Which celebrity beauty brand strategy and positioning is the most profitable and successful?

Celebrity beauty brands encash fame into fortune. Fenty beauty did close to $600 million in 18 months of launch. Kylie Cosmetics was valued at $1.2 billion when Coty bought a stake in it, and KKW Beauty sold out a 20% stake to Coty for $200 million, valuating the brand at $1 billion.

While celebrities have long ventured into all kinds of businesses, especially beauty, with the challenge of distribution out of the way and the rise of social media, they have found a more accessible outlet, DTC, to dollar their fame.

With massive awareness, which would cost over a few million dollars for any Indie beauty brand, celebrity beauty brands do not encounter the same challenges.

I decided to deep dive into some of the better-known celebrity beauty brands. Below are my observations and analysis of the strategies of celebrity beauty brands with their challenges and recommendations for the way forward.

Let’s analyze the celebrity’s motivation to launch a beauty brand within the matrix of their social followership(awareness) and the innovation level of their brand ideas.

(Studied celebrity beauty brands that are either independent entities or with a high level of creative input in collaboration with an incubator )

Celebrity Follower Status & Innovation in Brand Idea for Beauty Brand

(High Follower Status>=50 million followers on IG + Top 100 in FameFlux

Low Follower Status<=20 million followers on IG+>Top 1000 in FameFlux)

We could divide the above matrix into four quadrants:

Quadrant 1: Very High No. of Followers on Social Media and Low Innovation in Brand Idea

Kylie Cosmetics and KKW Beauty fall within the upper half of this quadrant. With follower counts above 50 million when launched, and now above 200 million and 100 million respectively on IG, dedicated fan pages across all social media platforms, the motivation to launch a brand that takes the category further was low.

When your social media follower base is greater than the social base of some of the average mainstream brands, there is little motivation to disrupt the category.

Both of the above brands are aspirational around the founder’s looks. I will call these brands: Accesselebrity, because they revolve around the celebrity’s prestige image, usually at affordable pricing.

Florence by Mills is in the lower half but towards the right of this quadrant. The founder, Millie Bobby Brown, had close to 50 Million followers when she launched. The brand has an idea beyond her personality & looks, clean beauty, which is trending(assuming) with her target segment; taking the brand beyond the celebrity.

Quadrant 2: Very High No. of Followers on Social Media and Highly Innovative Brand Idea

Fenty Beauty by Rihanna and Rare Beauty by Selena Gomez fall under this category. Fenty’s purpose is also a cause: inclusivity and beauty for all, and Rare Beauty is championing mental health with the brand idea of self-acceptance.

Quadrant 3: Low to Medium No. of Followers on Social Media and Low Innovation in Brand Idea

ProDNA by Paris Hilton is placed in this quadrant with 14.5 million followers for Paris on IG. Even though Paris is an iconic socialite, the brand neither takes after Paris’s style or personality nor has a very innovative brand idea beyond a patented formula. The fact that the brand has close to 50K followers on IG proves that it badly needs to move from this quadrant.

Quadrant 4: Low to Medium No. of Followers on Social Media and a Highly Innovative Brand Idea taking the Category Further

Goop, The Honest Company, Victoria Beauty, Josie Maran, Haus Labs, and BaYou are in this segment.

When Gwyneth started Goop in 2012, she was famous but hardly had any social media/digital following, and even now, her following on IG is 7.5 Million.

Why am I talking about social/digital following than general awareness? Because social introduced communities and tribes and gave rise to the DTC brands, one of the most robust channels for the brands mentioned above. I have assumed that online awareness, especially IG, reflects their mainstream awareness.

Goop is a truly transformational innovation in that the brand idea is at the intersection of curated content+eco-system for innovative brands+clean lifestyle.

The Honest Company founder Jessica Alba has 19 million followers on IG now. She launched THC in 2011 after seeing whitespace in the market. She felt a lack of sustainable and clean products that are safe for kids. The brand idea of conscious living was way ahead of its times. Despite the controversies, the brand has done well and has now attracted a fresh investment of close to $400 million.

The Honest Company is an innovative, purpose-driven brand( but not quite purpose=cause with mass emotional resonance) that helped take the conscious and clean beauty category to the next level.

Josie Maran Cosmetics is at the lower left end of this quadrant. Why? The brand idea is around Argan Oil, which was innovative at the launch, but innovation centered around an ingredient is a lower order innovation, hence the lower-left corner of the quadrant.

Josie Maran Cosmetics has a meager 220K followers on IG, and the brand used QVC( mass medium) to grow their business over close to 20 years, which explains the relative success.

At the bottom of this quadrant is BaYou with Love, a sustainable, ethical, and recycled gold from technology, a luxury brand founded by Nikki Reed of Twilight fame.

Why is Haus Labs in the 4th quadrant and not the first? Because first, the brand is endorsed by but not named after Lady Gaga. Second, Lady Gaga’s personality and lifestyle values are beyond her edgy looks but are rebellious in general, never going out of fashion. Haus is incremental innovation, and that’s why it is towards the left corner of the 4th quadrant. That does not mean it is not a powerful brand.

Haus Labs does have an emotional promise but is not fully an emotionally transformed brand around a consumer insight beyond Lady Gaga’s personality & beliefs.

Now that we have placed the celebrity beauty brands on the matrix of celebrity’s online awareness vs. innovation in the brand idea, it is time to evaluate their performance.

Celebrity Beauty Brands Average Speed of Penetration of Emerging Market

I have calculated the average speed of penetration of emerging markets for these celebrity beauty brands using three different formulas.

The average speed of $ (revenue)penetration means the average growth rate of $ (revenue)/year.

I have divided the spectrum of celebrity beauty brands into three stopovers for each of the below charts.

At the left end are Purpose=Cause driven brands, the middle is the Innovation brands, and Celebrity Focused brands are at the extreme right.

Awareness & Penetration Assumptions

I made three assumptions to decipher whether a celebrity beauty brand has penetrated the emerging or the mainstream market.

1.If a celebrity beauty brand is between $200 million and $300 million in revenue in a year, the brand has penetrated the emerging market. It is at the cusp of the early mainstream market. If the brand has crossed $300 million in yearly revenue, it has just started to penetrate the early mainstream market.

2.Most of the celebrities are well known by mainstream consumers. For celebrity beauty brands with over 5 million IG followers, I assumed that the brand has some level of awareness in at least the early mainstream market.

3.I also assumed that the bulk of sales, close to 50%, is from the North American market.

a. The First Formula is ($) Average Revenue Growth/Year

Here is a clear pattern:

The range of the average speeds of revenue penetration ( average growth in yearly revenue) increases as we move from right to left from trendy to innovation to purpose=cause driven brands.

Another pattern is that the average speed of revenue increases from bottom to top for each stopover as follows,

-For the purpose=cause driven brands, the average speed of revenue penetration is much higher for brands whose purpose=mass cause with emotional resonance, like Fenty Beauty and Rare Beauty, compared to a niche cause with low emotional resonance for the masses, like BaYou with Love.

BaYou with love is a clear exception and could also be due to the founder’s self-proclaimed lack of ambition to become big, a niche category with not much focus on beauty, and relatively low awareness for the founder, Nikki Reed.

-For innovative celebrity brands, the average speed of revenue penetration is higher for incremental innovation or brands with personality than brands with a leap in innovation. For example, Haus Labs has a higher ($) revenue growth/year vs. THC and Goop vs. Victoria Beckham Beauty. Victoria Beckham Beauty is also priced in the luxury segment, further leading to a drop in average speed of revenue penetration.

-For (trendy) celebrity-focused brands, the average speed of revenue penetration is considerably higher for Accesselebrity brands, focused on celebrity ( looks, personality, etc.) at affordable pricing than on a market trend.

For example, Kylie Cosmetics and KKW Beauty, accesselebrity brands, have way higher average revenue speeds than Florence By Mills (clean category trend).

-Each stopover is further divided into two halves, with top half brands having higher awareness and relatively lower awareness in the bottom half.

Josie Maran is an exception to the abovementioned pattern, but her massive sales and highest speed of revenue penetration, within the innovation stopover, could be explained by the fact that the brand has been using QVC, a mass TV medium, since its inception. It is also the least innovative brand idea out of all in this stopover.

-Majority of these celebrity beauty brands are priced affordably right from the get-go.

b. The Second Formula is $ Revenue/Year/Celebrity IG awareness (which shows the same hierarchical order if I add Twitter followers to IG.)

In other words, the average speed of revenue penetration for a unit of celebrity’s IG awareness.

Why this chart?

To see the speed of revenue for a unit of celebrity’s awareness, discounting the impact of high absolute awareness of the celebrity on sales revenue and co-relating it to just the core brand idea maybe.

Nutshell: How “effectively” the celebrity’s awareness turns into average revenue growth/year for the brand.

There are three deviations from patterns observed in the chart a.

-The average speed of the revenue penetration/celebrity IG awareness increases from right to left, from trendy stopover to the other two stopovers, innovation, and purpose=cause.

But, amongst the Innovation and Purpose=Cause stopovers, there isn’t much difference in the speed of the revenue range, except for Goop.

Goop, THC, and Haus Labs have 3.65, 1.58, 1.49 scores for $ Rev/Year/IG followers versus Fenty Beauty’s and Rare Beauty’s scores of 1.54 and 0.63, respectively. Rare Beauty just launched in 2020, and that explains the low score because Selena Gomez has the second-highest Instagram followers behind Kylie Kardashian. I expect this score to rise close to Fenty Beauty in a year or so.

-Within the Innovation Stopover, the pattern is reversed versus the previous chart a, in that the average speed of revenue penetration for celebrity IG awareness( $Rev/Year/Celebrity awareness ) is higher for a leap in innovation vs. incremental innovation.

-In contrast to chart a, within the Trendy stopover, the beyond celebrity beauty brand, Florence By Mills, ranks higher than accesselebrity brands like KKW Beauty and Kylie Cosmetics.

For the Innovation and Trendy stopovers, the above difference between charts a & b is because of the absolute awareness of the celebrity. But, when we calculate the ($)Revenue/Year/Celebrity’s awareness, we get how productive was celebrity’s awareness in generating that speed, and we see the pattern reversed for innovation and trendy stopovers.

The above means that a leap in innovation for a celebrity beauty brand with low to medium online awareness would have a higher average speed of revenue penetration per unit of celebrity’s IG awareness.

Similarly, for celebrity beauty brands with high awareness, the percentage of light buyers is more. Hence, the average speed of revenue penetration per unit of celebrity awareness decreases because of both decreased $ revenue/consumer and a possible decrease in penetration.

A single exception is Josie Maran in the Innovation stopover with the highest ($)Revenue/Year/Celebrity IG awareness.

This is likely due to the QVC model used by the brand for over a decade with the mass medium of television, which makes online awareness of the celebrity irrelevant. Josie Maran’s Revenue is very high inspite of the insignificant IG followership of 220K, which also explains the high productivity of her IG awareness( followers).

c. The Third Formula is ($) Revenue/Year/Celebrity Beauty Brand IG Followers

Why this chart?

The above chart tells us the average speed of revenue(yearly) for a unit of brand’s IG awareness: a lower number means that the brand preference is low for trials to happen or that the average $ revenue/consumer is low.

The pattern is similar to chart a with slight deviations within the stopovers for Innovation and Trendy Stopovers.

The chart shows the productivity of brand awareness for a particular celebrity beauty brand.

There is a clear pattern here.

The conversion of a celebrity’s IG brand awareness into $ Revenues/Year decreases as absolute IG brand awareness increases, making a case for evolving the beauty brand and marketing strategy.

Why?

Because of the difference between the emerging market and the mainstream market consumer.

Emerging market consumers are innovators and early adopters, bolder, heavier buyers, and fewer in number. In contrast, mainstream consumers get conservative, increase in numbers, and are lighter buyers as a brand moves deeper into the market. (Link to Envied/brand growth strategy).

The problem is twofold!

Celebrity beauty brands with high awareness, Kylie Cosmetics for example, have crossed the “awareness chasm” from the emerging market into the early mainstream market. They cannot rely solely on novelty or celebrity awareness to convert the mainstream consumer into sales. So, they have crossed the awareness chasm but not the sales chasm!

Therefore, they need to evolve their marketing mix to improve brand preference.

The second issue is the decrease in average purchase value since the mainstream consumer is not as heavy a buyer as the early adopter.

The answer lies in increasing penetration significantly as there is more opportunity there than increasing revenue/purchase for the mainstream consumer.

-Kylie Cosmetics and KKW Beauty have switched places, and Florence By Mills has a slightly higher ratio vs. Kylie.

Again, Josie Maran’s numbers are skewed as the brand is heavily focused on QVC with hardly any online presence. That’s why I have not factored the brand here on the chart.

Also, Victoria Beckham Beauty and Nikki Reed are outliers because of their luxury pricing. Nikki Reed’s BaYou with Love is a bigger outlier because of a niche cause-driven brand.

I am not making umbrella claims, and there will be contextual drivers such as the goal and vision of the founder or the budgets deployed towards marketing. Still, the charts above show patterns considering the massive awareness levels that a celebrity already enjoys.

Analysis of Celebrity Beauty Brands Speed of Penetration of Emerging Market

Before we dive into the analysis, I would like to introduce two more charts-

Speed of Tribe Creation and Emerging Market Penetration Speed

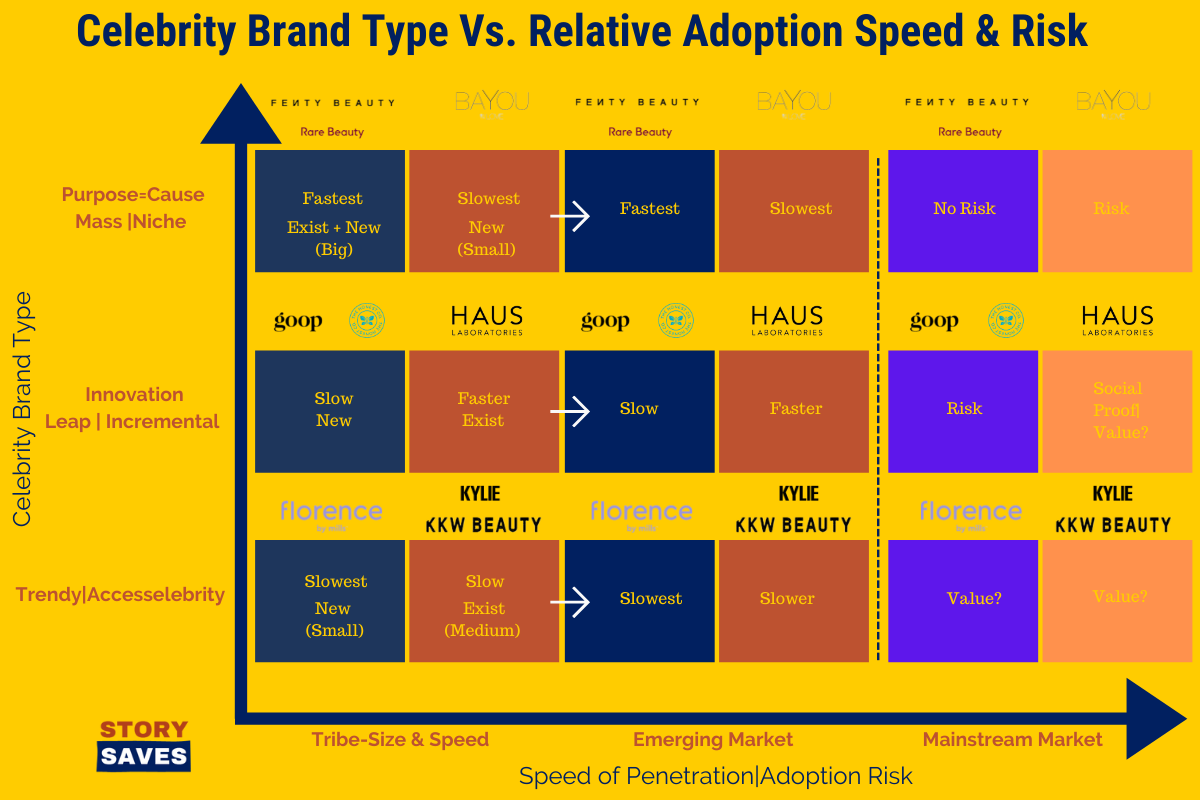

The above chart is a matrix plot between the size of existing celebrity tribe, motivated by the brand idea, and the size and speed of new tribe built around the brand idea.

Unlike other beauty brands, a celebrity beauty brand benefits from the existing celebrity super fans or tribe.

As the chart shows, for the fastest speed and size of tribe creation and consequent penetration of the emerging market, the brand idea should motivate a big existing celebrity tribe and a big new brand tribe beyond the celebrity.

Purpose=cause with mass emotional resonance achieves the fastest speed of tribe creation and emerging market penetration.

Fenty Beauty and Rare Beauty are prime examples.

The second-fastest speed of the emerging market would occur when the existing celebrity tribe is big and is motivated by the brand idea even when the new brand tribe potential to be motivated by the brand idea is small. This is because leveraging an existing tribe is faster than first creating and then leveraging a new tribe.

Haus Labs is an example of the above because of being an incremental innovation brand.

The above logic also explains the slow speed of penetration of the emerging market for small existing celebrity tribe and big new tribe potential for the brand idea.

Goop and The Honest Company are examples of the above as they are both leap innovations.

And, the slowest speed of penetration for the emerging market is when both the existing celebrity tribe and the new brand tribe that could be motivated by the brand idea are small.

Florence by Mills is an example of the above phenomenon. A small section of MBB’s existing tribe bought into the idea of clean beauty for their age group, and another small group of the tribe was motivated outside of her follower base.

Chart e applies chart d for three stopovers I discussed earlier for celebrity beauty brands.

I will use charts d & e along with the above observations for the analysis:

1.For a celebrity with a medium to high relative awareness level, it makes the most sense to create and launch a purpose=cause driven brand with emotional resonance for the masses to break through the emerging markets fastest and reach the mainstream consumer.

($) Revenue/Year and Productivity of Awareness =($) Revenue/Year/Celebrity IG awareness or Brand’s IG awareness is likely to be highest for the purpose=cause driven brand.

Launching at affordable pricing ensures this high productivity.

Fenty Beauty and Rare Beauty are prime examples. The consumer insight should resonate with the masses for the purpose=cause to deliver the highest average revenue/year and high productivity of IG awareness, brand, or celebrity.

The above option is also no risk for mainstream trials and adoption.

2.The next best option, with low to medium celebrity awareness, is to launch an innovative beauty brand versus an accesselebrity or trendy brand.

The second chart with Innovation stopover confirms the product innovation adoption theory, as explained above in Chart b of Average Speed of Penetration of Emerging Market.

That’s why leap innovations like THC and Goop perform better on revenue/year/celebrity IG followers vs. Haus Labs.

Leap in innovation combined with low celebrity awareness delivers a higher conversion rate into sales. If the brands with low celebrity awareness had taken the incremental innovation route, the conversion would not have been this high as the heavier buyers would not have been that fascinated, and there aren’t many light buyers to compensate.

Similarly, if celebrities with high awareness had gone with a leap in innovation, the average speed of revenue=$ Revenue Growth/Year would have been slower since the heavy buyers would have bought the brand but the very high number of early adopters and even higher number of light buyers, who are existing followers, would not have converted this fast and the overall revenue/year and revenue would have suffered.

Though a leap in innovation has a higher degree of risk generally, for a celebrity, even with guaranteed exposure to all the innovators and early adopters, and networks and money in place, going with incremental innovation is a short-term game even for brands with high awareness.

The advantage of incremental innovation for celebrity brands, with high celebrity awareness, is that the risk of failure because of non-adoption of an innovation is lower, for the early adopters in particular. Once the brand penetrates the emerging market, it could always reinvent itself for the masses.

Charts d & e confirm the above explanation as a leap innovation for a celebrity with low to medium awareness would primarily have to create a new tribe for the brand idea whereas an incremental innovation could leverage existing celebrity tribe for faster penetration of the emerging market.

But, once celebrity brands reach mainstream awareness, incremental innovation brands will experience a decline in the productivity of awareness into revenue(trials) and a considerable drop in average sales/consumer, and difficulty retaining consumers due to marginally better value or none for the mainstream consumer.

The risk would be more on the penetration but not the average sales/consumer or loyalty for the leap in innovation celebrity beauty brand.

Thus, either the incrementally innovative or trendy celebrity brand needs to reinvent itself for the mainstream or risk fading into oblivion, as the emerging market consumer has fastly shifting loyalty.

3.High celebrity awareness does not guarantee the speed of penetration, as is evident from the case of Kylie Cosmetics and KKW Beauty. Both are only second in awareness to Rare Beauty founder Selena Gomez.

Still, since the brands are celebrity-focused at affordable prices, it seems the brands lose appeal to all those followers or aware consumers who are not die-hard fans of Kylie and KKW’s looks, despite the highest and third-highest IG brand awareness out of all the celebrity brands.

Looking at charts d & e, we can see that accesselebrity and trendy celebrity beauty brands have slower and slowest speeds of penetration respectively of the emerging market.

For accesselebrity brands, all existing celebrity fans don’t become brand fans and there is not much motivation for the new brand tribe.

For trendy celebrity beauty brands, like Florence By Mills, which offer nothing innovative over other startup beauty brands, the speed of penetration of emerging market is the slowest.

Because only a small number of existing celebrity fans would be motivated to champion the brand idea and there is little potential to create a big new tribe for the core brand idea.

Victoria Beckham has an unusually low speed of penetration because of being an outlier due to luxury pricing and category, with fewer consumers as a result.

4.There is a difference in a celebrity’s IG awareness and a brand’s IG awareness. It takes time for celebrity awareness to translate into brand awareness or even otherwise for the brand awareness to develop since it is much younger than the celebrity.

($)Revenue/Year/Brand IG awareness decreases with an increase in brand awareness, which takes time, and these brands with lower ratios do much higher absolute revenues than those with low IG brand awareness.

e.g. Rare Beauty > Fenty Beauty, Haus >THC/Goop, and FBM>Kylie.

As mentioned in chart c, all celebrity brands are slowing their conversions down as they enter the mainstream market. They need to rethink beyond their celebrity endorsement and evolve marketing strategy.

Non-innovative and celebrity-focused brands could experience a decline in trials $(Revenue)/Awareness because of the lack of value to the mainstream consumer beyond the token celebrity brand. Also, the repeat purchase and loyalty could be lower.

Celebrity-focused brands would need reinvention, focused change in the marketing mix, or emotional transformation.

For leap in innovation brands, the risk of trials by the emerging market will be marginally higher for early adopters but significantly higher for early mainstream consumers, resulting in slower trials by emerging and mainstream markets.

But the loyalty and average purchase by consumer would be higher vs. incremental innovation. To overcome the risk of trials, the leap innovation brands could transform themselves emotionally, or change the marketing mix towards social proof.

Celebrity Beauty Brand Strategy Recommendations by Stopover

Purpose=Cause Stopover

a. Purpose=Mass and Emotional Cause

Fenty Beauty

Current Situation

With revenues close to 600 million dollars, assuming the majority coming from the USA, the brand has already gained awareness and some penetration in the early mainstream market.

Objective

Continue sales growth in existing markets and improve profitability.

Strategic Recommendations

-Build and Leverage Brand Idea for Trials with Brand Preference for Penetrating Early Mainstream Market

With high awareness and good penetration in the early mainstream market, further penetration requires focusing on brand preference for trials and ensuring the leak from the awareness to trials is minimal.

How to build brand preference?

Social Proof

Only awareness works if the target segment values sheer novelty. For brand preference, social proof in communication and distribution would help for the early mainstream market.

e.g. Fenty could provide social proof by city on their website and social media with testimonials of local consumers.

Focused Distribution in Mainstream Channels

For awareness to result in proportionate trials, Fenty must build out distribution to communicate Fenty’s social success to the consumer, inducing trials.

Of course, Fenty should pick retail partners that are a fit and will support the brand like Sephora.

Fenty could target other specialty discovery stores focused on beauty like Space Nk before fashion and lifestyle multi-category department stores.

Content Campaigns around Fenty’s Purpose( The Why)

Fenty should start creating content campaigns around its purpose of inclusivity by leveraging the brand tribe to create further awareness. Why? Because the early mainstream consumer is conservative compared to the early adopters, emotional resonance would result in brand preference, trials, and higher loyalty for both the early adopters and mainstream consumer.

-Leverage Clara Lionel Foundation

Fenty should align Clara Lionel Foundation with the core promise of inclusivity. Beyond raising donations, the brand should actively make contributions to the causes (I am sure it already does). In addition, Fenty should then show the progress of initiatives in promoting inclusivity by education, health, and emergency response programs, and share this content on social for building brand preference emotionally, cost-effectively, and strategically.

As of today, most of the impact numbers are from 2017 on the website. Clara Lionel Foundation should become a living and breathing website with progress and impact shown weekly, and daily on social media.

The above strategy would increase awareness disproportionately across the mainstream market as well.

-Improving Margins( NMC=Net Marketing Contribution) with Consumer Loyalty and Lift

Fenty should not forget to focus on consumer retention and increasing NMC as a result in the mad rush to increase market share and penetration.

Why? Cause the brand is penetrating well anyways, and with entry into the mainstream, loyalty starts to gain importance.

Increasing NMC means higher profitability meaning higher investment in business drivers, creating a virtuous cycle to aid further penetration.

For retention, the brand needs to create a loyalty index for each consumer and then classify them into tribe(super fans), loyal, repeat, captive, new, and unprofitable consumers.

Each category of consumers would require its strategy to grow the loyalty index and overall loyalty index leading to higher profitability for the brand.

*Improve Perceived Value Vs. Other Mainstream Brands

For the current line of products, whether beauty or skincare, Fenty could work on increasing the perceived value of the products/brand without decreasing price, versus the other mainstream, mainly challenger, brands.

*New product launches could target moving the consumer from one loyalty class to another.

Rare Beauty

Current Situation

With revenues over $60 million in its first five months of launch, the brand is on-trend to reach close to $200 million in 1 year. The next stop is to target the emerging market worldwide. With securing Sephora distribution globally, Rare Beauty is well on track to emulate Fenty’s success in the emerging market, globally, with a focus on North America.

Objective

Continue to grow sales, focusing on penetrating the global emerging market.

Strategic Recommendations

-Build on Brand Idea to Leverage Tribe for Massive Leap in Awareness & Penetration of Emerging Market

Rare Beauty’s speed of penetration is almost at par with Fenty’s because Purpose=mass and emotional cause drive them both. But the number of IG followers for Rare Beauty is almost 1/5th those of Fenty, partly cause it launched less than a year ago.

One of the strategies could be to launch a campaign with the brand idea of self-acceptance (mental health), leveraging real-life content generated by the hardcore tribe for massive awareness via engagement, which would result in even faster penetration of the emerging markets.

-Transparency on Rare Impact Fund’s Progress and Contribution

Rare Beauty is committed to expanding mental health services in educational settings, focusing on underserved communities.

Instead of mentioning 1% contribution, I would recommend the brand start sharing progress on funds collected, contributions made, and the impact so far with stories of real people.

The brand has an opportunity to be seen as a leader driving the change in the mental health space. Rare Impact page on the website already does an excellent job of that.

-Build Focused Distribution in the Discovery/Emerging Market

While I write this article, the brand just got accepted into Sephora, which will further increase the speed of penetration( average revenue growth rate/year).

For launch at Sephora, Rare Beauty could create a positive mental health experience at the point of sales and Rare Beauty’s website. The intent is to wow the early adopters, learn and create content for creating awareness leveraging user content globally, and increase the $ revenue/heavy buyers(early adopters).

Purpose=Niche Cause or Low on Mass Emotional Resonance

BaYou With Love

Current Situation

With $5 million in annual revenues, BaYou has only managed awareness and a bit of sale in the emerging markets, and that too mainly with innovators.

Objective

The founder, Nikki Reed, has claimed that she wants to remain a purpose-driven, small brand and has no aspirations to become big. The goal could be to increase profitability and reinvest in the brand for a better position(margins) and making a more significant difference to all stakeholders, with a clear focus on women, local artisans, and the environment.

Strategic Recommendations

-Transform into an Envied Brand with a Unifying, Emotionally Transformed Brand Idea to Develop an Ardent Tribe for Compelling Content, Stories, and Dialogue:

BaYou with love has many strategic initiatives driven by their core purpose=cause of sustainable, ethical fashion and production. The brand must transform itself into a unifying brand idea that brings sustainable and ethical fashion and production, women, local artisans, custom jewelry together into one simple yet moving, core brand idea.

The compelling brand idea applied to all touchpoints would transform BaYou with Love into an Envied Brand(link).

-Stories

The next step would be to have a dialogue with the tribe and source stories that amplify brand idea and engage the tribe in return for a tighter bond.

Right now, the consumer is not at the center of stories but influencers who champion sustainability.

BaYou needs to create stories around the ring and the role it plays in the life of a particular consumer. Topics could be: why she chose this ring, her aspirations, identity, etc., and the change it brought in her life, making the consumer the center of attraction and the story.

The story could be continuous for a consumer with the option to make them public or keep private, creating a long-term relationship, aligned with sustainability, making consumers want to have a long-term relationship with the brand. BaYou could then launch a subscription model.

These are the stories that would get shared on social media and would significantly increase the emotional appeal of the ring.

-Events

Create annual events with the fans wearing their favorite rings and jewellery, in Nikki’s California house, discussing sustainability, their personal stories, indulging in sophisticated and intellectual discourses with brand placement everywhere.

-Improve Net Marketing Contribution with Loyalty and Business model

BaYou with Love is only playing in the innovators and early adopters of the emerging market space.

On the positive side, these consumers are heavy buyers. To overcome the high cost of goods sold because of low volume, as cited by Nikki herself in an interview, the brand could introduce a business model to up the average dollar value/consumer.

BaYou could launch an annual subscription, for the luxury items, with sufficient lead time to source inventory.

One incentive for an annual subscription could be the potential and quantified impact on sustainability by that particular consumer and involving the consumer in the creative input for the luxury item.

-Transparency on Progress for “Story of a Stone”, “Sustainable Production” and “Conscious Sourcing”

BaYou needs to create metrics for each of the above sustainable initiatives and then show progress with both numbers and visuals.

For example: For the Story of a Stone, show the cumulative and quantified impact on carbon neutrality, visuals on the process of 100% hydropowered diamonds etc.

Transparency on progress could be linked to a loyalty program like that of Ten Tree, to make it resonate with each consumer as aggregate numbers don’t move consumers that well.

Innovative Stopover

a. Incremental Innovation Brands

Haus Labs

Current Situation

With revenues close to $141 million in a little less than two years, Haus Labs has done exceptionally well for an incremental innovation built around Lady Gaga’s personality and beliefs, beyond merely her looks. The brand is still in the emerging market with awareness and penetration, mainly amongst early adopters.

Objective

Increase speed of penetration of the emerging market to reach early mainstream faster and improve profitability

Strategic Recommendations

-Increase the IG/Social Brand Followers by Emotional Transformation into an Envied Brand

Haus has the highest $ Revenue/Year/IG brand followers of all the celebrity beauty brands studied for this article.

With the lowest conversion of Lady Gaga’s IG followers into IG brand followers, along with one of the lowest number of brand IG followers, it is safe to assume that only hardcore fans of Lady Gaga have become the brand’s IG followers. That could also be the reason for the high productivity of Haus Labs’ IG followers.

This means the brand needs to build awareness and penetration of early adopters and early mainstream beyond Lady Gaga’s hardcore fans.

Transform the brand emotionally to resonate with the target consumer beyond the personality and beliefs of Lady Gaga.

Launch a content-based campaign around the emotional transformation to increase brand’s awareness leveraging the hardcore tribe.

-How to Transform Emotionally into an Envied Brand?

Two ways

a. Move towards the Purpose=Cause Stopover

By incorporating the why behind “Born This Way” into the core promise of Haus Labs, “Making Kindness cool to overcome mental health amongst youth” and aligning all touchpoints, including content and product development, with this promise.

This strategy would ensure resonance with masses beyond the emerging market and offer the highest speed of penetration of the emerging market.

b. Emotional Transformation For The Identified Target Consumer

Transform Haus Labs by overcoming the emotional enemy of the target consumer, with a core emotional promise. Apply this core emotional promise to all touchpoints, including website, packaging, consumer service, new product development, etc.

The above would increase the conversion of IG followers, beyond hardcore fans, of Lady Gaga into brand followers and convert them into buyers.

And also resonate emotionally with the mainstream consumer for both trials and loyalty.

Option “a” is better if the celebrity has leverage with very high mass awareness and relevance. Why? Because the world also sees it as the celebrity giving back!

Haus could go either way.

Watchout

Haus Labs has an above-average speed of penetration of emerging market and productivity of celebrity and brand’s IG awareness. But, as mentioned in the analysis, and explained by charts d & e, it would only take the brand through the emerging market. It would result in a drastic reduction of trials & loyalty in the early mainstream market because of lack of value or emotional resonance.

Transforming the brand emotionally into an envied beauty brand now, when it is still in the emerging market, is a much better strategy than waiting for the stalled sales to happen.

The brand would otherwise struggle to go past $200-$300 million, as is evident from most other celebrity brands’ revenues.

Leap Innovation Brands

The Honest Company

Current Situation

THC does close to $300 million in revenues with an average revenue speed of $30 million/year over ten years. The brand has penetrated the emerging market and is at the cusp of the early mainstream market.

Speed of penetration of emerging market=slow relative to Haus(incremental innovation), and this also explains the low IG followers for the brand at 1 million.

The low speed of penetration was because the brand was a leap in innovation when it launched, as explained in the analysis section above with charts d & e.

Haus Labs has acquired fewer than 1 million followers on IG within less than two years of launch, whereas it took The Honest Company close to 10 years to reach 1 million followers.

Objective

Achieve early mainstream awareness & increase avg. revenue growth rate( speed of penetration)

Strategic Recommendations

-Emotionally Transform The Brand into an Envied Beauty Brand

THC speaks about “empowering people to live happy and healthy lives.” It targets mothers with all the different categories. The Honest Company needs to transform around an insight that resonates with mothers and then apply the core emotional promise to all touchpoints.

Alternatively, it could transform into a purpose=cause with mass emotional resonance driven brand.

-Leverage Brand Tribe to Create Awareness Campaigns Focused on Social Proof

The early mainstream market looks up to others in their professional or social circles before buying a new brand. The awareness campaigns should touch upon social groups for a particular location to generate social proof.

-Use the core brand promise to create a brand tribe and then leverage them to spread awareness cost-effectively. The mainstream market is more likely to buy into an emotional brand idea that resonates personally than a functional idea that is a leap from their consumption inertia.

-Distribution for Increasing Average Revenue Growth/Year & Social Proof

$30 million is not a very high average revenue increase year on year. Gaining massive distribution with leading retailers would help the brand increase the speed of growth. THC already sells through national retailers like Walmart and Target etc.

-Build Brand Preference by Increasing Perceived Value Vs. Challenger Brands using Pricing Strategy

THC could increase the perceived value of the products/brand without decreasing price for the current product line, versus the other mainstream challenger brands.

GOOP

Current Situation

Goop does close to $250 million in revenues with an average revenue speed of $27.77 million/year. As a rough estimate, the brand has just started to create awareness in the early mainstream market.

The brand seems to have a vast assortment of content and products in multiple categories, with awareness & penetration limited to the emerging market, clearly following the “improving the margins/competitive position strategy.”

Objective

Achieve early mainstream awareness & increase avg. growth rate (speed of penetration) and further improve margins and competitive position-Loyalty

Strategic Recommendations

-Leverage Brand Tribe: Consumers and Partners to Create Awareness Campaigns Focused on Social Proof

It seems that GOOP does not want to sell through other online portals, explaining its own marketplace; therefore, it could focus on becoming the discovery destination for clean brands by evolving the marketplace.

GOOP should create a partnership program with all its vendors leveraging their resources to create further awareness for the GOOP brand and portal within the mainstream market.

The above means, in addition to generating reach for GOOP on the social platforms of the partner brands, who are again playing in the emerging market, GOOP should leverage this partnership to reach the mass market either with mass media or online marketing campaigns with massive reach.

The above strategy would create substantial social proof and help penetrate the early mainstream market.

-Distribution of Content for Awareness for GOOP

The brand has a massive assortment of rich content and products across various categories but hardly any distribution beyond its own media. Goop needs to create and execute a content distribution strategy beyond its own channels or create paid campaigns to increase the reach of the enormous content.

The content campaign could be on “why Goop partners with the particular brands” and “what Goop stands for” as the core message.

-Transform GOOP Emotionally into an Envied Beauty Brand: Evolve “Discover Content+Clean Beauty+E-commerce Platform” with all the Product and Content categories into a Single Brand Promise that Resonates Emotionally with the Consumer

GOOP does have a brand promise of “discovering the latest content and products in clean beauty, wellness, and lifestyle.”

The issue is that the current content distribution on own portal and selling on own portal has a limited reach that is growing at a slow pace.

You need to reach the relatively conservative market, early mainstream.

Emotionally transforming the core brand promise & all touchpoints, including content, would enhance the reach into the mainstream market for all things GOOP sells on its portal, inducing brand preference for the mainstream consumer, and even increasing loyalty.

Feature early adopters and early mainstream consumers in your campaigns to generate the feeling of social proof for the mainstream consumer.

Trendy Stopover

a. Accesselebrity Brands

KYLIE COSMETICS

Current Situation

Kylie Cosmetics does close to a little over $200 million in revenues (including skincare) with an average yearly growth of over $30 million( average speed of penetration). Kylie Cosmetics has the highest number of IG followers, amongst all celebrity beauty brands, at around 25 million. The brand has poor relative productivity of IG awareness. With one of the slowest penetration speeds of the emerging market, lack of value to the mainstream market, and lack of a brand tribe beyond the celebrity, the brand needs a step-change in strategy.

Most of the other celebrity brands aren’t as well known in the mainstream market, or if they are, the conversion of awareness into revenues is not that abysmal.

Kylie Cosmetics is stuck in the emerging market.

Please note: Kylie Cosmetics revamped the brand around clean and vegan, which was not the best possible move! I assume that Coty saw over 200 million followers of Kylie on IG and over 25 million for her brand, and thought that riding the clean, vegan trend would help increase the conversion of followers into sales. Wrong move, as shown above by charts a to e and the subsequent analysis.

Objective

To convert the awareness of early mainstream consumers into trials and adoption. The brand is at a high risk of going into oblivion soon as both $ revenue speed and productivity of awareness into revenue are some of the lowest.

Strategic Recommendations

-Build Brand Preference

Kylie Cosmetics has substantial awareness in the early mainstream market, assuming most of her IG followers are from the US.

But, the conversion of brand’s IG awareness into revenue is the poorest of all celebrity brands. To overcome, Kylie Cosmetics needs to use social proof in the marketing communications, distribution in more discovery store chains, beyond the Ultas of the world, and sell through muti-category mainstream retailers.

-Reinvent into an Envied Beauty Brand-Transform Emotionally

Kylie Cosmetics and Skincare are leaving money on the table by creating accesselebrity beauty brands and not venturing beyond Kylie’s looks and hardcore fans. The brand should reinvent itself as a Purpose=Mass Emotional Cause driven brand or transform itself around an emotional consumer insight for stronger resonance.

It does not make sense to go for a leap innovation for the master brand having already penetrated the emerging market to some extent. As shown in charts d & e, leap innovation would mean creating a new tribe and slower penetration of the emerging market again.

In contrast, with a purpose=mass emotional cause-driven brand, Kylie Cosmetics would leverage most of the existing tribe and would build a big new tribe fastest. A massive brand tribe would help penetrate the rest of the emerging market at breakneck speed, reducing the risk and increasing the brand preference with the already aware mainstream consumer.

KKW BEAUTY

KKW Beauty did close to $100 million in revenues at the end of 2020 with a revenue speed of $27 million/year. The brand has 5 million IG followers and again one of the most subpar revenue speeds and conversion ratios of IG awareness( celebrity or brand) into sales.

Current Situation

KKW Beauty is struggling to penetrate the emerging market as there is hardly any novelty or value, leap or incremental, to the emerging market consumer beyond the hardcore KKW fans.

Objective

To wow and win the emerging market

Strategic Recommendations

–Reinvent as Envied Beauty Brand

KKW Beauty could reinvent itself as purpose=cause with mass emotional resonance, transform itself emotionally around a consumer insight or even go for a leap innovation as it has not yet quite penetrated the emerging market. For the fastest penetration of emerging markets and leverage existing mainstream awareness, KKW should go for a purpose=mass cause-driven brand. This strategy gets the highest support from innovators and early adopters beyond the beauty category.

Unlike Kylie Cosmetics, KKW Beauty does not need to work on brand preference for the mainstream market yet and should build a new tribe comprising the existing KKW tribe and new tribe for the brand idea.

b. Trendy Celebrity Brand

Florence By Mills

Current Situation

FBM did a meagre(:)) $16 million in the second year of its launch and has the lowest revenue speed of all the affordable brands. The conversion of the celebrity’s IG awareness into brand awareness is average but is likely to go up. Productivity of brand awareness is in line with other celebrity brands on the trendy stopover.

The biggest concern is the speed of revenue/year. The brand has little penetration into the emerging market.

Just clean beauty has not worked its magic for FBM. The brand is neither a leap in innovation over other clean beauty brands nor takes after the founder’s unique personality/values beyond targeting the consumer in her age group, who is not a big spender on skincare.

FBM seems to have struggled to convert Millie’s hardcore fans into brand fans or did not have the hardcore fans like Kylie and KKW.

FBM needs to uncover the “insight” stopping her demographic from skincare before working on a trend like clean.

Also, the slightly older age group does not resonate that well with Millie Bobby Brown’s and Florence By Mills’ teenage personality and energy.

Objective

Increase the speed of revenue/year=average growth of revenue/year by both improving conversion of FBM’s brand awareness into sales and increasing the brand’s IG awareness.

Create a hardcore tribe around the brand idea.

Strategic Recommendations

-Reinvent as an Envied Beauty Brand and Create a Fresh Brand Tribe for the New Brand Idea

Two options:

Purpose=Cause with Mass Emotional Resonance-

Instead of aligning the brand with Millie Bobby Brown’s personality, it is better to reinvent as a purpose=mass cause (emotional resonance) driven brand for the fastest penetration of the emerging market.

E.g., Gen Z is exceptionally socially conscious. Creating a purpose=cause driven brand around the promise of social equality is likely to result in massive awareness and preference for the brand, with support from influencers and early adopters like press, retailers, IG influencers, etc. The brand will speed through the emerging market at comparable speeds to Fenty Beauty and Rare Beauty.

Emotional Transformation around a Consumer Insight-

Gen Z does not have too many brands targeting them. One of the reasons, as mentioned before, is the lack of understanding of this consumer segment’s skincare needs.

FBM could transform the brand around an emotionally resonant consumer insight, keeping the category for this age group from developing.

Common Challenges & Recommendations For all Celebrity Beauty Brands

-Failures can impact celebrity status hence the tendency to avoid disruptively innovative brand idea.

This is more a fear than a real challenge. Rightly done, a leap in innovation would increase a celebrity’s awareness and also diversify risk.

-Fickle Celebrity Status

Celebrity status is fickle and could easily slip away. This further makes a case for rooting the brand in a purpose=cause with mass emotional resonance to penetrate the emerging market at the highest speed possible.

A purpose=mass cause-driven brand would also keep the celebrity relevant. As mentioned before, the world expects the celebrity to give back!

Conclusion

It has never been easier for a celebrity to encash their fame leveraging their digital followers and the power of their hardcore community.

The motivation to launch a beauty brand could range from monetization in the short-term leveraging their awareness to building a brand bigger or different than their celebrity profile or status for the long-term.

The counter-intuitive truth is that putting a stake in the ground and creating a purpose=cause driven brand that resonates emotionally with the masses to leverage mass awareness offers the fastest penetration of the emerging market with the highest revenue speed(per year) and absolute revenue. Examples are Fenty and Rare Beauty.

On the contrary, designing the brand around celebrity’s looks and their hardcore fans results in a relatively slow penetration of the emerging market. Examples are Kylie Cosmetics and KKW Beauty.

The second-best option for high awareness celebrities would be to create an incremental innovation around the personality and values of the celebrity that resonate with the consumer like Haus Labs than to create a brand around the celebrity’s looks or only around a category trend like clean beauty.

A celebrity with or without high awareness could also create an emotionally resonant brand around a consumer insight and have a very high speed of penetration of emerging market and mainstream market.

For a celebrity with low awareness, leap innovation could achieve high revenue per awareness, but the speed of penetration would be way lower than with a purpose=mass cause driven brand. Goop and The Honest Company are typical examples.

The emerging-market penetration speed is driven by the size of existing celebrity tribe motivated by the brand idea and the potential speed and the size of new tribe formation for the brand idea.

For a leap innovation, the new tribe will matter more and take time to be created and leveraged.

In contrast, for a purpose=mass cause-driven brand, the size of the existing celebrity tribe motivated by the brand idea will be big. Also, the new tribe’s potential for size and speed of build would be huge, therefore offering the highest speed of penetration of the emerging market.

For incremental innovation around a celebrity’s personality and values, like Haus Labs, the existing celebrity tribe for the brand idea would matter, offering high speed of penetration of the emerging market.

For trendy celebrity brands, around a celebrity’s looks like Kylie and KKW, the existing tribe for the celebrity matters much more, but not all would be motivated. And, hardly any new tribe would be motivated by the brand idea, explaining the slow penetration of the emerging market.

For mainstream success, purpose=cause driven brand offers the highest potential because of both emotional resonance and relevance of products for the masses without any risk of trial or adoption.

Leap innovation offers higher risk of trials in mainstream and incremental innovation offers low emotional resonance and value to the mainstream.

Reinvention as an envied beauty brand around an emotional consumer insight to penetrate the mainstream or loyalty strategy would help leap innovation celebrity brands.

For brands around the celebrity looks, like Kylie Cosmetics & KKW Beauty, mainstream offers the challenge of lack of emotional resonance and perceived value and hence need for reinvention into an envied beauty brand around purpose=emotional mass cause or an emotional promise around a consumer insight/enemy.

Both Long-Term and Short-Term point towards a celebrity beauty brand driven by a cause that has mass resonance, especially if you have massive awareness that stretches across the mainstream/mass market. Equally powerful would be a celebrity beauty brand built with a core emotional promise around consumer insight.

Feel free to share your thoughts on the analysis and recommendations?

Also, subscribe for once a week or twice a month email newsletter on validated frameworks and strategies to grow your beauty brand.

TRANSFORM INTO AN ENVIED BEAUTY BRAND

For The Next Phase of Profitable Growth!

ROHIT BANOTA, Founder of StorySaves, has transformed dozens into envied beauty brands for the next phase of sharp and profitable growth, during pre(launch), early stage or even stalled growth stage of business.

He has over 17 years of marketing and business experience growing consumer packaged brands including with startups and MNCs like P&G Beauty and Grooming.