Ep.4-Part 1: Beauty Brand's Full Guide to Seed Fundraising

Beauty startups need inventory. They need to hire people, and more importantly, they need to grow. Every startup in its journey reaches a stage where it feels the need for capital. Similarly, funding for a beauty brand can help a great deal. One of the reasons beauty startups never scale up is they never put a deadline for when they want to initiate the hyper-growth or scaling up of their brand, and they see newer brands with similar or slightly evolved or sometimes even exactly the same ideas, grow right past them and become big and iconic beauty brands.

You can totally bootstrap, And that’s a separate discussion. But in today’s episode, I will speak about how a beauty brand can raise seed funding when it’s doing between a hundred thousand USD to a million-dollar USD in annual revenues and get ready for hyper-growth. I’m going to talk about my experience working with beauty brands and advising them on how to raise funding and do it the right. I have listed my experience working with and advising beauty startups at Jump Accelerator and also have learned what are the best practices when it comes to raising money for early-stage beauty brands.

There is a method to the madness of raising funds. I will talk about the sequential process of fundraising, explaining the terminology frameworks, and also cite a few resources that will be of help to you.

State of Funding For Beauty Brands

First, a little background on funding in the beauty industry.

In the last four years, the amount invested in beauty has increased by three times.

With close to 2 billion, raised in 2021 in approximately 200 deals by beauty brands.

Kaitlyn Strandberg is a partner in a VC firm, Lerer Hippeau, which has invested in a skincare brand called Topicals, and a wellness brand called Cure Hydration. She says that this industry is now coming of age.

According to her, the M&A activity has picked up in the beauty industry, and also, the valuations are touching a billion dollars. She says, “This category is still not very well understood by investors, mainly because close to 90% of investors are men.”

Another VC firm, True Beauty Ventures, invests in beauty and wellness brands, for example, they’ve invested in a brand called Youthforia. Their co-founder, Cristina Nuñez, says that investors typically look for disproportionate returns in a very short period, something which is observed quite frequently in tech, especially for brands that, you know, raise a lot of funding and then scale up fast, but not as well observed in the beauty category. Also, beauty is very inventory intensive compared to some other sectors like tech, And that’s why investors might have traditionally shied away from it unless and until they saw some very good traction.

Why Raise Money or Funding for a Beauty Brand?

Let’s talk about why a beauty brand, why would a beauty brand need to raise money. Let’s be clear, even without outside funding or capital, a beauty brand,

a startup beauty brand, or an early-stage beauty brand can still make it to $10 million USD, but it might not grow that fast, and it is likely to hit a plateau. Beyond 10 million when the growth stage really happens, and you need to scale up, you would need money for the paid acquisition, for inventory, for hiring a team, and also for supporting retail channels or any other channel for that matter, because now you want to scale up big and fast.

You can still do up to $10 million on your own. It might not be that fast, and you might face many issues with cash, et cetera, but it is still possible.

I have worked with brands that have gone up to USD 10 million and sometimes even beyond without raising any money from venture funds.

The real reason to raise funds, by the way, Venture is not the only option to raise funds, but since we are talking about seed fundraising, the only reason or the real reason to raise funds is for the speed of growth and if you want to become a high eight or nine-figure beauty brand with or without an exit, and if you do not grow fast enough, someone else will.

It is much more “important” to grow profitably than to sacrifice profits for the sake of growth. Having said that, a lot of venture funding typically happens in those scenarios where you will not be profitable during that phase when the venture money is being poured in, and hence the speed of growth. But that doesn’t mean that you cannot do it. I know of brands, for example,

Hero Cosmetics, a brand acquired for over USD 600 Million a month or so back, was always profitable throughout its growth.

I am talking mainly about venture capital or angel funding in this episode, but that doesn’t mean you have to raise money from outside.

You can still make do with cash management.

Also, as I said before, venture is not the only source of “funding”. There are many other ways you can raise money for your startup without diluting your equity. While there are a lot of investors out there who want to invest their money, the not-so-good news is that fundraising is an excruciatingly long, tiring, and complicated process, especially for women-led beauty brands, considering only 2.5% of women-led beauty brands ever get funded.

Mainly, and this is my assumption, Because, it’s a pretty safe assumption, 90% of investors are men who do not understand the category that well.

Having said that, if you’re determined to fundraise, if you have done your homework well, and you’ve got an idea that is truly extremely incremental or disrupting the category, and you can make that argument very convincingly, persuasively, for sure, you can make it happen!

When & If to Raise Money or Funding for a Beauty Brand?

So when or if to raise, Raise money? Only when it’ll give your startup beauty brand or early-stage beauty brand a clearly defined edge and vice versa to the investor.

Raising capital is not the biggest indicator of a startup’s or an early-stage beauty brand’s success. Traction is the biggest indicator of your beauty brand’s eventual success.

In the words of Paul Graham, the founder of Y Combinator, silicon valley based accelerator that mainly focuses on tech, they also fund and accelerate CPG brands, including beauty and skincare brands. According to PG, “Raise only when taking money from a fund can accelerate your growth and your growth capabilities are such that it is likely to attract funding.”

Also, avoid getting into the fundraising game if you do not have a persuasive pitch yet. What do I mean by a persuasive pitch to the investors? Your pitch will be the most persuasive when you have validation for your value and growth hypothesis, these are the terms popularized by the Lean Startup author Eric Ries.

Value hypothesis means the reason your loyal consumers are so, and growth hypothesis means how you are acquiring new consumers. Validation for your value hypothesis means proving a causal link between any initiative around your brand that leads to higher consumer value, which leads to higher loyalty, and, ultimately, desired incremental profits for the brand. Validation for the growth hypothesis means proving a causal link between any tweaking you might do with your growth initiative and an increase in new consumer acquisition for your beauty brand.

The validation for the value and growth hypothesis has to be complemented by your big vision, the market opportunity, your ability to achieve it all packaged in a story.

CAVEAT

One caveat here, since we borrowed this concept of value hypothesis and growth hypothesis from the Lean Startup author Eric Ries, He also speaks about a minimum viable product, which works very well in the tech industry and can work to quite an extent, even in the beauty industry, if the brand is truly disruptive.

Or you can show radical functional value, A radical functional increment over the

products that the consumer is used to using, you can maybe go with a minimum viable product, both to early consumers and even to an investor, once you have some validation. But otherwise, I would not recommend, you know, unless and until, as I said, your beauty brand truly disrupts the category, meaning solving a problem that no one has solved. If your beauty brand is doing that, you can choose a minimum viable product for early consumers.

Get validation for traction, for value and growth hypothesis, and then approach,

Use this to approach the investors, I would not recommend it in other scenarios, meaning if you offer incrementally better functional value or, you know, if your solution is not that novel in nature, I would say that you package it as a complete brand to the early consumers. Then with the validation, you go to the investors, and I say this because of this prevalent thought that consumption drives emotion, not the other way around.

You cannot frame the challenge as the solution. Consumption is not happening because you do not have the money to advertise, or launch with big retailers; sorry, you do not have that money, and most likely, you won’t get it just because the odds are stacked against you. How many brands do get funded, I just spoke about only 2.5% of women-led brands get funded. Hence, your chances of success are way, way higher if you can create a beauty brand which is worthy of advocacy, even with the fact that functionally you might not be way, way beyond the existing solutions.

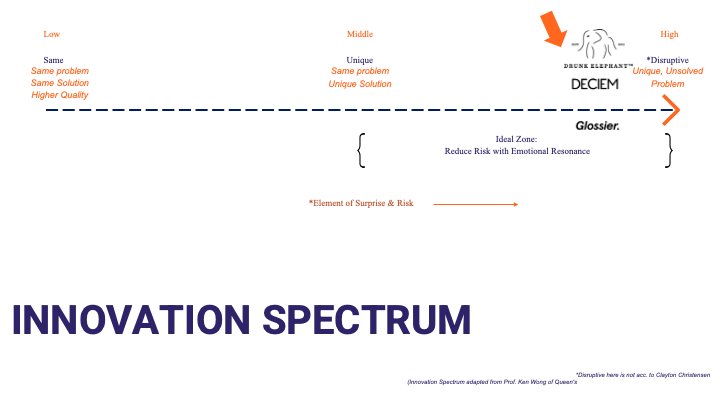

Here is the “INNOVATION SPECTRUM” chart where I explain how any beauty brand will be on a spectrum, either, from left to right, either you will solve a problem that everyone else is solving, and your solution has a higher quality, or if you go to the second stopover you, solve the same problem that other beauty brands are solving, but your the solution will be new, and the last stop, the third stop, is when you are solving a unique unsolved problem.

As you move between two and three, your chances of getting an investment or validation for both value and growth by early consumers and then taking that to the investors, your chances of doing so successfully Increase with a minimum viable product, that is, as you travel from two to three.

If you are between the first and the second stopover, I would recommend that you do not go with an MVP to either the lead consumers or the investors.

I hope I made my point.

How Much to Raise or Fund Your Beauty Brand?

Now, how much should you raise? What is the amount that you should? The amount to raise depends upon how far advanced do you want to be by five years, or at least by three years, or the next milestone, whichever is sooner.

Four factors determine the amount that you want to raise.

1. Speed of Growth

First is your speed of growth. How fast do you want to grow versus the funding amount.

2. Credibility with Investors

Second is credibility with the Investors, you need to have multiple plans where

you show how different funding amounts will lead to different rates of growth and different futures for your beauty brand if you were to take the money.

But you have to be very confident in articulating that taking investors’ money will only increase the speed of growth you are poised to grow any which way. Using your growth and value hypothesis, you could create three different scenarios.

They could be most likely, best case scenario, and minimum acceptable scenario for your brand, and tie them to different levels of funding years and business results.

You “will ask” for the cost of achieving those business results, by a certain time, you are not going to ask money to take accountability for the results that you want to achieve; you will ask for the cost of achieving those scenarios, the cost of mainly people, inventory and investing in growth, whether it’s marketing, et cetera, for two, three, and five years.

Another reason to have multiple scenarios is to avoid rigid expectations of results. The other two factors influencing how much to raise are more checks.

3. Dilution

The third factor and the first check is: You do not want to dilute your equity by more than 25% at this stage. Ideally, you should go for 10%, but most likely you’ll end up giving 20% of your equity.

4. Alternatives

The fourth factor and the second check are looking at alternatives. Look at all the alternatives you have at your disposal, or you can, for funding the amount of money you need without diluting your equity before making up your mind that you have to go for venture financing.

Another thing, there is no definite amount of funding that you need during the seed round. You know, you could go between USD 50,000 to USD 2 million, even though generally, seed funding happens within the range. USD 200,000 to $1 million USD.

Venture Financing Options

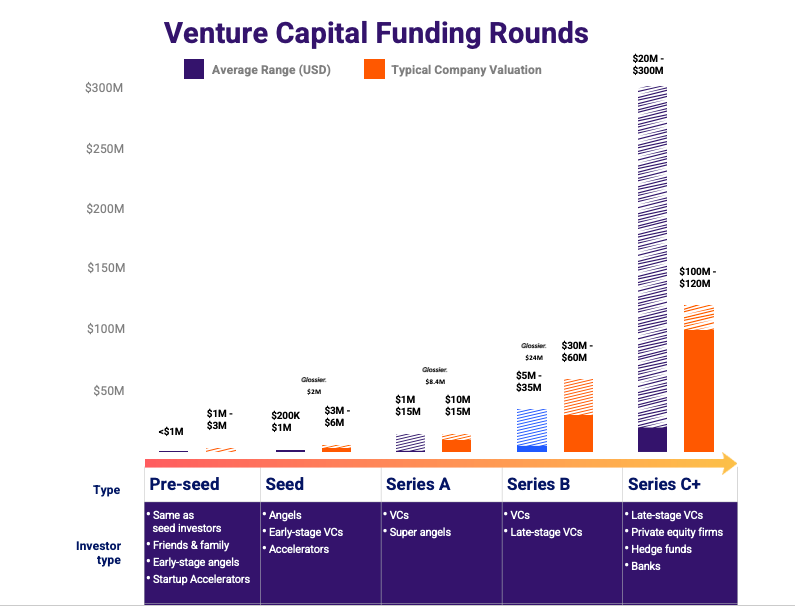

Now let’s look at different venture financing options. So, venture financing generally happens in a sequential process and has its nomenclature. It usually starts with a Seed round, then goes to Series A, Series B, Series C, Series D, Series E, and then an acquisition or an IPO.

It is quite possible, and at times, a round might start straight away, the venture financing might start from Series A itself without any seed round.

If you look at this chart, it gives you a relative understanding of different rounds of funding. The ones that I spoke of, what is the typical valuation of beauty brands or, you know, startup brands during those rounds, and what is the typical amount funded for that startup, early-stage, growth & late stage, you know, brands, et cetera.

The chart here gives you a relative picture of the funding amount and the valuation for a brand or a startup during its different stages of evolution. And if you want it, you could always email me: rohit@jumpaccelerator.com, and I’ll be more than happy to email you this chart.

All right.Coming back to different kinds of “venture financing,” Seed rounds are usually convertible debts or safe agreements, which is a simple agreement for future equity.

At Jump, We are currently exploring how we can evolve these solutions for beauty brands that jump will end up helping get funded by investors.

1. Convertible Debt

Let’s start with convertible debt. So, a convertible debt is a loan given by the “Investor” to the startup with an agreement to repay the principal with interest upon maturity. And this payment happens by conversion, and hence convertible, conversion into equity.

When the startup does the equity round, the investor will usually either pay a set “valuation” or get a discount during the equity round, discounts range from 10 to 20%, and these are considered seed premium for the investor.

Convertible debt can include a callable option where the investor can force conversion into shares or ask for the money, the principal amount back with interest.

2. SAFE

The second is SAFE, which like I said, is Simple Agreement for Future Equity.

It is quite like convertible debt, but there is no maturity, no interest, and no need for payback to the investor.

Usually, they can carry, have a cap, and have some kind of discount.

3. Equity

Let’s come to equity. By the way, take proper legal counsel before you issue any equity. An equity Round means you are now setting up a valuation for your startup with a share price and issuing new shares to the investors.

Let’s take an “example”: Refer Table Below.

Let’s say you are raising $1 million on a $2 million pre-money valuation, and let’s say for example, you have a hundred thousand shares outstanding. So your current share price Is, you are selling shares at $2 million, which was your pre-money valuation, divided by the number of outstanding shares, which is a hundred thousand, So, $2 million divided by a hundred thousand is equal to $20 is your share price.

And to raise a million dollars at $20 share price, you will have to issue 50,000 new shares, which means your total number of outstanding shares would be a hundred thousand plus 50,000, which is equal to 150,000 And your post-raise valuation will become, $20, the share price, * 150,000 shares, which is equal to $3 million now with a dilution of, 100,000 became 150,000.So, the dilution of 50,000 divided by 100,000 equals 33.33%. Other considerations during an equity round are anti-dilution, incentive plans, liquidation preferences, and protective provisions, et cetera.

For each of these ways of funding, whether it’s convertible debt, equity, or safe, please use standard documents.

How To Value Your Beauty Brand?

So how do you know your beauty brand valuation? how much is your beauty brand?

There are three considerations. The objective is not to get a very high valuation. It’s very, very, you know, it’s highly misunderstood that the objective is to get a very high valuation. You should get A, a reasonable valuation, B, which helps you raise the amount of funding you want, and C, with a dilution that is satisfactory to you.

But how do you “set” valuation for your beauty brand, the answer is you don’t.

The investor does. Two Investors will value your brand differently because their perceived risk and reward will differ. Because you’re a startup or an early-stage brand with a lot of uncertainty, and that uncertainty is uncertain in itself.

So, you know, there’s risk in the amount of uncertainty as well, which means that two investors will perceive the amount of uncertainty, risk, and reward differently,and that’s why the first investor will set the valuation for your beauty brand.

Without the investor, you could look at similar beauty brands that have raised money in the same period as you are trying to raise.

Or you can look at precedents of, you know, beauty brands in the past that have raised money, you know, how much revenue they were doing, what is the potential that they have reached, and how much money they raise to get a rough estimate of how to value your beauty or suggested value to the investor.

In the end, the investor will decide the valuation for your beauty brand.

Cool.

Summary

So this was part one of a complete guide for seed fundraising for your beauty brand, where I covered:

-State of Funding in Beauty

-Why Raise Money?

-When & If to Raise?

-How Much to Raise?

-Venture Financing Options

-How to Value your Brand?

in the second episode, and maybe there’ll be a third too, but for now, in the second episode, I will cover

-The difference between VCs and angels.

-What are the different options for women-led beauty brands beyond VCs and Angels?

-How to create a fit list of investors?

-How to approach these investors?

-How to meet them?

-How to create a pitch deck?

-What are term sheets?

-What are the terms and conditions on which you want to raise money?

-What are the dos and don’ts of seed fundraising, equity, crowdfunding, et cetera.?

And maybe a couple more things to complete this guide on how to seed fundraise for your startup beauty brand, especially a women-led beauty brand.

Thank you for listening. Please subscribe if you haven’t already. Take the quiz on how ready is your beauty brand for hyper-growth : How ready is your beauty brand for hyper growth?

Also, do not forget to submit your application to our next batch of Jump Accelerator to accelerate your beauty brand to $20M- $100M without spending a fortune on ads, agencies, influencers, or retailers: apply to our next month hyper-jump batch

We hyper-grow women-led, early-stage beauty brands using both science & emotion via an accountable solution.

References:

- How to raise money, Paul Graham

- Guide to seed fundraising, Geoff Ralston

The ultimate guide to raise capital for a Startup,