5+ 3rdyear*3/5 +4thyear*2/5 and 5thyear*1/5)*0.30(trial)*0.70(adoption)=0.105

% of awareness & distribution, trial and adoption over the years are assumptions based on past performance or any other benchmark/logic.

Potential number of consumers within the segment for the brand: 5 million*0.105= 0.525 million

Segment Profitability-Potential No. of consumers*Consumer Lifetime Value-0.525 million*274.71=$144 million over 5 years

Consumer Lifetime Value and Segment Profitability are used to compare 3 different segments identified (during segment identification part of the screening gate). High consumer lifetime value, segment profitability and high projected NMC and MROI (explained above-reference) are needed to approve the idea to the next stage.

High/Exclusive Segment Access

Even with high segment attractiveness: no competition for the problem you are trying to solve, high consumer lifetime value and segment profitability along with high projected NMC and MROI (lower relative investment in M&S), you still need access to the final-end consumer whether via a channel or direct.

E.g. If you launch a beauty brand for the consumer who shops at drugstore market but you don’t have a way to access that channel because the brand does not meet their listing criteria, then innovation might not do much good.

A good alternative would be to build a direct to consumer brand, create a brand tribe, leveraging a powerful brand story, with a great level of bonding and profitability so as to deal from the point of strength with any channel for listing. Brand tribes, instead of marketing ($) resources, could also be leveraged to create awareness with the end consumer, who shop at the desired channel, via digital media for generating queries and pull.

Another alternative is to identify a beachhead market with the right fit independent/local/image stores and generate proof of concept with numbers to generate pull with consumers and make your case with bigger retailers.

Capability

Post segment identification, attractiveness and access, look at feasibility of those ideas with innovation capabilities you have and can build within the time horizons mentioned and resources you possess.

For health and beauty CPG these capabilities would mainly revolve around R&D-lab, manufacturing capacity, ingredients, packaging, website, content development, stores (if own brick and mortar stores), certification for claims, etc.

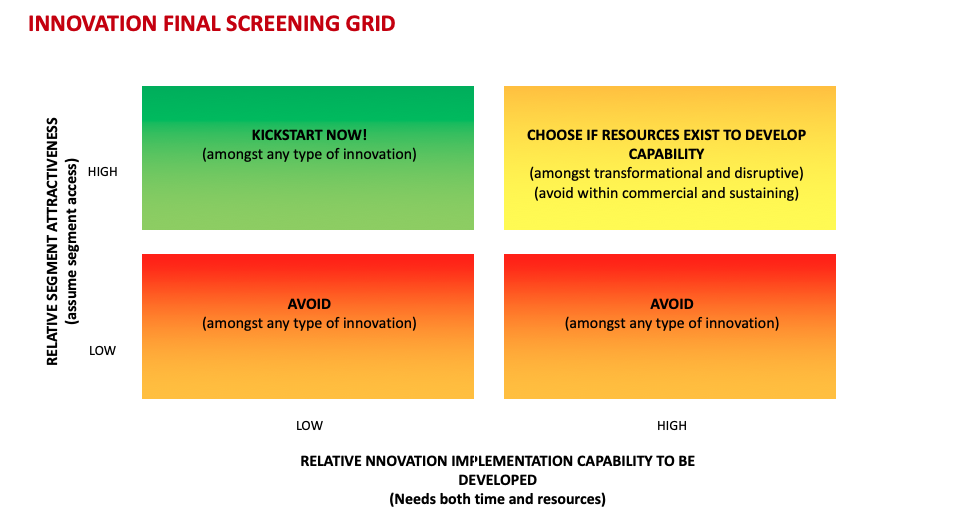

Innovation Final Screening Grid

Screen ideas by comparing them within their innovation type and make sure you have ideas across all types of innovation to be moved to the next stage.

Both innovation capability and segment attractiveness are relative to other ideas within the innovation type.

Low Innovation Capability and Low Segment Attractiveness

Avoid such innovations within all 4 types of innovation as the returns don’t justify the effort. There is a tendency to use such combo amongst commercial innovation thinking it is a quick win but there is no win here.

Low Innovation Capability and High Segment Attractiveness:

Kickstart now! Applies to ideas within any 4 types of innovation.

High Innovation Capability and Low Segment Attractiveness:

Avoid! Irrespective of innovation type.

High Innovation Capability and High Segment Attractiveness:

Choose! If you have resources needed to develop the capability within Transformational and Disruptive innovation. There is no point in moving such ideas for commercial and sustaining innovation to next stage.

Strategic Fit

One final step could be to again check the strategic fit with the brand story even though the Innovation Factory with 4 types of innovation takes care of the same in advance.

Innovation Strategy-Innovation Plan Stage 3- Testing and Scheduling

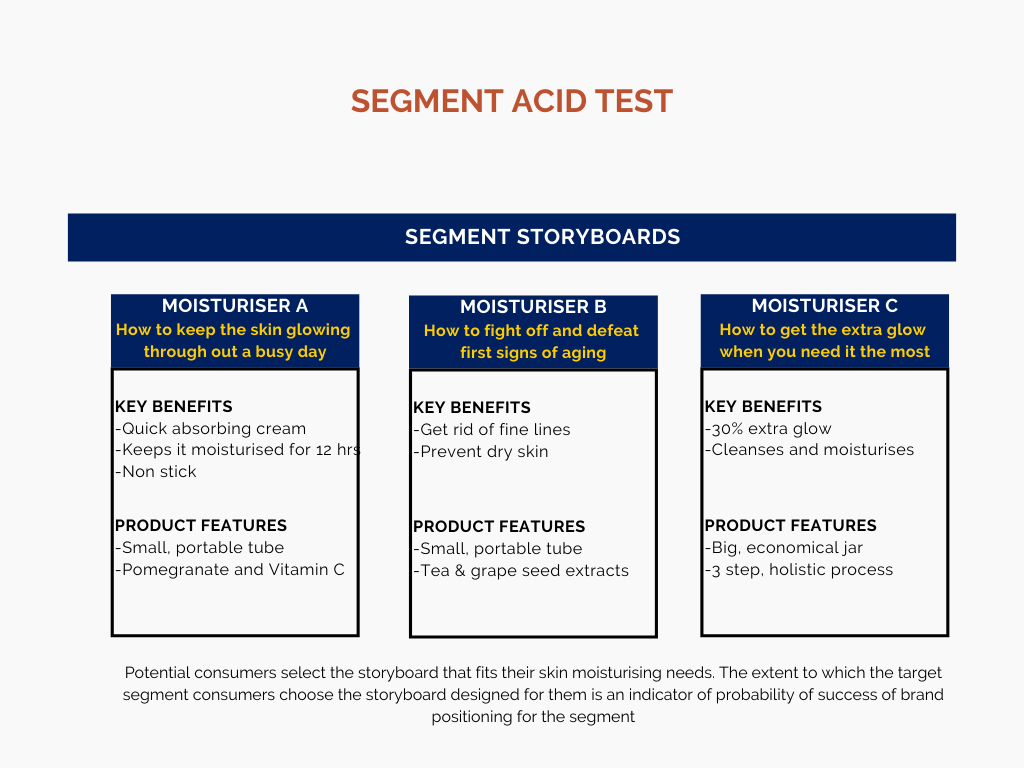

Brand Value Proposition(link) and Segment Acid Test

Work out three alternative core functional promises of your brand for three different consumer segments, identified during screening (segmentation identification), and create a brand value proposition, in the form of a storyboard, for each of them which includes the core promise, key benefits and product features.

Moisturiser A is the storyboard for the “visibility maximizer” segment we had identified earlier during screening.

You could get creative with storyboarding and have images, settings and slogans etc.

Show the three different storyboards to 3 different pre-selected segments, and if most of the target segment respondents select the storyboard designed for them and find it attractive means the brand story value proposition has survived the segment acid test.

On top, get them to critique the storyboard and take suggestions to improve the offer.

Prototyping and Testing

Once the innovation value proposition has survived the segment acid test, create prototypes for sampling. Share the first batch of products with the target segment consumer during shows etc. Take feedback with a survey or a video call or observation in person to improve the offering yet again.

Scheduling, Timelines and Milestones-Production, Marketing and Sales

Once the innovation is a go ahead for production, schedule and finalise budgets for sourcing ingredients, production, labels, marketing and sales for launch and distribution.

Innovation Strategy-Innovation Plan: Stage 4: Go To Market

Brand Story Emotional Transformation and Positioning

In this step, you transform the innovation into a coherent brand story with an emotional core promise.

For transformational innovation, whether you innovate your entire brand (with multiple products) or innovate one of the products, you need to transform the core functional promise into core emotional promise , with the help of a consumer benefits pyramid.

For commercial innovation and Sustaining innovation, if your existing brand story is not transformed emotionally, it makes sense to do so before effective storytelling.

Post emotional transformation, create a brand positioning statement as a guide for all communication and storytelling as well for internal organization to deliver on the communication.

Brand Architecture

Commercial Innovation: Master Brand. No brainer, no change in product or nomenclature.

Sustaining Innovation: Master brand architecture with an added personality

Transformational Innovation: Brand Architecture could be master brand or an independent brand based on:

1. For a health and beauty brand, which has master brand architecture and multiple products: If one of the products, you have, needs transformational innovation, which could later have multiple extensions/SKUs/products, then, either you could create a new brand name or a strongly endorsed brand name like Olay Total effects or Olay Pro X or Olay Regenerist.

Current Master Brand Awareness (positive associations)- “Innovation Category” Fit with Master Brand

(Declining sales and profits but not negative associations-like you don’t listen to radio but associations for me are positive and nostalgic and Spotify is a proof of that)

Low-Low: New Brand (Irrespective of resources)

Low-High: Strongly Endorsed Brand as you can create more awareness with the same set of resources.

High-Low: New Brand (Irrespective of resources)

High-High: Strongly Endorsed Brand-why not master brand? -cause this innovation will have its own SKUs and products later on, why not new?-to leverage existing awareness.

2. If you are transforming your entire master brand(with multiple products) and creating blue ocean with the whole brand, then you could use a new brand name or use current master brand/or with an added personality.

Current Master Brand Awareness (positive associations)- “Innovation Category” Fit with Master Brand

(Declining sales and profits but not negative associations-like you don’t listen to radio but associations for me are positive and nostalgic and Spotify is a proof of that)

Low-Low: New Brand (Irrespective of resources)

Low-High: Current Master Brand/or with an added personality

High-Low: New Brand (Irrespective of resources)

High-High: Current Master Brand with an added personality (especially if you are pricing it premium)

Disruptive Innovation: Worry about branding a bit later, as the innovation evolves but of course, use a new brand name-Independent Brand.

Brand Story emotional transformation and Brand architecture will then dictate packaging design, labels, logo, pricing, website design and content development.

Pricing

Type of Innovation and the value it adds to the target consumer decides the price.

You would not tinker the price for commercial innovation.

For sustaining innovation, you want to charge a premium based on quality advantage. Transformational innovation warrants a high margin with a premium price compared to the product category transformed.

Disruptive Innovation always starts at a much lower price than the category norm.

Channel Sales Plan

Identify channels that are a fit with your target segment and design channel sales pitch (to buyers) highlighting channel’s profitability and strategic fit, design POSM-point of sales material by channel along with demo scripts/props and plan for training sales and demo reps.

Marketing Plan

Design website as a touch point for the brand story. Create storytelling plan and design content by media for PR, Digital and for In-store. Also, plan marketing promotions for channel and direct consumers to induce trials.

Brand Tribe Program

For sustaining and commercial innovation, collaborate with current brand tribe and innovators/early adopters respectively for brand diffusion, whereas for transformational innovation, create a new brand tribe program leveraging the brand story and get the innovators on board first.

Production Plan

Forecast sales and plan for inventory.

Launch

Kickstart sales and marketing.

Conclusion

Innovation delivers profits for decades whereas promotion is good enough for quarterly topline.

Innovation Strategy is a well-organized factory to identify and leverage opportunities, with a stage gate process and frameworks, over different lengths of time, within and across categories that are a fit with the core promise of a brand.

4 types of innovation are Commercial, Sustaining, Transformational and Disruptive.

For commercial innovation, you need brand story and subsequent storytelling with content. VICE DUH? is a framework I created for impactful storytelling.

Sustaining Innovation is about incremental improvements and reflecting trends.

Transformational Innovation is an order of magnitude better product that will create new demand in an uncontested space, better known as blue ocean.

Disruptive Innovation, is not a product/service/offering as is commonly misunderstood, but is a path that an offering takes when it targets low foothold consumers of a brand/category or non-consumers of a category with an inferior quality offering at a much lower price, and disrupts the mainstream when the advancement in technology etc. makes it possible to offer the same or even better than mainstream quality at a much lower price.

For any innovation, especially for craft and disruptive brands, consumer lifetime value and segment profitability matter more than total addressable market size.

Segment Acid Test is critical to evaluate your innovation fit with the chosen segment.

Most critical element of Go to Market is emotional transformation of brand story, & subsequent application to and alignment of all consumer touch points including website, media, packaging etc.

With this knowledge, analyze your current innovation efforts and results, and go chart out your innovation strategy and take the market by storm!

I created the below quiz to help you get started.

ROHIT BANOTA, Founder of StorySaves, has transformed dozens into envied beauty brands for sharp and profitable growth, kickstarted from day 1 with “strategic brand story” and “story-led brand strategy” & powered by digital.

He has over 17 years of marketing and business experience growing consumer packaged brands including with startups and MNCs like P&G Beauty and Grooming.